First-time homebuyers should prioritize pre-approval and budgeting. Understanding loan options and interest rates is critical.

Embarking on the journey to homeownership can be thrilling yet overwhelming, especially for first-time buyers. Navigating the complex world of mortgages requires a solid grasp of financing basics. To make an informed decision, one must research various loan types, assess their creditworthiness, and determine what they can realistically afford.

This initial groundwork lays the foundation for a smoother home-buying experience. Armed with pre-approval, buyers gain a competitive edge and clarity on their spending limits. It’s essential to compare interest rates and terms from different lenders to secure the best deal. Tailoring the search to align with financial capacity ensures long-term affordability and reduces the risk of future financial strain. Keep these tips in mind to transform the dream of owning a home into a reality.

Credit: www.ffcommunity.com

Embarking On The Homebuying Journey

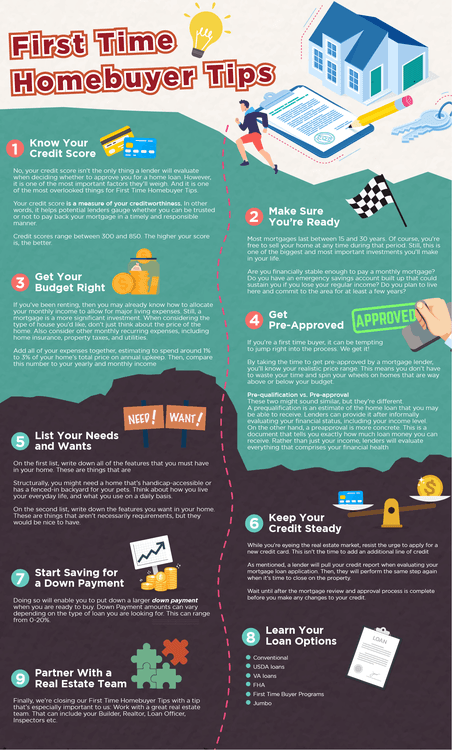

Starting the journey to buy a first home is exciting. First-time homebuyers face a thrilling adventure. It is key to learn about loans. This knowledge helps dreams come true. Let’s dive into essential loan tips.

Setting Realistic Goals

Understanding finances is the first step. Homebuyers need clear goals. These should match their budget. Monthly income and expenses guide this. A down payment is critical. It affects loan terms.

- Determine how much you can afford.

- Research home prices in your desired area.

- Plan for additional costs, like closing fees.

Importance Of Credit History

Credit scores impact loan options. High scores mean better terms. Lenders trust borrowers with good credit. A strong credit history saves money. Lower interest rates become possible.

| Credit Score Range | Loan Impact |

|---|---|

| 750 and above | Excellent terms |

| 700-749 | Good terms |

| 650-699 | Fair terms |

| Below 650 | Poor terms |

Check your credit report early. Fix any errors fast. Pay bills on time. Reduce debt before applying. These actions boost credit scores.

Budgeting For Your Dream Home

Welcome to the exciting journey of buying your first home! Before diving into house hunting, understanding how to budget for your dream home is crucial. Let’s break down the basics of calculating what you can afford and the hidden costs that come with homeownership.

Calculating Affordability

Knowing what you can afford is the first step. This means looking at your income, debts, and savings. A simple rule is the 28/36 rule. No more than 28% of your gross monthly income should go to housing expenses. Your total debts should not exceed 36% of your income. Let’s look at an example:

| Monthly Income | Housing Expense (28%) | Total Debts (36%) |

|---|---|---|

| $5,000 | $1,400 | $1,800 |

Use online calculators for a more tailored estimate. Remember, this is a guide, not a hard rule.

Hidden Costs To Consider

Many first-time buyers forget about the extra costs. These can add up. Here are some to keep in mind:

- Closing Costs: Usually 2-5% of the home price.

- Home Maintenance: Save 1-3% of the home price yearly.

- Property Taxes: Varies by location.

- Home Insurance: Required by lenders.

- HOA Fees: If applicable.

Planning for these costs will help you stay within budget. Remember, owning a home is not just about the mortgage payment. It’s about being prepared for all financial responsibilities.

