To apply for a business loan with bad credit, start by assessing your credit report for errors and exploring lenders with flexible credit requirements. Next, prepare a solid business plan and gather any collateral you can offer.

Navigating the process of securing a business loan with bad credit can be daunting, yet it’s not insurmountable. Having less-than-perfect credit does not preclude entrepreneurs from accessing necessary funds. The key lies in understanding your credit position and seeking out lenders that specialize in working with similar financial profiles.

A thorough business plan that demonstrates potential profitability is essential, as it can persuade lenders to take a chance on your business. Offering collateral can also be a compelling way to secure a loan, as it reduces the risk for the lender. It’s crucial to present a clear financial picture, showcasing steady income and the ability to make repayments, to improve your chances of loan approval. By taking these strategic steps, even those with a challenged credit history can find the financial support needed to grow their business.

Introduction To Business Financing

Business financing is the lifeline for companies. It helps in starting, growing, and sustaining a business. Many options exist, like loans, investors, and grants. Understanding these choices is key to success.

The Role Of Credit In Loan Approval

Lenders look at credit scores to judge risk. A high score can mean better loan terms. Yet, a low score can lead to rejection or high-interest rates. Credit history shows your repayment behavior. It’s crucial in the lender’s decision.

Challenges Of Securing Funds With Poor Credit

Bad credit can close doors to traditional loans. Banks often say no. High-interest alternative lenders might say yes. You’ll face higher costs and tough terms. Understanding these challenges is important.

Credit: www.bankrate.com

Assessing Your Credit Situation

Before you apply for a business loan with bad credit, it’s vital to understand where you stand. This part of the process is about taking a close look at your credit situation. Knowing your credit score and what affects it can help you make better decisions. Let’s dive into how you can assess your credit situation effectively.

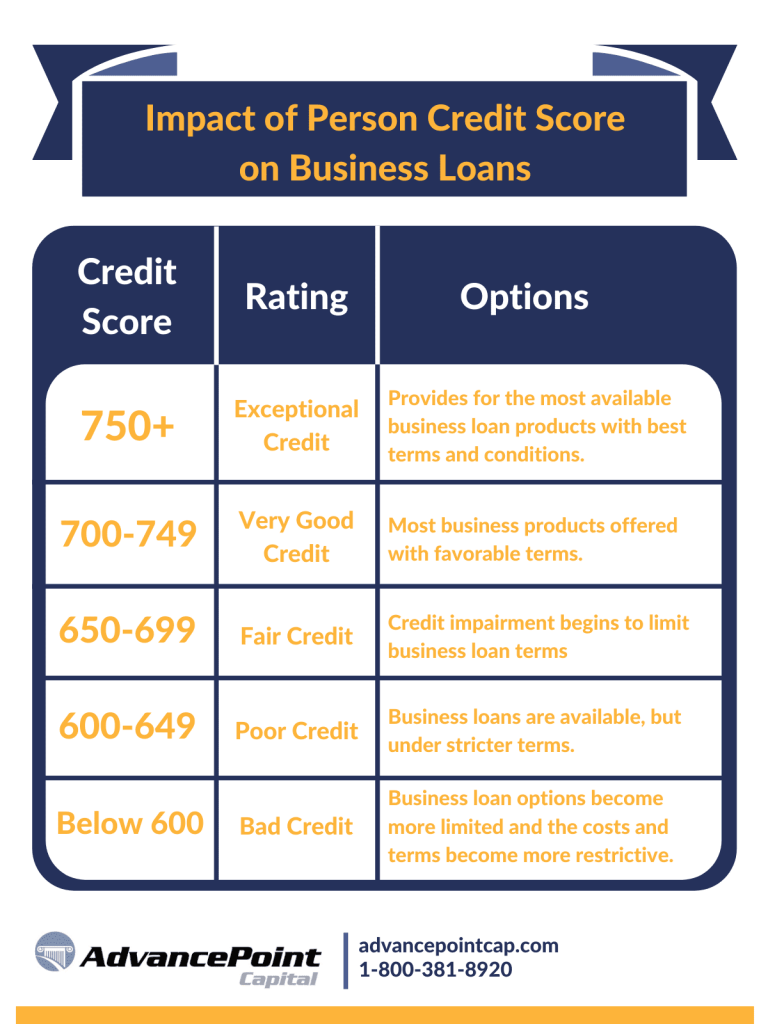

Interpreting Your Credit Score

Your credit score is a key factor lenders look at. It’s a number that shows how risky it might be to lend you money. A higher score means less risk. Here’s a simple breakdown:

- Excellent: 720 and above

- Good: 690-719

- Fair: 630-689

- Bad: 629 and below

Knowing your score helps you see what loans you might get.

