Business loans for women entrepreneurs offer financial support to female-led companies. These loans aim to empower women in the business sector.

Access to capital is a critical factor for launching and growing a business. For women entrepreneurs, securing a business loan can be a pivotal step towards achieving their entrepreneurial goals. Lenders and institutions recognize the unique challenges faced by women in the business world and have created loan programs to help bridge the gap.

These loans often come with favorable terms, including lower interest rates and flexible repayment plans, catering specifically to the needs of women-owned businesses. Understanding the application process and meeting the eligibility criteria can unlock numerous opportunities for women looking to drive their businesses forward. With a range of options available, from government-backed loans to private funding, women entrepreneurs are better positioned than ever to turn their business aspirations into reality.

Credit: aofund.org

Introduction To Female Entrepreneurship

Today’s business landscape is changing. Women entrepreneurs are at the forefront, creating innovative ventures. They bring fresh perspectives to industries worldwide. This shift paves the way for a more diverse and inclusive economy.

Rise Of Women In Business

The number of women-owned businesses is soaring. Data shows a significant increase in female-led initiatives. This growth contributes to economic prosperity. It also empowers more women to take the entrepreneurial leap.

- Higher female entrepreneurship rates

- Greater economic diversity

- More job creation

Challenges Faced By Women Entrepreneurs

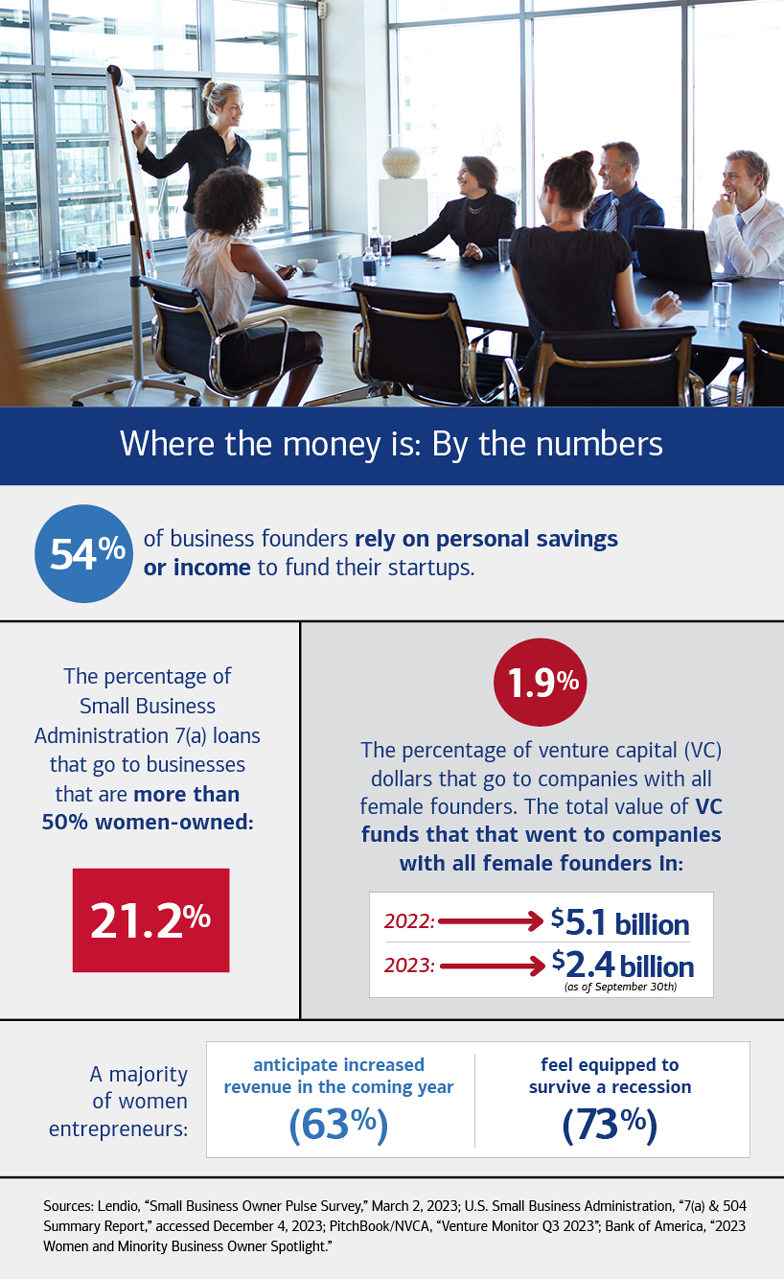

Despite the rise, women in business face unique challenges. Access to capital is a major hurdle. Women often receive less funding than their male counterparts. This gap hinders growth and sustainability.

| Challenge | Impact |

|---|---|

| Funding disparities | Limits business growth |

| Network limitations | Reduces opportunities |

| Market perception | Affects credibility |

The Importance Of Funding For Business Growth

Funding plays a key role in growing a business. Money helps businesses expand and reach new heights. This truth holds even more weight for women entrepreneurs. Let’s dive into why funding is crucial for business growth, especially for women-led ventures.

Capital As A Catalyst

Funding acts as a spark for business growth. It allows women entrepreneurs to:

- Buy new equipment

- Invest in marketing

- Hire more staff

- Expand their operations

With enough capital, a small business can transform into a larger enterprise.

Impact Of Adequate Funding On Women-owned Businesses

Access to funding can break barriers for women entrepreneurs. It leads to:

