Yes, obtaining a business loan without a business plan is possible, though challenging. Lenders may offer loans based on personal credit or collateral instead.

Navigating the financial landscape to secure a business loan can be daunting, especially for new entrepreneurs. Traditional lenders typically require a comprehensive business plan to understand the venture’s potential and risks. However, some modern financing options prioritize other factors, such as personal credit history or the availability of collateral.

This flexibility allows for different avenues of funding, accommodating entrepreneurs who may not have a formal business plan yet. Crafting a concise, well-rounded introduction to this topic involves highlighting the importance of a business plan while acknowledging alternative paths to securing funds.

Introduction To Business Financing

Navigating the world of business financing can be tricky. Entrepreneurs often face the question: Is a business plan essential for a loan? Understanding the role of a business plan and the realities of acquiring a loan is crucial. Let’s debunk some myths and highlight the importance of business plans in securing financing.

The Importance Of Business Plans

A business plan acts as a roadmap. It outlines goals, strategies, and financial projections. Lenders look for clarity and foresight. A well-crafted plan can often mean the difference between approval and rejection.

- Clear Vision: Shows lenders a snapshot of your business’s future.

- Risk Assessment: Helps assess the viability and potential risks.

- Funding Allocation: Details on how funds will be utilized.

Myths About Business Loans

Many believe loans are inaccessible without elaborate business plans. This isn’t always true. Alternative lenders may offer loans without requiring one. Let’s explore some common misconceptions.

| Myth | Reality |

|---|---|

| All lenders need business plans. | Some lenders prioritize credit scores and cash flow. |

| Business plans guarantee loans. | Approval depends on multiple factors, not just the plan. |

| Startups can’t secure loans. | Specialized loan programs exist for startups. |

Types Of Business Loans

Exploring the world of business loans can be exciting. You might wonder, “Can I get a business loan without a business plan?” The answer is yes, but knowing the types of loans available is key. Let’s dive into the different types of business loans.

Secured Vs. Unsecured Loans

Business loans come in two main flavors: secured and unsecured.

- Secured loans need something valuable from you. This could be property or equipment. If you can’t pay back, the lender can take these.

- Unsecured loans don’t need collateral. But, they might have higher interest rates. This is because they are riskier for the lender.

Alternative Lending Options

Not all business loans come from banks. There are alternative lending options.

These can be easier to get, especially without a business plan.

- Online lenders offer quick loans. They often have simple forms online.

- Peer-to-peer lending lets people lend money to each other. It’s done on websites that match lenders with borrowers.

- Microloans are small loans. They are perfect for startups or small needs.

Business Plan Alternatives

Thinking of a business loan without a traditional plan? You’re not alone. Many entrepreneurs seek alternatives to lengthy business plans. Let’s explore some streamlined options that can support your loan application.

One-page Pitch

The one-page pitch is a brief yet powerful alternative. It highlights your business’s core aspects. This document includes:

- Business concept: what your business does.

- Target market: who you serve.

- Unique value proposition: why customers choose you.

- Revenue model: how you make money.

This concise pitch can impress lenders with its clarity and focus.

The Lean Startup Model

The Lean Startup Model emphasizes agility and adaptability. It consists of:

- Key Partnerships: your business allies.

- Key Activities: your critical business actions.

- Key Resources: your main assets.

- Customer Relationships: how you connect with customers.

- Customer Segments: specific groups you target.

- Channels: where you sell your product.

- Cost Structure: your business costs.

- Revenue Streams: where your income comes from.

This model helps you create a living document. It evolves with your business.

Credit: fastercapital.com

Lender’s Perspective

Securing a business loan can be a pivotal moment for any entrepreneur. Lenders typically seek assurance that their investment is sound. This often comes in the form of a business plan. But what if you don’t have one?

Risk Assessment Without A Business Plan

Lenders use business plans to gauge risk. Without one, they rely on other criteria. These include credit history, collateral, and cash flow.

Key Factors Considered By Lenders

- Credit Score: A high score can show reliability.

- Revenue: Consistent income suggests a healthy business.

- Collateral: Assets can secure the loan.

- Industry Experience: Expertise can reduce lender worry.

- Existing Debt: Less debt means less risk for lenders.

Building Your Case

Building Your Case for a business loan without a business plan starts now. You need to show lenders you’re a safe bet. Let’s dive into how.

