The best unsecured loans for low credit scores are typically offered by online lenders and credit unions. They often feature flexible terms and higher interest rates to offset the credit risk.

Navigating the financial marketplace for unsecured loans when you have a low credit score can seem daunting, but there are options designed to help those with less-than-ideal credit histories. These financial solutions offer a lifeline for individuals needing funds without the requirement of collateral.

Understanding the nuances of each lending option is crucial to securing a loan that aligns with your financial situation. Lenders specializing in bad credit loans focus on your ability to repay rather than just your credit score, which means employment history and current income play a significant role. By researching and comparing different loan offers, you can find a solution that minimizes fees and interest, helping to make repayment more manageable.

Introduction To Unsecured Loans

When credit scores dip, loan options dwindle. Yet, unsecured loans remain a beacon for borrowers. These loans need no collateral. Borrowers agree to pay back the loan based on creditworthiness. This introduction spotlights the best unsecured loans for low credit scores.

The Appeal Of Unsecured Loans

Unsecured loans offer freedom. No assets tie to them. Borrowers with few assets find this appealing. Approval relies on credit history and income. These loans cover various needs. They finance emergencies, home improvements, and more.

Challenges With Low Credit Scores

Low credit scores often lead to loan denials. Lenders view low scores as high risk. This risk can mean higher interest rates for approved loans. Borrowers with low scores face limited options. Yet, some lenders specialize in loans for these credit profiles.

Criteria For Choosing The Best Loans

Finding the best unsecured loans for low credit scores can be tricky. Knowing what to look for helps make the decision easier. This section dives into the criteria for choosing the best loans. We focus on two main areas: Interest Rates and Terms, and Lender Reputation and Reliability.

Interest Rates And Terms

The interest rate and loan terms directly affect your payments. Look for loans with low interest rates and flexible terms. This makes the loan more affordable over time.

- Interest rates determine how much extra you pay back.

- Loan terms affect how long you have to pay back the loan.

Compare loans to find the best rates and terms. Use online calculators to see how different rates and terms change your monthly payment.

Lender Reputation And Reliability

Choosing a trustworthy lender is crucial. A lender with a good reputation offers peace of mind.

- Read online reviews to learn about lender reliability.

- Check with the Better Business Bureau for lender ratings.

A reliable lender has clear terms and good customer support. They help you understand your loan options.

Top Unsecured Loan Options For Low Credit

Finding a loan with a low credit score can be tough. Many lenders require high credit ratings. But options exist for those with less-than-perfect credit. Below are top unsecured loan choices for low credit scores. They don’t need collateral. Your assets stay safe even if you struggle with payments.

Personal Loans For Bad Credit

Personal loans offer money without collateral. They’re based on creditworthiness. Here are some options:

- Online Lenders: They often have lower requirements. Some cater specifically to low credit scores.

- Credit Unions: Member-focused and may offer loans with lower rates. Good standing with them helps.

- Peer-to-Peer (P2P) Platforms: Connect borrowers directly with investors. Rates vary based on risk.

Check terms and interest rates carefully. Ensure you can meet the repayment schedule.

Short-term Cash Advances

Need cash fast? Short-term cash advances can help. They’re usually for small amounts. Here’s what to know:

| Loan Type | Amount | Repayment Term |

|---|---|---|

| Payday Loans | Up to $500 typically | Next paycheck |

| Installment Loans | Varies | Months to a few years |

These loans come with high interest rates. Only choose if you can repay quickly.

Credit: www.youtube.com

Online Lenders Versus Traditional Banks

Exploring loan options can be a daunting task, especially with a low credit score. Two popular sources for borrowing are online lenders and traditional banks. Each avenue offers distinct experiences. Let’s delve into the differences between them.

Pros And Cons Of Online Lending

Online lenders have grown in popularity. They offer convenience and faster approval times. Here are some key points to consider:

| Pros of Online Lending | Cons of Online Lending |

|---|---|

|

|

When To Consider A Traditional Bank

Traditional banks are often preferred for their reliability and established reputations. They can be the right choice in certain scenarios:

- Existing relationships: Use your bank history to your advantage.

- Lower rates: Good credit can secure favorable terms.

- Face-to-face service: Get personal advice and support.

Remember, banks may require more documentation and have stricter criteria. Approval may take longer. Choose a bank if these factors align with your needs.

Improving Your Chances Of Approval

Finding a loan with a low credit score can be tough. Your credit score tells lenders how risky it is to give you money. A low score might make them say no. But, don’t worry. You can still improve your chances of getting a loan approved. Let’s explore some ways to make your loan application stronger.

Building A Stronger Application

To make your loan application look better, focus on these points:

- Show stable income: Lenders like to see that you can pay back the loan. A steady job means steady money.

- Lower your debts: Try to pay off other debts. This makes you look less risky.

