The best personal loan deals offer low interest rates and flexible repayment terms. Top lenders typically provide competitive fees and quick funding options.

Finding the best personal loan deal requires comparing offers from multiple lenders to ensure you get the lowest interest rate and most favorable terms for your financial situation. Consider your credit score, income, and borrowing needs to pinpoint the ideal loan.

Reliable lenders will offer transparent terms and an easy application process, making it simple to manage your finances. Remember to read the fine print and understand all associated costs before committing to a loan. With careful research, securing a personal loan that aligns with your financial goals is achievable.

Introduction To Personal Loans

Personal loans offer financial solutions for diverse needs. Unlike specific loans like mortgages or auto loans, personal loans provide funds without securing an asset. Consumers use these loans for various purposes, from debt consolidation to unexpected expenses.

The Rise Of Personal Financing

The demand for personal financing has surged. Easy online applications and competitive rates contribute to its popularity. People prefer personal loans for their simplicity and quick disbursement.

Purpose And Versatility Of Personal Loans

Personal loans shine in their flexibility. Borrowers use them for multiple reasons:

- Debt consolidation

- Home renovations

- Medical emergencies

- Wedding expenses

- Education fees

These loans adapt to your financial needs, making them a go-to option for many.

Credit: primeview.co

Evaluating Loan Offers

Finding the best personal loan deals is important. We must compare offers carefully. This helps us save money and get good terms. Let’s learn how to evaluate loan offers.

Interest Rates: The Deal Maker Or Breaker

Interest rates decide how much you pay back. Lower rates mean you pay less over time. Always look for the lowest interest rate. But, remember, your credit score affects your rate.

- Fixed rates stay the same. They make budgeting easy.

- Variable rates can change. They might start lower but can increase.

Compare rates from different lenders. Use online calculators to see how rates affect payments.

Fees And Penalties To Watch Out For

Lenders charge different fees. Knowing these can save you money.

- Origination fees are charged upfront. They cover processing your loan. Not all lenders charge them.

- Late payment fees are penalties for paying late. Always pay on time to avoid these.

- Prepayment penalties are fees for paying off your loan early. Some lenders don’t charge these. Check before you agree to a loan.

Read the fine print. Ask questions about fees and penalties. Choose a loan with the least fees.

Credit Score Impact

Understanding the ‘Credit Score Impact’ is crucial for securing a personal loan. A credit score reflects your financial health. It determines your eligibility for loan deals. Lenders use this score to assess risk. A higher score can mean better loan terms.

Your Credit Score And Loan Eligibility

Your credit score plays a pivotal role in loan approval. It’s a measure of your creditworthiness. Lenders consider this score before offering loan terms. A high score opens doors to competitive rates and terms. A low score may limit your options.

Improving Your Score For Better Deals

Boosting your credit score is possible with smart habits. Pay bills on time, maintain low credit balances, and avoid new credit inquiries. These actions improve your score over time. A higher score secures more attractive loan offers.

Loan Terms Explained

Finding the best personal loan deals means understanding loan terms. Loan terms affect your monthly payments. They also influence how much you pay over time. Let’s dive into key terms every borrower should know.

Understanding Repayment Periods

The repayment period is how long you pay back a loan. Shorter periods mean higher monthly payments. Yet, they lead to less interest over time. Longer periods lower monthly payments but increase total interest. Choose a period that fits your budget.

- Short-term loans: 1-3 years

- Medium-term loans: 3-5 years

- Long-term loans: 5+ years

Fixed Vs. Variable Interest Rates

Fixed interest rates stay the same for the loan’s life. This makes budgeting easier. You know your payment amount each month. Variable rates can change. They may start lower than fixed rates. But they can increase over time.

| Interest Type | Pros | Cons |

|---|---|---|

| Fixed | Predictable payments | Higher initial rate |

| Variable | Lower initial rate | Uncertain future payments |

Online Lenders Vs Traditional Banks

Choosing between online lenders and traditional banks for a personal loan is a big decision. Each has its benefits and drawbacks. Let’s explore these options.

Pros And Cons Of Online Lending

Online lenders offer quick and easy loan applications. They often provide competitive interest rates. Yet, there are downsides too.

