Individuals with low credit scores can consider secured loans or credit unions for borrowing options. Peer-to-peer lending and online lenders also offer loans for those with poor credit.

Navigating the financial landscape with a low credit score can be challenging, yet various loan options exist to help. Secured loans provide a pathway for individuals to borrow against assets, offering lenders collateral that can make approval more likely. Credit unions, often more accommodating than traditional banks, may extend credit to members with lower scores, sometimes at more favorable interest rates.

For a modern twist on lending, peer-to-peer platforms connect borrowers directly with investors, bypassing the stringent requirements of institutional lenders. Additionally, numerous online lenders specialize in loans for those with less-than-perfect credit, though it’s crucial to scrutinize the terms to avoid high-interest rates and fees. Understanding these alternatives empowers individuals to make informed financial decisions, even when their credit history is less than ideal.

Credit: simplefastloans.com

The Reality Of Low Credit Scores

The Reality of Low Credit Scores can be daunting for many individuals. A low credit score often translates to limited financial options. It affects the ability to secure loans and the terms that come with borrowing. Understanding this reality is crucial for those navigating the realm of personal finance.

Impact On Borrowing

Low credit scores directly impact borrowing capabilities. Lenders view low scores as a risk. They often hesitate to offer loans. When they do, interest rates are higher, and loan terms are not favorable. This makes borrowing expensive and sometimes unattainable.

- Higher interest rates increase the cost of borrowing.

- Strict loan terms limit flexibility.

- Loan approvals become less likely.

Common Causes Of Low Credit

Several factors contribute to a low credit score. It is important to identify these causes to address credit issues effectively.

| Cause | Effect |

|---|---|

| Late Payments | Hurt credit history |

| High Credit Utilization | Signals risk to lenders |

| Defaulting on Loans | Significantly lowers score |

| Applying for Many Loans | Leads to hard inquiries |

Understanding these causes helps in taking steps to improve credit scores. Good credit management involves timely payments, low credit utilization, and avoiding unnecessary credit applications.

