When it comes to investing, there are several options available to individuals looking to grow their wealth. Two popular choices are peer-to-peer lending and investing in bonds. Both offer the potential for attractive returns, but there are significant differences between the two that investors should be aware of before making a decision.

What is Peer-to-Peer Lending?

Peer-to-peer lending, often abbreviated as P2P lending, is a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary. Peer-to-peer lending platforms connect borrowers with investors, cutting out the traditional banking system.

Credit: thecrowdspace.com

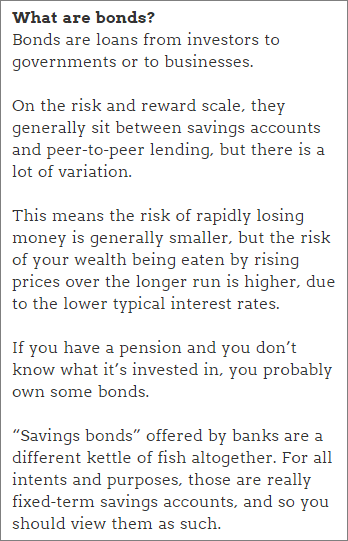

Understanding Bonds

Bonds, on the other hand, are debt securities issued by governments, municipalities, or corporations to raise capital. When an investor buys a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

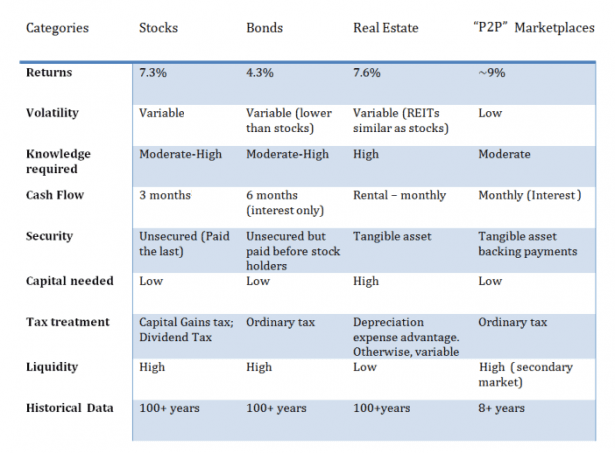

Comparing Risk and Return

Both peer-to-peer lending and bonds carry a degree of risk, but the nature of the risk differs between the two. Peer-to-peer lending typically involves loans to individuals or small businesses, which may carry a higher risk of default. On the other hand, bonds issued by governments or established corporations are generally considered less risky, although they may offer lower returns compared to peer-to-peer lending.

Liquidity and Accessibility

One of the key differences between peer-to-peer lending and bonds is liquidity. While bonds are generally considered to be relatively liquid investments, peer-to-peer lending can be less liquid due to the longer-term nature of the loans. Additionally, bonds are typically traded on public exchanges, making them more accessible to a wider range of investors compared to peer-to-peer lending platforms, which often have specific eligibility criteria for investors.

Diversification and Portfolio Allocation

Investors looking to diversify their portfolios may find that both peer-to-peer lending and bonds have a role to play. Bonds are often used as a way to add stability and income to a portfolio, while peer-to-peer lending can offer the potential for higher returns, albeit with higher risk. By carefully allocating funds to both types of investments, investors can create a well-rounded portfolio that balances risk and return.

Tax Considerations

From a tax perspective, the treatment of income from peer-to-peer lending and bonds may differ. Interest income from bonds is generally taxable, but the tax treatment of peer-to-peer lending income can vary depending on the jurisdiction and the individual investor’s circumstances. It’s important for investors to consider the tax implications of both options before making investment decisions.

Credit: www.4thway.co.uk

Frequently Asked Questions On Peer To Peer Lending Vs Bonds

Q: How Does Peer To Peer Lending Work?

A: Peer to peer lending is a method where individuals lend money to each other without the involvement of traditional financial institutions.

Q: What Are The Benefits Of Peer To Peer Lending?

A: Peer to peer lending offers higher returns, diversification, and the opportunity to support small businesses and individuals in need.

Q: Are Peer To Peer Loans Safe?

A: While peer to peer loans carry risk, platforms often have measures in place, such as credit checks and loan diversification, to minimize risks.

Q: What Are Bonds?

A: Bonds are fixed-income securities where investors lend money to the issuer in exchange for periodic interest payments and the return of principal at maturity.

Conclusion

Ultimately, the decision between peer-to-peer lending and bonds will depend on an individual’s investment goals, risk tolerance, and overall financial situation. Both options offer the potential for attractive returns, but they also come with their own set of risks and considerations. By carefully weighing the pros and cons of each option, investors can make informed decisions that align with their long-term financial objectives.