- Increased business survival rates

- Higher employment numbers

- Greater innovation

- Expanded market reach

These factors contribute to a strong economy and a vibrant business community.

Types Of Business Loans Available

Women entrepreneurs have diverse options for funding. Understanding each loan type is crucial. Here, explore the loans available to women in business.

Conventional Bank Loans

Conventional bank loans are a primary source. Banks offer various terms. Interest rates are often competitive. Good credit scores are usually needed. Collateral might be required.

Sba-backed Loans

The Small Business Administration (SBA) backs certain loans. SBA loans have favorable terms. They support women-owned businesses. Less collateral is sometimes acceptable.

Microloans And Nonprofit Lenders

Microloans suit small startups. Nonprofit lenders often provide them. They focus on women, minorities, and veterans. These loans are smaller. They help businesses grow.

Credit: business.bankofamerica.com

Evaluating The Best Loan Options For Women Entrepreneurs

Securing a business loan is a significant step for women entrepreneurs. It helps turn business ideas into reality. Finding the right loan option can be challenging. This section will guide you through the best loans for women entrepreneurs.

Loan Terms And Interest Rates

Loan terms define how long you have to repay. Short-term loans often have higher payments but lower total interest. Long-term loans spread out payments but increase total interest. Interest rates can vary widely. They depend on your credit score, loan amount, and lender. Fixed rates stay the same. Variable rates can change over time. Compare these factors:

- Repayment period

- Total cost of the loan

- Monthly payment amount

Use online calculators to estimate monthly payments.

Eligibility Criteria

Lenders have specific eligibility criteria. These often include:

- Credit score: A higher score can mean better rates.

- Business history: New businesses may need to provide more evidence of stability.

- Revenue: Proof of income shows you can repay the loan.

Prepare documents like tax returns and financial statements in advance.

Loan Application Process

The loan application process involves several steps:

- Gather documents: Collect financial records and business plans.

- Compare lenders: Look for those that support women-owned businesses.

- Apply: Fill out applications carefully. Double-check for errors.

Online applications can be faster. Some lenders offer guidance during the process. Choose a lender that communicates clearly and promptly.

Specialized Loan Programs For Women

Women entrepreneurs often seek specialized loan programs tailored for them. These programs help start or grow their businesses. Let’s explore some notable options.