- Check your credit report: Sometimes, mistakes happen. Make sure your credit report is right. Fix any errors you find.

These steps can make lenders more likely to say yes to you.

Understanding Co-signing

A co-signer can also help you get a loan. Think of a co-signer like a helper. If you can’t pay, they promise to pay for you. This can make lenders feel safer. But, choose someone you trust. Both of you should understand the rules.

| Benefits | Risks |

|---|---|

| Better loan approval chances | Co-signer’s credit could get hurt |

| Possibly lower interest rates | Relationship strain if issues arise |

Remember, a co-signer is a big responsibility. Both sides need to agree.

Credit: www.youtube.com

Navigating Interest Rates And Fees

Understanding interest rates and fees is vital for loan seekers with low credit scores. These factors can impact the overall cost of borrowing. Let’s explore how to navigate these financial hurdles effectively.

How Credit Affects Interest

Credit scores play a crucial role in determining loan costs. A low score often leads to higher interest rates. Lenders see low credit scores as a sign of risk. They charge more to offset this risk. It’s important to know your score before applying. This helps in finding the most favorable rates.

Better credit means lower interest rates. Try to improve your score before seeking a loan. Even a small increase can save you money. Check out loans tailored for low credit scores. These options might provide better rates.

Avoiding Hidden Fees

Unsecured loans can come with various fees. Look beyond the interest rate. Check for application fees, origination fees, and prepayment penalties. All these add to the loan’s cost.

Read the fine print carefully. Identify all possible charges. Ask the lender about unclear terms. Make sure you understand the full cost of the loan.

- Compare offers from multiple lenders.

- Focus on the total loan cost, not just monthly payments.

- Choose loans with no or low fees to keep costs down.

Loan Use And Financial Strategy

Getting a loan with a low credit score can be tough. Yet, smart choices can help. You must have a plan for your loan. This plan should focus on using the loan wisely and improving your finances.

Smart Spending Of Loan Funds

Once you get an unsecured loan, it’s crucial to spend the money wisely. Use the loan for needs, not wants. This means fixing a car for work over a new TV. Below are ways to spend your loan funds smartly:

- Debt Consolidation: Combine high-interest debts into one loan.

- Emergency Costs: Cover unexpected expenses like medical bills.

- Home Repairs: Fix urgent issues that could cost more later.

Long-term Financial Health

Your financial health should get better with the loan. Make a budget to track your spending. Pay your loan on time every month. Try to save a bit from your income. These steps will help raise your credit score.

| Task | Action |

|---|---|

| Budgeting | Plan your spending and saving |

| Loan Payments | Pay on time, every time |

| Savings | Put away a small amount regularly |

Alternatives To Unsecured Loans

Finding the right loan with a low credit score can be tough. Let’s explore some options beyond unsecured loans.

Secured Loans

Secured loans require collateral. This security can help borrowers get approval. It reduces risk for lenders. Collateral can be a car, house, or savings account. Interest rates may be lower. Repayment terms might be more flexible.

Credit Union Loans

Credit unions are member-owned. They offer more personalized services. Loans from credit unions often have lower rates. Members benefit from friendlier loan terms. Building a relationship with a credit union helps.

Peer-to-peer Lending

Peer-to-peer platforms connect borrowers and investors. It’s an online process. Rates can be competitive. Credit scores may be less of a barrier. Quick funding is a key advantage. It’s a modern way to borrow.

Avoiding Predatory Lenders

Finding loans with low credit scores can be tricky. It’s vital to steer clear of predatory lenders. These lenders often target those with poor credit. They offer loans with extremely high interest rates or hidden fees. Let’s learn how to spot these risky offers and borrow safely.

Recognizing Red Flags

High interest rates and unclear terms signal trouble. Watch for lenders not requiring credit checks. They may have unfavorable conditions. Look for upfront fees or pressured decisions. These are common tactics used by predatory lenders.

- No credit check promises

- High upfront fees

- Pressured fast decisions

Safe Borrowing Practices

Adopt safe borrowing habits to protect yourself. Start by comparing loan options. Check lender reviews and ratings. Ensure they have valid licenses. Read all loan terms carefully. Seek loans with clear, reasonable repayment terms. Consider credit unions or online lenders known for fair practices.

| Safe Practice | Details |

|---|---|

| Compare loans | Look at multiple loan offers |

| Check reviews | Research lender reputation |

| Validate licenses | Confirm lender’s legality |

| Read terms | Understand repayment conditions |

Stick to lenders that offer transparency. Avoid those with hidden fees or unclear terms. By recognizing red flags and practicing safe borrowing, you can secure a loan without falling victim to predatory practices.

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

Can Poor Credit Get Unsecured Loans?

Yes, individuals with low credit scores can still obtain unsecured loans. Lenders offering bad credit loans often focus on your income and employment stability rather than credit alone.

