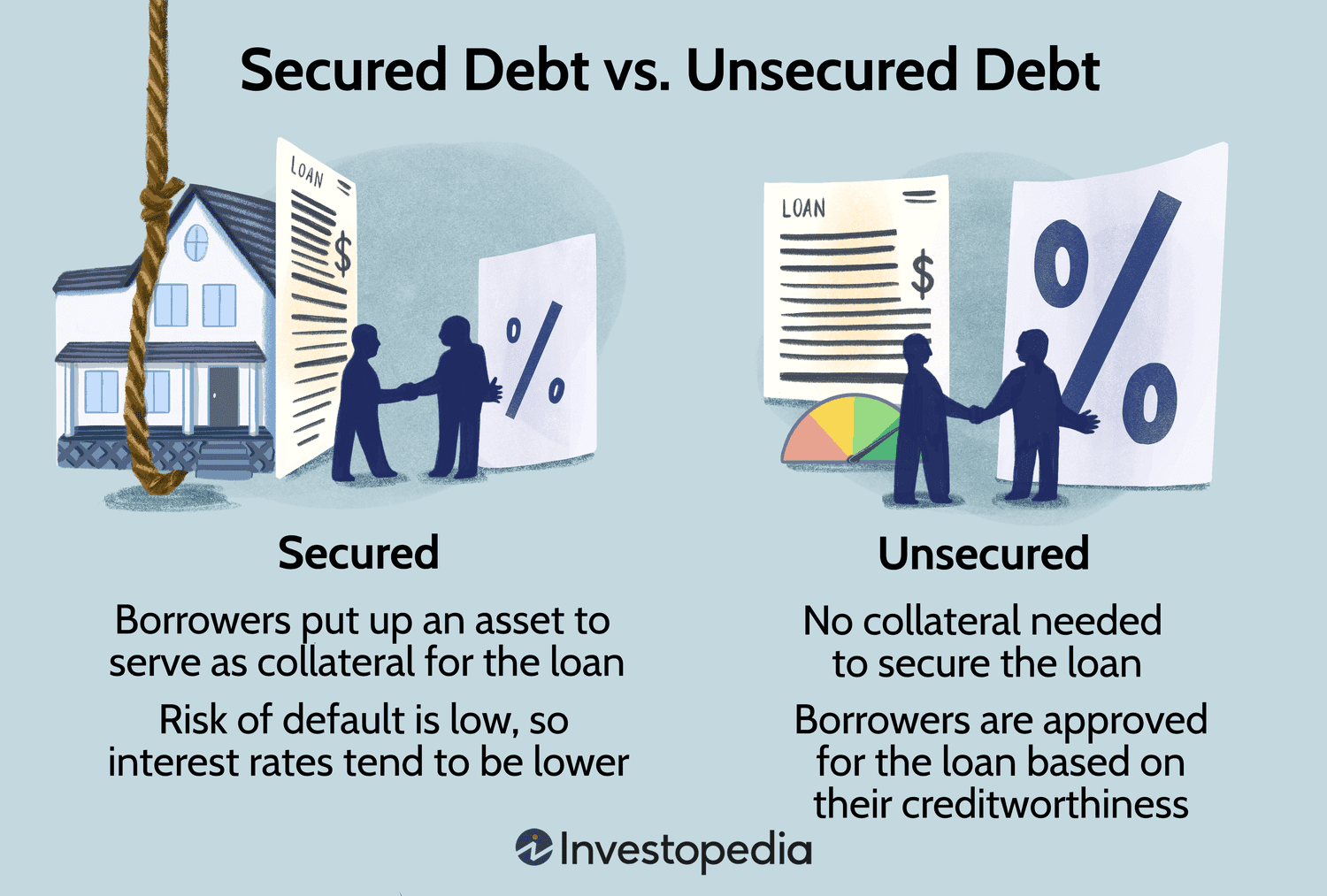

Secured loans require collateral, while unsecured loans do not. Collateral is an asset pledged to secure repayment of the loan.

Understanding the difference between secured and unsecured loans is crucial when seeking financial options. Secured loans often come with lower interest rates, reflecting the lowered risk to lenders due to the collateral offered. On the other hand, unsecured loans may have higher interest rates, reflecting the higher risk of lending without tangible security.

This distinction affects the borrower’s risk, the borrowing limits, and the repayment terms. It’s vital for borrowers to consider their ability to offer collateral and their willingness to risk it when choosing between a secured or an unsecured loan.

