Low-income families can explore government programs and credit unions for loan options. Personal loans and payday alternative loans are viable choices.

Navigating the financial landscape as a low-income family can be challenging, especially when seeking loan opportunities that don’t exacerbate financial strain. Fortunately, there are tailored options designed to meet the needs of those with limited income. Government-backed loans offer accessible terms and lower interest rates, while credit unions provide more personalized services and often have less stringent criteria compared to traditional banks.

These avenues are crafted to help families manage essential expenses without falling into a debt trap. Understanding these alternatives is crucial for making informed decisions that align with long-term financial health.

The Landscape Of Low-income Financing

Access to financing can be a steep hill to climb for families with limited income. Understanding the landscape of low-income loans is crucial. It offers a lifeline for managing expenses and improving quality of life.

Challenges Faced By Low-income Families

Financial hurdles are abundant for families earning less. Monthly bills, unexpected expenses, and saving for the future strain budgets. Credit access becomes a critical issue.

- High-interest rates deter borrowing.

- Credit checks can block loan approval.

- Limited options force tough choices.

These challenges make finding the right financial support essential.

Common Types Of Low-income Loans

Several loan types cater to low-income families. Each serves a different need. Let’s explore the most common ones.

| Type of Loan | Purpose | Features |

|---|---|---|

| Payday Loans | Immediate cash | Short-term, high fees |

| Personal Loans | Various expenses | Fixed terms, lower interest |

| Subsidized Loans | Education, housing | Government support, low interest |

Each loan type has unique benefits and requirements. Families must weigh options carefully.

Credit: www.creditkarma.com

Assessing Your Financial Situation

Before you explore low-income loan options, it’s crucial to assess your financial situation. This step helps you understand what you can afford. Let’s break this down into easy parts.

Budgeting Basics

Budgeting is the first key step. It shows where your money goes. Start by listing your monthly income. Then, subtract your expenses. What’s left is your spending money. Use these simple steps:

- Track all expenses for a month.

- Group expenses into categories (food, housing, etc.).

- Set goals to save money.

Try using a budgeting app. It makes tracking easier.

Understanding Credit Scores

Your credit score is a big deal. Lenders look at it. A high score means better loan terms. Here’s a simple way to check yours:

- Use free online tools to check your score.

- Read your credit report for errors.

- Fix any mistakes to improve your score.

Remember, paying bills on time helps your score. Avoid borrowing too much money.

Government-backed Loan Programs

Many families face challenges when seeking loans.

Government-backed loan programs offer solutions.

These programs provide low-income families with financial support.

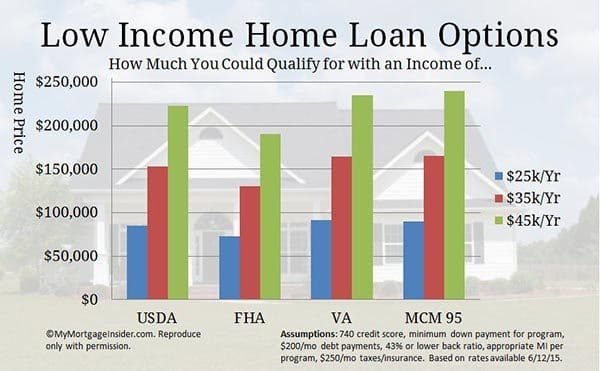

Fha Loans Explained

The Federal Housing Administration (FHA) backs these loans.

FHA loans require lower down payments.

They are more accessible than conventional loans.

- Credit requirements are less strict.

- Down payments can be as low as 3.5%.

- The FHA provides lender protection against defaults.

Usda Rural Development Loans

USDA loans support rural homebuyers.

These loans come with no down payment.

| Feature | Benefit |

|---|---|

| 100% Financing | No savings needed for down payments. |

| Low Mortgage Insurance | Reduces monthly costs. |

| Flexible Credit Guidelines | Makes qualifying easier. |

USDA loans help families afford homes outside busy cities.

