Yes, you can obtain a loan with low income, but options may be limited. Qualifying for a loan typically involves meeting certain income thresholds set by lenders.

Securing a loan on a low income is challenging, yet not impossible. Lenders evaluate your income to assess your ability to repay. A low income might necessitate higher interest rates or require a co-signer. Exploring various lenders is key, as some specialize in loans for those with lower earnings.

Additionally, government programs or credit unions might offer more favorable terms for low-income individuals. It’s critical to review your budget and consider the loan’s impact on your financial health. Always compare offers and read the fine print to ensure the loan aligns with your repayment capabilities and long-term financial goals. Remember, borrowing responsibly is paramount, regardless of income level.

The Reality Of Low Income Borrowing

Borrowing money with a low income poses unique challenges. Lenders often set income thresholds that can seem out of reach. Despite this, options exist for individuals needing financial assistance.

Challenges Faced By Low-income Earners

Low-income earners encounter several obstacles when seeking loans.

- Strict requirements narrow down loan options.

- Higher interest rates burden already tight budgets.

- Loan amounts may be limited due to perceived risk.

- Credit checks can be a hurdle without a solid history.

Income Thresholds For Loan Approval

Income plays a crucial role in loan approvals.

| Loan Type | Typical Income Requirement |

|---|---|

| Personal Loan | $20,000+ |

| Auto Loan | $18,000+ |

| Home Loan | $30,000+ |

These figures are examples and vary by lender and loan type.

Loan Types Accessible To Low-income Applicants

Finding a loan on a low income seems hard. Yet, options exist. This section explores loan types available to low-income applicants. We will look into secured and unsecured loans and government-backed programs. These options make borrowing easier and more accessible.

Secured Vs. Unsecured Loans

Secured loans need an asset as collateral. This could be a car or house. They often have lower interest rates. This is because they are less risky for lenders. Unsecured loans do not need collateral. They might have higher interest rates. Yet, they are still an option for low-income individuals.

- Secured Loans: Car loans, Home loans

- Unsecured Loans: Personal loans, Credit cards

Government-backed Loan Programs

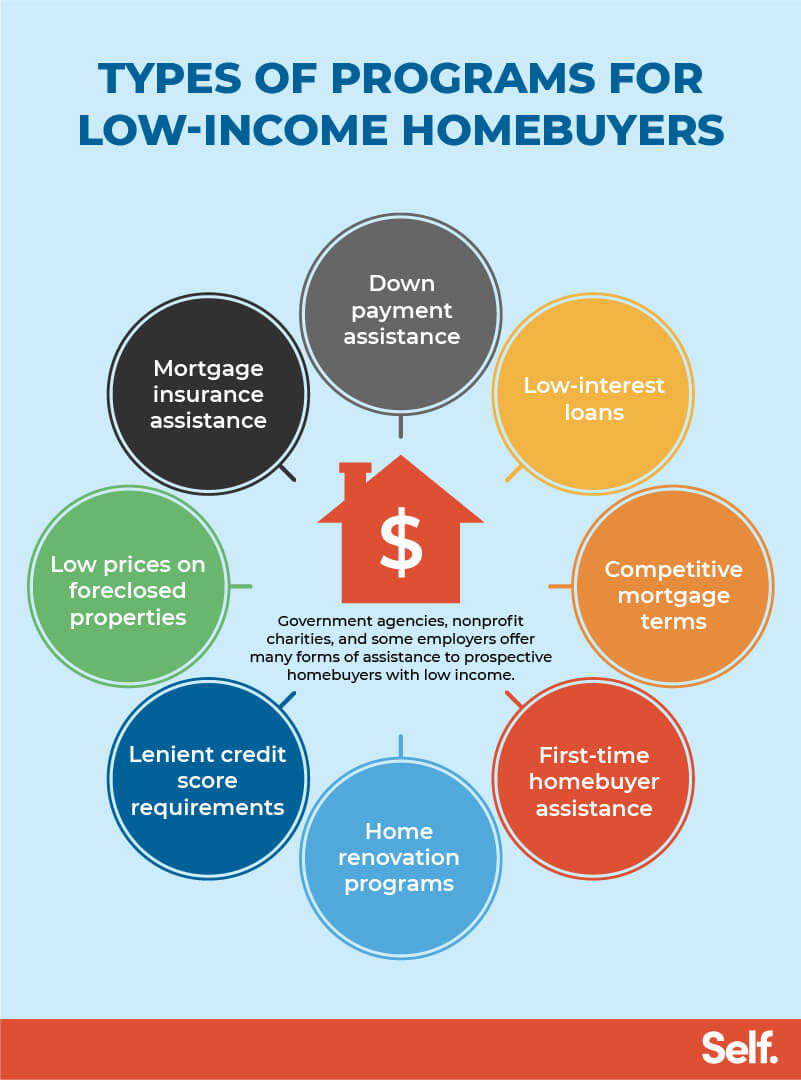

Some government programs help low-income individuals get loans. These loans have special terms. They might have lower interest rates or down payments. Examples include:

