Small business loan requirements typically include a solid credit history and a strong business plan. Lenders may also request financial statements and collateral.

Navigating the maze of small business financing can be daunting for entrepreneurs seeking to bring their visions to life. Securing a loan often hinges on the business owner’s ability to present a compelling case for the investment, showcasing not only their creditworthiness but also the potential for business growth.

A lender’s confidence is bolstered by detailed financial records, such as profit and loss statements, balance sheets, and cash flow projections, which provide a snapshot of the company’s financial health. A comprehensive business plan is indispensable, mapping out the strategic direction and operational framework of the enterprise. Equally important is the readiness to offer collateral, which serves as a security net for lenders. With these elements in place, business owners stand a better chance of obtaining the necessary capital to fuel their ambitions and drive their businesses forward.

Introduction To Small Business Loans

Starting a small business is an adventure. Funding is a vital part. A small business loan can be the bridge between your business dream and reality. It helps cover costs when cash flow is tight. It can also fund expansion plans. Let’s explore the essentials of small business loans.

The Importance Of Financing For Growth

Capital is the engine of business growth. Without it, scaling up is tough. Loans offer a lifeline for businesses aiming to grow. They finance new equipment, inventory, and hiring. A loan can turn a small operation into a thriving enterprise.

Common Types Of Small Business Loans

- Term Loans: Lump sum borrowed, paid back over time.

- Lines of Credit: Access to funds up to a limit, use as needed.

- SBA Loans: Backed by the Small Business Administration, lower risk.

- Equipment Financing: For buying new machinery or vehicles.

- Merchant Cash Advances: Quick cash, repay with future sales.

Different loans suit different needs. Choose based on your business goals and financial health.

Credit Score Essentials

Let’s dive into Credit Score Essentials for a small business loan. A good credit score opens doors to loan approval. It’s like a report card for your finance.

Understanding Credit Score Impact

Your credit score is key for loan approval. Banks look at it first. A high score means less risk for them. It leads to better loan terms for you.

- 700+: Excellent – Easy loan approval.

- 650-699: Good – Fair terms.

- 600-649: Fair – Higher interest rates.

- Below 600: Poor – Loan approval is tough.

Improving Your Credit For Loan Approval

To boost your credit score, start with these steps:

- Check your credit report for errors. Fix them fast.

- Pay bills on time. Late payments hurt your score.

- Lower your debt. Use less of your credit limit.

- Keep old credit accounts open. They help your history.

Improving your credit takes time. Start early before applying for a loan.

Revenue And Profitability Analysis

Understanding revenue and profitability is key for small business loans. Lenders need to know your business can repay the loan. This section will break down what you need to show lenders.

Documenting Financial Health

Good financial records prove your business’s health. You’ll need documents like:

- Balance sheets – Show assets, liabilities, and equity.

- Profit and Loss statements (P&L) – Reveal income and expenses over time.

- Cash flow statements – Reflect how well you manage money.

- Bank statements – Offer a real-time look at your finances.

Prepare these documents for at least two years. They should be detailed and accurate.

How Lenders Evaluate Business Performance

Lenders look at numbers to gauge performance. They focus on:

- Revenue trends – Is income growing?

- Profit margins – What’s the earning after costs?

- Debt ratios – Can you manage more debt?

- Credit score – Is your history with credit strong?

They compare these to industry standards. This tells them if your business stands out.

Be ready to discuss these numbers. Explain any ups and downs. Show plans to keep your business strong.

Credit: www.links-financial.com

Business Plan And Loan Proposal

Before securing a small business loan, two critical documents matter. These documents show lenders your business’s potential and how you plan to repay the loan. A solid business plan and a compelling loan proposal are your keys to approval.

Crafting A Persuasive Business Plan

A business plan is your roadmap to success. It outlines your business goals, strategies, and how you’ll achieve them. Lenders want to see a clear, concise plan that demonstrates your business acumen.

Your business plan must:

- Define your business concept and value proposition.

- Detail market research and analysis.

- Explain your product or service offerings.

- Describe your management team’s experience.

