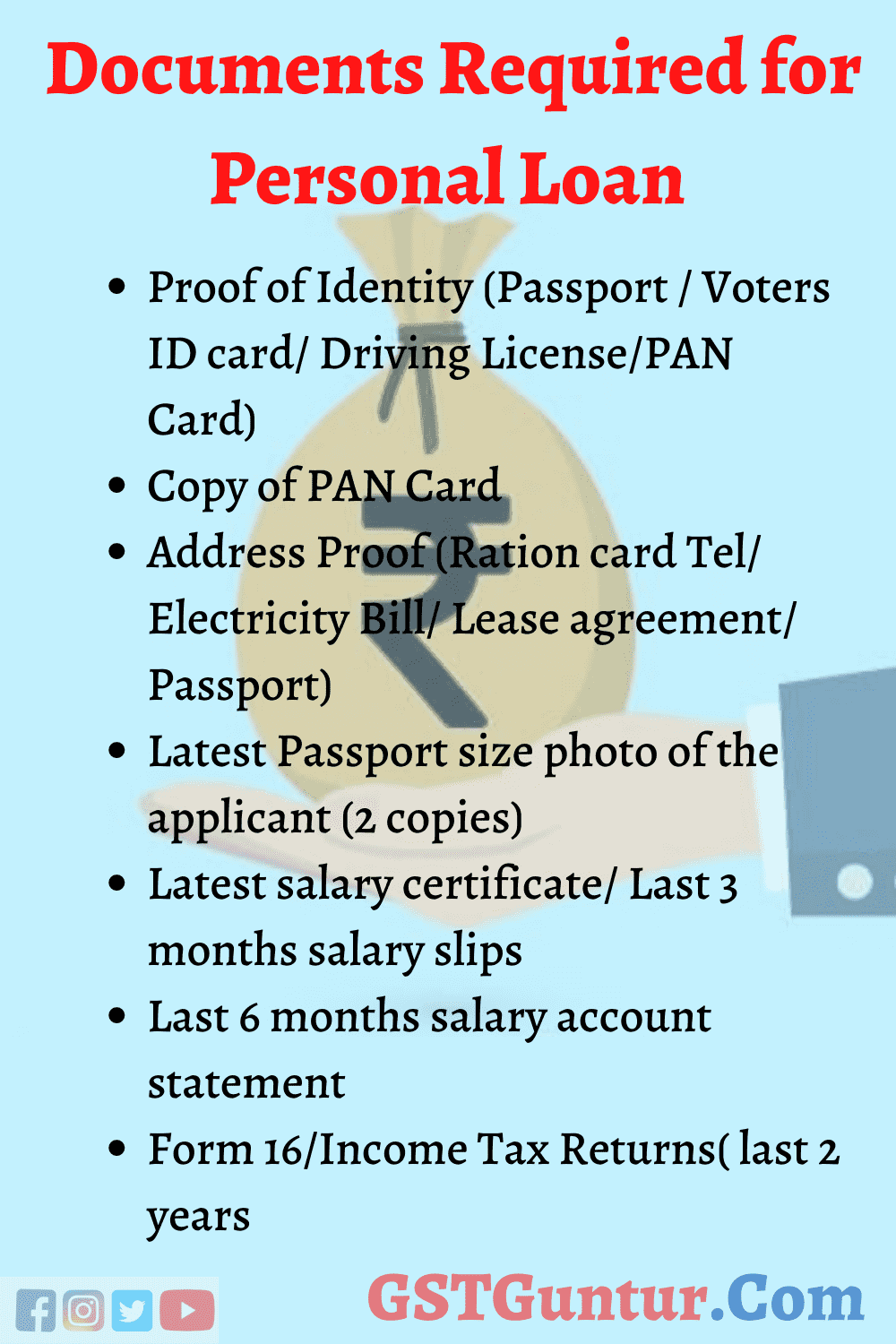

To apply for a personal loan, you typically need proof of identity, income verification, and credit history documentation. Lenders may also request proof of address and employment.

