To avoid loan scams online, always verify the lender’s credentials and never pay upfront fees. Research the company’s legitimacy through trusted sources before engaging.

Navigating the online financial landscape can be fraught with pitfalls, especially when it comes to securing loans. Scammers are adept at presenting themselves as legitimate lenders, making it crucial for borrowers to be vigilant. A key defense is thorough research—scrutinizing online reviews, checking with regulatory bodies, and confirming contact details.

It’s also wise to be wary of offers that seem too good to be true, such as loans with incredibly low-interest rates or guaranteed approvals without credit checks. Solid financial decisions begin with education, so familiarizing oneself with common scam tactics can serve as an invaluable shield against fraud. By adhering to these principles, you can protect your finances and personal information from predatory schemes lurking on the internet.

Credit: www.cash1loans.com

The Rise Of Online Loan Scams

In recent years, online loan scams have surged. Fraudsters exploit the internet’s convenience to deceive unsuspecting borrowers. They lure victims with promises of quick cash and easy approval. Awareness is the first step in safeguarding oneself from these digital traps.

Identifying The Threat

Recognizing online loan scams is crucial for online safety. Here are key red flags:

- No credit check promises

- Upfront fees requested before loan approval

- Lenders without physical addresses or contact details

- High-pressure tactics urging immediate decisions

- Offers via phone calls, email, or door-to-door visits

Recent Scam Statistics

Scam numbers are alarming. Consider these stats:

| Year | Scam Reports | Losses ($) |

|---|---|---|

| 2021 | 50,000+ | 3 million+ |

| 2022 | 60,000+ | 4 million+ |

The trend is clear. Scams are rising. Losses are mounting. Stay vigilant and informed to avoid falling victim.

Credit: www.self.inc

Common Traits Of Loan Scams

Common Traits of Loan Scams can trick many people. Scammers use clever tricks to steal your money. It’s important to know these tricks to stay safe.

Red Flags To Watch Out For

- Pressure to act quickly. Real lenders give you time.

- Upfront fees before you get the loan. This is a big no.

- Vague details about costs. Everything should be clear.

- No credit check promises. Real loans often need checks.

Unsolicited Loan Offers

Did an offer come without asking? Be careful. Real lenders don’t do this often.

- Emails or texts out of nowhere are suspect.

- Offers that seem too good to be true usually are.

- Always check the lender’s contact information. It should be easy to find and real.

Know these signs to protect your money. Stay safe and always double-check.

The Importance Of Research

When seeking loans online, research is your shield. It helps you spot scams and choose safe options. Let’s dive into how you can safeguard your finances with thorough research.

Verifying Lender Credentials

First, confirm the lender’s legitimacy. Scammers often pose as reputable lenders. Check their credentials before sharing your information.

- Visit official websites, not just any link you come across.

- Look for a physical address and contact details.

- Ensure they have a valid license for lending in your state.

- Use government databases to verify their registration.

Reading Reviews And Testimonials

Next, find out what others say about the lender. Reviews and testimonials reveal the lender’s reliability. Here’s how to approach this step:

| Source | Action |

|---|---|

| Online Forums | Search for lender feedback. |

| Review Sites | Read multiple reviews for a balanced view. |

| Social Media | Check comments and direct messages. |

Remember, some reviews might be fake. Check for genuine, detailed experiences.