- Project financials, including income, cash flow, and balance sheets.

Components Of A Strong Loan Proposal

A loan proposal complements your business plan. It should convince lenders that you’re a low-risk investment. A compelling proposal addresses how the loan will help your business grow and how you’ll repay it.

Include these components in your loan proposal:

- Executive Summary: Capture the lender’s interest with a snapshot of your business and loan request.

- Business Description: Offer insight into your company, its history, and its mission.

- Loan Amount: Clearly state how much funding you need and how you’ll use it.

- Repayment Plan: Outline your strategy for paying back the loan, including timelines and budgets.

- Collateral: Detail any assets you can offer as security for the loan.

- Financial Statements: Include recent financial statements to support your repayment plan.

Collateral Requirements

Understanding collateral requirements is key when applying for a small business loan. Lenders often ask for collateral. This means you promise something of value. It helps secure the loan. Let’s dive into what types of collateral are accepted and the risks and benefits of secured loans.

Types Of Collateral Accepted

Lenders accept various types of collateral for small business loans. These include:

- Real estate: Buildings or land owned by the business.

- Equipment: Machines or technology used in your business.

- Inventory: Products your business plans to sell.

- Accounts receivable: Money owed to your business by customers.

Each type of collateral has its own value. Lenders will assess this before approving the loan.

Risks And Benefits Of Secured Loans

Secured loans involve both risks and benefits. It’s important to know these before applying.

| Benefits | Risks |

|---|---|

| Lower interest rates | Possible loss of collateral |

| Higher loan amounts | Debt if business fails |

| Longer repayment terms | Legal actions if not repaid |

Benefits include lower interest rates and higher loan amounts. This makes secured loans attractive. Risks involve the possible loss of collateral. This happens if the loan is not repaid. Understanding these risks and benefits helps make informed decisions.

Debt-to-income Ratio

Understanding the Debt-to-Income Ratio (DTI) is key when applying for a small business loan. This measure assesses a company’s ability to manage monthly payments and repay debts.

Calculating Your Business’s Dti

Calculating DTI is simple: sum up your monthly debt payments and divide them by your monthly gross income. The result is a percentage that represents your DTI.

Let’s break down the calculation:

- List all monthly debts – loans, credit lines, mortgage payments.

- Add these payments together to find the total monthly debt.

- Determine monthly gross income – your business’s income before taxes.

- Divide total debt by gross income to get the DTI percentage.

Why Dti Matters To Lenders

Lenders use DTI to gauge risk. A low DTI suggests a strong balance between debt and income. It indicates that your business can comfortably handle additional loan payments.

Here’s why lenders care about DTI:

- Financial Health: A low DTI points to good financial health.

- Risk Assessment: DTI helps lenders assess the risk of default.

- Loan Decisions: DTI influences the approval or denial of a loan.

Keep your DTI low to improve your chances of securing a business loan. Aim for a DTI below 35% as most lenders prefer this threshold.

Industry Experience And Track Record

Getting a small business loan requires more than paperwork. Lenders look at your industry experience and track record. This shows how well you understand your business sector. It also shows your ability to manage a successful business. Let’s explore how you can showcase your industry expertise and the impact of your experience on loan approval.

Demonstrating Industry Expertise

Business owners must prove their knowledge in their field. This involves showing your qualifications, certifications, and relevant training. Highlight any industry awards or recognitions you’ve received. Create a list of:

- Certifications that relate to your business

- Awards or honors in your industry

- Training programs completed that enhance your expertise

Use these elements to build a strong case. This will show lenders you have the skills to succeed.

The Role Of Experience In Loan Approval

Lenders trust business owners with a solid track record. They want evidence of your experience. This can include:

- Years in business, showing longevity and stability

- Previous successful projects or ventures

- Financial statements from past years to demonstrate growth

Present these details in a clear format. Use tables to compare yearly growth. This will make it easy for lenders to assess your business’s health.

| Year | Revenue | Profit |

|---|---|---|

| 2020 | $500,000 | $50,000 |

| 2021 | $600,000 | $70,000 |

| 2022 | $700,000 | $90,000 |

Remember, a good track record can outweigh less-than-perfect credit. Show lenders a pattern of growth and smart management. This can help you secure the loan you need for your small business.

