To secure a loan with low interest, offer collateral and maintain a strong credit score. Compare lenders to find the best rates.

Securing a low-interest loan often requires a combination of good credit history and valuable collateral. Lenders see these as signs of reliability, which can lead to more favorable terms. A secured loan, by definition, means you’re backing the loan with assets, reducing the risk for the lender and, consequently, the interest rate for you.

It’s important to shop around and negotiate with various financial institutions. Each lender has unique criteria and interest rates, so doing your homework can save you a significant amount of money. Ensure your financial stability is evident; stable income and a low debt-to-income ratio can also sway lenders to offer you better rates. Remember, the goal is to appear as a low-risk borrower to secure that low-interest loan.

Credit: clarifycapital.com

Secured Loans: The Basics

Understanding secured loans is key to unlocking lower interest rates. These loans require collateral. This collateral reduces risk for lenders. Lower risk often means lower interest rates for borrowers.

What Is A Secured Loan?

A secured loan involves an asset as a guarantee. Borrowers provide assets like homes or cars. These assets secure the borrowed funds. Failure to repay may lead to asset loss.

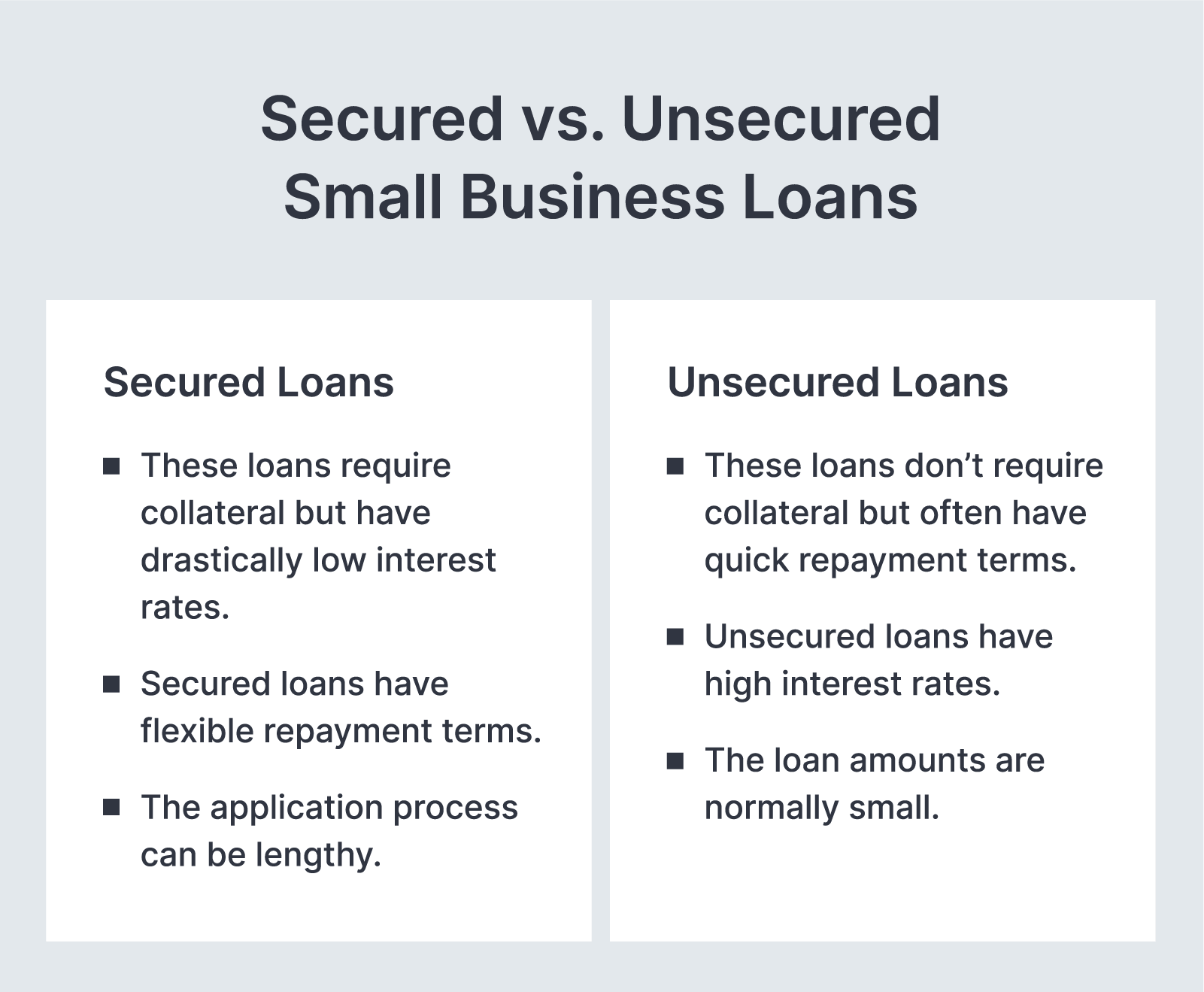

Comparing Secured And Unsecured Loans

Secured and unsecured loans differ mainly in risk and interest rates. Below is a comparison:

| Loan Type | Risk to Lender | Interest Rate |

|---|---|---|

| Secured Loan | Lower | Typically lower |

| Unsecured Loan | Higher | Typically higher |

- Secured loans are backed by collateral.

