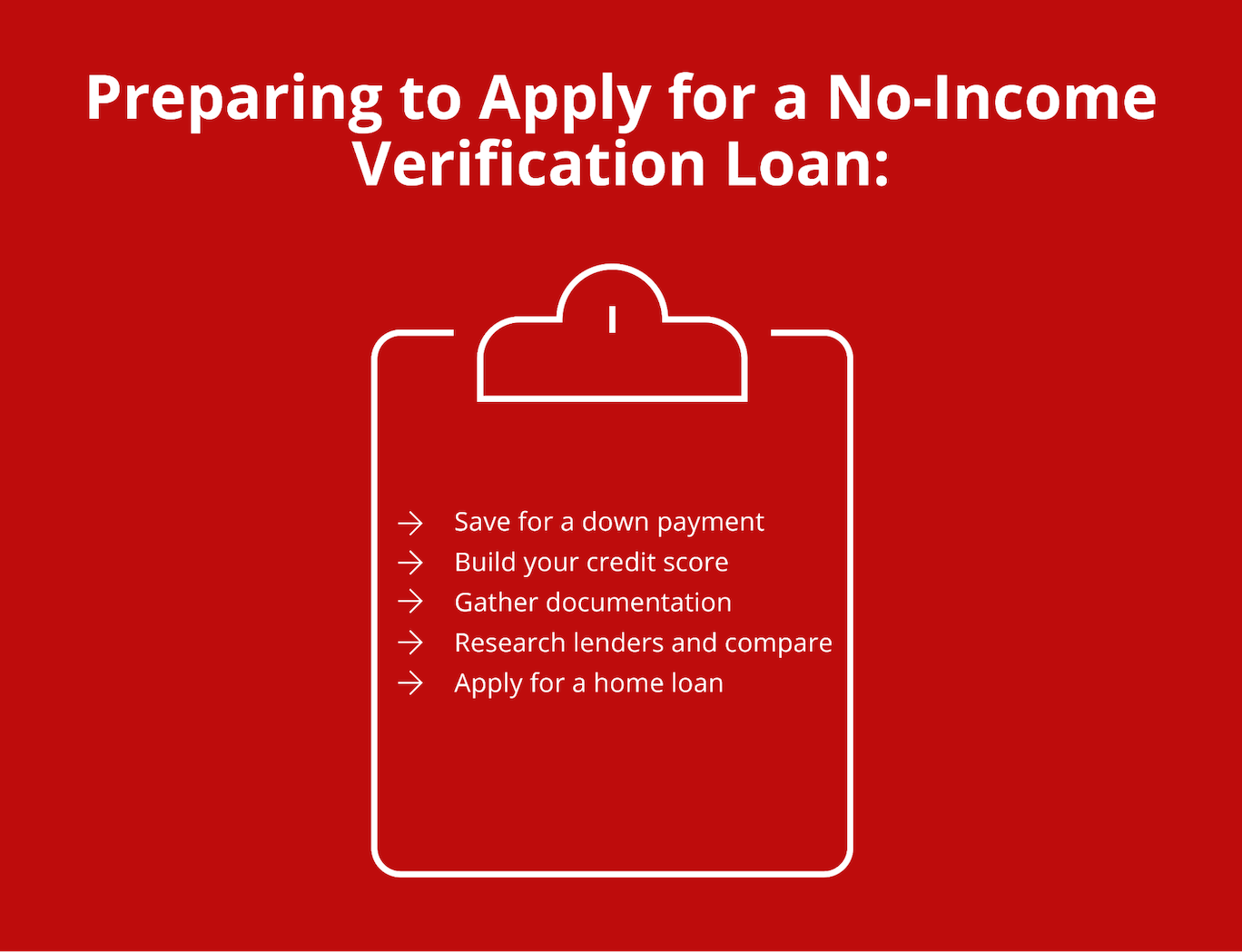

To apply for a no-income verification loan, start by researching lenders that offer this type of financing. Compile necessary financial documents, such as bank statements and asset information, before submitting an application.

Securing a loan without traditional income proof can be a lifeline for entrepreneurs and the self-employed. These specialized loans cater to applicants who may not have a consistent salary but still demonstrate the ability to repay. As traditional loans demand pay stubs or tax returns, no-income verification loans rely on other financial indicators.

They are ideal for those with substantial savings, irregular income streams, or significant assets. Borrowers should aim to showcase their financial health through alternative documents, ensuring the lender of their repayment capability. This loan type can be a flexible solution for funding personal or business needs without the conventional income paperwork.