Introduction To Secured And Unsecured Loans

Understanding loans is key to financial health. Knowing the difference between secured and unsecured loans is crucial. Each type impacts your borrowing terms and obligations. Let’s explore these differences.

The Basics Of Borrowing Money

Loans allow for money borrowing with a promise to pay back. Lenders offer various loan types. Borrowers must meet specific criteria. Credit scores often influence loan conditions.

- Credit Score: A numerical expression of creditworthiness.

- Lender: An individual or institution that lends money.

- Borrower: A person or entity taking out a loan.

Secured Vs Unsecured: A Preliminary Contrast

Secured loans require collateral. Unsecured loans do not. Collateral reduces lender risk. No collateral means higher interest rates.

| Loan Type | Collateral Required | Risk to Lender | Interest Rate Trend |

|---|---|---|---|

| Secured Loan | Yes | Lower | Generally lower |

| Unsecured Loan | No | Higher | Generally higher |

Collateral can be a house, car, or other assets. High credit scores often lead to better terms. Unsecured loans rely heavily on credit history. Lenders assess risk before approval.

Secured Loans Explained

Let’s talk about secured loans. These are loans that need something valuable from you as a promise. This promise is called collateral. If you can’t pay back the loan, the lender can take your collateral.

Collateral As A Loan Guarantee

Collateral is an important part of secured loans. It’s like a safety net for the lender. It can be your house, car, or other valuable things. If you fail to pay, the lender can take these items.

Common Types Of Secured Loans

- Mortgages: Loans to buy a house. Your house is the collateral.

- Auto loans: Loans to buy a vehicle. The vehicle is the collateral.

- Secured personal loans: These can use different things as collateral. Like savings accounts or stocks.

Unsecured Loans Explained

An unsecured loan is money borrowed without collateral. Lenders assess your creditworthiness. They do not require assets as security. This makes unsecured loans a riskier venture for lenders. Yet, they are more accessible for borrowers.

Qualifying For An Unsecured Loan

To get an unsecured loan, lenders look at your credit score. A high credit score means better loan terms. You will need proof of stable income. Lenders want to see that you can repay the loan.

- Credit History: A record of timely payments helps.

- Income: Steady income reassures lenders.

- Debt-to-Income Ratio: Lower ratios mean less risk for lenders.

Typical Unsecured Loan Options

There are several common types of unsecured loans. Each serves different financial needs.

| Loan Type | Use |

|---|---|

| Personal Loans | For personal expenses or debt consolidation. |

| Credit Cards | For everyday purchases or emergencies. |

| Student Loans | To pay for education costs. |

| Signature Loans | Based solely on the borrower’s signature. |

Risk Assessment In Lending

Understanding the risk in lending is crucial. Lenders and borrowers face different risks. These risks affect loan terms.

Lender’s Risk In Secured Loans

Secured loans mean lower risk for lenders. Borrowers provide collateral. This collateral can be a house, car, or other assets. If borrowers fail to pay, lenders can take the collateral. This process is known as repossession or foreclosure.

Lenders assess the value of collateral before approving a loan. This value must cover the loan amount if the borrower defaults. Lenders prefer valuable and easy-to-sell assets for security.

Borrower’s Risk In Unsecured Loans

In unsecured loans, borrowers don’t pledge collateral. This means higher risk for lenders, but more risk for borrowers too. Lenders can’t take physical assets. Instead, they may take legal action. This could lead to wage garnishment or liens.

Borrowers may face higher interest rates. Lenders do this to offset the increased risk. Good credit scores are often needed for these loans.

Interest Rates And Loan Terms

Understanding the differences between secured and unsecured loans is crucial, especially when it comes to interest rates and loan terms. These factors can greatly influence your decision on which loan to choose. Let’s dive into how these loan types compare in terms of interest rates and the duration you’ll have to pay back the loan.

Comparing Interest Rates

Interest rates are a key factor in any loan decision. Generally, secured loans have lower interest rates than unsecured loans. This is because secured loans are less risky for lenders. They can take your asset if you can’t pay. Unsecured loans, lacking collateral, usually charge more to cover the higher risk.

- Secured loans: Often have interest rates between 2% and 10%.

- Unsecured loans: Rates can range from 6% to 36%, depending on your credit.