Government Grants And Loans

The government supports women in business with grants and loans. These funds often have lower interest rates and favorable terms.

- Small Business Administration (SBA) Loans: SBA offers various loan programs designed for women. The Women’s Business Centers help with advice and access to funding.

- Grants.gov: A portal where women can find government grants. These are funds you don’t have to pay back.

Private And Nonprofit Funding Initiatives

Many private and nonprofit organizations provide financial support to women entrepreneurs. These include both loans and grants.

- Amber Grant: Awards a monthly grant to a woman-owned business. Plus, an annual grant is also available.

- Tory Burch Foundation: Offers loans, mentorship, and education to women entrepreneurs.

These programs aim to empower women in business. They provide the tools needed for success.

Preparing For The Loan Application

Women entrepreneurs often face unique challenges. One such challenge is securing business loans. A well-prepared loan application can set the foundation for success. Let’s explore the key steps to prepare for this important process.

Developing A Solid Business Plan

A business plan outlines your venture’s goals, strategies, and financial projections. Lenders want to see a clear path to profitability. Ensure your plan includes:

- Executive Summary: An overview of your business and plans.

- Market Analysis: Insights into your industry, market, and competitors.

- Organization Structure: Your team’s roles and expertise.

- Financial Plan: Detailed sales, costs, and profit projections.

Understanding Credit Requirements

Lenders scrutinize your credit score to assess risk. A higher score can lead to better loan terms. Key points include:

| Credit Score Range | Impact |

|---|---|

| 300 – 629 | Bad Credit |

| 630 – 689 | Fair Credit |

| 690 – 719 | Good Credit |

| 720 and up | Excellent Credit |

Work on improving your score by paying debts on time and keeping credit utilization low.

Gathering Necessary Documentation

Documents prove your business’s legitimacy and financial health. Collect the following:

- Personal Identification: Such as a driver’s license or passport.

- Business Licenses: Any government-issued permits or licenses.

- Financial Statements: Including balance sheets and income statements.

- Bank Statements: Typically, lenders ask for the last two years.

- Tax Returns: Both personal and business returns may be required.

Having these documents ready shows lenders you are organized and serious about your request.

Success Stories: Women Who Thrived With Business Loans

Success Stories: Women Who Thrived with Business Loans shine a light on the remarkable achievements of female entrepreneurs. These women took a leap of faith, backed by financial support, and transformed their dreams into thriving businesses.

Case Studies

Let’s delve into the journeys of women who used business loans to scale new heights.

- Jessica’s Tech Startup: A small loan helped her software firm double its client base.

- Maya’s Organic Farm: With funding, Maya turned her small plot into a regional supplier.

- Laura’s Fashion Line: Laura launched a boutique, and her brand is now internationally recognized.

Lessons Learned

These success stories teach us vital lessons:

- Plan Ahead: A clear business plan is key to securing a loan.

- Invest Wisely: Spend your loan on growth-focused expenses.

- Stay Resilient: Challenges will come, but perseverance pays off.

Tips For Managing Business Finances Post-loan

Getting a business loan is a big step for women entrepreneurs. It opens new doors for growth. Yet, managing your finances after getting a loan is crucial. It ensures that the loan benefits your business. Here are tips to manage your business finances post-loan.

Effective Use Of Loan Capital

Plan every dollar of your loan. Knowing where your money goes is key. Create a budget for your loan funds. Stick to it. Prioritize spending on growth activities. These could be marketing, inventory, or new equipment.

Strategies For Loan Repayment

Start paying back early. Even small amounts help. Check if your loan has prepayment penalties. If not, paying early saves on interest. Set up automatic payments. This avoids missed payments and late fees.

Planning For Future Financial Needs

Always look ahead. Set money aside for future expenses. This could be taxes or emergency repairs. Use financial tools to forecast cash flow. Be ready for both opportunities and challenges.