Securing a personal loan requires careful preparation and attention to detail. Applicants must gather the necessary paperwork to prove their eligibility and creditworthiness. This process starts with the basics: a government-issued ID to confirm identity and a social security number for credit checks.

Pay stubs, tax returns, or bank statements often fulfill the income verification requirement. A good credit score, supported by a credit report, can influence loan approval and terms. Utility bills or lease agreements usually serve as proof of address. Employment verification, such as a job letter, reassures lenders of consistent income. Each document plays a crucial role in the lender’s decision-making process, making it essential for borrowers to present a complete and accurate portfolio.

Introduction To Personal Loans

Personal loans provide financial support when you need it most. They offer a way to cover expenses without the long-term commitment of a mortgage or the specific purpose of an auto loan. Whether for consolidating debt, making home improvements, or funding a dream wedding, personal loans can bridge the gap between your financial needs and the funds you have on hand.

Why People Seek Personal Loans

The reasons for obtaining a personal loan are as diverse as the borrowers themselves. Some common motivations include:

- Debt consolidation: Simplify finances by combining multiple debts into a single loan.

- Emergency expenses: Cover unexpected costs like medical bills or car repairs.

- Home renovations: Invest in your home without tapping into equity.

- Major events: Fund significant life events such as weddings or travel.

Types Of Personal Loans Available

Personal loans come in various forms to suit different financial scenarios:

| Loan Type | Features |

|---|---|

| Secured loans | Require collateral, lower interest rates. |

| Unsecured loans | No collateral needed, slightly higher rates. |

| Fixed-rate loans | Steady interest rate, predictable payments. |

| Variable-rate loans | Interest aligns with market rates, payment amounts vary. |

Credit: www.kotak.com

The Importance Of Documentation

The Importance of Documentation plays a key role in securing a personal loan. Lenders review these documents to decide on your loan approval. They confirm your identity, income, and credit history through them. Without the right documents, getting a loan becomes tough.

Role Of Documents In Loan Approval

Documents serve as proof of your financial health. Lenders need to trust you can repay the loan. Here’s what documents do:

- Verify Identity: They confirm you are who you say you are.

- Income Proof: They show you earn enough to repay the loan.

- Credit History: They reveal how well you’ve managed loans before.

Common Pitfalls To Avoid

Applicants often make mistakes that can delay or deny their loan. Avoid these:

- Submitting outdated or fake documents.

- Forgetting to sign or fill in all required fields.

- Ignoring to update personal information, like address changes.

Always double-check your documents before submission. Ensure they are current and complete. This simple step can speed up your loan process.

Identification Proof

When applying for a personal loan, lenders require proof of identity. This ensures the person applying is indeed who they claim to be. Banks and financial institutions have specific needs for this purpose.

Primary Id Requirements

Primary identification is a must for a personal loan. It must have a photo and be government-issued. This confirms your identity and legal age. Below is a list of accepted primary IDs:

- Driver’s License: A common form of ID with a photo.

- Passport: Widely accepted and proves nationality.

- State ID: Government-issued alternative to a driver’s license.

- Military ID: For service members, showing name and photo.

Secondary Id Options

If a primary ID is not available, lenders may accept secondary IDs. These support the primary ID.

| Type of Secondary ID | Details |

|---|---|

| Birth Certificate: | Confirms birth date and place. |

| Social Security Card: | Shows Social Security number. |

| Utility Bills: | Confirms your current address. |

| Bank Statement: | Reflects financial history and address. |

Remember, secondary IDs often need to be paired with a primary ID. Always check with your lender for their specific requirements.

Credit: eforms.com

Income Verification

Income Verification stands as a vital step in securing a personal loan. Lenders assess your ability to repay the loan. They require proof of your earnings. This evidence comes in various forms, tailored to your employment status.

Salary Slips And Employment History

Evidence of steady income assures lenders of your repayment capability. For salaried individuals, the documents listed below are crucial:

- Recent Salary Slips: Usually, the last three months’ slips are needed.