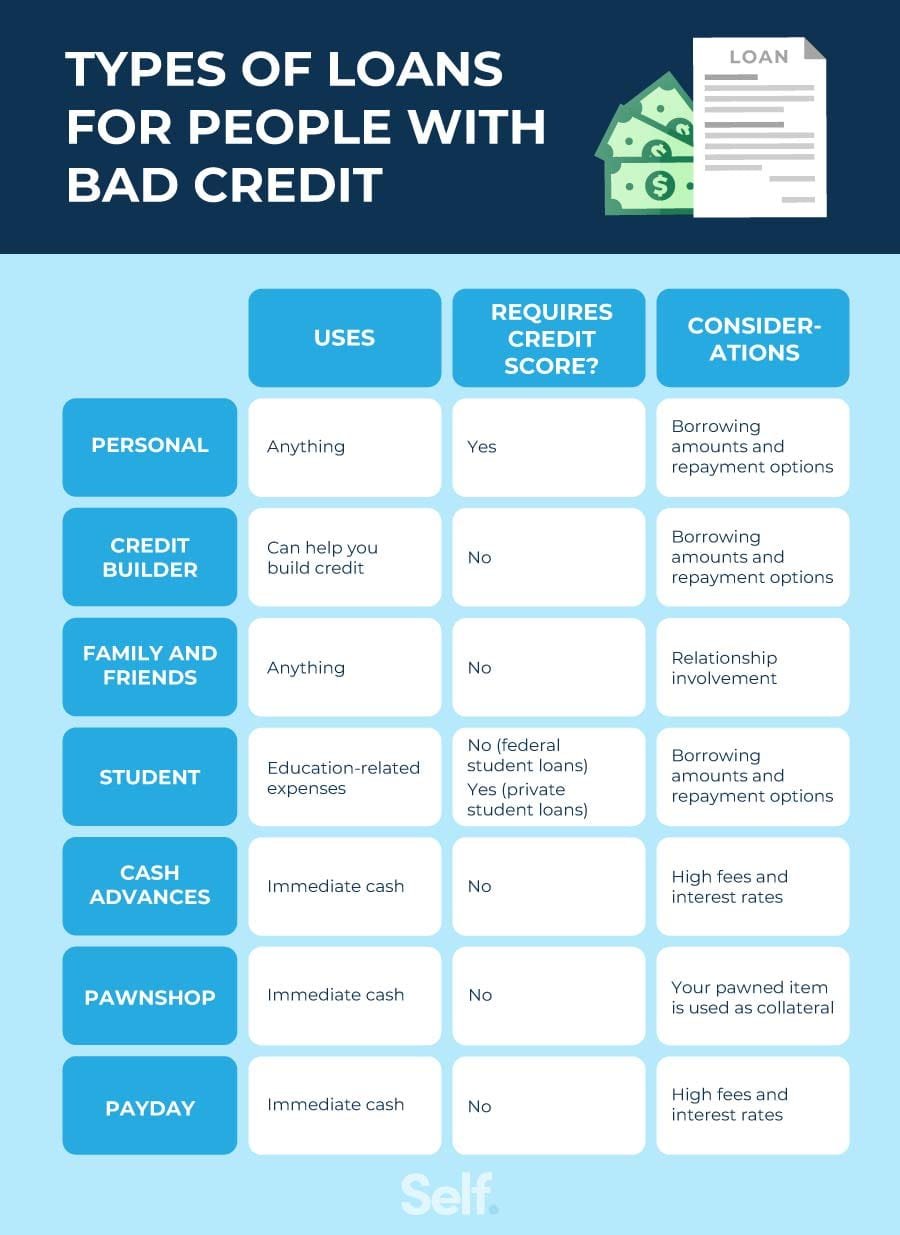

Types Of Low-credit Loans

Finding a loan with low credit can be tough. Yet, options exist. We explore various low-credit loans. Each has its pros and cons.

Secured Vs. Unsecured Loans

Low-credit loans come in two types: secured and unsecured.

- Secured loans need an asset for backing. This could be a car or house. They often have lower interest rates.

- Unsecured loans do not need an asset. They rely on your credit score. These loans might have higher interest rates.

Payday Loans: A Closer Look

Payday loans are a type of unsecured loan. They are for short-term needs.

| Feature | Detail |

|---|---|

| Amount | Small, usually up to $500 |

| Term | Short, often 2 weeks |

| Interest Rate | High, due to risk |

| Repayment | Single payment on next payday |

Before choosing, consider the interest and terms carefully. Payday loans can help but also carry risks.

Navigating The World Of Credit Unions

Are you exploring loan options with a low credit score? Credit unions might be the answer. These member-owned institutions often provide more personalized services. They help individuals with lower credit scores secure loans. Let’s dive into the benefits and loan options available through credit unions.

Member Benefits

Credit unions stand out for their member-focused approach. They offer competitive rates and flexible terms. Members share a common bond, such as location or employment. This community feel leads to tailored financial solutions. Look at some benefits members enjoy:

- Lower fees: Fewer and smaller fees than traditional banks.

- Better rates: Interest rates often beat those offered by banks.

- Member service: Personalized support is a priority.

- Profit sharing: Earnings go back to members, not shareholders.

Loan Options With Credit Unions

Credit unions provide various loan options for members with low credit. They look beyond credit scores to help you qualify. Here’s a snapshot of loan types available:

| Loan Type | Features |

|---|---|

| Personal Loans | Flexible terms, fixed rates. |

| Auto Loans | Competitive rates, new and used cars. |

| Secured Loans | Use savings as collateral, lower rates. |

| Payday Alternative Loans | Small amounts, short terms, fewer fees. |

Each loan type is designed to fit different needs. Personal loans help with unexpected expenses. Auto loans make car buying easier. Secured loans offer lower interest rates with savings as collateral. Payday alternative loans provide quick cash without high fees.

Peer-to-peer Lending Platforms

Peer-to-Peer (P2P) lending platforms offer a modern way to borrow money. These online services connect individuals who need to borrow money with those willing to lend. P2P can be a lifeline for those with low credit scores. Let’s dive into how P2P lending works and its pros and cons for individuals with low credit.