- Unsecured loans are not.

- Collateral reduces risk for the lender.

- Secured loans tend to offer lower interest rates.

Benefits Of Low-interest Secured Loans

Securing a loan with a low interest rate is smart. It means you pay less over time. This guide highlights the benefits of low-interest secured loans.

Save Money Over Time

Low-interest rates make a big difference. You save money. Here’s how:

- Lower monthly payments – More money in your pocket each month.

- Reduced total cost – Pay less over the loan’s life.

Imagine you borrow $10,000. A low rate can save you thousands.

Potential For Larger Loan Amounts

Banks often offer bigger loans at lower rates. Why? It’s less risky for them. Here’s what you gain:

- More money for big projects or purchases.

- Flexibility to use the loan as you see fit.

This means you can tackle big dreams. Maybe a new kitchen or a car.

Eligibility Criteria For Secured Loans

Understanding eligibility for secured loans is key. Secured loans offer lower interest rates. They need collateral and a good credit score.

Credit Score Requirements

Lenders look at your credit score first. This number tells them about your loan history. A higher score means better loan terms. Aim for a credit score above 660. Some lenders require higher scores. Check your credit report before applying. Fix any errors fast. This could improve your score.

Necessary Collateral

Collateral makes these loans “secured.” It can be a car, house, or savings. The item must have value. This value lowers the risk for lenders. If you cannot pay, they take the collateral. Choose collateral wisely. It should cover the loan amount. Know the risks involved.

| Type of Collateral | Examples | Notes |

|---|---|---|

| Real Estate | House, Land | High value, longer loan terms |

| Vehicles | Car, Boat | Must be fully paid off |

| Personal Assets | Jewelry, Art | Requires appraisal |

| Savings/Investments | Bank accounts, Stocks | Liquid assets work best |

Choosing The Right Collateral

Securing a loan with low interest starts with the right collateral. Choosing valuable and acceptable assets can lower your interest rates. This selection is crucial in the lending process.

Types Of Acceptable Collateral

- Real estate: Homes, land, and other property types.

- Vehicles: Cars, boats, and motorcycles.

- Savings accounts: Your saved funds act as collateral.

- Investments: Stocks, bonds, or mutual funds.

- Valuables: Jewelry, art, or collectibles.

Select assets that lenders prefer. High-value items secure better rates. Choose wisely to benefit your financial health.

Assessing Collateral Value

Lenders evaluate your assets to determine the loan amount. They consider market value, condition, and liquidity.

| Asset Type | Factors Affecting Value |

|---|---|

| Real Estate | Location, market trends, property condition |

| Vehicles | Make, model, year, mileage, condition |

| Investments | Market performance, dividends, risk profile |

| Valuables | Authenticity, rarity, demand, condition |

Get appraisals for accurate values. Use this information to negotiate loan terms. Secure your financial future with smart collateral choices.

Shopping For The Best Loan Terms

Finding the best loan terms is key to saving money. Let’s dive into how you can snag a secured loan with low interest. This guide will help you shop smartly.

Comparing Lenders

Start by gathering options. Use online tools to list out lenders. Focus on those known for low-interest rates. Don’t settle for the first offer. Always look around.

- Check out banks, credit unions, and online lenders.

- Use comparison websites for a quick overview.

- Read reviews to gauge customer satisfaction.

Make a table to compare. Note down interest rates, fees, and loan amounts.

| Lender | Interest Rate | Fees | Loan Amount |

|---|---|---|---|

| Lender A | 5% | $100 | Up to $10,000 |

| Lender B | 4.5% | $150 | Up to $15,000 |

Understanding Loan Terms And Conditions

Reading the fine print is crucial. Look for terms that suit your needs.

- Interest Rate: Lower is better. Aim for the lowest you can find.

- Repayment Period: Longer periods mean smaller payments, but more interest.

- Fees: Watch out for hidden fees. Ask questions if unsure.

Ask the lender to explain anything confusing. They should help you understand.

Remember, a good loan is more than just low interest. It’s about finding a loan you can live with, comfortably.

Credit: www.advantiscu.org

Improving Your Credit Score For Better Rates

Seeking a secured loan with a low interest rate?

Improving your credit score is key.

Better credit scores unlock lower rates.

Credit Building Strategies

Start with these steps to boost your score:

- Pay bills on time – Avoid late payments.

- Keep credit balances low – High balances hurt scores.

- Limit new credit applications – Too many harm your score.

- Maintain old accounts – Longer credit history helps.

Monitoring Your Credit Report

Regularly check your credit report for accuracy.

- Request free reports from major bureaus.

- Look for errors or unfamiliar accounts.

- Dispute any inaccuracies promptly.

Staying vigilant protects your score.

Negotiating With Lenders

Negotiating with lenders can be a powerful step in securing a loan with a low interest rate. Understanding how to effectively communicate with financial institutions gives you an edge. You can save money over the life of your loan. Let’s explore key tactics to employ during loan negotiations.

