Are you curious about how Islamic banking can offer you financial solutions aligned with your values? Islamic banking products and services are designed to provide you with ethical and Sharia-compliant ways to manage your money, invest, and finance your goals.

Whether you’re looking for a unique savings account, a home financing option without interest, or business funding that shares risks and rewards fairly, Islamic banking has tailored options just for you. You’ll discover the key products and services that make Islamic banking stand out and how they can work for your personal and business financial needs.

Keep reading to unlock the benefits and principles behind these innovative financial solutions.

Islamic Deposit Accounts

Islamic deposit accounts offer a unique way to save and invest money following Islamic law. These accounts avoid interest, which is not allowed in Islam. Instead, they use profit-sharing and other Shariah-compliant methods. Customers benefit from ethical and transparent banking services.

These deposit accounts come in various forms to meet different needs. They allow clients to manage funds securely while following Islamic principles. Understanding each type helps in choosing the right account for personal or business use.

Current Accounts

Islamic current accounts work like regular checking accounts. They provide easy access to funds for daily transactions. No interest is paid on balances, keeping the account Shariah-compliant. Banks may charge a fixed fee for services instead of earning from interest.

These accounts allow deposits and withdrawals without restrictions. Customers can use checks, debit cards, and online banking. They suit individuals and businesses needing liquidity and convenience.

Investment Accounts

Investment accounts in Islamic banking use profit-sharing models like Mudarabah. The bank invests the deposited funds in approved projects. Profits are shared between the bank and the account holder according to a pre-agreed ratio.

These accounts do not guarantee fixed returns. Instead, profits depend on the success of investments. They offer an opportunity for customers to grow their savings ethically. Investment accounts usually have longer terms than current accounts.

Credit: www.researchgate.net

Trade Finance Solutions

Trade finance solutions in Islamic banking support businesses in their import and export activities. These solutions follow Islamic principles, avoiding interest and promoting fairness. They help companies manage risks and improve cash flow during international trade.

Import Letter Of Credit

The Import Letter of Credit ensures safe payment for goods from overseas. It acts as a guarantee from the bank to the seller. The bank promises to pay once the seller meets agreed terms. This method protects both buyer and seller in the trade. It complies with Shariah rules by avoiding interest and uncertainty.

Export Financing

Export financing helps businesses get funds before or after shipping goods abroad. It provides working capital without charging interest. Banks share profit and loss with the exporter, following Islamic finance rules. This support allows exporters to grow without financial strain. It encourages fair trade and smooth international business operations.

Fixed Assets Financing

Fixed assets financing in Islamic banking helps businesses acquire essential long-term assets. These assets include buildings, machinery, and equipment needed for operations and growth. Islamic banks provide Shariah-compliant financing solutions that avoid interest and promote profit-sharing or leasing.

This type of financing supports companies aiming to expand, upgrade machinery, or start new projects. It respects Islamic principles, ensuring all transactions are ethical and transparent. Businesses benefit from flexible repayment terms and fair risk distribution.

Business Expansion Loans

Islamic banks offer business expansion loans to fund growth plans. These loans use profit and loss sharing methods like Musharakah or Mudarabah. The bank and business share profits based on an agreed ratio. Losses are also shared fairly, reducing risk for both parties.

This financing helps companies open new branches, increase production, or enter new markets. It provides capital without charging interest, aligning with Islamic finance rules.

Machinery And Equipment Funding

Machinery and equipment funding allows businesses to buy or lease vital tools. Islamic banks often use Ijarah contracts for leasing assets. The bank buys the equipment and leases it to the client for a fixed fee.

Clients can also purchase equipment through Murabaha, where the bank buys and resells the asset at a markup. Payments are made in installments, keeping costs clear and manageable.

Project Financing

Project financing supports large-scale ventures like construction or manufacturing. Islamic banks provide funds using asset-backed contracts such as Istisna’a. This contract covers manufacturing or building projects with agreed costs and delivery times.

Financing is based on shared risks and profits, ensuring fairness. It helps businesses complete projects without relying on interest-based loans.

Working Capital Financing

Working capital financing is vital for businesses to manage daily operations smoothly. It helps cover short-term expenses like salaries, rent, and inventory. Islamic banks offer working capital solutions aligned with Shariah principles. These products avoid interest and focus on profit-sharing or asset-backed financing.

Profit And Loss Sharing (pls) Models

Islamic banks use PLS models such as Mudarabah and Musharakah for working capital. Mudarabah involves the bank providing capital while the client manages the business. Profits are shared based on a pre-agreed ratio. Losses are borne by the capital provider.

Musharakah means a joint partnership. Both the bank and client contribute capital. They share profits and losses according to their investment ratio. This model encourages cooperation and risk sharing.

