Open Enrollment for health insurance is a specific period when individuals can enroll in or change their health insurance plans. Missing this window may require waiting for the next period, unless you qualify for a Special Enrollment Period.

Open Enrollment allows individuals to review their health insurance options and make changes or new enrollments. It’s a crucial time to assess coverage needs and compare plans. This period typically occurs once a year and ensures that everyone has the opportunity to secure health insurance.

Employers, the government, and insurance companies usually provide information and support during this time. Understanding Open Enrollment can help you avoid penalties and ensure you have the necessary coverage for medical needs throughout the year.

Credit: lchcommunityhealth.org

Basics Of Open Enrollment

Understanding the basics of open enrollment is essential for everyone. This period allows you to make crucial health insurance decisions. Let’s break down what open enrollment means and its purpose.

Definition

Open enrollment is a specific time each year. During this period, you can sign up for health insurance. You can also make changes to your existing plan. After this period, changes are limited.

Purpose

The purpose of open enrollment is to ensure everyone has access to health coverage. It helps prevent gaps in coverage. It also allows people to update their plans based on life changes.

- Sign up for new health insurance

- Change existing plans

- Ensure continuous coverage

| Benefit | Explanation |

|---|---|

| Access to coverage | Everyone gets a chance to enroll in a health plan. |

| Plan updates | Update your plan based on your current needs. |

| Prevent gaps | Ensures you have continuous health insurance coverage. |

Open enrollment periods are crucial. They help maintain your health and financial security. Make sure to mark your calendar for this important time.