Loan Term Differences

The loan term is how long you have to pay back the loan. Secured loans usually offer longer terms. This can make monthly payments smaller but you pay more interest over time. Unsecured loans often have shorter terms, leading to higher monthly payments but less interest paid overall.

| Loan Type | Typical Term Length |

|---|---|

| Secured Loan | 5 to 30 years |

| Unsecured Loan | 1 to 7 years |

Choosing between a secured or unsecured loan depends on what fits your financial situation best. Consider both interest rates and loan terms before making a decision.

Credit: efinancemanagement.com

Credit Score Impact

The credit score impact is key when choosing between secured and unsecured loans. Your credit score often determines your options and conditions. Here, we’ll explore how each loan type interacts with credit requirements.

Secured Loan Credit Requirements

Secured loans need collateral, like a home or car. Lenders view these loans as lower risk. Thus, they may offer them to those with lower credit scores. Yet, this doesn’t mean anyone can get one. A minimum credit score is still essential. Lenders may offer better terms to those with higher scores. Let’s break down the requirements:

- Collateral: Must provide an asset as security.

- Credit flexibility: More lenient credit score acceptance.

- Rates and terms: Better for higher scores.

Unsecured Loan And Creditworthiness

Unsecured loans do not require collateral. Your creditworthiness plays a bigger role here. Lenders assess risk based on your credit score. High scores often lead to better interest rates and terms. Low scores may result in denial or higher rates. Consider the following:

- No collateral: No asset needed to secure the loan.

- Credit score: Must be higher to qualify.

- Interest rates: Influenced by your creditworthiness.

Default And Repossession

Understanding default and repossession is crucial when choosing between secured and unsecured loans. This knowledge helps in making informed financial decisions. Let’s explore the consequences of not paying back these loans.

Consequences Of Defaulting On Secured Loans

A secured loan is backed by collateral. Collateral is an asset you own. If you default, the lender can take this asset. This process is called repossession.

- Defaulting leads to losing the collateral.

- Examples include homes for mortgages and cars for auto loans.

- Lenders sell the asset to recover the loan amount.

- Credit scores drop significantly after repossession.

Unsecured Loan Defaults And Collections

An unsecured loan does not need collateral. No asset backs the loan. But, defaulting is still serious.

- Lenders may hire collection agencies to recover the debt.

- Credit scores can suffer greatly.

- Lawsuits can be filed against the borrower.

- Wage garnishment is a potential outcome.

Credit: www.self.inc

Choosing Between Secured And Unsecured Loans

Deciding on a loan type is crucial. It affects your finances. Understand the difference to make a smart choice.

Assessing Your Financial Situation

Examine your finances before choosing a loan. Assess your ability to provide collateral. Consider your job stability. Think about your long-term financial goals. This ensures you pick a loan that fits your situation.

- Review current debts

- Check credit score

- Evaluate asset value

Making An Informed Decision

Secured loans need collateral. They often have lower interest rates. Unsecured loans do not require collateral. They might have higher rates.

| Loan Type | Collateral Required | Interest Rate |

|---|---|---|

| Secured | Yes | Lower |

| Unsecured | No | Higher |

Consider your ability to offer assets. Think about your comfort with potential risks. Weigh the pros and cons of each loan type. This helps in making a decision that aligns with your financial health.

Conclusion: Key Takeaways

Conclusion: Key Takeaways offer a clear understanding of the differences between secured and unsecured loans. This knowledge is crucial when deciding on a loan that fits your financial situation.