- Pros:

- Fast application process

- Lower interest rates

- Convenient online access

- Cons:

- Less personal service

- Higher risk of scams

- Limited face-to-face support

Why Stick With Traditional Banking?

Traditional banks offer security and personal services. They have physical locations. But, they might not always have the best rates.

- Pros:

- Personal customer service

- Physical branches for visits

- Often more secure

- Cons:

- Slower application process

- Higher interest rates possible

- Requires in-person visits for some services

Credit: www.bankrate.com

Negotiating Your Loan

Getting the best personal loan deal often means more than just applying and hoping for approval. Negotiation can lead to lower interest rates and better terms. This guide will show you how to talk your way into an improved loan agreement.

Strategies To Secure Lower Rates

Negotiation is key when securing a personal loan. It’s not just about accepting the first offer. Use these strategies to get lower rates:

- Improve your credit score before applying.

- Show lenders a strong financial history.

- Choose shorter loan terms for reduced interest rates.

- Compare rates from multiple lenders.

- Ask for rate reductions on existing loans.

Leveraging Competing Offers

Use offers from different lenders to your advantage. Present these to your preferred lender and ask them to match or beat the rates. This shows you’ve done your homework and are serious about getting the best deal. Follow these steps:

- Gather loan offers from several lenders.

- Highlight the best terms you’ve received.

- Present these to your chosen lender confidently.

- Don’t be afraid to walk away if your terms aren’t met.

Hidden Costs Unveiled

Looking for the best personal loan deals? It’s crucial to understand all costs involved. Lenders often advertise attractive interest rates. But, other expenses can surprise borrowers. Let’s unveil these hidden costs.

Insurance And Loan Protection

Lenders may suggest insurance on your loan. This protection covers your payments during unexpected events. It includes job loss or medical emergencies. This cost isn’t always clear upfront. Let’s break it down:

- Credit insurance: It pays off your loan upon death or disability.

- Unemployment insurance: It covers payments if you lose your job.

These insurances add to your monthly payment. Always ask for detailed insurance costs. Compare these costs with independent insurance providers.

Prepayment Charges And Processing Fees

Early loan payoff can lead to penalties. These are prepayment charges. They ensure lenders still profit if you pay off your loan early. Let’s look at these fees:

| Fee Type | Description |

|---|---|

| Prepayment charges | A percentage of the remaining loan or a fixed fee. |

| Processing fees | Initial costs to set up your loan. Often non-refundable. |

Processing fees vary by lender. They impact your total loan cost. Always confirm these fees before signing a loan agreement.