Credit: consumer.ftc.gov

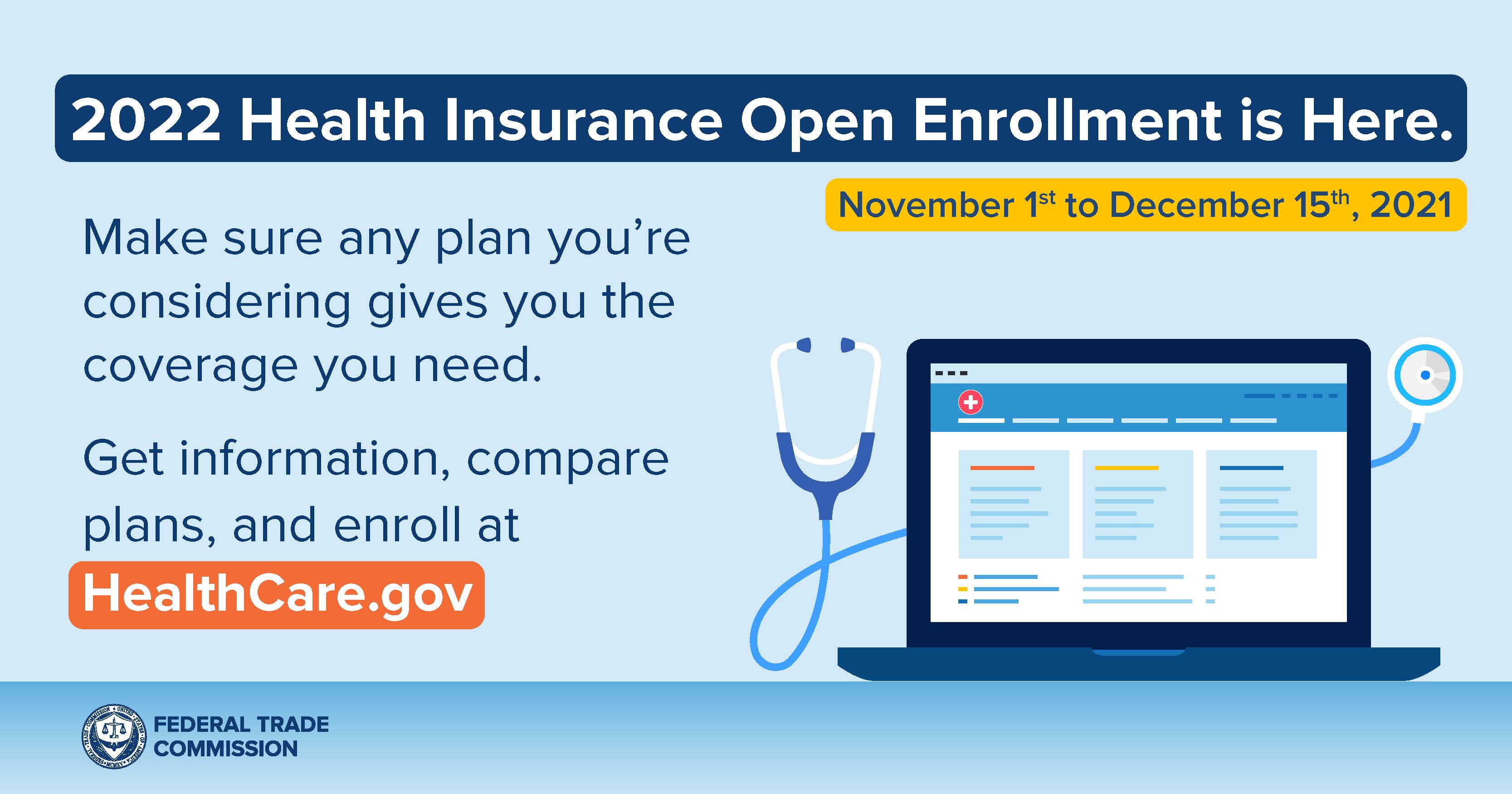

Key Dates

Understanding the key dates for open enrollment is essential. These dates determine when you can enroll, change, or update your health insurance plan. Missing these dates can have significant consequences, so it’s important to mark them on your calendar.

Annual Period

The Annual Open Enrollment Period is a specific time each year. During this period, you can enroll in a new health insurance plan or make changes to your current one. Below is a table with the usual dates for the annual period:

| Event | Dates |

|---|---|

| Start Date | November 1 |

| End Date | December 15 |

These dates may vary, so always check with your provider. Missing the annual period can limit your options for the entire year.

Special Enrollment

Special Enrollment Periods are for those who experience qualifying life events. These events allow you to enroll outside the annual period. Examples of qualifying events include:

- Getting married

- Having a baby

- Losing other health coverage

During a special enrollment period, you have 60 days from the event to enroll. This ensures you get the coverage you need without waiting for the annual period.

Knowing the key dates helps you plan and ensures you have the best health coverage.

Eligibility Criteria

Understanding the eligibility criteria for open enrollment is crucial. During this period, individuals can sign up for health insurance plans. This section explains who can enroll and the qualifying events that may allow enrollment outside the open period.

Who Can Enroll?

During the open enrollment period, most people can sign up for health insurance. This includes:

- Individuals without current health insurance

- People looking to change their existing plan

- Dependents under a family plan

- Young adults turning 26 and leaving their parents’ plan

Special groups like low-income families may qualify for Medicaid. Seniors aged 65 or older can enroll in Medicare.

Qualifying Events

Some events allow you to enroll outside the open period. These qualifying events include:

| Event | Description |

|---|---|

| Marriage | Gain coverage for your spouse and stepchildren |

| Birth/Adoption | Add a new child to your plan |

| Job Loss | Enroll if you lose employer-sponsored coverage |

| Relocation | Change your plan if you move to a new area |

| Divorce | Remove a spouse from your plan |

These events trigger a Special Enrollment Period allowing changes to your plan.

Types Of Health Plans

Choosing the right health plan during Open Enrollment is crucial. There are various types of health plans available. Each type offers different benefits and features. Understanding these types helps you make an informed decision.

Private Insurance

Private insurance is purchased directly from an insurance company. These plans offer flexibility and a wide range of options. You can choose plans based on your needs and budget.