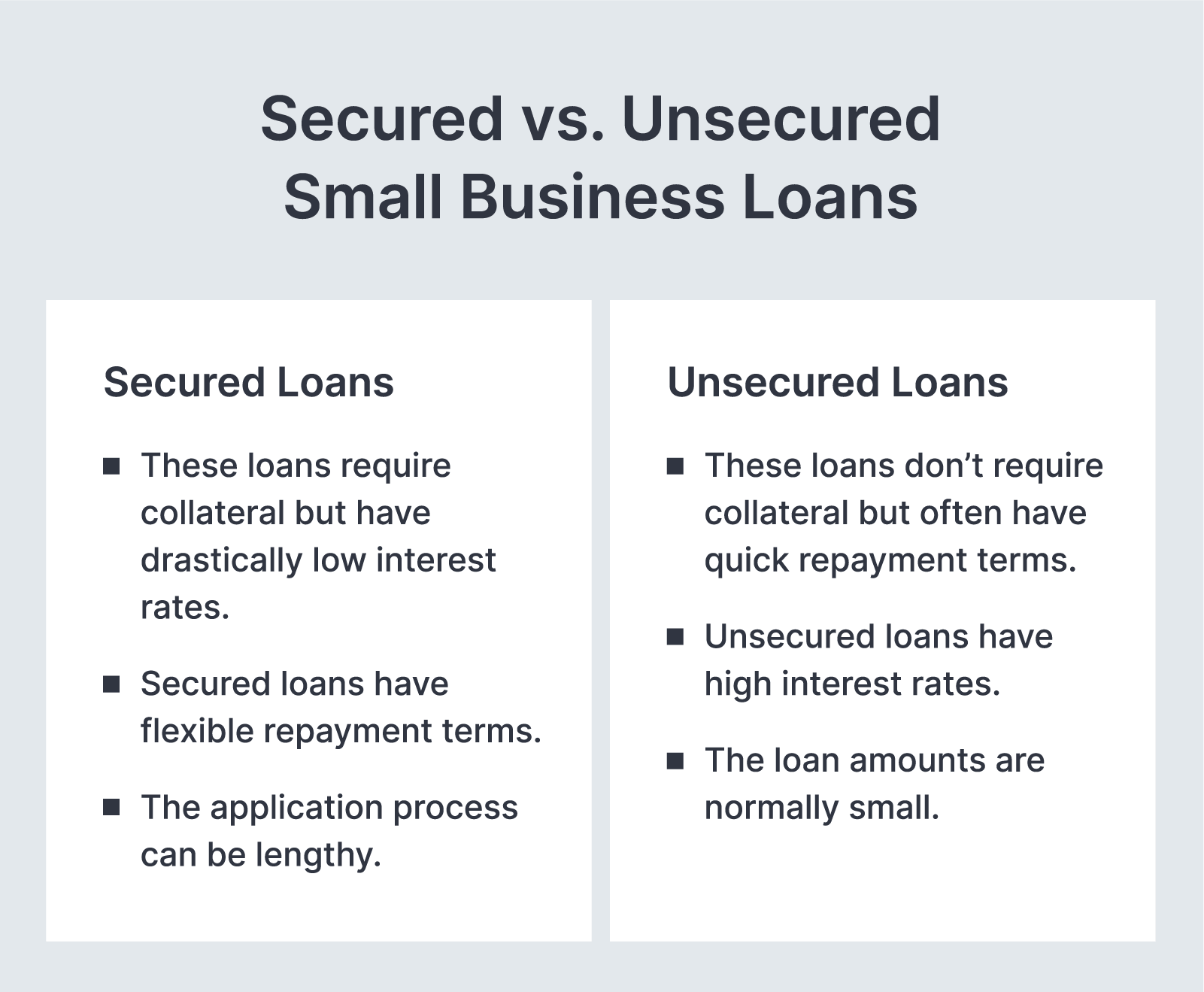

Recap Of Secured Vs Unsecured Loans

- Secured loans require collateral.

- Unsecured loans do not need assets for approval.

- Interest rates for secured loans are usually lower.

- Unsecured loans often have higher interest rates.

- Secured loan applications might take longer to process.

- Unsecured loans can offer quicker access to funds.

Final Thoughts On Loan Selection

Choosing between secured and unsecured loans involves evaluating risks and benefits. Consider your ability to provide collateral. Assess your comfort with potential interest rates. Factor in the urgency of your financial needs. Always choose wisely to ensure financial stability and peace of mind.

Credit: clarifycapital.com

Frequently Asked Questions

What Is A Secured Loan?

A secured loan is a type of credit backed by collateral. This means the borrower pledges an asset, like a car or home, which the lender can seize if the loan is not repaid.

How Does An Unsecured Loan Work?

Unsecured loans don’t require collateral. Lenders offer them based on your creditworthiness and promise to repay. They often have higher interest rates than secured loans.

Are Secured Loans Cheaper Than Unsecured?

Typically, secured loans have lower interest rates since they’re less risky for lenders. Collateral reduces the lender’s potential losses, leading to more favorable terms.

What Affects Unsecured Loan Interest Rates?

Unsecured loan rates are influenced by the borrower’s credit score, income, debt-to-income ratio, and the lender’s assessment of repayment risk. Better credit often results in lower rates.

Conclusion

Understanding the difference between secured and unsecured loans is crucial for making informed financial decisions. Secured loans offer lower interest rates but require collateral, while unsecured loans are more accessible but often come with higher costs. By weighing these options, borrowers can choose the best path for their financial health and goals.

Make the choice that aligns with your needs and future plans.