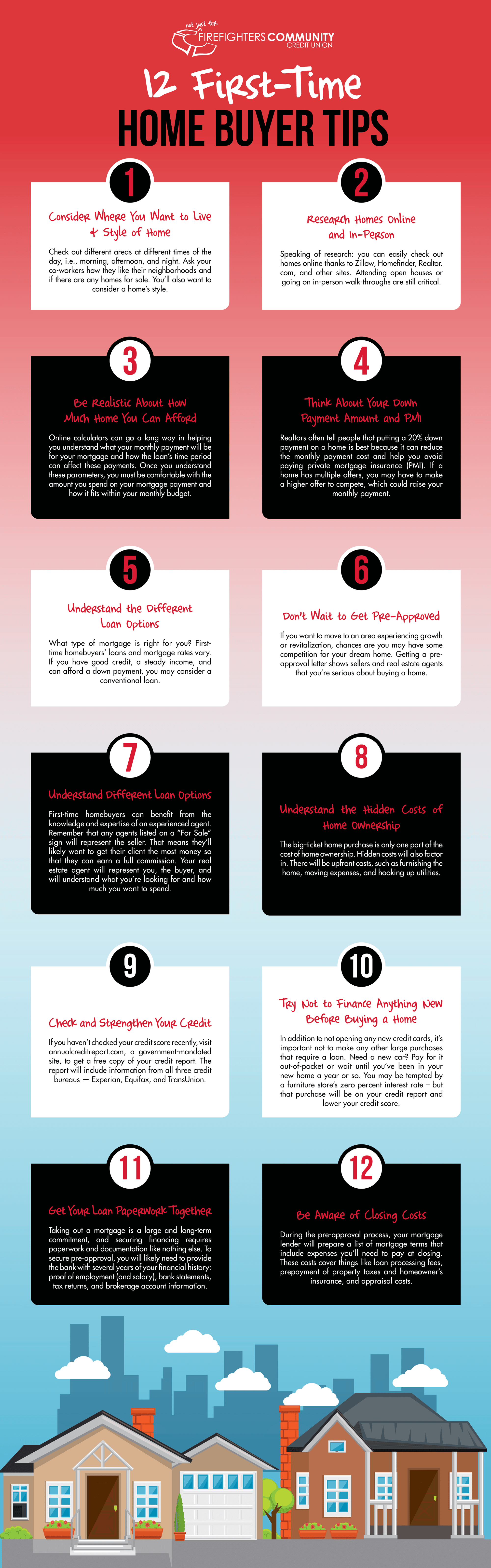

Understanding Your Loan Options

Understanding Your Loan Options is crucial for first-time homebuyers. The right loan can save you thousands. Let’s explore the different types available.

Types Of Home Loans

Various home loans cater to different needs. Here are the most common:

- Conventional Loans: Not government-insured, require good credit.

- FHA Loans: Insured by the Federal Housing Administration, lower down payments.

- VA Loans: For veterans, no down payment required.

- USDA Loans: For rural homebuyers, no down payment required.

Fixed Vs. Variable Interest Rates

Choosing the right interest rate affects your monthly payments.

| Fixed Rates | Variable Rates |

|---|---|

| Stable monthly payments. | Can change over time. |

| Good for long-term budgeting. | May start lower than fixed rates. |

| No surprises in payments. | Could rise, increasing payments. |

Consider your financial stability when choosing between fixed and variable rates.

The Pre-approval Process

Navigating the pre-approval process is a crucial step for first-time homebuyers seeking a smooth loan experience. This early evaluation confirms your buying power, setting a solid foundation for your property search.

Getting pre-approved is a vital step for first-time homebuyers. It shows sellers you are serious. Banks look at your finances. They decide how much they can lend you. This helps you shop within your budget. It makes buying your dream home easier.

Benefits Of Pre-approval

- Know your budget: You learn what you can afford.

- Save time: Only look at homes you can buy.

- Competitive edge: Sellers prefer buyers with pre-approval.

- Quick closing: Pre-approval speeds up the process.

Documentation Needed

To get pre-approved, gather your papers first. Banks need to see your financial health. Here’s what you’ll need:

| Document Type | Details |

|---|---|

| ID Proof | License or Passport |

| Income Proof | W-2 forms, pay stubs |

| Tax Returns | Last two years |

| Bank Statements | Last few months |

| Credit Report | Shows your debts |

Get these documents ready. Show the bank you are a safe bet. Then, get your pre-approval letter. Start your home search with confidence.