The Art Of Loan Negotiation

Successful loan negotiation starts with preparation. Know your credit score and financial standing. Present yourself as a low-risk borrower. This increases your chances of getting a favorable rate. Build a case as to why you deserve a lower rate. Highlight a stable income, low debt-to-income ratio, or solid credit history.

Strategies For Lower Interest Rates

Employ strategic approaches to reduce your interest rates. Here are some effective strategies:

- Compare offers: Gather loan terms from multiple lenders. Use these as leverage.

- Highlight competitor offers: Show lenders better rates you’ve been offered. Ask them to match or beat them.

- Rate discounts: Inquire about discounts for auto-payments or existing customer relationships.

- Shorter loan terms: Opt for shorter repayment periods. These often come with lower rates.

- Secured loans: Offer collateral. This can significantly lower the interest rate.

Effective communication is key. Be polite yet firm. Explain clearly what you want. Show them why it’s reasonable. Remember, you are in control. You can walk away if the terms don’t meet your needs.

| Strategy | Benefit |

|---|---|

| Loan comparison | Gain leverage |

| Competitor rates | Push for price matching |

| Auto-pay discounts | Receive rate reductions |

| Short repayment period | Access lower rates |

| Collateral offer | Secure reduced rates |

Follow these strategies to navigate loan negotiations successfully. With preparation and knowledge, you can secure a loan that fits your financial goals.

Finalizing Your Loan

Finalizing Your Loan is a crucial step in securing a low-interest financial future. This phase involves diligence and understanding. It ensures the terms meet your needs.

Application Process

The application process begins once you select a lender. Gather all required documents. These include identification, financial records, and collateral details.

- Complete the application form with accuracy.

- Submit the form along with necessary documents.

- Wait for the approval notification.

Lenders review your application. They check your creditworthiness and the value of collateral. A prompt response to any queries speeds up the process.

Understanding The Fine Print

Reading the fine print is vital. It contains loan terms, interest rates, and repayment schedules.

- Look for hidden fees or penalties.

- Understand the interest rate structure.

- Clarify repayment terms.

Ask questions if anything is unclear. Ensure you agree with all terms before signing. This prevents surprises during the repayment period.

Loan terms should align with your financial plan. A clear understanding now saves stress later.

Managing Your Loan Responsibly

Managing Your Loan Responsibly is crucial for financial health. When you secure a loan with low interest, responsibility ensures you maintain that rate. Proper management also means avoiding penalties and building a solid credit score.

Making Timely Payments

Always pay on time. This is the golden rule of loan management. Late payments result in fees and can increase interest rates. Set reminders or automate payments to ensure punctuality.

Planning For Early Repayment

Paying off a loan early can save you money on interest. Check for prepayment penalties. If none, consider extra payments. Even small additional amounts can cut down loan terms and interest costs.

Dealing With Financial Hurdles

Dealing with financial hurdles can feel like a giant mountain. But, getting a secured loan with low interest helps. It’s like finding a path through the mountain. This guide helps you navigate two important paths: Refinancing Options and Handling Loan Default.

Refinancing Options

Think of refinancing like redoing a puzzle. You already have pieces (your loan). Refinancing just fits them together better. This can lead to lower interest rates and smaller monthly payments.

- Shop around: Look at different banks and lenders.

- Check rates: Find the best interest rates.

- Calculate savings: Use online calculators to see your savings.

Remember, refinancing might have fees. Always check these first.

Handling Loan Default

Loan default is like falling in a hole. But, you can climb out. Here’s how:

- Talk to your lender: They might help you find a solution.

- Adjust your loan terms: Maybe you need smaller payments.

- Consider a settlement: Pay less than what you owe.

Act fast if you’re near default. The sooner you act, the better.

Credit: fastercapital.com

Frequently Asked Questions

What Is A Secured Loan?

A secured loan is a type of loan backed by collateral. This means the borrower pledges an asset, like a car or house, which the lender can seize if the loan is not repaid. Secured loans often have lower interest rates due to the reduced risk for the lender.

How Can I Qualify For Low-interest Rates?

To qualify for low-interest rates, maintain a high credit score, choose a loan with collateral, and compare offers from multiple lenders. Also, consider a shorter loan term and ensure a stable income, as these factors can influence the interest rate offered.

What Affects Secured Loan Interest Rates?

Secured loan interest rates are influenced by the borrower’s credit score, the value of the collateral, loan amount, term length, and market interest rates. A higher credit score and valuable collateral can help secure a lower interest rate.

Can I Use My Home As Collateral For A Loan?

Yes, you can use your home as collateral for a loan, commonly known as a home equity loan or mortgage. This can often result in a lower interest rate since the loan is secured by the value of your property.

Conclusion

Securing a low-interest loan doesn’t have to be daunting. With the right preparation and knowledge, you can navigate the process smoothly. Remember to research lenders, maintain a strong credit score, and compare offers. By following these steps, you’re more likely to secure a loan that fits your financial needs.

Start your journey towards financial stability today!