Peer-to-peer (P2P) lending has become a popular way for individuals to lend and borrow money without going through traditional financial institutions. But many people are unsure about the tax implications of peer-to-peer lending. Is the income from P2P lending taxable? Let’s delve into the details to understand the tax treatment of peer-to-peer lending.

Understanding P2P Lending and Taxes

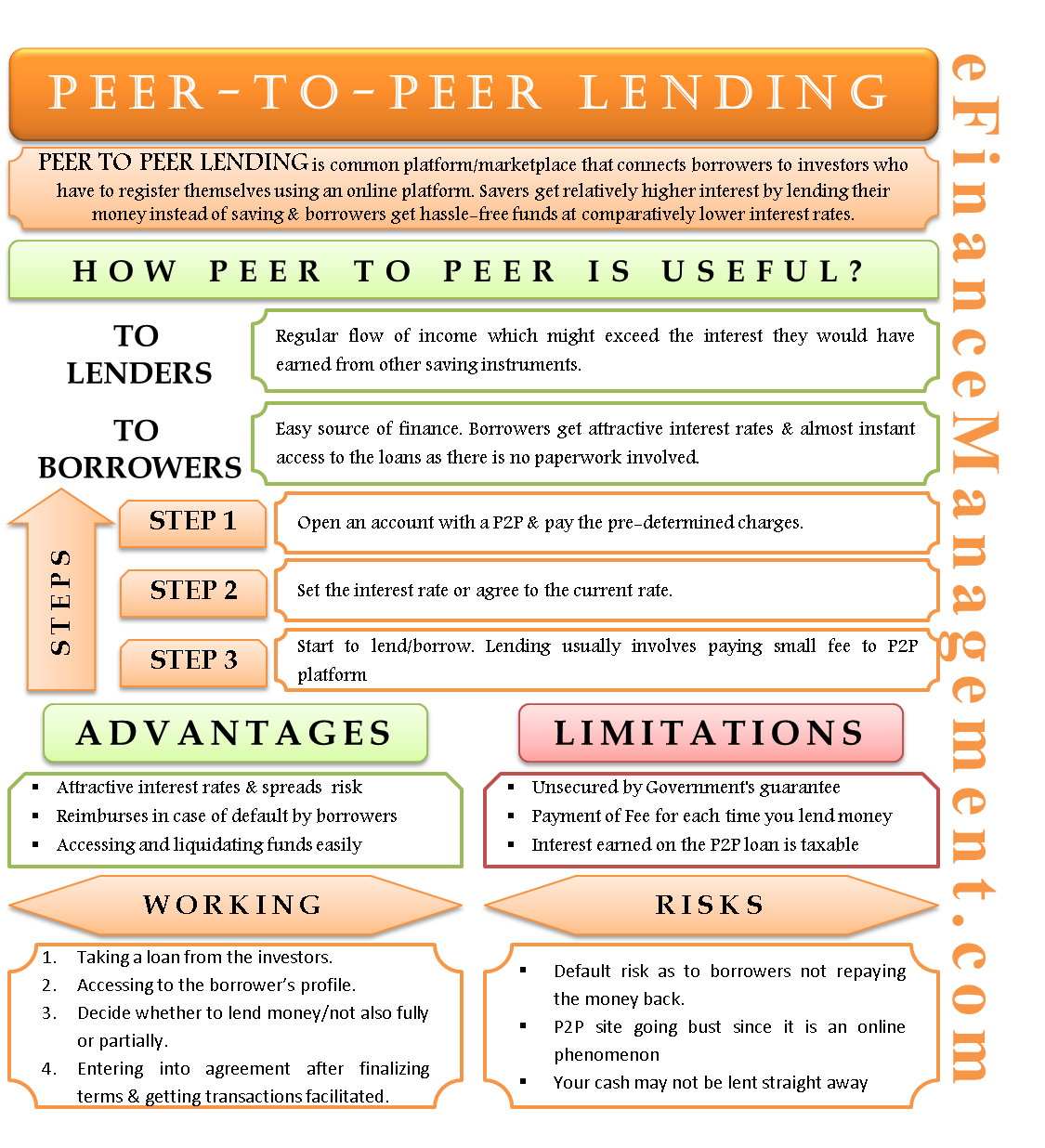

P2P lending involves individuals lending money to other individuals or small businesses through online platforms. When you earn interest or returns from P2P lending, it constitutes income that may be subject to taxation. It’s essential to consider the tax implications before engaging in P2P lending to avoid any surprises come tax season.

Types of Taxable Income in P2P Lending

Income from P2P lending generally falls into the category of taxable interest income. The interest you receive from the loans you make through P2P lending platforms is considered taxable income by the IRS (Internal Revenue Service).

Additionally, if you are an individual, the interest income you earn from P2P lending is typically considered taxable at your ordinary income tax rate. This means that the interest earned is generally taxed at the same rate as your employment income.

Credit: efinancemanagement.com

Tax Reporting Requirements for P2P Lending

When engaging in P2P lending, it’s crucial to understand the tax reporting requirements. P2P lending platforms are required to provide you with a Form 1099-INT or similar tax statement if your annual interest income exceeds a certain threshold. This form outlines the interest income you’ve earned from P2P lending, which must be reported on your tax return.

It’s important to accurately report your P2P lending income on your tax return to avoid potential penalties or audits. Failing to report interest income from P2P lending can lead to unfavorable consequences with the IRS.

Deductibility of P2P Lending Losses

While interest income from P2P lending is taxable, it’s essential to note that any losses incurred from P2P lending may be deductible. If a borrower defaults on a loan you’ve made through a P2P platform, resulting in a loss, you may be able to deduct the amount of the loss from your overall taxable income, subject to certain limitations and requirements.