Credit: www.loanry.com

Introduction To No-income Verification Loans

Embarking on the financial journey of securing a loan can be daunting. Especially without a traditional income proof. No-Income Verification Loans may be the solution. This type of loan caters to those with non-standard income sources. Understanding these loans is crucial before applying.

What Are No-income Verification Loans?

No-Income Verification Loans differ from standard loans. Traditional loans require proof of income. These do not. Lenders focus on other factors to assess creditworthiness. This includes credit history and assets.

These loans are ideal for self-employed individuals. Also, investors and retirees benefit from them. They make funds accessible without standard documentation.

Who Should Consider These Loans?

- Self-employed professionals with variable income streams

- Individuals with significant assets but irregular income

- Investors in need of liquidity without disrupting investment strategies

- Retirees seeking financial flexibility

These loans offer financial solutions for unique situations. They should be approached with clear understanding. Seek advice from financial professionals if necessary.

:max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-2783fe8c12084267bf62e2d35cedc18f.png)

Credit: www.investopedia.com

Eligibility Criteria For Applicants

Understanding the Eligibility Criteria for Applicants is crucial before applying for a no-income verification loan. This type of loan suits people without traditional income proof. Let’s dive into the main criteria.

Minimum Credit Score Requirements

A good credit score often matters for loan approval. Most lenders look for a score above 600. Yet, some may accept lower scores with higher interest rates.

| Credit Score Range | Loan Approval Chances |

|---|---|

| 300-599 | Low |

| 600-699 | Medium |

| 700+ | High |

Alternative Income Considerations

No job? Lenders may still approve you. They look at other income sources.

- Rental income can prove your ability to pay back.

- Investment returns show financial health.

- Even alimony or child support counts as income.

Be ready to show bank statements or similar documents as proof.