How P2p Works

P2P lending bypasses traditional banks. Borrowers create profiles on a lending platform. They post their loan needs. Investors review these profiles and choose who to lend to. Loans come from multiple investors, not just one.

Pros And Cons For Low-credit Individuals

P2P loans offer benefits and drawbacks for those with low credit scores. It’s important to understand these before applying.

| Pros | Cons |

|---|---|

|

|

Online Lenders And Fintech Solutions

The world of loan options for individuals with low credit is evolving. Online lenders and fintech solutions now offer new paths to financial support. These options are fast and user-friendly.

Innovative Loan Products

Online lenders and fintech companies have changed the game. They use technology to assess loan eligibility in new ways. This means more people can get loans, even with low credit scores. Let’s explore some innovative products:

- Peer-to-Peer Loans: These loans connect borrowers directly with investors.

- Microloans: Small loans, often used by people starting a business.

- Installment Loans: These loans have fixed payments over time.

- Cash Advances: Short-term loans based on future earnings.

What To Watch Out For

While these options can be helpful, there are risks. Here are key points to consider:

- Interest Rates: Some loans may have high rates. Always compare.

- Fees: Look out for hidden fees. Read all terms carefully.

- Repayment Terms: Understand when and how you need to repay.

- Scams: Choose reputable lenders. Avoid offers that seem too good.

It’s important to research and understand each option. This ensures you choose the best for your needs.

Government And Nonprofit Programs

Government and Nonprofit Programs offer hope to those with low credit. These programs can help when traditional loans are not an option. From federal loan alternatives to community-based initiatives, let’s explore the support available to individuals.

Federal Loan Alternatives

For many, federal loans are a lifeline. They come with benefits like low interest rates and flexible repayment terms. Key options include:

- FHA Loans: Easier approval than conventional loans.

- VA Loans: No down payment for veterans.

- USDA Loans: For rural homebuyers, often no down payment.

Community-based Initiatives

Local nonprofits and community groups often step in to assist. They provide loans and financial guidance. Here are examples:

| Program | Focus | Benefits |

|---|---|---|

| Credit Unions | Member-focused lending | Lower rates, personal service |

| Microfinance Institutions | Small business support | Access to capital, training |

| Community Development Financial Institutions | Economic growth in areas | Loans for underserved communities |

Explore these options to find the right fit for your financial needs. With the right support, better credit is within reach.

Building Credit With Installment Loans

Many people face the challenge of building credit. Installment loans can be a key tool. They allow for manageable payments. This can lead to a stronger credit profile. Let’s explore how strategic borrowing and monitoring credit scores work with installment loans.

Strategic Borrowing

Strategic borrowing means planning loan use. It’s not just about getting funds. It’s about choosing the right type of loan. Installment loans are such a choice. They come with a fixed schedule. This helps in planning repayments.

- Choose a loan with clear terms.

- Ensure the repayment amount is affordable.

- Stick to the payment schedule.

Doing these steps can help build credit. It shows lenders responsibility. On-time payments are key.

Impact On Credit Score

Credit scores can rise with good habits. Installment loans offer a chance to demonstrate these habits. Each on-time payment gets reported. This can positively affect credit scores.

| Payment | Impact |

|---|---|

| On-Time | Positive |

| Late | Negative |

Remember, late payments hurt scores. It’s important to always pay on time. This builds a positive credit history. It also boosts credit scores.

Loan Alternatives: Beyond Traditional Lending

Finding the right loan can be tough with low credit. Traditional banks often say no. But hope is not lost. Other ways to get money exist. Let’s explore some unique loan options.

Borrowing From Friends And Family

Borrowing money from those you know can be a good choice. It’s often more flexible and less formal. But it requires trust and clear terms. Below is a simple way to keep things straight:

| Details | Importance |

|---|---|

| Loan Amount | Know how much you need. |

| Repayment Plan | Plan how and when to pay back. |

| Interest | Discuss if you’ll pay interest. |

| Written Agreement | Keep records to avoid issues. |

Using Home Equity

Homeowners have a unique option: using home equity. This means borrowing against the value of your house. It’s a risky but powerful tool. You can get loans or lines of credit. Here’s what you should know:

- Equity is the home’s value minus what you owe.