Strong Financial Records

Think of your financial records as your business’s report card. They show your money history. You need them to be strong to impress lenders.

- Profit and Loss Statements: Show if you’re making money.

- Balance Sheets: Display what you own and owe.

- Cash Flow Statements: Reveal how cash moves in and out.

Use charts or graphs to make these records clear. A picture is worth a thousand words, especially to lenders.

Clear Value Proposition

Your value proposition is your secret sauce. It’s why customers choose you. Make it clear and compelling.

| Component | Explanation |

|---|---|

| Unique Selling Points (USPs) | What makes you stand out? |

| Customer Benefits | How do you solve problems or add value? |

| Market Position | Where do you fit in the landscape? |

Think short, sweet, and to the point. Your value proposition should be easy to remember and repeat.

Navigating The Loan Process

Navigating the loan process can seem daunting without a business plan. Yet, it’s possible. Lenders may offer loans based on other factors. Let’s explore the path to securing a business loan without the traditional blueprint.

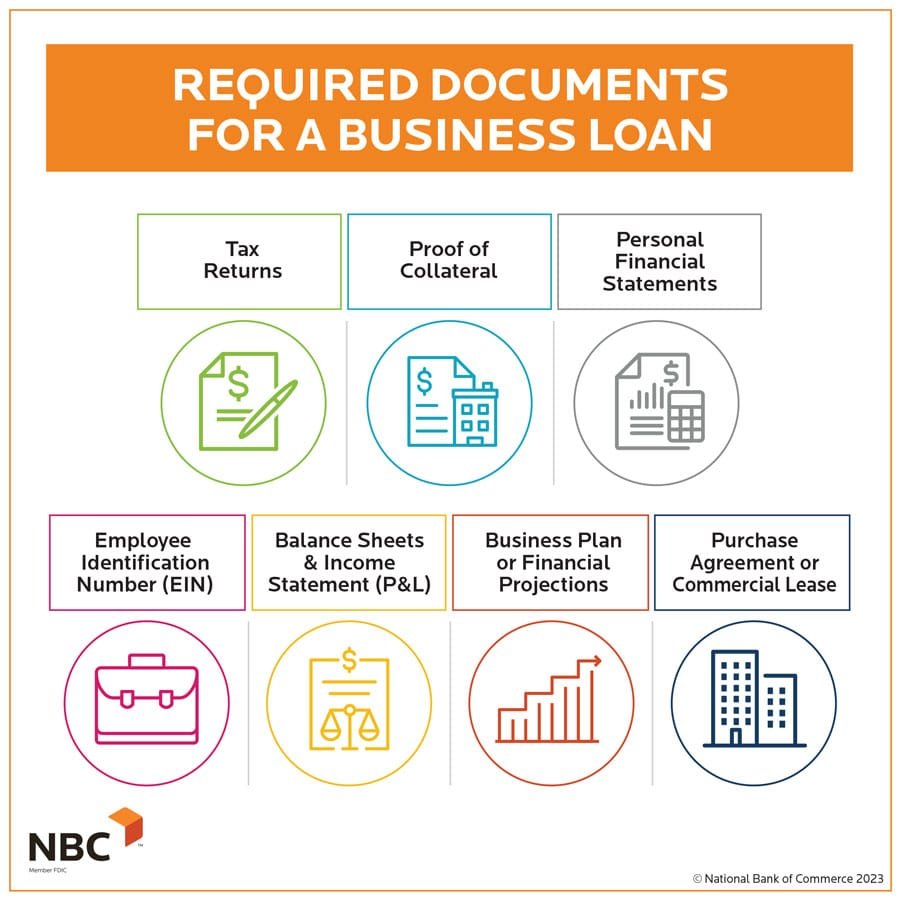

Documentation Required

Lenders will ask for specific documents. These help them assess your creditworthiness. Prepare the following:

- Financial statements: Showcase your company’s health.

- Proof of income: Tax returns and bank statements are key.

- Legal documents: Registration and licenses affirm your legitimacy.

- Collateral: Assets that secure the loan.

