Short-term health insurance coverage provides temporary medical coverage, typically for 30 days to 12 months. It fills gaps when transitioning between other health plans.

Short-term health insurance is designed for people in transitional periods. This type of coverage is ideal for those who are between jobs, waiting for other health insurance to begin, or need a temporary solution. These plans often have lower premiums compared to traditional health insurance but may cover fewer services.

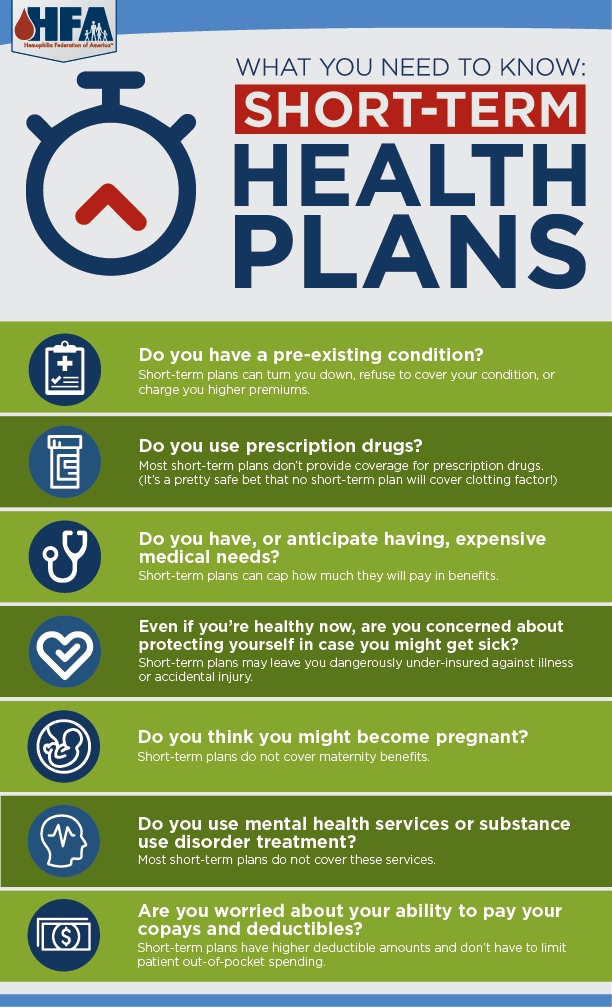

They can provide peace of mind by covering unexpected medical emergencies. However, it’s important to read the policy details carefully, as short-term plans may not cover pre-existing conditions or offer the same comprehensive benefits as long-term insurance plans.

Credit: www.hemophiliafed.org

Introduction To Short-term Health Insurance

Short-term health insurance offers temporary coverage for unexpected health needs. It fills the gap when you are between long-term plans. This type of insurance is flexible and provides essential protection.

What It Covers

Short-term health insurance covers emergency care and hospital visits. It also includes doctor visits and urgent care. Prescriptions are usually covered but with limits.

Policies may include basic wellness care. This can vary by provider. Read your policy details carefully. Ensure it meets your needs.

| Service | Coverage |

|---|---|

| Emergency Care | Yes |

| Hospital Visits | Yes |

| Doctor Visits | Yes |

| Prescriptions | Limited |

| Wellness Care | Varies |

Who Needs It

People in transition periods often need short-term health insurance. This includes those between jobs or waiting for new coverage to start. Students and new graduates can also benefit.

Short-term plans are ideal for temporary gaps in coverage. They are not suitable for long-term health needs. Check if this type of coverage fits your situation.

Families and individuals can use short-term plans. These policies are also good for travelers needing coverage for a short time.

Eligibility Criteria

Understanding the eligibility criteria for short-term health insurance coverage is essential. This helps determine who can benefit from this type of insurance. Short-term health insurance is designed to provide temporary coverage. Let’s explore the key aspects of eligibility.

Qualifying For Coverage

To qualify for short-term health insurance, certain conditions must be met. Below are common requirements:

- Applicants must be under 65 years old.

- They must be U.S. citizens or legal residents.

- Applicants should not be eligible for Medicaid or Medicare.

- They must pass a basic health questionnaire.

Common Restrictions

Short-term health insurance comes with restrictions. Knowing these can help applicants make informed decisions:

- Pre-existing conditions may not be covered.

- Maternity care is often excluded.

- Mental health services may have limited coverage.

- Prescription drugs may not be included.

A table summarizing the common restrictions can help:

| Restriction | Details |

|---|---|

| Pre-existing Conditions | Often not covered |

| Maternity Care | Usually excluded |

| Mental Health | Limited coverage |

| Prescription Drugs | May not be included |

Knowing the eligibility criteria helps in choosing the right plan. Short-term health insurance can be a temporary solution for many.

Cost And Affordability

Short-term health insurance is a great option for many people. It’s important to understand the costs involved. Let’s break down the cost and affordability of short-term health insurance coverage.

Premiums And Deductibles

Premiums are the monthly payments you make for your insurance. They are usually lower than long-term health plans. This makes short-term health insurance more affordable for many.