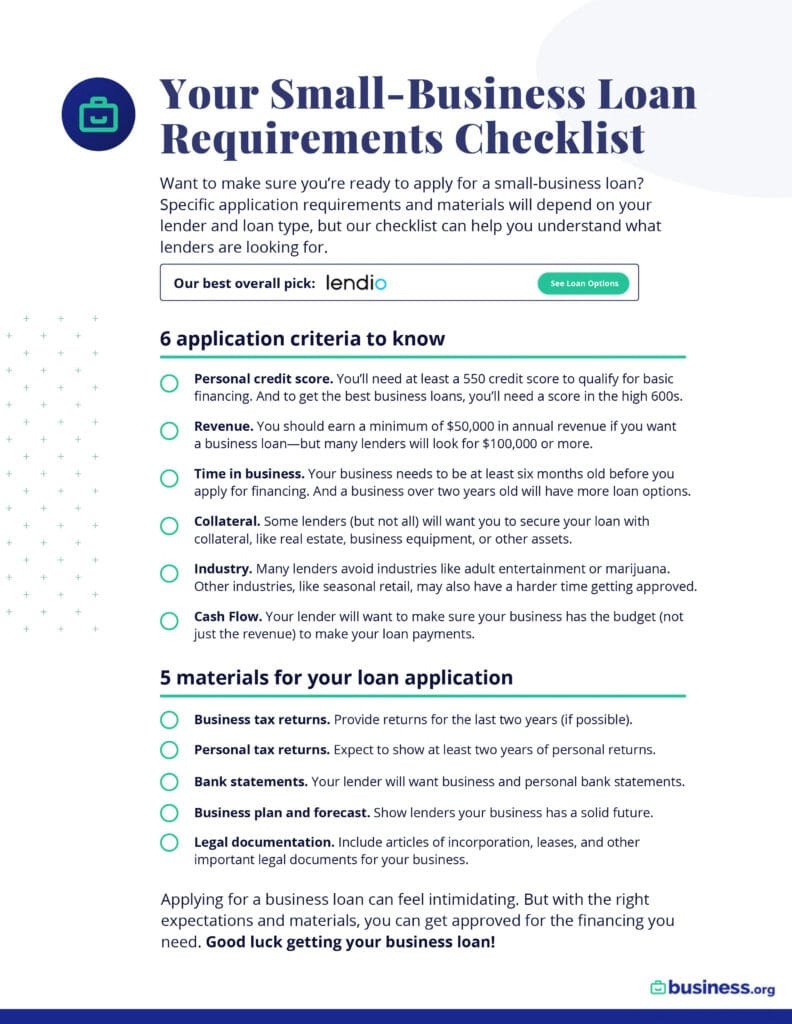

Preparing For The Application Process

Securing a small business loan requires careful preparation. Business owners must gather pertinent documents. They should understand lender expectations. A solid application increases chances for approval. Let’s explore the necessary steps for a strong loan application.

Documentation Checklist

- Business Plan: Outlines company goals and strategies.

- Financial Statements: Show business health and profitability.

- Bank Statements: Provide insight into cash flow.

- Credit Report: Reflects creditworthiness.

- Tax Returns: Verify income and tax compliance.

- Legal Documents: Include licenses, registrations, and contracts.

- Collateral: Details on assets for loan security.

Expectations During The Loan Review

Lenders assess loan applications carefully. They check credit scores and repayment history. Lenders evaluate financial statements and cash flow. They consider collateral value. Understanding these factors helps borrowers present strong cases.

| Credit Score | Financial Health | Collateral |

|---|---|---|

| High scores favor loan approval. | Profitability and stability matter. | Assets can secure the loan. |

Lenders may ask for additional information. They might request business forecasts. They may inquire about debt management. Quick responses to such queries help maintain momentum.

Navigating Loan Terms And Agreements

Small business owners often face the challenge of securing funds. Understanding loan terms and agreements is crucial. This can be the difference between a costly mistake and a smart financial decision.