Murabaha is a common Islamic working capital product. The bank buys goods or raw materials needed by the business. Then it sells them to the client at a known markup. The client repays in installments. This method avoids interest and is transparent.

Ijarah is another asset-backed option. The bank leases equipment or assets to the business. The client pays fixed rent for a set period. At lease end, ownership may transfer to the client under Ijarah Muntahia Bittamleek.

Benefits Of Islamic Working Capital Financing

These financing options align with ethical business values. They promote fairness and shared risk. The absence of interest reduces financial pressure on businesses. Flexible repayment terms help maintain steady cash flow. Islamic working capital financing supports sustainable business growth.

Takaful Services

Takaful services offer an Islamic alternative to conventional insurance. They operate on the principles of mutual help and shared responsibility. Members contribute to a pool of funds. This pool supports participants during hardship or loss. Takaful avoids uncertainty and interest, which are not allowed in Islam.

The services mainly divide into two categories. Family Takaful focuses on life and health protection. General Takaful covers property and casualty risks. Both types emphasize fairness and cooperation among members.

Family Takaful

Family Takaful provides financial protection for individuals and families. It covers risks like death, disability, and critical illness. Participants pay contributions to a shared fund. If a claim arises, payments come from this fund. The system ensures that losses are shared among all members. This model supports long-term savings and investment. It helps families secure their future without violating Islamic rules.

General Takaful

General Takaful covers a wide range of risks related to property and business. It protects against damage, theft, and liability claims. Participants pool their money to cover such losses. The fund compensates any member who suffers a loss. This service supports individuals and businesses in managing risks. It follows Islamic principles by avoiding gambling and interest. General Takaful promotes transparency and trust among participants.

Profit And Loss Sharing Models

Islamic banking relies on profit and loss sharing models to align the interests of banks and clients. These models promote fairness and risk-sharing, avoiding interest-based transactions. They encourage partnership and cooperation, making banking more ethical and transparent.

Profit and loss sharing models form the core of many Islamic banking products. They allow both parties to share the outcomes of a business venture, whether profit or loss. This approach supports economic growth and financial inclusion.

Mudarabah Partnerships

Mudarabah is a partnership where the bank provides capital. The client contributes expertise and manages the business. Profits are divided according to a pre-agreed ratio.

Losses, however, fall entirely on the capital provider, the bank. The client loses effort but not money. This model motivates the client to perform well.

Mudarabah suits investment accounts and project financing. It helps clients start or expand businesses without bearing financial loss.

Musharakah Joint Ventures

Musharakah is a joint venture where both parties invest capital. The bank and client share profits and losses in proportion to their investment.

Both partners have a say in business decisions. This cooperation builds trust and shared responsibility.

Musharakah works well for large projects and asset financing. It provides flexibility and risk distribution between bank and client.

Asset-backed Financing

Asset-backed financing stands at the core of Islamic banking. It ensures all financial transactions are linked to tangible assets. This approach avoids interest (riba) and promotes fairness. Banks buy assets and then sell or lease them to clients. The client benefits from clear terms and asset ownership or use. This financing method supports various needs, such as buying homes, vehicles, or equipment. It also suits businesses requiring machinery or project funding.

Murabaha Cost-plus Sales

Murabaha is a popular Islamic financing method. The bank buys an asset requested by the client. Then, the bank sells it to the client at a higher price. This markup is agreed upon upfront. The client pays in fixed installments over time. No interest charges apply, just the agreed profit margin. This method is simple and transparent. It suits clients who need clear payment plans for asset purchases.

Ijarah Leasing Contracts

Ijarah is a leasing agreement between the bank and client. The bank buys an asset and leases it to the client. The client pays rent for using the asset during the lease period. The bank keeps ownership of the asset throughout the lease. This method helps clients avoid large upfront costs. It is useful for equipment, vehicles, or property leasing. The rental payments are fixed and known in advance.

Ijarah Muntahia Bittamleek Ownership

This type of Ijarah includes a lease-to-own option. The client leases the asset with the right to own it later. Ownership transfers to the client at the end of the lease term. Payments cover both rent and gradual asset ownership costs. This contract supports clients who want to eventually own the asset. It combines the benefits of leasing and buying. This method provides financial flexibility and asset security.

Specialized Financing Contracts

Specialized financing contracts form a key part of Islamic banking. They offer flexible solutions while adhering to Shariah principles. These contracts help finance manufacturing, trading, and commodity purchases without charging interest.

Islamic banks use these contracts to support business needs with ethical financing. They focus on asset-backed transactions and avoid uncertainty or speculation. This approach builds trust and transparency between banks and clients.