Navigating Government Assistance Programs

Navigating Government Assistance Programs can seem daunting for first-time homebuyers. Yet, these programs offer valuable support. They can lower buying costs significantly. Understanding and using these programs is key to a smoother purchase process.

First-time Buyer Grants

First-time buyer grants provide financial aid that doesn’t require repayment. This aid helps cover down payments and closing costs. Eligibility often depends on income, home location, and the buyer’s status as a first-time buyer.

- State Housing Finance Agencies: Offer state-specific grants.

- HUD’s HOME Investment Partnerships Program: Supports low-income buyers.

- Good Neighbor Next Door: Assists educators, law enforcement, and emergency personnel.

To find grants, visit the website of the U.S. Department of Housing and Urban Development (HUD). Also, check your state’s housing finance agency.

Tax Incentives Explained

Tax incentives make owning a home more affordable. They reduce the amount of tax you owe. First-time buyers can benefit from various tax breaks.

- Mortgage Interest Deduction: Deduct interest paid on your mortgage.

- Property Tax Deduction: Deduct property taxes paid.

- Mortgage Points Deduction: Deduct what you paid for mortgage points.

Always consult with a tax advisor. They can help you understand these benefits. Remember, tax laws change. Keep updated on the latest benefits for homeowners.

Credit: www.midflorida.com

Saving For A Down Payment

Embarking on the journey of homeownership begins with a critical step: saving for a down payment. This financial milestone can seem daunting for first-time homebuyers. Understanding the best strategies to accumulate the necessary funds is key. A solid down payment reduces monthly mortgage costs and can offer more favorable loan terms.

Strategies To Boost Savings

Setting a clear savings goal is crucial. Break down the total down payment amount into manageable monthly savings targets. Consider opening a dedicated savings account to keep track of progress. Look into automatic transfers from your checking to savings account right after payday.

- Cut unnecessary expenses

- Sell items not needed

- Pick up a side job

Review your budget to find areas to trim. Whether it’s dining out less or canceling unused subscriptions, every bit helps. Selling unused items or freelancing can also boost your down payment fund.

Low Down Payment Loans

Many first-time buyers benefit from low down payment loan options. Federal and state programs can help. FHA loans often require as little as 3.5% down. USDA and VA loans can offer zero down payment paths for eligible buyers.

| Loan Type | Down Payment Required |

|---|---|

| FHA Loan | 3.5% |

| USDA Loan | 0% |

| VA Loan | 0% |

Research these options to find the best fit. A trusted lender can provide guidance on qualifying. Remember, even with low down payment loans, closing costs and moving expenses must be considered.

Crafting A Competitive Offer

When stepping into the housing market, first-time homebuyers must craft competitive offers. A strong offer opens doors to your dream home. Let’s explore smart strategies to stand out.

Market Research

Understanding local housing trends is key. Knowledge of recent sales prices in your desired area guides your offer. Use this data to assess home values. Adjust your bid accordingly to remain competitive yet fair.

- Review comparable sales: Look at homes with similar features and conditions in your target neighborhood.

- Analyze market conditions: Determine if it’s a buyer’s or seller’s market. This affects how much you should offer.

- Consider future potential: A home’s long-term value can justify a higher offer if growth is expected.

Negotiation Tactics

Negotiating terms can secure a deal. Start with a fair offer that leaves room for discussion. Show flexibility and readiness to close quickly to appeal to sellers.

- Present a solid pre-approval: This shows you’re serious and ready to purchase.

- Stay within budget: Stick to your financial limits to avoid overcommitting.

- Communicate effectively: Keep lines open with the seller for a smooth negotiation.

Remember, each offer is unique. Tailor your strategy to align with your goals and the seller’s expectations.

Credit: www.servicesutra.com

Closing The Deal

Sealing the ownership of your first home is thrilling. Yet, it entails a critical process: closing the deal. This stage demands a keen understanding of the final steps. You will finalize the loan and grasp the closing costs. Let’s navigate these waters smoothly to unlock the door to your new home.