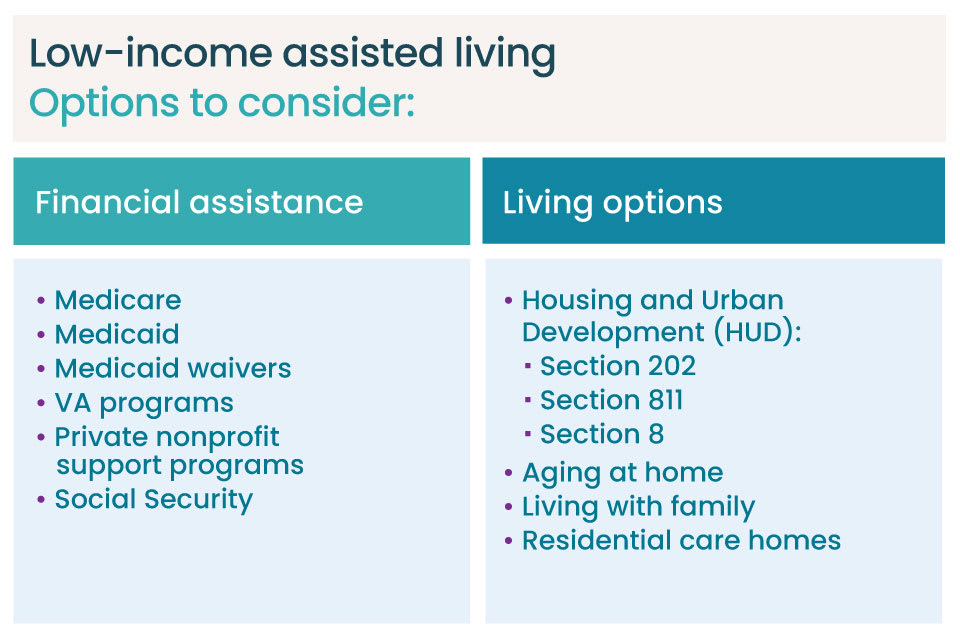

Community Initiatives And Non-profit Lenders

Families with limited income often struggle to secure loans from traditional banks. Community initiatives and non-profit lenders offer a beacon of hope. These organizations provide financial solutions tailored to low-income groups. They understand the challenges and work to offer more accessible lending options.

Local Non-profit Resources

Local non-profits play a critical role in supporting low-income families. They offer loans with lower interest rates and flexible terms. Services may include financial education and debt counseling to help borrowers manage their finances better.

- Emergency loan programs for unexpected expenses

- Assistance with housing and utility payments

- Grants and scholarships for education and development

Credit Unions As An Alternative

Credit unions are member-owned financial cooperatives. They often provide affordable loan options for members. Credit unions may offer personalized service and guidance to help families achieve financial stability.

| Feature | Credit Union | Traditional Bank |

|---|---|---|

| Interest Rates | Typically lower | Can be higher |

| Membership | Community-based | Open to anyone |

| Profit Sharing | Members benefit | Shareholders benefit |

Online Lenders And Microloans

Many families need help with money. Online lenders and microloans can help. They offer small loans. This is good for low-income families.

The Rise Of Peer-to-peer Lending

Peer-to-peer lending connects people who need money with those who have money to lend. It’s all done online. This makes getting a loan easier and often cheaper. Here are some key points:

- Easy online applications

- Quick money transfer

- Lower fees than banks

Microfinance For Small Personal Loans

Microloans are small loans. They are perfect for people who need a little bit of money. Here’s how they help:

- Build credit score

- Pay for important things

- Start small businesses

Many online platforms offer microloans. They work with low-income families. They make sure families can pay back without stress.

| Loan Type | Benefits | Best For |

|---|---|---|

| Peer-to-Peer | Quick, Low fees | Urgent needs |

| Microloans | Build credit, Small needs | Starting businesses |

Credit: www.aplaceformom.com

Strategies To Avoid High-interest Debt Traps

Seeking financial support can lead families to high-interest debt traps. Understanding the risks and managing borrowing habits is crucial. Explore low-income loan options carefully. Learn strategies to avoid falling into a cycle of debt.

