High-deductible health insurance plans (HDHPs) feature higher out-of-pocket costs before coverage kicks in. These plans often have lower monthly premiums.

High-deductible health insurance plans are popular for their affordability in monthly premiums. They require policyholders to pay a significant amount out-of-pocket before the insurance covers medical expenses. Ideal for healthy individuals or those with minimal medical needs, HDHPs pair well with Health Savings Accounts (HSAs).

HSAs allow individuals to save money tax-free for medical expenses. This combination offers financial flexibility and potential tax benefits. HDHPs are often chosen by employers to manage healthcare costs. Understanding the balance between deductibles and premiums is crucial when selecting this type of health insurance.

Credit: www.ferencearison.com

Introduction To High-deductible Health Insurance

High-deductible health insurance plans (HDHPs) are increasingly popular. These plans offer lower monthly premiums but require higher out-of-pocket costs before coverage kicks in. Understanding these plans is essential for making informed healthcare decisions.

What It Is

High-deductible health insurance is a type of health plan. It features a higher deductible than traditional insurance plans. A deductible is the amount you pay for healthcare services before the insurance starts to pay.

For instance, if your plan has a $2,000 deductible, you pay the first $2,000 of covered services yourself. After meeting the deductible, the insurance pays the rest.

How It Works

HDHPs work by shifting more initial costs to the insured person. This means you pay more upfront for medical care. But once the deductible is met, the insurance starts to cover costs.

These plans often pair with Health Savings Accounts (HSAs). HSAs allow you to save money tax-free for medical expenses. Contributions to an HSA can be used to pay for various health-related costs.

| Feature | HDHP | Traditional Plan |

|---|---|---|

| Monthly Premium | Lower | Higher |

| Deductible | Higher | Lower |

| Out-of-Pocket Costs | Higher initially | Lower initially |

| Eligible for HSA | Yes | No |

Here are some key points about HDHPs:

- Lower monthly premiums

- Higher out-of-pocket costs before coverage starts

- Eligible for Health Savings Accounts (HSAs)

HDHPs are suitable for those who don’t expect frequent medical expenses. They are also good for people who want to save on monthly premiums. Knowing the basics of how they work can help you make the right choice.

Benefits Of High-deductible Plans

High-deductible health insurance plans offer many benefits. These plans help save money. They are a great choice for healthy individuals. Here are some key benefits:

Lower Premiums

High-deductible plans come with lower premiums. This means you pay less each month. It’s a good option for those who rarely visit the doctor. You can save more money over time.

Tax Advantages

High-deductible plans often pair with Health Savings Accounts (HSAs). HSAs offer many tax advantages. You can put money into an HSA before taxes. This reduces your taxable income.

| Benefit | Explanation |

|---|---|

| Lower Premiums | Pay less each month for insurance. |

| Tax Advantages | Save money on taxes with an HSA. |

- Lower premiums make these plans affordable.

- HSAs offer tax savings and flexibility.

- Pay less each month.

- Save on taxes with an HSA.

Drawbacks Of High-deductible Plans

High-deductible health insurance plans have their share of drawbacks. They might seem appealing due to their lower premiums. But they can lead to higher costs and financial risks.

Higher Out-of-pocket Costs

With high-deductible plans, you pay more out-of-pocket. This means paying for medical expenses until you meet your deductible. Here’s a breakdown:

- Deductible: The amount you pay before insurance covers costs.

- Copayments: Fixed fees you pay for services, like doctor visits.

- Coinsurance: Your share of costs after meeting the deductible.

These higher costs can be a burden. Especially for those with frequent medical needs.

Potential Financial Risk

High-deductible plans can pose financial risks. You might face unexpected medical bills. Here’s how:

- Emergency visits can lead to high out-of-pocket expenses.

- Unexpected surgeries can drain your savings.

- Chronic conditions require frequent care, adding up costs.

These risks can strain your finances. It’s important to have a savings plan.

Consider the potential financial impact before choosing a high-deductible plan. It’s crucial to weigh the costs and risks involved.

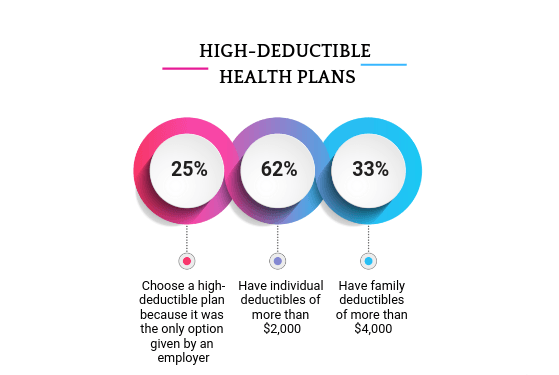

Credit: www.ibj.com

Eligibility Criteria

High-Deductible Health Insurance (HDHI) plans are popular. They offer lower premiums and higher deductibles. This can save money for healthy individuals. But not everyone can enroll. Let’s explore the eligibility criteria.