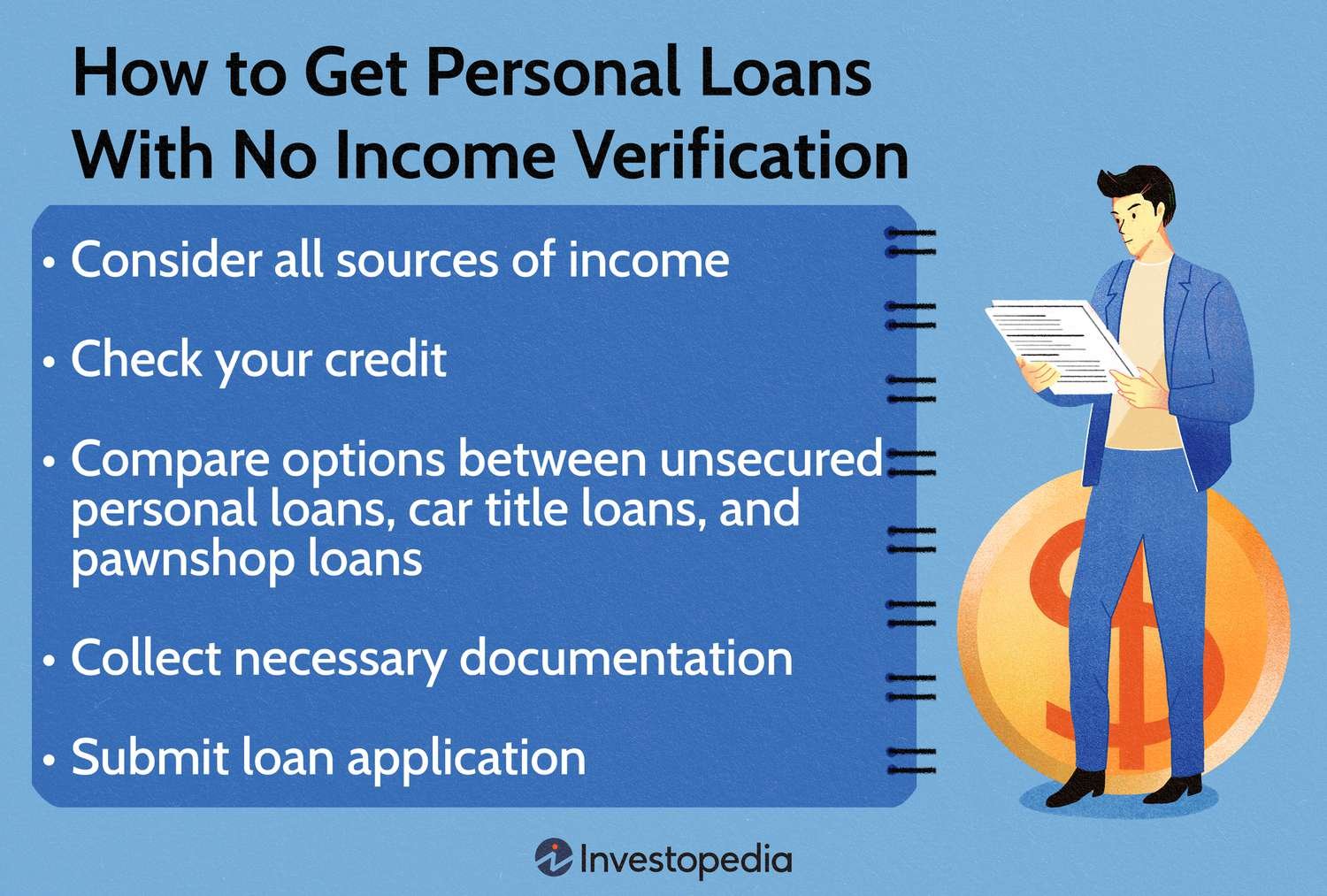

Preparing For The Application

Preparing for the Application is a critical step in securing a no-income verification loan. It sets the stage for a smooth process. Potential borrowers must gather the right documents and understand lender expectations.

Gathering Necessary Documentation

Collecting essential papers is your first task. Lenders require proof of your financial health. Here’s what you need:

- Bank statements – Show cash flow.

- Asset documentation – Prove your worth.

- Credit report – Reflects credit history.

- Rental history – Confirms reliability.

Understanding Lender Expectations

Lenders have clear criteria. You must meet these to qualify. Expectations often include:

| Credit Score | Assets | Debt-to-Income Ratio |

|---|---|---|

| Good or excellent | Sufficient for loan size | Low enough for new debt |

Understand these requirements. They help you see your chances. Strengthen your application where needed.

Choosing The Right Lender

Choosing the right lender is crucial when applying for a no-income verification loan. It’s not just about getting approval. It’s about finding terms that work for you. This guide walks you through the steps to compare lenders effectively.

Comparing Loan Terms And Conditions

Compare lenders by looking at their loan terms and conditions. Start with these key factors:

- Interest rates: Lower rates mean lower costs over time.

- Repayment terms: Flexible terms can ease your financial burden.

- Fees: Look out for hidden charges that add up.

Use a table to keep track of different lenders’ terms. Here’s an example:

| Lender | Interest Rate | Repayment Term | Fees |

|---|---|---|---|

| Lender A | 5% | 24 months | $0 |

| Lender B | 7% | 12 months | $100 |

Reading Customer Reviews And Testimonials

Customer reviews and testimonials offer real insights. Look for trends in feedback. Positive reviews can signal a trustworthy lender.

Don’t ignore negative reviews. They can reveal red flags. Check for issues like poor customer service or hidden fees.

Create a list of pros and cons for each lender based on reviews. Here’s a quick format:

| Lender | Pros | Cons |

|---|---|---|

| Lender A |

|

|

| Lender B |

|

|

The Application Process Step-by-step

Navigating through the application process for a no-income verification loan can seem daunting. Yet, it’s simpler than it appears. Let’s break down the steps, making this journey easier for you.

Online Application Vs. In-person

- Online applications offer convenience and speed. Fill out forms from anywhere, anytime.

- In-person applications provide a personal touch. Get questions answered on the spot.

Choose based on your comfort level. Both paths lead to the same goal.

What To Expect After Submitting An Application

- Receive a confirmation email or message. It means your application is in.

- Wait for the review process. This can take a few days to a week.

- Prepare for a possible follow-up call or email. They might need more info.

- Get the decision. Approved? You’ll get the next steps. Not approved? Ask why.

Patience is key. Use this time to gather any additional documents you might need.

Potential Pitfalls And How To Avoid Them

Getting a no-income verification loan seems easy. Yet, it has traps. This section will guide you through avoiding common mistakes and red flags during the application process.

Common Mistakes When Applying

- Not checking eligibility: Lenders have different rules. Always check these first.

- Ignoring loan terms: Read all conditions. Know what you agree to.

- Forgetting to review: Double-check your application. Mistakes can cause delays.