Deductibles are the amounts you pay before your insurance covers costs. Short-term plans often have higher deductibles. This helps keep the premiums low.

| Cost Component | Short-Term Plan | Long-Term Plan |

|---|---|---|

| Monthly Premium | Lower | Higher |

| Deductible | Higher | Lower |

Comparing Costs

Let’s compare the costs of short-term and long-term health plans.

- Short-term plans have lower monthly premiums.

- Long-term plans have higher monthly premiums.

- Short-term plans have higher deductibles.

- Long-term plans have lower deductibles.

- Short-term plans are ideal for temporary needs.

- They are great for gaps in coverage.

- Long-term plans are better for ongoing health care needs.

In summary, short-term health insurance offers a balance between premiums and deductibles. It’s a good choice for those needing temporary coverage.

Key Benefits

Short-term health insurance is a great option for many people. It provides essential benefits and flexibility. This type of coverage is ideal for temporary needs. Below are the key benefits you should know about.

Temporary Coverage

Short-term health insurance offers temporary coverage. This is perfect for those in between jobs or waiting for other coverage to begin. You can get coverage for a few months or up to a year. This ensures you are not left without health insurance.

| Duration | Eligibility |

|---|---|

| Up to 12 months | Individuals, families |

Flexibility And Choice

Short-term health insurance provides flexibility and choice. You can pick plans that suit your needs. This means you can choose your deductible and coverage limits.

- Pick your deductible

- Choose coverage limits

- Wide range of providers

This type of plan is also less expensive. It helps you save money while still getting the coverage you need.

Limitations And Drawbacks

Short-term health insurance has its benefits, but it also has several limitations and drawbacks. These can affect the overall value and effectiveness of the coverage. Below, we will explore some key issues you may face with short-term health insurance.

Coverage Gaps

One of the biggest drawbacks is coverage gaps. Short-term plans often do not cover essential health benefits. These may include maternity care, mental health services, and prescription drugs.

Here are some common coverage gaps:

- Maternity and newborn care

- Mental health and substance abuse services

- Prescription medications

- Preventive care and wellness services

Exclusions And Limitations

Short-term health plans come with many exclusions and limitations. These often exclude pre-existing conditions and have strict coverage limits.

Common exclusions and limitations include:

| Exclusion | Details |

|---|---|

| Pre-existing conditions | Any condition diagnosed before the policy start date. |

| Preventive care | Routine check-ups and screenings are often not covered. |

| Specialist visits | Visits to specialists may not be covered or have high copays. |

Note: Always read the policy details carefully to understand what is and isn’t covered.

Credit: paragoninstitute.org

How To Apply

Short-term health insurance provides temporary coverage. It’s ideal for gaps between jobs or waiting for other insurance. Knowing how to apply can be simple. Let’s explore the process step-by-step.

Application Process

The application process for short-term health insurance is straightforward. First, visit the insurer’s website. Next, fill out the online application form. Provide personal details like name, age, and address. You might also need to answer health-related questions.

Once you complete the form, review the information. Ensure all details are accurate. Submit the form online. Some insurers may offer instant approval. Others might take a few days to process your application. After approval, you can start using your coverage immediately.

Choosing The Right Plan

Choosing the right plan is crucial. Consider your health needs and budget. Compare different plans offered by insurers. Look at the coverage limits and exclusions. Check if the plan covers your preferred doctors and hospitals.

Use comparison tools available on insurer websites. These tools help you find the best plan. Pay attention to the monthly premiums and out-of-pocket costs. Read customer reviews and ratings. This gives you an idea of the insurer’s service quality.

Below is a table to help you compare plans:

| Plan | Monthly Premium | Coverage Limit | Deductible | Exclusions |

|---|---|---|---|---|

| Plan A | $100 | $1,000,000 | $1,000 | Pre-existing conditions |

| Plan B | $150 | $2,000,000 | $500 | Prescription drugs |

Pick a plan that balances coverage and cost. This ensures you get the protection you need without overspending.

Credit: covertexasnow.org

Frequently Asked Questions

What Is Short-term Health Insurance?

Short-term health insurance provides temporary coverage for unexpected medical expenses. It’s ideal for gaps between long-term plans.

Who Needs Short-term Health Insurance?

People between jobs, recent graduates, or those waiting for long-term coverage often choose short-term health insurance.

How Long Does Short-term Health Insurance Last?

Short-term health insurance typically lasts from one month to a year, depending on the plan and state regulations.

What Does Short-term Health Insurance Cover?

Short-term health insurance usually covers doctor visits, emergency care, and hospitalization. It may not cover pre-existing conditions.

How Much Does Short-term Health Insurance Cost?

Costs vary based on coverage, age, and location. Generally, short-term health insurance is more affordable than long-term plans.

Conclusion

Short-term health insurance offers flexible and temporary coverage options. It can be a good fit during transitions. Always review the plan details carefully. Understand the limitations and benefits. This type of insurance can provide peace of mind when you need it most.

Consider your specific needs before making a decision.