- Employment History: Work stability is shown through your employment record. A continuous job history over the last two years is often preferred.

These documents highlight your financial stability. They help lenders gauge your long-term earning potential.

Self-employed Applicants’ Documentation

For the self-employed, income verification can be more complex. The following are typically required:

| Document Type | Description |

|---|---|

| Tax Returns | Last two years’ returns showing consistent income. |

| Profit and Loss Statements | Professional prepared statements are best. |

| Bank Statements | Reflects business cash flow and health. |

These papers confirm your business’s earnings. They show your ability to honor loan commitments.

Credit History And Scores

When applying for a personal loan, your credit history and scores play a big role. Lenders look at these to decide if they should give you money. Let’s dive into what these terms mean and how you can improve them.

Understanding Your Credit Report

Your credit report is like your financial report card. It shows how well you handle money. Banks and lenders check this to see if you pay your bills on time. It has your past loans, credit card use, and other money matters.

- Credit Accounts: The types of accounts you have, like loans or credit cards.

- Payment History: If you pay your bills on time or not.

- Credit Inquiries: Times you asked for new credit.

- Debts: How much money you owe.

Improving Your Credit Score For Loan Approval

A good credit score makes getting a loan easier. Here are simple steps to boost your score:

- Pay Bills on Time: Always pay your bills when they are due.

- Lower Your Debts: Try to pay off what you owe quickly.

- Keep Old Credit Cards: Older accounts show you have experience with credit.

- Limit New Credit Requests: Asking for too much new credit can lower your score.

By following these steps, you can make your credit report better. This will help you get a loan with good terms.

Proof Of Residence

Securing a personal loan requires certain documents. Proof of Residence is crucial. Lenders want to confirm your living address. This step is vital for the application process.

Utility Bills

Utility bills act as residence proof. Lenders accept various types.

- Electricity bills

- Water bills

- Gas bills

- Internet service bills

- Cable TV bills

These documents should show your name and current address. They must be recent, usually within the last three months.

Lease Agreements

Lease agreements are another form of proof. They confirm your rental arrangements. Make sure your agreement is valid. It should list your name, address, and landlord’s contact information.

Alternative Residence Verification

Some applicants lack utility bills or lease agreements. Alternative documents can help.

- Bank statements

- Property tax receipts

- Voter registration cards

- Postal change of address confirmation

These alternatives should also be up-to-date. They must include your name and current living address.

Bank Statements And Financial Health

When applying for a personal loan, lenders scrutinize your financial health. They want to ensure you can repay the loan. Your bank statements are like a financial report card. They reveal your cash flow, spending habits, and saving discipline. Lenders use this data to assess risk and decide on your loan application.

Recent Bank Statements

Recent bank statements play a crucial role in your personal loan application. These documents offer a snapshot of your recent financial activity. Lenders typically request statements from the last three to six months. They look for red flags such as overdrafts or insufficient funds.

Ensure your statements are ready:

- Check for accuracy: Verify all entries before submission.

- Gather statements: Collect the last three to six months’ worth.

- Include all accounts: Show a complete picture of your finances.

Analyzing Your Financial Stability

Lenders analyze your bank statements to gauge your financial stability. Consistent income and a pattern of savings reflect well on your financial habits. On the other hand, erratic deposits or frequent large withdrawals may raise concerns.

Key aspects lenders consider:

- Income regularity: Shows steady employment.

- Spending patterns: Indicates responsible money management.

- Savings: Demonstrates financial security and discipline.