Who Can Enroll

Not all individuals qualify for HDHI plans. Here are some key points:

- Individuals – Any adult can enroll if they meet the specific requirements.

- Families – Families can also enroll, but all members must meet the criteria.

- Employees – Employees can enroll if their employer offers HDHI plans.

Requirements

To enroll in an HDHI plan, you must meet the following requirements:

| Requirement | Description |

|---|---|

| Age | Must be at least 18 years old. |

| Health Savings Account (HSA) | Must be eligible to open an HSA. |

| High Deductible | Must agree to a high deductible amount. |

Meeting these requirements is essential. They ensure you are eligible for HDHI plans. This type of insurance is not for everyone. Consider your health needs and financial situation. Make an informed decision before enrolling.

How To Choose The Right Plan

Choosing the right high-deductible health insurance plan can be challenging. You need to consider various factors to ensure it meets your needs. This guide will help you make an informed decision.

Assessing Your Needs

First, assess your health care needs. Ask yourself these questions:

- How often do you visit the doctor?

- Do you take any regular medications?

- Do you have any ongoing medical conditions?

- What is your budget for health care expenses?

Understanding these needs helps you select the best plan.

Comparing Options

Next, compare different plans. Look at the following aspects:

| Aspect | Plan A | Plan B | Plan C |

|---|---|---|---|

| Deductible | $1,500 | $2,000 | $2,500 |

| Monthly Premium | $200 | $150 | $100 |

| Co-Pay | $20 | $25 | $30 |

| Out-of-Pocket Max | $5,000 | $6,000 | $7,000 |

Use this comparison to find the plan that offers the best value.

Choosing a high-deductible health insurance plan requires careful consideration. By assessing your needs and comparing options, you can find a plan that fits your lifestyle and budget.

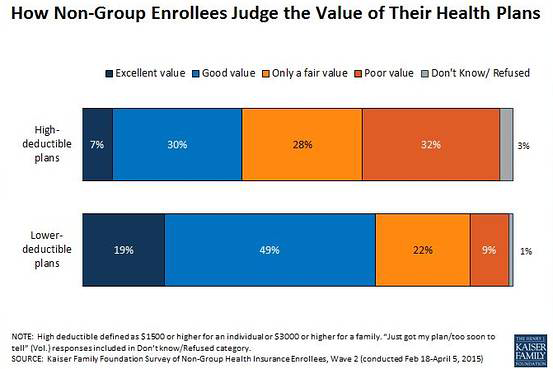

Credit: www.kff.org

Tips For Managing Costs

Managing costs with high-deductible health insurance can be challenging. By following these tips, you can make the most of your coverage and keep expenses low.

Health Savings Accounts

A Health Savings Account (HSA) is a great tool. You can save money tax-free. Use it to pay for medical expenses.

- Contribute to your HSA regularly.

- Use HSA funds for qualified medical expenses.

- Save receipts for HSA reimbursements.

HSAs also offer investment options. You can grow your savings over time. It is like a retirement account for health expenses.

Preventive Care

High-deductible plans often cover preventive care at no cost. This includes yearly check-ups and vaccinations.

| Service | Cost |

|---|---|

| Annual Physical Exam | $0 |

| Vaccinations | $0 |

| Screenings (e.g., cancer) | $0 |

Take advantage of these services. They help detect problems early. Early detection saves money and keeps you healthy.

Frequently Asked Questions

What Is High-deductible Health Insurance?

High-deductible health insurance has lower premiums and higher deductibles compared to traditional plans.

How Do High-deductible Plans Work?

You pay lower premiums but higher out-of-pocket costs before the insurance covers expenses.

Are High-deductible Plans Good For Young People?

Yes, they’re often suitable for younger, healthier individuals with fewer medical needs.

Can I Use An Hsa With A High-deductible Plan?

Yes, Health Savings Accounts (HSAs) are often paired with high-deductible plans to save for medical expenses.

What Are The Pros And Cons Of High-deductible Plans?

Pros: Lower premiums, HSA eligibility. Cons: Higher out-of-pocket costs, potential financial strain.

Conclusion

High-deductible health insurance offers lower premiums but higher out-of-pocket costs. It’s ideal for healthy individuals with minimal medical expenses. Evaluate your healthcare needs and financial situation before choosing. This type of plan can save money if used wisely. Always compare options to find the best fit for your lifestyle and budget.