Negotiating Loan Terms

Understanding loan terms is crucial. Aim for the best deal. Consider these tips:

| Term | Tip |

|---|---|

| Interest Rate | Seek the lowest rate. It reduces payment amounts. |

| Repayment Period | Longer periods can ease monthly burdens. |

| Additional Fees | Ask about upfront costs. Avoid surprises. |

| Prepayment Penalties | Clarify if paying early incurs fees. |

Success Stories

Many dream of starting a business. Some succeed without a traditional business plan. Let’s explore real success stories.

Entrepreneurs Who Made It

Stories of successful entrepreneurs inspire us. They prove passion and vision can outweigh formal plans.

- Sara Blakely turned $5,000 into Spanx, a billion-dollar brand.

- Mark Zuckerberg started Facebook in a dorm, without a detailed business plan.

- Jan Koum launched WhatsApp and later sold it for $19 billion, all without a traditional plan.

Lessons Learned

Each entrepreneur teaches us valuable lessons. Understanding these can help others succeed too.

| Entrepreneur | Lesson |

|---|---|

| Sara Blakely | Start small, think big. |

| Mark Zuckerberg | Focus on growth, not just plans. |

| Jan Koum | Solve real problems, success will follow. |

Credit: upmetrics.co

Strategies For Approval

Seeking a business loan without a plan can be tough. But you can still win approval. You must show lenders that your business stands on firm ground. Let’s dive into effective strategies that can help you secure that loan.

Networking With Lenders

Building relationships with bankers is key. Start with smaller, local banks. They often invest in community businesses. Attend business events. Meet bank representatives. Share your vision and progress. Use these connections when applying for loans.

- Visit community banking events

- Engage with bank staff

- Show your business in action

Leveraging Business Assets

Your assets can act as loan security. This reduces risk for lenders. List all business assets. Include equipment, inventory, and real estate. Highlight steady revenue streams. Demonstrate strong asset management.

| Asset Type | Value | Use as Collateral |

|---|---|---|

| Equipment | $50,000 | Yes |

| Inventory | $20,000 | Yes |

| Real Estate | $200,000 | Yes |

Show lenders a clear path to repayment. This builds trust. Lenders need to see a return on their investment. Use your assets wisely.

Managing Finances Without A Loan

Many entrepreneurs wonder about funding options without a business plan. Exploring alternatives to traditional loans is crucial. Here are some strategies to manage finances without relying on a business loan.

Bootstrapping Your Business

Bootstrapping means starting a business with personal finances. It’s a hands-on approach to business funding. Entrepreneurs invest their own money. They may also use their personal credit. This method avoids debt. It encourages lean management. With bootstrapping, the focus is on minimal viable products and services. This ensures quick market entry. Owners retain full control. Profits get reinvested into the business. This fuels growth organically.

Crowdfunding And Angel Investors

Crowdfunding is a popular funding option. It involves raising small amounts of money from many people. Platforms like Kickstarter and Indiegogo are popular choices. Entrepreneurs present their ideas online. They seek financial support from the public. Rewards or equity are offered in return. This method validates the business idea. It also builds a customer base before launch.

Angel investors provide capital for startups. They exchange funding for equity. They often bring expertise and mentorship. This can be invaluable for new business owners. Angel investors typically have a network. This network can open doors for startups. Finding the right investor is key. They should align with the business vision and growth plans.

Credit: www.sbdc.duq.edu

Frequently Asked Questions

Can I Secure A Loan Without A Business Plan?

Yes, you can secure a business loan without a business plan, but it may limit your options. Lenders often prefer to understand your business strategy through a plan before approving loans.

What Alternatives To A Business Plan Do Lenders Accept?

Lenders might accept detailed financial projections, a solid credit history, or collateral instead of a business plan. Strong existing business revenues can also serve as an alternative for startups.

Are Business Loans Possible With Just An Idea?

Getting a business loan with just an idea is challenging. Lenders typically look for some proof of concept or initial investment from the entrepreneur before providing funds.

How Important Is A Business Plan For Loan Approval?

A business plan is crucial for loan approval as it demonstrates the feasibility and profitability of your business. However, some lenders may focus more on financial data and creditworthiness.

Conclusion

Securing a business loan without a plan is possible, but challenging. Lenders value clarity and risk management. Demonstrating strong financial health and potential for growth can be key. Consider alternative financing options or develop a concise plan to enhance your chances.

Remember, preparation and research are your best allies in this journey.