Identifying Factors That Impact Your Credit

Several things can lower your credit score. It’s important to know what they are. This way, you can work on fixing them. Here are some common factors:

| Factor | How It Affects Your Credit |

|---|---|

| Late Payments | Shows you might not pay back on time. |

| High Debt | Makes lenders think you can’t handle more debt. |

| Too Many Applications | Looks like you’re desperate for credit. |

Focus on fixing these issues to improve your credit score.

Improving Your Creditworthiness

When seeking a business loan with bad credit, improving your creditworthiness is vital. It’s about demonstrating to lenders that you’re a low-risk borrower. By enhancing your credit score, you’ll unlock better loan terms. Let’s explore effective strategies to rebuild your credit and create a strong financial track record.

Strategies For Credit Repair

- Review Credit Reports: Check for errors. Dispute inaccuracies promptly.

- Reduce Debt: Pay down balances. Lower your credit utilization ratio.

- Pay Bills On Time: Establish a pattern of timely payments. Set reminders.

- Limit New Credit Inquiries: Avoid unnecessary hard checks on your credit.

- Seek Professional Help: Consider credit counseling. Develop a plan.

Building A Positive Financial Track Record

Creating a positive financial history is crucial. It shows lenders your business is trustworthy. Here are practical steps to build a solid track record:

- Maintain Accurate Financial Records: Organize your books. Use reliable accounting software.

- Manage Cash Flow Effectively: Monitor income and expenses. Stay on top of billing.

- Secure Alternative Financing: Explore options like secured credit cards. Use them wisely.

- Build Vendor Relationships: Establish credit terms with suppliers. Pay them early or on time.

- Demonstrate Business Growth: Show consistent revenue increases. Prepare financial statements.

Alternative Loan Options

Crafting A Strong Business Plan

Crafting a strong business plan is key to loan approval. Especially with bad credit. A solid plan shows lenders you are serious and prepared. Let’s dive into creating a plan that highlights your business’s strengths.

Highlighting Profitability And Revenue Streams

First, focus on the money-making parts of your business. Lenders want to see how you make money. Break down your main sources of income.

- Product sales: Show numbers from past sales.

- Services: Detail the services you offer and earnings.

- Recurring revenue: Subscriptions or contracts that pay regularly.

Use charts or tables to make this info clear. This helps lenders see your business’s potential.

Mitigating Risks In Your Business Model

Next, show how you deal with risks. Every business has risks. Your plan should show you know yours and have a plan to handle them.

- Identify risks: List the main risks your business faces.

- Plan to manage: Show steps to reduce or handle these risks.

- Future strategies: How will you avoid or lessen risks moving forward?

Tables work well here too. They can list risks and your strategies in a clear way.

In sum, your business plan must tell a story. A story of a business that makes money and knows how to stay safe. This will help you get a loan, even with bad credit.

Credit: www.experian.com

Collateral And Guarantees

Securing a business loan with bad credit can be challenging. Yet, collateral and guarantees offer viable paths. They provide lenders with security, increasing approval chances. Understanding these options is vital for a successful application. Let’s explore asset-backed solutions and personal guarantees.

Asset-backed Financing Solutions

Asset-backed financing allows businesses to borrow against their assets. Lenders consider this less risky. Businesses can leverage various assets as collateral. These include:

- Real estate: Often provides high loan values.

- Inventory: Enables funding for product-based businesses.

- Equipment: Secures loans for operational needs.

- Accounts receivable: Transforms future income into immediate capital.

This type of loan often results in quicker approval. It’s ideal for businesses with valuable assets.

Personal Guarantees: Pros And Cons

A personal guarantee involves committing personal assets. This can persuade lenders to approve loans. Below are the pros and cons:

| Pros | Cons |

|---|---|

| Increases loan approval odds | Risks personal assets |

| May lower interest rates | Creates personal financial exposure |

| Boosts lender confidence | Complicates separating personal/business finances |

Personal guarantees require careful consideration. They can be a powerful tool but come with inherent risks.

Navigating The Application Process

Navigating the application process for a business loan with bad credit can be daunting. But with the right approach and preparation, securing the necessary funds is still within reach. Understanding what lenders look for and how to present your business in the best possible light is crucial. Let’s dive into the steps to take when applying for a business loan with less-than-perfect credit.

Gathering Essential Documentation

Preparation is key when applying for a business loan with bad credit. Begin by collecting all the necessary documents that lenders typically require:

- Business financial statements to show your financial health

- Bank statements to verify cash flow

- Tax returns to provide income history

- Business plan to demonstrate future growth

- Credit report to discuss any negative items

Keep these documents organized and ready to present to lenders. This shows you’re serious about the loan and understand your financial standing.

Effective Communication With Lenders

Talking to lenders with transparency can build trust. Be clear about your credit situation and how you plan to improve it. Here are tips for effective communication:

- Be honest about your credit challenges

- Highlight strengths in your business performance

- Discuss your plan for loan repayment

- Ask questions to clarify terms and conditions

Remember, lenders appreciate a well-informed borrower. Show them your commitment to turning your business around, despite your credit score.