- FHA Loans for home buyers

- VA Loans for veterans

- USDA Loans for rural home buyers

These programs aim to make loans more accessible. They help people buy homes or meet other financial needs.

Evaluating Your Loan Eligibility

Wondering about getting a loan on a low income? Your loan eligibility depends on several factors. Let’s explore these to understand your chances better.

Credit Score Considerations

Your credit score is key in loan approval. It shows your history with credit. A high score means better loan terms for you. Check your score before applying. Aim for a score above 670.

Improve your credit score by paying bills on time. Reduce your credit card balances. Avoid new credit inquiries before applying for a loan.

Debt-to-income Ratio Significance

Your debt-to-income ratio (DTI) is crucial. It compares your total debt to your income. Lenders prefer a DTI below 36%. Calculate your DTI by dividing total monthly debt by gross monthly income.

Lower your DTI for better loan chances. Pay off debts if possible. Increase your income with a side job or overtime.

Note: Lenders also consider your employment stability and income regularity. Stable income improves loan eligibility.

Strategic Steps To Improve Loan Approval Odds

Securing a loan with a low income is tough. But, strategic actions can boost approval chances. Let’s explore how to increase those odds.

Boosting Your Credit Score

Your credit score opens doors to loan approvals. A higher score shows lenders you’re reliable. It’s key to work on your score before applying for loans. Follow these steps:

- Check credit reports for errors and correct them.

- Make payments on time.

- Keep credit utilization below 30%.

- Avoid opening new credit lines unnecessarily.

Reducing Existing Debt

Less debt means lenders may view you as less risky. Use these tactics:

- Focus on paying off high-interest debts first.

- Consider a debt consolidation loan if it lowers interest.

- Create a budget plan to manage expenses.

- Put any extra cash, like tax returns, toward debt reduction.

Alternative Financing Options

Finding a loan with low income is tough but not impossible. Explore alternative financing options that cater to lower-income individuals. These options provide the financial boost you need without traditional bank loans’ strict requirements.

Peer-to-peer Lending

Peer-to-peer (P2P) lending connects borrowers directly with investors. It’s an online platform where you can get loans without a bank. You share your loan needs, and people invest in your loan. It’s simpler and often more accessible than traditional loans.

- Flexible terms: Choose what works for you.

- Lower rates possible: Depends on your profile.

- Easy online process: Quick and user-friendly.

Microloans And Nonprofits

Microloans and nonprofit organizations focus on helping low-income individuals. They offer small loans to those who need them. These loans are perfect for starting a small business or covering urgent expenses.

| Option | Description | Best For |

|---|---|---|

| Microloans | Small, short-term loans. | Starting a business. |

| Nonprofits | Loans with low or no interest. | Emergency funds. |

Both options are designed to support your financial growth. They understand the challenges of low income and offer a helping hand.

Credit: marketplacehomes.com

Smart Budgeting For Loan Repayment

Securing a loan with a low income is a challenge. Yet, it’s possible. Smart budgeting plays a pivotal role in managing loan repayments. It involves understanding your income, expenses, and how to allocate funds efficiently. Let’s explore practical steps to create a budget that ensures timely loan repayments without compromising your financial health.

Creating A Sustainable Budget

A sustainable budget helps you track spending and save for loan repayments. Start by listing all income sources. Include your salary, any side hustles, and irregular income. Next, note your fixed expenses. These are your rent, utilities, and loan payments. Then, account for variable expenses like groceries and entertainment.

Use a table to visualize your budget:

| Income Sources | Fixed Expenses | Variable Expenses | Loan Repayment |

|---|---|---|---|

| Salary | Rent | Groceries | Monthly due |

| Side job | Utilities | Entertainment | Extra payment |

Trim unnecessary costs to free up cash for loan payments. A sustainable budget ensures you live within your means while repaying the loan.