Understanding Interest Rates And Fees

Interest rates and fees determine the cost of a loan. They can vary widely between lenders. It’s important to understand not just the annual percentage rate (APR), but also any additional costs. This may include origination fees, processing fees, or early repayment penalties. Let’s break down the typical costs:

- APR: The yearly cost of your loan, including interest and fees.

- Origination Fee: A charge by the lender for processing a new loan.

- Prepayment Penalty: A fee for paying off your loan early.

Comparing these can help you find the most affordable loan. Use online calculators to estimate your total costs.

Negotiating Favorable Loan Terms

Negotiation is key to favorable loan terms. Start by reviewing every detail in the loan agreement. Look for areas that could be more favorable. These could include the repayment schedule, collateral requirements, or covenants. Having a clear business plan can strengthen your position. It shows lenders your ability to repay. Don’t hesitate to ask questions. Clarify any confusing terms before signing. If possible, consult with a financial advisor. They can offer insights and help negotiate better terms. Ultimately, your goal is a loan that supports your business growth without overburdening it.

Credit: www.heritagefederal.org

Avoiding Common Pitfalls

Getting a small business loan seems tough. But, knowing what to avoid makes it easier. Let’s dive into how to dodge common pitfalls in the loan process.

Common Reasons For Loan Rejection

- Poor credit score: Shows you might not pay back.

- Weak cash flow: Suggests your business can’t cover loan payments.

- Lack of collateral: Banks often need assets as a safety net.

- Short business history: New businesses are riskier to lend to.

- High debt levels: Too much existing debt is a red flag.

Strategies To Increase Approval Odds

- Improve your credit score: Pay bills on time, reduce debt.

- Boost cash flow: Increase sales or cut expenses to show profit.

- Offer collateral: Secure the loan with business or personal assets.

- Prepare a solid business plan: Show lenders how you’ll succeed.

- Seek advice: Consult with financial experts to strengthen your application.

Alternative Financing Options

When you’re starting or growing a small business, securing a loan can be daunting. But there’s good news: beyond traditional bank loans, a variety of alternative financing options are available. These options can offer more flexibility and accessibility for your business needs. Let’s explore some of these creative solutions.

Exploring Non-traditional Lenders

Non-traditional lenders often provide more flexible terms for small businesses. Unlike banks, these lenders might focus on your company’s potential rather than just its credit history. Here’s what they offer:

- Fast application processes

- Less stringent credit requirements

- Flexible repayment options

Online platforms and financial technology companies fall into this category. They evaluate your business differently and can be a lifeline when banks say no.

Crowdfunding And Other Innovative Solutions

For businesses with a strong customer base or an innovative idea, crowdfunding could be a perfect fit. This method pools small investments from a large number of people, usually via the internet. Here’s what makes it stand out:

- Direct customer engagement

- Validation of business concepts

- Access to a wide network of supporters

Platforms like Kickstarter and Indiegogo are popular choices for crowdfunding. They allow businesses to raise funds while building a community around their product or service.

Credit: www.business.org

Frequently Asked Questions

What Determines Small Business Loan Eligibility?

Eligibility for a small business loan typically hinges on factors like credit score, annual revenue, and business age. Lenders scrutinize these to assess repayment capacity.

How To Apply For A Small Business Loan?

Applying for a small business loan involves preparing financial statements, business plans, and tax records. Submit these with your application to potential lenders.

What Is The Minimum Credit Score For A Loan?

The minimum credit score required for a loan varies; however, scores above 680 are favorable. Some lenders accommodate lower scores with higher interest rates or collateral.

Are Collaterals Needed For Business Loans?

Not all business loans require collateral, especially for smaller amounts. But securing a loan with assets can lead to better terms and higher loan amounts.

Conclusion

Securing a small business loan is crucial for growth and sustainability. Understanding the requirements is your first step to success. From credit scores to business plans, preparation is key. Remember, every lender has unique criteria, so research thoroughly. With the right approach, obtaining the financing your business needs is entirely achievable.

Start planning today for a brighter tomorrow.