Finalizing The Loan

Finalizing your home loan is a pivotal moment. Be ready with all necessary documents. Your lender will confirm the loan details. This includes the interest rate, loan term, and monthly payments. Ensure all is clear and ask questions if needed. Your signature seals the agreement. Let’s break this down:

- Review the loan terms: Ensure they match your initial understanding.

- Check the interest rate: Confirm it’s locked in as agreed.

- Understand the payment schedule: Know when payments start.

Understanding Closing Costs

Closing costs can surprise many first-time homebuyers. These are fees paid at the end of the real estate transaction. They include a variety of charges. Knowing these costs upfront avoids last-minute stress. Here’s what to expect:

| Cost Type | Description | Typical Cost |

|---|---|---|

| Appraisal Fee | Assesses home value | $300-$500 |

| Title Search | Ensures clear property title | $200-$400 |

| Home Inspection | Examines property condition | $300-$500 |

| Closing Fee | Paid to the settlement agent | $500-$800 |

| Total | Varies |

Review your closing disclosure before the big day. This document outlines all closing costs. Ask your lender for clarification on any unfamiliar fees. Remember, some costs are negotiable. Don’t hesitate to discuss these with your real estate agent or attorney.

Protecting Your Investment

Buying your first home is exciting. It’s a huge step. But it’s more than just a living space. It’s a big investment. You must protect it. Here are key ways to safeguard your new home.

Home Insurance Essentials

Home insurance is not optional. It’s a must. It covers damages and losses. Think fire, theft, or natural disasters. Pick the right policy. Make sure it fits your needs. Understand what it covers.

- Dwelling coverage – Pays to repair or rebuild your home.

- Personal property – Protects your belongings inside.

- Liability protection – Covers you if someone gets hurt on your property.

- Additional living expenses (ALE) – Helps if your home is unlivable during repairs.

Setting Up An Emergency Fund

An emergency fund is your safety net. It’s cash for unexpected costs. Aim for three to six months of living expenses. Start small if you need. Grow it over time. It’s peace of mind. You’re ready for surprises.

- Open a savings account.

- Automate your savings. Small, regular deposits grow fast.

- Use it for emergencies only. Not for wants, just needs.

Long-term Financial Planning

Long-Term Financial Planning is key for first-time homebuyers. It helps you manage your money after buying your home. Planning ahead makes sure you can handle your mortgage and other costs. Let’s dive into two important parts: refinancing your mortgage and planning for future expenses.

Refinancing Your Mortgage

Refinancing means changing your loan to get a better deal. It can lower your payments or shorten your loan time. Here are steps to take:

- Check your credit score. A high score can get you a better rate.

- Compare loans. Look at different banks to find the best offer.

- Calculate costs. Refinancing has fees. Make sure it’s worth it.

Refinancing at the right time can save you lots of money. Keep an eye on interest rates and act when they drop.

Planning For Future Expenses

Owning a home comes with extra costs. You need to plan for them. Here’s how:

- Save for emergencies. Aim for three to six months of expenses.

- Remember repairs. Set aside money for fixing your home.

- Think about taxes and insurance. They can change each year.

Planning helps you enjoy your home without money worries. Start early and review your plan each year.

Frequently Asked Questions

What Credit Score Is Needed For A Home Loan?

A credit score of 620 or higher is typically required by most lenders for a conventional home loan. However, some loan programs, like FHA loans, may accept scores as low as 580.

How Much Down Payment Is Required For First-time Buyers?

First-time homebuyers may need as little as 3% down for conventional loans. Government-backed loans like FHA might only require 3. 5%. Certain programs offer down payment assistance as well.

Can Closing Costs Be Included In A Home Loan?

Generally, closing costs are paid out of pocket on closing day. Some loan types allow for seller concessions or rolling costs into the loan, subject to appraisal value and lender approval.

What Are The Benefits Of Pre-approval For First-time Buyers?

Pre-approval strengthens your offer by showing sellers you’re a serious, qualified buyer. It also helps you understand how much you can afford before you start house hunting.

Conclusion

Navigating the journey to homeownership can feel overwhelming, but the right loan tips smooth the path. Remember, understanding your options and preparing financially sets you on the course to success. Embrace the process, seek expert advice, and soon, you’ll unlock the door to your first home.

Let these tips guide you to make informed decisions and turn your dream into reality.