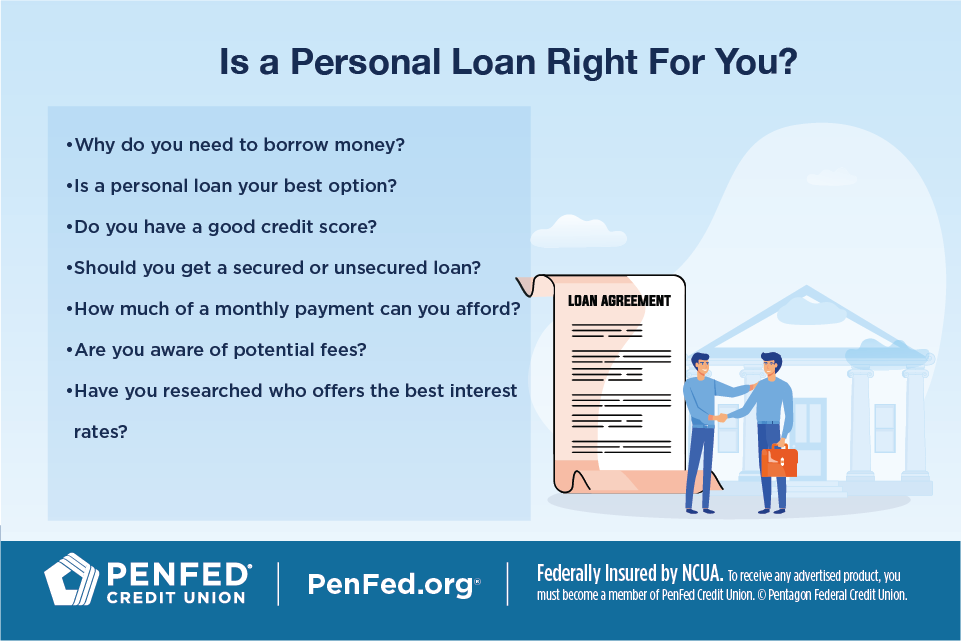

Credit: www.penfed.org

Smart Borrowing Practices

Finding the best personal loan deals involves more than just low interest rates. Smart borrowing ensures you stay in control of your finances. It’s important to borrow wisely. Let’s discuss how to avoid overindebtedness and plan for a stable financial future.

Avoiding Overindebtedness

Too much debt can lead to financial stress. Be cautious with loan amounts. Only borrow what you need. Ensure you can meet monthly repayments. Consider the loan term carefully. Shorter terms mean higher payments but less interest overall. Use a loan calculator to understand repayments. Check your credit score before applying. A better score can secure lower rates. Always read the fine print. Know all fees and penalties involved.

Planning For Future Financial Stability

Secure your financial future when taking out loans. Start with a solid budget. Know your income and expenses. Set aside savings before borrowing. This acts as a safety net. Choose fixed-rate loans for predictable payments. This helps with long-term budgeting. Think ahead for large purchases. This avoids last-minute high-interest loans. Keep an eye on your credit report. Regular checks can catch errors early. Aim to improve your credit score for better loan conditions in the future.

Real-life Loan Success Stories

Read how real people tackled debt and funded dreams with smart loans.

Debt Consolidation Wins

Meet Emma. She juggled multiple credit card bills. Interest rates were high. She chose a personal loan to merge her debts. One payment, lower rate, less stress.

- Monthly payments dropped by 25%

- Debt-free in 4 years, instead of 10

- Stress levels? Down significantly

Investment And Growth Opportunities

John’s story inspires. He took a calculated risk. He invested his loan in a small startup. The company flourished.

| Year | Profit Increase |

|---|---|

| Year 1 | 50% |

| Year 2 | 75% |

| Year 3 | 120% |

John’s loan sparked a growth journey. His courage paid off.

Conclusion: Sealing The Best Deal

Finding the best personal loan deal is like winning a prize. It feels great! But, before you sign, make sure everything is perfect. Let’s wrap up with some final tips.

Final Checklist Before Signing

- Interest rates – Check they are the lowest you can get.

- Fees – Look for any hidden charges. Ask questions if unsure.

- Repayment terms – Make sure they fit your budget. Can you pay early without penalties?

- Customer reviews – What do others say? Good service matters.

Tick these boxes, and you’re good to go. Remember, the fine print is your friend. Read it well.

Staying Informed For Future Borrowing

Even after sealing the deal, keep learning. Markets change. New deals appear. Stay ahead.

- Follow finance news. Trends can affect interest rates.

- Use loan calculators. They help plan future loans.

- Build a good credit score. It opens doors to better rates.

- Read loan blogs and forums. Learn from others’ experiences.

Armed with knowledge, you’ll always find the best deals. Happy borrowing!

Frequently Asked Questions

What Determines Personal Loan Interest Rates?

Interest rates on personal loans are influenced by credit score, income, debt-to-income ratio, and the lender’s policies. A higher credit score often yields lower rates.

How Can I Find The Best Personal Loan Deal?

To find the best personal loan deal, compare rates from multiple lenders, check for fees, and read the terms carefully. Online comparison tools can simplify this process.

Is It Possible To Negotiate Personal Loan Terms?

Yes, some lenders may allow negotiation on personal loan terms, especially if you have a strong credit history or an existing relationship with the financial institution.

What Are The Hidden Costs Of Personal Loans?

Hidden costs in personal loans can include origination fees, prepayment penalties, and late payment fees. Always read the fine print to identify any extra charges.

Conclusion

Finding the right personal loan can transform your financial landscape. We’ve navigated through countless options to bring you deals that stand out for their favorable terms and reliability. Taking the time to compare and choose wisely could mean significant savings and a smoother repayment journey.

Remember, the best deal aligns with your financial goals and capabilities. Happy borrowing!