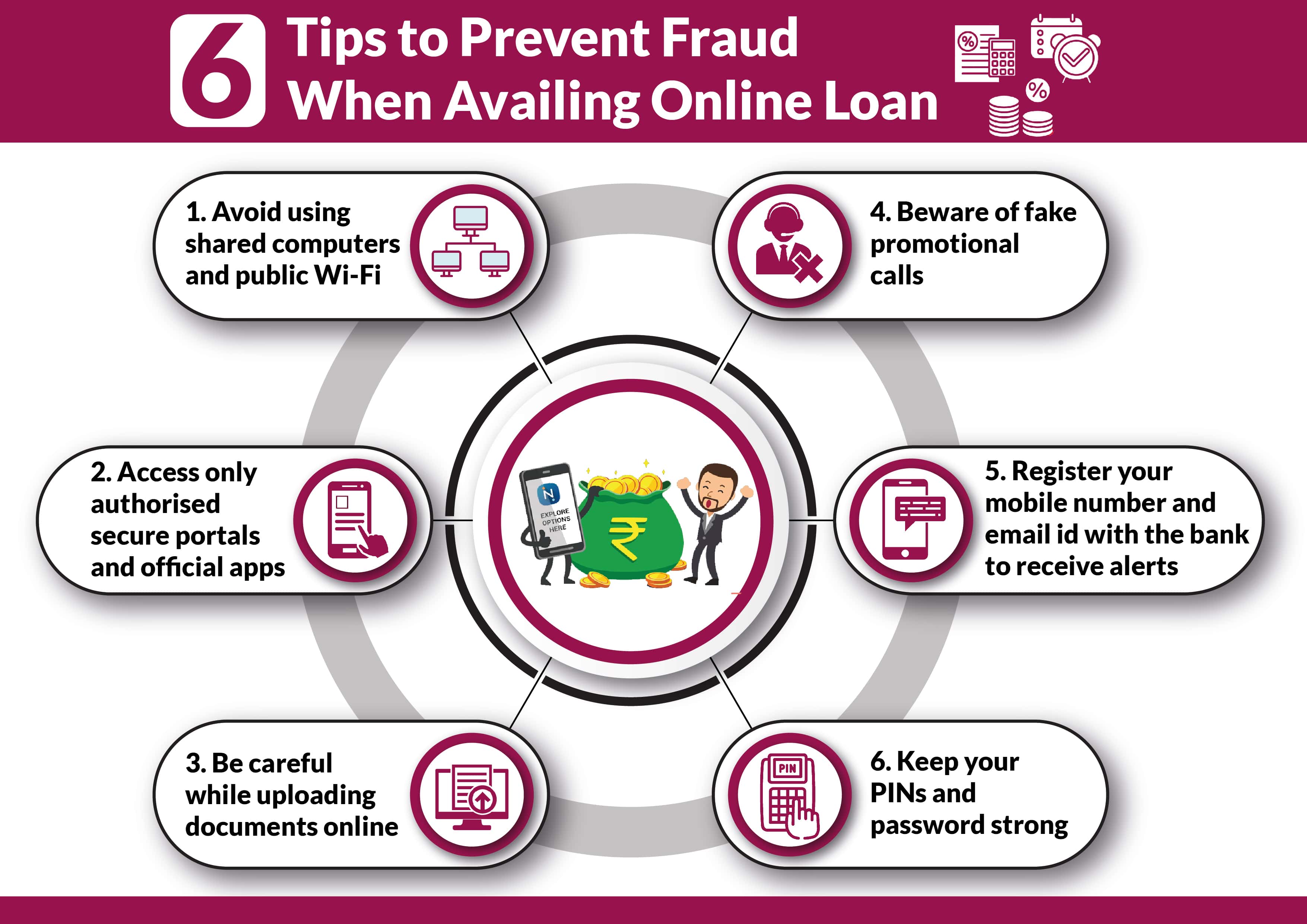

Secure Websites And Transactions

Secure Websites and Transactions play a vital role in online safety. Scammers often set up fake loan websites. They look real but are traps. Protect yourself by knowing how to spot secure websites. These sites encrypt your data, keeping your information safe.

Recognizing Secure Urls

Always check the web address when you visit a site. Secure sites start with ‘https://’. The ‘s’ stands for ‘secure’. A padlock icon should appear next to the URL. This means the site has a security certificate. Never enter personal details on sites without these signs.

Encryption And Data Protection

Legit lenders protect your data. They use encryption. This scrambles your details. Only the lender can unscramble it. Look for privacy policies on their sites. These should explain how they use and protect your data. Avoid lenders without clear encryption and data protection measures.

- Check for ‘https://’ in URLs

- Look for the padlock icon next to the web address

- Review the site’s privacy policy

- Ensure they mention data encryption

Remember, a secure website is just the first step. Always research the lender. Read reviews and check for complaints. This helps you avoid loan scams online.

Personal Information Safety

Personal Information Safety is key to avoiding loan scams online. Your personal data is like gold to scammers. They can steal your identity or empty your bank account. Let’s keep your information safe online.

Sharing Data Wisely

Be smart about where you share your personal details. Not all websites are safe. Here are ways to protect your data:

- Check the website – Make sure it starts with

https://. The ‘s’ means secure. - Look for reviews – Find what others say about the site.

- Use strong passwords – Mix letters, numbers, and symbols.

Avoiding Phishing Attempts

Phishing is when scammers trick you into giving your info. They might send fake emails or texts. Here’s how to avoid these traps:

- Don’t click on suspicious links – Even if it looks real, check first.

- Verify the sender – Contact the company through official channels.

- Update your software – Keep your devices protected against threats.

Credit: www.axisbank.com

Loan Offers Too Good To Be True

Loan offers that seem perfect often hide risks. Scams lure victims with promises of easy money. Stay alert for deals that feel too good. They usually are.

Analyzing Loan Terms

Scammers craft loan terms to confuse. Look for clear information. Legit loans have transparent conditions. Check for fees not explained. Trust your instincts on this.

Interest Rates As Warning Signs

Low interest rates can deceive. Compare rates from different lenders. A rate much lower than average is a red flag. Always question ultra-low offers.

- Research the lender online.