- Health Maintenance Organization (HMO) – Requires you to use a network of doctors.

- Preferred Provider Organization (PPO) – Offers more choices for doctors and hospitals.

- Exclusive Provider Organization (EPO) – Limits coverage to a network of doctors.

- Point of Service (POS) – Combines features of HMO and PPO plans.

Employer-sponsored Plans

Most people get their health insurance through their employer. These are called employer-sponsored plans. Employers usually cover a part of the premium.

There are different types of employer-sponsored plans:

- Group Health Insurance – Covers employees and sometimes their families.

- High Deductible Health Plans (HDHP) – Lower premiums but higher deductibles.

- Health Reimbursement Arrangements (HRA) – Employers fund accounts to pay for medical expenses.

Understanding these options helps you choose the best plan for your needs. Remember to consider your family’s health needs and budget.

Steps To Enroll

Open Enrollment for Health Insurance can be confusing. Knowing the steps to enroll helps. This section provides clear steps to follow. Let’s break it down into preparation and the submission process.

Preparation

Before you start, gather all needed documents. This ensures a smooth process. Here’s a list of what you might need:

- Social Security numbers for all family members.

- Employer and income information.

- Policy numbers for current health insurance.

- Information on any health coverage available through jobs.

Check the enrollment dates. Missing the deadline means waiting for the next period. Understand your needs and budget. Compare different plans available.

Submission Process

After preparing, the next step is the submission. Follow these steps:

- Visit the official website: Go to the health insurance marketplace.

- Create an account: Provide your email and create a password.

- Fill out the application: Enter personal details and income information.

- Compare plans: Review different plans that fit your needs.

- Choose a plan: Select the best plan for you and your family.

- Submit application: Confirm your choices and submit the application.

- Receive confirmation: Check for a confirmation email and further instructions.

Ensure all information is correct before submitting. Mistakes can delay the process. After submitting, wait for approval and confirmation. Keep an eye on your email for updates.

Common Mistakes

Open enrollment is a crucial time for choosing health insurance. Many people make mistakes that can cost them. Understanding these mistakes can save you time and money. Let’s explore some common pitfalls.

Missing Deadlines

Missing the open enrollment deadline is a big mistake. If you miss it, you may not get coverage. This can lead to high medical bills. Always mark the deadline on your calendar. Set reminders a week before the last date.

Here’s a simple table to keep track of important dates:

| Event | Date |

|---|---|

| Open Enrollment Start | November 1 |

| Open Enrollment End | December 15 |

Choosing The Wrong Plan

Choosing the wrong plan can be costly. Many people pick plans without research. Some plans have high premiums but low coverage. Others have low premiums but high out-of-pocket costs. Always compare plans carefully.

Use this checklist to choose the right plan:

- Check if your doctor is in-network

- Look at the plan’s coverage for prescriptions

- Consider your monthly premium

- Check the deductible and out-of-pocket maximum

This approach ensures you get the best coverage for your needs.

Credit: themanchestermirror.com

Frequently Asked Questions

What Is Open Enrollment Period?

Open enrollment is a set time each year when you can sign up for health insurance.

When Is Open Enrollment For 2023?

For 2023, open enrollment typically runs from November 1 to December 15.

Can I Change Plans During Open Enrollment?

Yes, you can switch to a different health insurance plan during open enrollment.

What Happens If I Miss Open Enrollment?

Missing the open enrollment period means you might have to wait for the next one, unless you qualify for a special enrollment period.

Who Is Eligible For Open Enrollment?

Anyone looking to purchase or change their health insurance plan is eligible during the open enrollment period.

Conclusion

Understanding open enrollment for health insurance is crucial. It allows you to choose the best plan for your needs. Make sure to review all options and deadlines. This period is your chance to secure the right coverage. Stay informed and proactive to ensure your health and financial well-being.