Emergency Funds And Loan Payments

Emergency funds are vital. They offer a buffer against unexpected expenses. Start small if necessary. Aim to save a portion of your income monthly. This fund should cover at least three months of living expenses. It ensures you don’t miss loan payments during financial emergencies.

- Set a savings goal for your emergency fund.

- Automate savings to deposit a fixed amount from each paycheck.

- Avoid touching the fund unless it’s a genuine emergency.

Remember, timely loan payments are essential. They help maintain a good credit score and avoid penalties. With a solid budget and emergency fund, you can manage loan repayments, even with a low income.

Navigating Co-signing Options

Navigating Co-Signing Options can be a game-changer for individuals with low income seeking loans. A co-signer with a stronger financial background can bolster your application. Let’s explore the upsides and downsides, as well as the duties that come with having a co-signer.

Pros And Cons Of Having A Co-signer

Finding someone to co-sign your loan might open doors that seemed shut. The right co-signer increases your chances for approval and could snag you a lower interest rate. Yet, it’s not all smooth sailing. Your co-signer’s credit is on the line, and your relationship could be at risk if you fail to pay.

- Pros:

- Better loan terms

- Higher approval odds

- Credit building opportunity

- Cons:

- Risks for the co-signer

- Potential relationship strain

- Shared debt responsibility

Responsibilities Of A Co-signer

A co-signer shares the burden of your debt. They promise to pay if you cannot. This role demands a clear understanding of the responsibilities and a solid trust foundation.

| Responsibility | Details |

|---|---|

| Payment Obligation | Must pay loan if the primary borrower defaults |

| Credit Impact | Borrower’s actions directly affect co-signer’s credit score |

| Legal Accountability | Liable for the debt in the eyes of the law |

Credit: www.self.inc

Preparing For The Loan Application Process

Securing a loan with a low income is challenging. Yet, the right preparation can improve your chances. A well-prepared loan application showcases your financial responsibility. It highlights your ability to manage loan repayments. Let’s guide you through the essential steps for a successful loan application.

Essential Documents Checklist

Gather these documents before applying:

- Proof of Identity: Passport, driver’s license, or ID card.

- Income Verification: Recent pay stubs, tax returns, or employer letters.

- Bank Statements: Accounts showing income and expenses.

- Credit History: Credit report and credit score.

- Proof of Residence: Utility bills or lease agreement.

Expectations During The Loan Interview

Know what lenders look for:

- Be ready to discuss your finances openly.

- Show how you plan to repay the loan.

- Explain any credit issues you may have had.

- Be honest about your income and expenses.

Answer questions confidently. Show that you have a solid repayment plan. Remember, preparation is key to success.

Avoiding Predatory Lenders

Seeking a loan with a low income can be daunting. It’s crucial to avoid predatory lenders who prey on the financially vulnerable. This part of our guide focuses on identifying such lenders and practicing safe borrowing.

Identifying Red Flags

Lenders should act in your best interest. Watch out for signs that suggest otherwise:

- Unclear fee structures: Legitimate lenders are transparent about costs.

- Rushed decisions: Pressure to sign quickly can mean trouble.

- Guaranteed approval: Trustworthy lenders always check your creditworthiness.

- Requests for upfront payment: This is often a clear sign of a scam.

Safe Borrowing Practices

Protect yourself with these smart borrowing strategies:

- Research lenders thoroughly before engaging.

- Read all loan terms carefully.

- Compare rates from multiple sources.

- Check for licensed lenders with positive reviews.

- Seek advice from financial experts if unsure.

Credit: mymortgageinsider.com

Frequently Asked Questions

Can Low Income Affect Loan Approval?

Having a low income can impact loan approval, as lenders typically look for a stable financial background. However, if you have a strong credit history or can provide collateral, your chances may improve.

What Are Loan Options For Low-income Earners?

Low-income earners can explore options like secured loans, credit unions, government-assisted programs, and peer-to-peer lending. Each option has different requirements and may be more accommodating to lower incomes.

How To Qualify For A Low-income Loan?

To qualify for a low-income loan, maintain a good credit score, minimize existing debts, and consider a co-signer. Lenders may also require proof of consistent income, even if it’s low.

Does Credit Score Matter For Low-income Loans?

Yes, credit score matters for low-income loans. A higher credit score can compensate for low income, signaling to lenders that you’re a responsible borrower, potentially leading to better loan terms.

Conclusion

Securing a loan on a low income is possible with the right approach. Exploring various lenders and considering government programs can open doors. Remember, a strong financial plan and credit score improvement are key. Start your journey towards financial assistance today, because opportunities await those who seek them out.