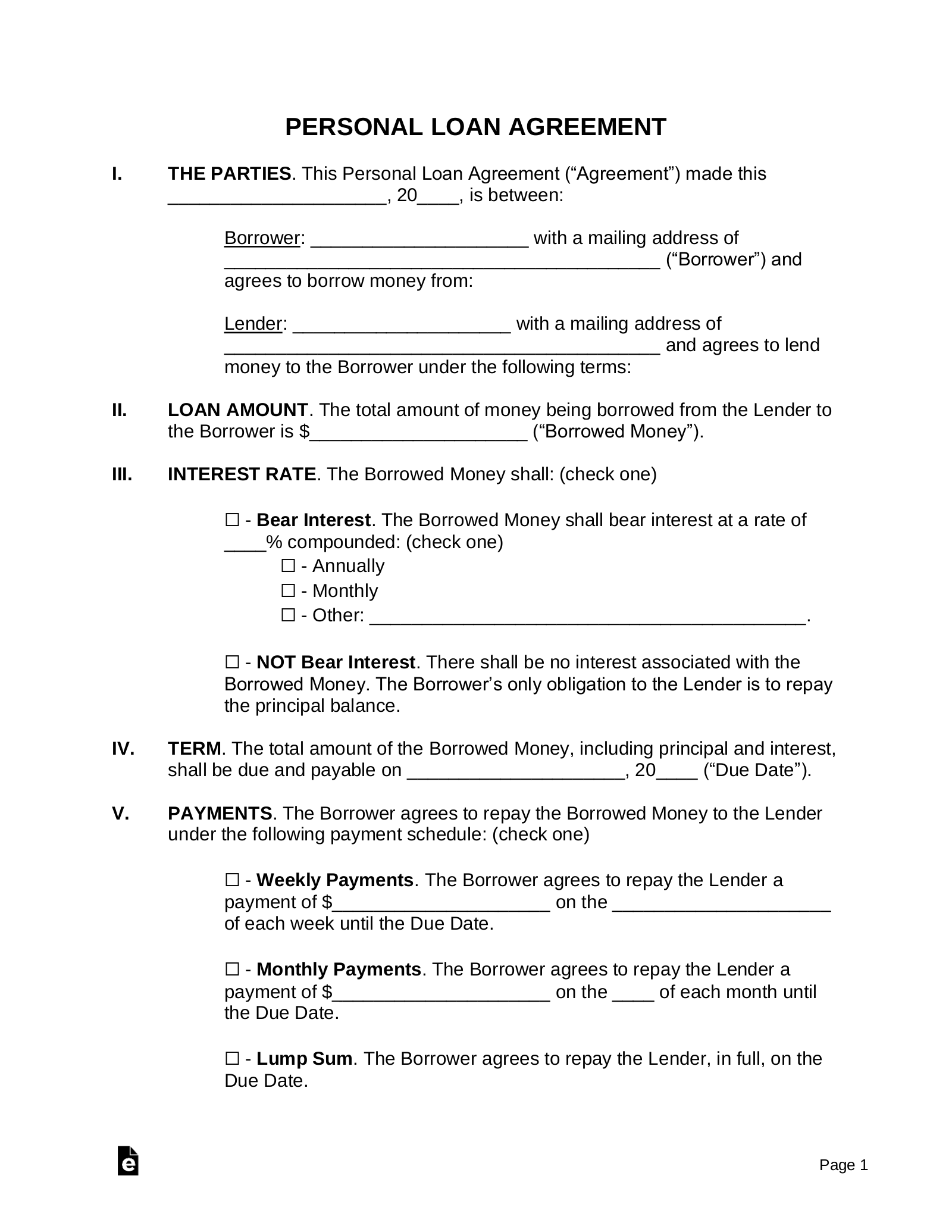

Collateral Documentation

Understanding the requirements for personal loan collateral is key. This section covers important collateral documents.

When Collateral Is Required

Not all personal loans need collateral. Secured loans do. Here’s a breakdown of times when you’ll need to provide collateral:

- Large loan amounts: High-value loans often require security.

- Poor credit history: Collateral compensates for credit risks.

- Lower interest rates: Collateral can reduce costs.

Assessing The Value Of Collateral

Lenders evaluate collateral to determine loan amounts. They use several methods:

- Appraisal by certified professionals.

- Market value comparisons.

- Condition and age considerations.