Navigating Challenges And Setbacks

Starting a business is an exciting journey, especially for women entrepreneurs. But, it comes with unique challenges. Navigating these challenges and setbacks can be difficult. This section will help women entrepreneurs overcome hurdles and seek support.

Overcoming Common Hurdles

Women entrepreneurs face many common hurdles in business. These include funding issues, market access, and work-life balance.

- Funding Issues: Women often find it harder to secure loans. They should prepare strong business plans. This can improve their chances.

- Market Access: Women sometimes struggle to enter certain markets. Networking and partnerships can help break these barriers.

- Work-Life Balance: Managing business and family can be tough. Setting clear boundaries can help maintain balance.

Seeking Support And Mentorship

Support and mentorship are crucial for women entrepreneurs. They provide guidance, advice, and inspiration. Here are some ways to seek support:

- Join women entrepreneur groups. These groups offer networking and resources.

- Find a mentor. A mentor can provide valuable insights and support.

- Attend workshops and seminars. These events can boost skills and knowledge.

Additionally, many organizations offer grants and programs for women entrepreneurs. These can provide financial and educational support.

Here is a table of some useful resources:

| Resource | Description |

|---|---|

| National Association of Women Business Owners (NAWBO) | Provides networking and business resources |

| Women’s Business Centers (WBCs) | Offers training and funding opportunities |

| SCORE | Mentorship and training for entrepreneurs |

Conclusion: Empowering Women In Business

Empowering women in business closes the gender gap in entrepreneurship. It boosts the economy and enriches communities. Business loans for women entrepreneurs play a crucial role in this empowerment. They provide the financial support needed to start and grow businesses. Let’s explore how the future looks for women’s entrepreneurship and the importance of a supportive ecosystem.

The Future Of Women’s Entrepreneurship

The future shines bright for women entrepreneurs. More women are starting businesses than ever before. This trend is set to increase, with business loans becoming more accessible. These loans help women overcome financial barriers. They enable them to bring innovative ideas to life.

- Better access to funding

- Increased representation in all industries

- Greater innovation and diversity in the business world

With continued support, women will lead more companies. They will break new ground in industries previously dominated by men.

Encouraging A Supportive Ecosystem For Female Founders

A supportive ecosystem is key for female founders. It includes access to mentors, networks, and resources. This ecosystem helps women navigate the challenges of entrepreneurship.

Initiatives to foster this environment include:

- Mentorship programs that connect new entrepreneurs with experienced ones.

- Networking events that build valuable connections.

- Workshops and resources focused on the unique needs of women in business.

Such support empowers women to succeed. It encourages them to pursue their business dreams. Together, we can build a future where women’s business ventures thrive.

Credit: www.go-yubi.com

Frequently Asked Questions

What Are Business Loans For Women Entrepreneurs?

Business loans for women entrepreneurs are financing options tailored to support women-owned businesses. They can include reduced rates, mentorship programs, and flexible repayment terms to help female entrepreneurs grow their ventures.

How Can Women Apply For Business Loans?

Women can apply for business loans by preparing a solid business plan, maintaining a good credit score, and approaching banks, credit unions, or online lenders that offer loan programs specifically designed for women entrepreneurs.

What Are The Benefits Of Women-specific Business Loans?

Women-specific business loans often come with benefits like lower interest rates, networking opportunities, educational resources, and sometimes more lenient lending criteria to encourage and empower women in the business world.

Are There Grants For Women-owned Businesses?

Yes, there are grants specifically for women-owned businesses. These grants are non-repayable funds provided by government entities, private organizations, and foundations to support women in starting and expanding their businesses.

Conclusion

Securing a business loan can empower women entrepreneurs to transform their visions into reality. It’s a step towards financial independence and business growth. Remember, the right loan can be a game-changer. Explore your options, prepare thoroughly, and take the leap.

Your entrepreneurial journey is just a loan away. Start today and shape your tomorrow.