- A Home Equity Loan gives you a lump sum.

- A Home Equity Line of Credit (HELOC) works like a credit card.

Remember, you risk losing your home if you can’t pay back. Always think carefully and plan ahead.

Smart Borrowing Strategies

Exploring loan options with low credit can be tricky. Smart borrowing strategies are key. They help you secure better terms and avoid costly pitfalls. Learn how to compare loans and read the fine print. This guides you to a wise financial choice.

Loan Comparison Techniques

Comparing loans is crucial. Look for the best rates and terms. Use these tips:

- Check APRs: Lower APRs mean less interest over time.

- Assess fees: Find out about origination fees, prepayment penalties, and late fees.

- Consider terms: Shorter terms usually have higher monthly payments but lower interest overall.

- Use calculators: Online tools help you estimate total costs.

Reading The Fine Print

Always read the fine print before signing a loan agreement. Here’s what to focus on:

- Interest rates: Confirm the rate is as advertised.

- Repayment schedule: Note when payments are due and for how long.

- Extra charges: Be aware of any additional fees.

- Default consequences: Understand the risks if you can’t pay on time.

| Term | Definition |

|---|---|

| APR | Annual Percentage Rate, the cost of borrowing per year |

| Fees | Extra charges that may apply to the loan |

| Default | Failure to repay the loan as agreed |

Credit: greenwayworldsolutions.com

Protecting Yourself From Predatory Lenders

Finding a loan with low credit can be tough. It’s important to stay safe. Predatory lenders often target those in need. This section helps you protect yourself.

Recognizing Red Flags

Some lenders may not be honest. Know these signs to stay safe:

- High fees: Unusually high costs are a big warning.

- Rushed decisions: Being pushed to sign fast is not good.

- Vague terms: Details should be clear and easy to understand.

- No credit check: Legit loans usually check your credit history.

Reporting Unethical Practices

If you spot a bad lender, it’s important to report them. This helps everyone.

- Talk to authorities: Local consumer protection offices can help.

- File a complaint: The Federal Trade Commission (FTC) takes reports online.

- Stay informed: Learn your rights. It makes you stronger.

Future Financial Planning

Planning for the future starts today, especially if you’re working with low credit. Let’s explore options that not only address immediate financial needs but also pave the way for long-term success.

Improving Credit For Long-term Success

Building a better credit score is crucial for financial health. Start with these steps:

- Check credit reports for errors

- Pay bills on time, every time

- Reduce debt to income ratio

- Keep old credit accounts open

- Apply for a secured credit card

Each action strengthens credit. This opens doors to better loan options.

Financial Counseling Resources

Guidance is key when navigating financial waters. Numerous resources exist:

- Non-profit credit counseling

- Financial literacy workshops

- Online budgeting tools

- Debt management plans

Use these tools to craft a robust financial strategy. Secure a brighter financial future.

Credit: www.loantube.com

Frequently Asked Questions

What Are Low-credit Loan Options?

Low-credit loan options include secured loans, payday alternative loans from credit unions, online lenders specializing in subprime borrowers, and co-signed or joint loans. These options often accept lower credit scores.

How Can I Secure A Loan With Poor Credit?

To secure a loan with poor credit, search for lenders offering loans for low credit scores. Provide proof of stable income, consider a co-signer, and be prepared for potentially higher interest rates and fees.

Are Payday Loans Accessible With Bad Credit?

Yes, payday loans are typically accessible with bad credit, but they come with high interest rates and fees. It’s crucial to consider alternative options and understand the terms before proceeding.

Can I Get A Personal Loan With A 500 Credit Score?

Getting a personal loan with a 500 credit score is challenging but possible. Look for lenders who cater to bad credit borrowers, but be mindful of higher interest rates and strict loan terms.

Conclusion

Navigating the realm of loans with low credit can be a challenge, yet it’s far from impossible. Numerous options exist to help bridge financial gaps without the need for perfect credit. Exploring these avenues can open doors to better financial health and opportunities.

Remember, informed choices lead to brighter financial futures. Let’s take control and move forward with confidence.