Credit: advancepointcap.com

Negotiating Loan Terms

Let’s dive into how you can negotiate loan terms despite having a bad credit score. Understand that every term in a loan agreement is a piece of a larger puzzle. Aligning these pieces to fit your financial situation is key. This involves focusing on interest rates, repayment schedules, fees, and penalties.

Interest Rates And Repayment Schedules

Interest rates can significantly affect your loan’s cost. With bad credit, lenders may offer higher rates. It’s crucial to negotiate for the lowest possible rate. A lower rate means lower payments over time. Discuss repayment schedules as well. Flexible schedules can ease your financial burden. Aim for terms that offer breathing room for your cash flow.

- Negotiate the rate down if you can.

- Seek flexible repayment options.

- Understand how the rate impacts overall cost.

- Choose a schedule that aligns with income patterns.

Understanding Fees And Penalties

Fees and penalties can sneak up on you. They can turn a manageable loan into a financial nightmare. Scrutinize every fee detailed in the loan agreement. This includes origination fees, late payment fees, and prepayment penalties. Clarify with lenders what each fee entails. Work towards waiving or reducing unnecessary charges.

| Type of Fee/Penalty | Description | Negotiation Strategy |

|---|---|---|

| Origination Fee | Cost to process your loan application | Ask for a reduction or waiver |

| Late Payment Fee | Charge for paying after due date | Request a grace period |

| Prepayment Penalty | Cost for paying off loan early | Seek loans without this penalty |

In summary, know the details of your loan agreement. Focus on interest rates and repayment schedules. Understand all fees and penalties. This knowledge empowers you to negotiate better terms. It helps you secure a loan that aligns with your business’s financial health.

After Loan Rejection: Next Steps

Getting a business loan with bad credit can be challenging. If a lender rejects your loan application, don’t lose hope. Your journey doesn’t end here. Understand the reasons for rejection. Explore alternative funding options.

Analyzing Lender Feedback

Lenders provide feedback on why they turned down a loan application. It is crucial to review their comments. They highlight areas for improvement. Focus on these aspects to enhance your creditworthiness.

- Credit Score: This number matters. Work on boosting it.

- Debt-to-Income Ratio: Lower this ratio by paying off debts.

- Collateral: Offer more assets to secure the loan.

- Business Plan: Ensure it reflects strong potential for success.

Exploring Non-traditional Funding Sources

Several alternatives exist beyond traditional bank loans. These options may overlook credit scores. They consider other factors for loan approval.

- Online Lenders: Some offer loans despite low credit scores.

- Microloans: Small loans aimed at startups and small businesses.

- Peer-to-Peer Lending: Connects borrowers with individual lenders.

- Crowdfunding: Raise small amounts from many people online.

- Merchant Cash Advances: Quick funds in exchange for a cut of future sales.

Maintaining Financial Health Post-loan

Getting a business loan with bad credit is a big step. Keeping your business healthy after getting the loan is even more important. Let’s talk about how to stay financially healthy.

Once you secure a loan, the real work begins. Use the loan wisely. Plan for the future. Let’s dive into strategies for managing debt and improving your credit score.

Debt Management Strategies

Managing debt is key to financial health. Follow these steps to stay on track:

- Create a budget to track spending and savings.

- Set clear goals for debt repayment.

- Use automatic payments to never miss a due date.

- Review your loan terms often.

These steps help you manage debt and keep your business running smoothly.

Future Planning And Credit Improvement

Improving your credit score is a long-term goal. Follow these tips:

- Pay bills and loan payments on time, every time.

- Lower your debt as much as possible.

- Check your credit report for errors.

- Use credit wisely. Don’t max out credit cards.

Improving your credit score opens doors for future loans and opportunities.

Frequently Asked Questions

Can Bad Credit Affect Loan Approval?

Bad credit can impact loan approval, signaling higher risk to lenders. However, some lenders specialize in bad credit business loans. They focus on your business’s revenue and potential rather than credit score alone.

What Are Bad Credit Business Loan Options?

Options for bad credit business loans include merchant cash advances, invoice financing, and secured loans. Alternative lenders and credit unions may offer loans with flexible requirements compared to traditional banks.

How To Improve Chances For A Business Loan?

To enhance loan approval odds, prepare a solid business plan, improve your credit score where possible, and seek collateral to secure the loan. Additionally, find a co-signer or offer a personal guarantee if necessary.

What’s The Minimum Credit Score For Business Loans?

Minimum credit scores vary by lender, but traditional banks typically require 600-650+. Alternative lenders may accept lower scores, focusing more on business performance and cash flow.

Conclusion

Securing a business loan with bad credit might seem daunting, but it’s not impossible. By following the strategies outlined, you can improve your chances significantly. Remember, preparation and transparency with lenders are key. Don’t let a low credit score deter your business dreams.

Take the right steps, and you’ll find avenues open for funding.