The Perils Of Payday Loans

Payday loans promise quick cash. They come with steep interest rates. Short repayment terms force borrowers into consecutive loans. This creates a debt spiral. Families should avoid these high-cost loans.

- Identify alternative loan sources.

- Seek community financial assistance programs.

- Consider credit unions for lower rates.

Credit Card Use And Debt Management

Credit cards offer flexibility. Yet, unchecked use leads to unmanageable debt. High interest compounds the problem. Families must use credit cards wisely. Follow these steps:

- Track all credit card expenses.

- Set a budget for credit card use.

- Pay more than the minimum monthly payment.

- Look for cards with lower interest rates.

| Strategy | Action | Benefit |

|---|---|---|

| Budgeting | Limit spending | Control debt growth |

| Debt consolidation | Combine debts | Lower interest rates |

| Negotiation | Discuss terms with creditors | Reduce fees |

Adopt a proactive approach to debt management. Regularly review credit reports. Seek financial counseling if necessary. This can prevent debt from escalating.

Building Credit: A Path To Better Loan Options

Strong credit opens doors to better loan conditions. Families with low income can build credit. This leads to more favorable loan options. Credit building is not instant. It is a journey worth taking. Let’s explore tools to build credit effectively.

Secured Credit Cards Explained

Secured credit cards are powerful credit building tools. They require a cash deposit. This deposit acts as your credit limit. These cards report to credit bureaus. On-time payments improve your credit score. Use secured cards responsibly for credit growth.

Installment Loans For Credit Building

Installment loans can boost credit scores. They have fixed payments over time. These include personal, auto, or student loans. Timely payments show lenders you’re trustworthy. This positive activity reflects in your credit history. It’s a step toward better loan access.

Financial Education And Support

Finding the right low-income loan options can be challenging. Knowledge is power, especially when it comes to managing money. Financial education provides critical support to families. It helps them understand loan terms and manage debt. Let’s explore free resources available for financial learning and support.

Free Financial Counseling Services

Struggling with debt? Free financial counseling services can help. Experts guide you through budgeting and debt management. They provide personalized plans for financial stability. Many non-profits and community programs offer these services at no cost.

Workshops And Online Tools

Prefer learning at your own pace? Workshops and online tools are great resources. They offer interactive learning experiences. You can gain insights into saving, investing, and improving your credit score. Here’s a list of what to look for:

- Budgeting workshops

- Credit building seminars

- Debt reduction strategies

- Online financial calculators

- Money management games and apps

Credit: www.rocketmortgage.com

Frequently Asked Questions

What Are Low-income Loan Options?

Low-income loan options include federal loans like FHA and VA loans, local government assistance programs, and loans from credit unions or community banks tailored for low-income families.

How To Qualify For Low-income Loans?

To qualify for low-income loans, you usually need to meet certain income thresholds, have a stable employment history, and a decent credit score. Documentation of income and financial need is also required.

Are Payday Loans Suitable For Low-income Families?

Payday loans can provide quick cash but often have high-interest rates and fees. They are not generally recommended for low-income families due to the potential for creating a cycle of debt.

Can Low-income Families Get Mortgage Assistance?

Yes, low-income families can get mortgage assistance through programs like HUD’s FHA loans, USDA loans for rural areas, and various state-funded homeowner assistance programs.

Conclusion

Exploring low-income loan options can open doors for families in need. Careful research and financial planning are key. Remember, the right loan can provide a lifeline without overwhelming debt. Seek out reputable lenders and consider all terms carefully. Empower your family’s future with informed financial choices.