- Applying hastily: Take your time. Rushing can lead to errors.

Red Flags To Watch Out For

| Red Flag | Action to Take |

|---|---|

| Unclear fees | Ask for a full fee breakdown. |

| Vague terms | Request clear explanations. |

| Pressure to sign | Don’t rush. Think it over. |

| No license info | Verify lender’s credentials. |

After Approval: Receiving And Managing Funds

Congratulations on securing your no-income verification loan! Now, let’s focus on what happens after approval. Understanding the process of receiving and managing the loan funds is crucial. It ensures that you stay on top of your finances and utilize the loan effectively.

How Funds Are Disbursed

Once your loan gets approval, the lender will disburse the funds. This process typically involves direct deposit into your bank account. Ensure your account details are correct to avoid delays. Some lenders may offer alternative disbursement options. Check with your lender for specifics.

Best Practices For Managing Loan Money

- Create a budget: Track where every dollar goes.

- Set goals: Define what you’re aiming to achieve with this loan.

- Make timely payments: Avoid extra charges and maintain a good credit score.

- Keep records: Document all transactions and statements.

- Don’t mix funds: Keep loan money separate from other finances.

By following these practices, you can ensure the loan serves its intended purpose. It helps in maintaining financial stability.

Alternatives To No-income Verification Loans

Finding the right loan can be tough without proof of income. But there are alternatives to no-income verification loans that you might want to consider. These options can provide the financial support you need without the strict requirements of traditional loans.

Secured Loans And Collateral Options

Secured loans require an asset as collateral. This can be a car, a house, or savings. The lender holds onto this collateral if the borrower defaults. Here are key points to remember:

- Lower interest rates: Collateral reduces risk for lenders, potentially leading to better rates.

- Asset risk: If you fail to repay, you could lose your asset.

- Types of secured loans include home equity loans and auto title loans.

Assistance Programs And Community Resources

Local assistance programs can offer financial help. Community resources provide support without the need for loan repayment. Explore these options:

- Government benefits: Programs like SNAP or TANF help with basic needs.

- Non-profits: Charities may offer grants or interest-free loans.

- Credit unions: These institutions often have more flexible lending criteria.

Faqs About No-income Verification Loans

Navigating the world of no-income verification loans can be tricky. Here are some common questions answered to help you understand the process better.

Can I Apply With Bad Credit?

Bad credit does not automatically disqualify you. Lenders consider other factors like your assets and investment history. It’s essential to shop around, as each lender has unique criteria.

Are These Loans Available For Self-employed Individuals?

Yes, self-employed individuals can apply. Lenders may require proof of consistent income through bank statements or similar documents instead of traditional pay stubs.

Conclusion: Is A No-income Verification Loan Right For You?

Deciding on a no-income verification loan needs careful thought. This option suits some people well, but not everyone. Below, we discuss the main points to help you choose wisely.

Summarizing The Pros And Cons

Let’s look at the good and bad sides of these loans:

| Pros | Cons |

|---|---|

|

|

Making An Informed Decision

Think about these points before choosing:

- Understand your financial health. Know what you can afford.

- Explore other loan options. Maybe there’s a better fit.

- Consider the future. Can you handle the loan if things change?

Choosing a loan is big. Take your time and pick wisely.

Credit: griffinfunding.com

Frequently Asked Questions

What Is A No-income Verification Loan?

A no-income verification loan is a credit option where the lender does not require traditional proof of income, such as tax returns or pay stubs. Instead, other financial aspects like credit history and assets may be evaluated.

Who Qualifies For No-income Verification Mortgages?

Typically, self-employed individuals, freelancers, and those with irregular income streams qualify for no-income verification mortgages. Lenders may require a higher credit score or significant assets as security.

What Documents Are Needed For Income-verification Loans?

While no-income verification loans don’t require standard income proof, lenders might ask for bank statements, asset documentation, and a good credit report to assess financial stability.

How Do No-income Verification Loans Differ From Traditional Loans?

No-income verification loans differ from traditional loans in their approval process, which doesn’t heavily rely on income documentation. They may carry higher interest rates due to perceived increased risk.

Conclusion

Securing a no-income verification loan might seem daunting, but it’s achievable with the right approach. Remember, preparation and understanding the lender’s requirements are key. By following the steps outlined, you’re better positioned to navigate the process smoothly. Take action today, and you could unlock the financial flexibility you need without traditional income proof.