Documents needed may include:

| Collateral Type | Required Documents |

|---|---|

| Real Estate | Property deeds, mortgage statements. |

| Vehicles | Title documents, registration, insurance. |

| Investments | Stock certificates, account statements. |

References And Contacts

When applying for a personal loan, lenders often request ‘References and Contacts’. This helps verify your reliability and trustworthiness. Below are the details on what you’ll need to provide.

Personal And Professional References

Lenders may ask for both personal and professional references. These individuals vouch for your character and financial responsibility. Ensure you inform your references in advance, so they expect potential contact. Here’s what you typically need:

- Full name of each reference

- Relationship to you

- Contact information, including phone number and email

- Address may also be required

Emergency Contact Information

Your emergency contact is someone lenders can reach out to if they cannot contact you. This person is not responsible for your debt. Typically, the emergency contact should be someone very close to you. Here’s the information you’ll need:

| Contact’s Name | Relationship | Primary Phone Number |

|---|---|---|

| Example: Jane Doe | Example: Sister | Example: 555-1234 |

Choose a reliable individual who can provide accurate information about your whereabouts if necessary.

Final Checklist Before Application

Before you apply for a personal loan, make sure you’re ready. Our Final Checklist Before Application helps. This guide keeps things simple and clear.

Document Review And Verification

First, double-check your documents. All your papers must be correct and up-to-date. Here’s a quick list:

- Identity Proof: Passport or Driver’s License

- Address Proof: Recent utility bill or lease agreement

- Income Proof: Last 3 months’ pay slips or bank statements

- Credit History: Credit report

Make sure each document is clear and easy to read. Take good photos or scans.

Tips For A Smooth Application Process

Applying for a loan can be easy. Follow these tips:

- Check Eligibility: Make sure you meet the loan’s requirements.

- Organize Documents: Keep all your documents in one place.

- Fill Out Forms Carefully: Answer all questions truthfully and clearly.

- Ask Questions: If something is unclear, ask the lender for help.

Remember, preparation is key. Take your time and double-check everything.

Faqs On Personal Loan Documentation

Understanding what documents you need for a personal loan is crucial. Lenders require specific papers to process your application. This section answers frequently asked questions about personal loan documentation.

Addressing Common Concerns

Do lenders always need the same documents? No, requirements vary by lender. Always check with your lender for a specific list.

Can I get a loan without income proof? It’s unlikely, as lenders need to assess your ability to repay the loan.

Is a credit check always performed? Yes, lenders use credit checks to gauge creditworthiness.

What if I’m self-employed? Self-employed individuals must provide additional paperwork, like tax returns or profit statements.

Expert Advice On Documentation

- Organize your documents before applying. It speeds up the process.

- Update all paperwork. Ensure every document is current and valid.

- Check for accuracy in all documents. Mistakes can cause delays.

- Keep copies of everything you submit. You might need them later.

Remember: Proper documentation is key to a smooth loan approval process. Follow these tips and prepare the necessary documents to increase your chances of a successful loan application.

Credit: www.lendingpoint.com

Frequently Asked Questions

What Items Are Mandatory For Personal Loan Approval?

To secure a personal loan, you typically need proof of identity, proof of income, credit history documentation, and sometimes proof of residence. These documents help lenders assess your loan eligibility.

How Does Credit Score Impact Personal Loan Terms?

A higher credit score can lead to better personal loan terms, such as lower interest rates and more favorable repayment terms. Lenders use it to gauge creditworthiness and repayment capacity.

Can Self-employed Individuals Get Personal Loans?

Yes, self-employed individuals can obtain personal loans by providing additional documentation such as tax returns, financial statements, and proof of stable income to demonstrate their ability to repay.

What Documents Do Lenders Require For Income Verification?

Lenders commonly request recent pay stubs, bank statements, W-2 forms, or tax returns to verify your income for a personal loan. These show your earnings and help them determine your loan amount.

Conclusion

Securing a personal loan requires thorough preparation and the right documents. Gather your ID, proof of income, and credit history before applying. This ensures a smoother process and better chances of approval. Remember, each lender may have different requirements, so double-check their list.

Get organized and take the step towards your financial goal with confidence.