What Are The Best Unsecured Loans For Bad Credit?

The best unsecured loans for bad credit typically include personal installment loans, payday alternatives from credit unions, and some online lenders that cater to subprime borrowers.

How To Qualify For Unsecured Loans With Poor Credit?

To qualify for an unsecured loan with poor credit, ensure a stable income, minimize existing debt, and search for lenders with flexible credit requirements. Providing proof of financial responsibility may also help.

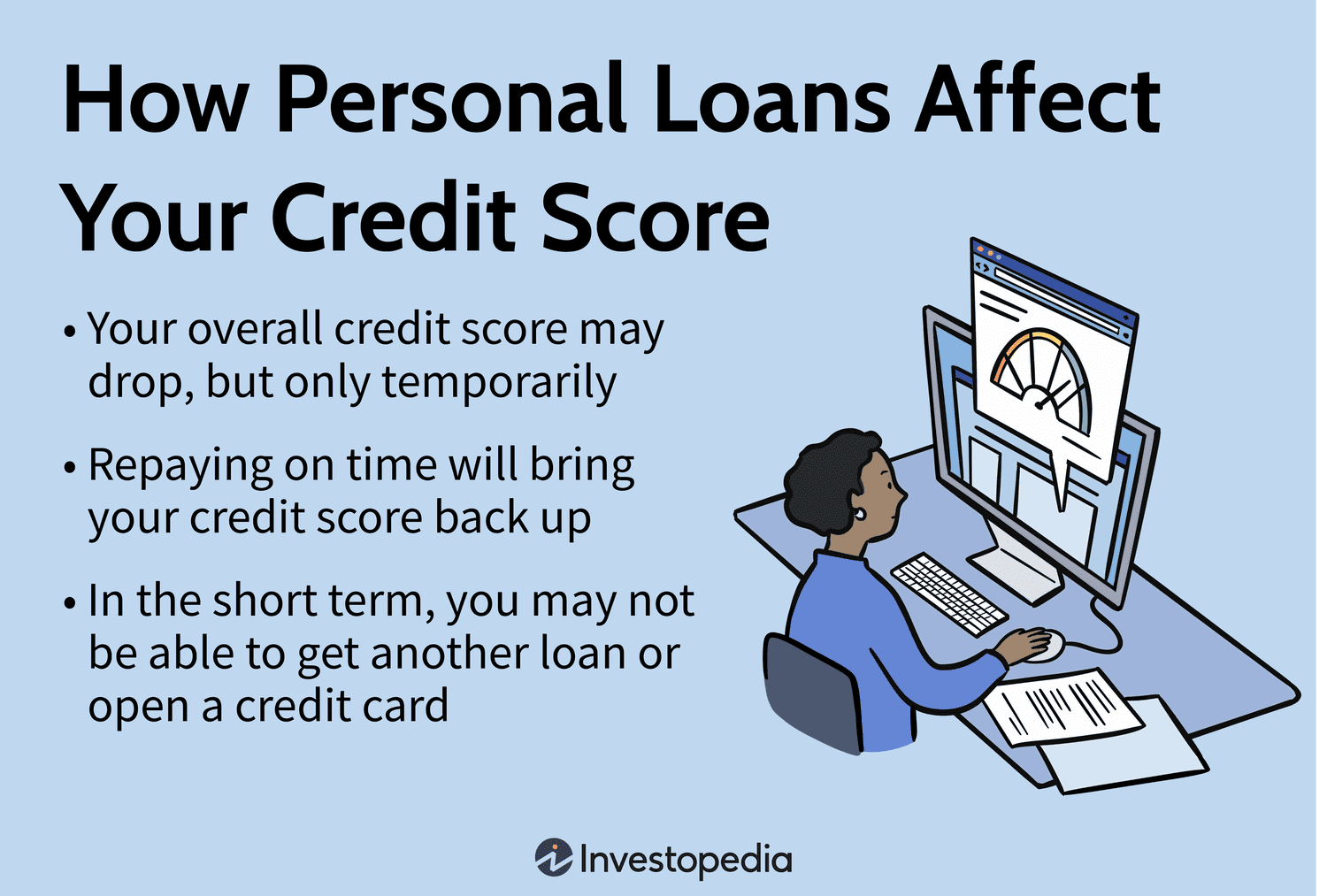

Will An Unsecured Loan Affect My Credit Score?

Taking out an unsecured loan can affect your credit score. If managed well, making timely payments can positively impact your score. Conversely, late payments can result in a negative impact.

Conclusion

Navigating the realm of unsecured loans with a low credit score can seem daunting. Yet, with the right information and choices, it’s entirely possible to find a suitable option that meets your financial needs. Remember, thorough research and careful consideration are your best allies in securing a loan that aligns with your circumstances.

Let this guide serve as your starting point towards financial empowerment and stability.