It’s advisable to consult with a tax professional to understand the specific rules and limitations regarding the deductibility of P2P lending losses.

State and Local Tax Considerations

In addition to federal income tax, it’s important to consider state and local tax implications of P2P lending. The tax treatment of P2P lending income and losses may vary by state, so it’s crucial to be aware of the specific tax rules in your state and locality.

State and local tax regulations can impact the overall tax liability associated with your P2P lending activities. Consulting with a tax advisor who is well-versed in the tax laws of your state can provide valuable insights into the state and local tax considerations related to P2P lending.

Credit: fastercapital.com

Frequently Asked Questions On Is Peer To Peer Lending Taxable?

Faq 1: Are The Returns From Peer To Peer Lending Taxable?

Yes, the returns from peer to peer lending are taxable. You are required to report your interest earned as income on your tax returns.

Faq 2: How Do I Report My Peer To Peer Lending Income To The Irs?

To report your peer to peer lending income to the IRS, you will need to fill out Schedule B and Form 1099-INT. These forms will help you properly report your interest income from peer to peer lending platforms.

Faq 3: What Tax Rate Applies To Peer To Peer Lending Income?

The tax rate that applies to your peer to peer lending income depends on your overall taxable income and tax bracket. It is best to consult with a tax professional to determine your specific rate.

Faq 4: Do I Need To Pay Self-employment Taxes On Peer To Peer Lending Income?

No, peer to peer lending income is not considered self-employment income. Therefore, you are not required to pay self-employment taxes on the returns you earn from peer to peer lending.

Conclusion

As an alternative form of investing and borrowing, peer-to-peer lending offers potential returns, but it’s essential to understand the tax implications associated with P2P lending income and losses. By comprehensively understanding the tax treatment of peer-to-peer lending and adhering to the reporting requirements, you can ensure compliance with tax laws and effectively manage the tax implications of your P2P lending activities.

Remember, accurate reporting and compliance with tax regulations are essential for maintaining the financial integrity of your P2P lending endeavors.