- Seek reviews and complaints.

- Verify license with state regulators.

Regulatory Bodies And Legal Safeguards

Navigating the online loan landscape can be tricky. Scammers are out there. Luckily, regulatory bodies work hard to keep you safe. Legal safeguards are in place, too. They help protect you from fraud. Let’s dive into understanding these protections.

Understanding Regulatory Roles

Regulatory agencies oversee financial activities. They enforce laws. This ensures fair and safe practices. In the US, agencies like the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) play key roles. They monitor lenders and loans. They make sure lenders follow the rules.

- FTC stops unfair business practices.

- CFPB handles complaints and protects consumers.

- State regulators license lenders and enforce local laws.

Reporting Suspicious Activities

You can report scams. Do it as soon as you suspect something. Contact the FTC or CFPB. Use their online platforms. Your reports help catch scammers. They also prevent others from falling victim.

Keep records of all your loan communications. This includes emails, calls, and messages. Report with evidence. The more details you provide, the better.

Stay alert and report. It’s a powerful way to fight loan scams.

Staying Informed: A Key Defense

Scammers evolve their tactics rapidly, making it crucial to stay informed. Knowledge is power when protecting yourself against loan scams online. Understanding the latest scam trends and utilizing educational resources can be your best defense. Let’s explore how you can arm yourself with information and tools to safeguard your finances.

Keeping Up With Scam Trends

Scammers constantly devise new schemes. It’s important to keep up. Here are ways to stay on top of these trends:

- Follow financial news outlets.

- Subscribe to scam alerts from trusted organizations.

- Join online forums discussing personal finance security.

Regular updates can alert you to scams before you encounter them.

Educational Resources And Tools

Educating yourself is essential. Below are resources and tools to use:

| Resource | Type | Benefit |

|---|---|---|

| FTC Website | Government | Official scam information |

| Consumer Finance Protection Bureau | Government | Financial education tools |

| Online Security Courses | Educational | Internet safety skills |

Use these resources to build your knowledge. They can help you spot and avoid scams.

Alternatives To Risky Online Loans

Finding safe financial solutions is crucial. Many online loan scams exist. It’s important to know trustworthy options. This guide presents alternatives to risky loans. Understand safe ways to borrow money online.

Reputable Online Lenders

Choose established online lenders. Look for positive reviews and licenses. Verify their credentials. Check with the Better Business Bureau. Ensure they follow regulations. Strong customer service is a good sign.

- Check for secure websites.

- Read user testimonials.

- Compare interest rates and fees.

Traditional Banking Options

Consider banks for loans. They offer personal, auto, and home loans. Credit unions are good too. They might have lower rates. Visit local branches. Discuss loan options. They can guide you.

| Option | Benefits |

|---|---|

| Banks | Reliable, regulated |

| Credit Unions | Member-focused, better rates |

Always read the fine print. Understand the loan terms. Ask about early repayment penalties. Choose what fits your needs.

Building A Safety Net

Building a Safety Net helps you stay safe from loan scams. A strong safety net means you won’t need risky loans. Let’s build one now.

Emergency Funds

Saving money for tough times is smart. This is your emergency fund. It’s cash for when things go wrong. No more scary loans!

- Start small: Even a little saving helps.

- Grow it: Add more when you can. Every bit counts.

- Keep it safe: In a bank is best. It earns interest too!

Financial Planning

Planning your money means no surprises. You know what you have and what you need. This makes you strong against scams.

- Track spending: Know where your money goes.

- Set goals: Save for things you want. Like a bike or games.

- Check often: Look at your money plans a lot. Make sure they work.

Building a safety net is your shield. It keeps you and your money safe. No more falling for bad loans!

Frequently Asked Questions

What Are Common Signs Of A Loan Scam?

Loan scams often promise easy approval or require upfront fees. Scammers might avoid credit checks or use high-pressure tactics. Look for official licensing and don’t share personal info hastily.

How Do I Verify A Lender’s Legitimacy?

Check the lender’s credentials with government financial regulatory bodies. Read online reviews, and ensure their contact details and physical address are verifiable and consistent.

Can I Trust Online Loan Offers With No Credit Checks?

Be cautious. Legitimate lenders typically review your credit history. Offers bypassing credit checks can be red flags for scams. Research thoroughly before proceeding.

What Steps Should I Take If I Suspect A Loan Scam?

Immediately cease communication. Report the incident to authorities like the FTC or your local consumer protection agency. Also, alert your bank and consider credit monitoring services.

Conclusion

Navigating online loan offers demands vigilance. Remember, verifying lender credentials and reading reviews are your best defenses against scams. Stay informed, cautious, and always trust your instincts. By doing so, securing a safe loan becomes much simpler. Let this guide be your beacon in the complex world of online lending.