Istisna’a Manufacturing Contracts

Istisna’a is a contract for manufacturing or construction. The bank agrees to produce or build an asset for the client. Payment can be made in stages or after completion. This contract suits large projects like buildings or machinery. It helps clients fund production without upfront cash.

Salam Forward Purchases

Salam contracts involve buying goods in advance. The buyer pays the full price upfront. The seller delivers the goods later at an agreed date. This contract supports farmers and traders needing cash early. It reduces risks for both parties by fixing price and delivery time.

Tawarruq Commodity Transactions

Tawarruq enables liquidity without interest. The client buys a commodity from the bank on credit. Then, the client sells it immediately for cash. This process provides cash while respecting Islamic rules. It helps individuals and businesses meet short-term funding needs.

Benefits Of Islamic Banking Products

Islamic banking products offer unique benefits that appeal to many customers. These products follow specific principles that set them apart from conventional banking. Customers gain from ethical, transparent, and fair financial services. The focus on shared risks and rewards creates a balanced approach to finance.

Ethical Investment Principles

Islamic banking avoids investments in harmful industries. It rejects businesses dealing with alcohol, gambling, and tobacco. This ensures money supports positive social and economic growth. Ethical investing builds trust between banks and customers.

Risk Sharing Advantages

Islamic banks share profits and losses with customers. This reduces the burden of financial risks on one party. It encourages responsible borrowing and investing. Both banks and clients work as partners in projects and ventures.

Shariah Compliance

Islamic banking products follow Shariah laws strictly. This compliance guarantees that all transactions are free from interest (riba). It also prohibits uncertainty (gharar) and gambling (maysir). Customers can be confident their finances respect their faith.

Financial Inclusion

Islamic banking opens finance access to underserved communities. It offers alternatives for those who avoid conventional interest-based banking. Products are designed to suit small businesses and individuals alike. This supports economic growth and reduces poverty.

Credit: www.slideteam.net

Comparing Islamic And Conventional Banking

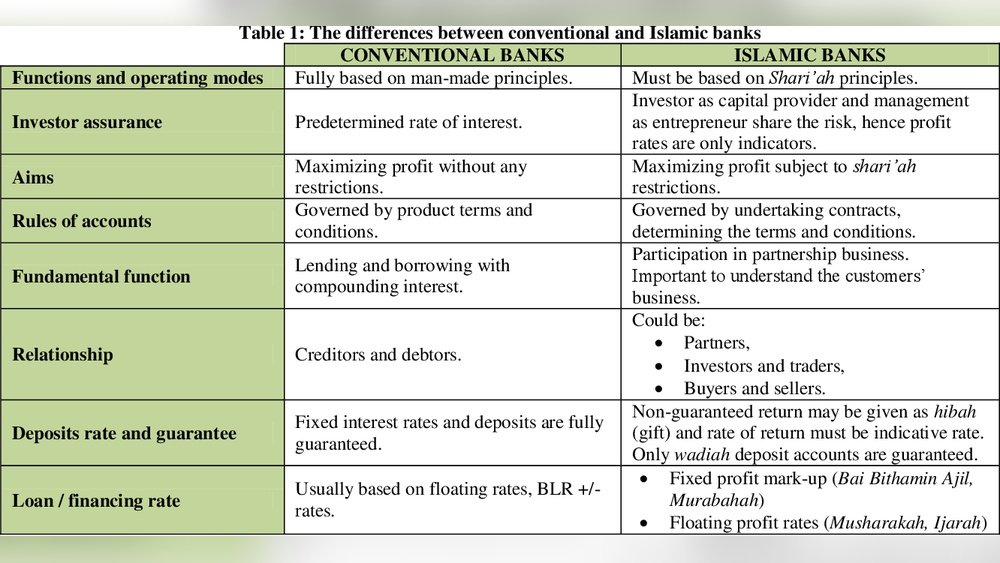

Islamic banking and conventional banking serve similar financial needs but differ greatly in principles and operations. Understanding these differences helps customers choose the right banking system. Islamic banking follows Shariah law, emphasizing ethical and interest-free transactions. Conventional banking focuses on interest-based profit and loss models. This section compares key features of both banking types.

Interest-free Financing

Islamic banks do not charge or pay interest, known as riba, which is forbidden in Islam. Instead, they use profit-sharing and asset-backed methods to earn returns. Conventional banks rely heavily on interest from loans and deposits. This interest is fixed or variable, depending on the agreement. Interest-free financing reduces the risk of exploitation and promotes fairness in Islamic banking.

Asset-backed Transactions

Islamic banking requires all transactions to be backed by tangible assets or services. This means money must be linked to real economic activity. Common contracts include Murabaha (cost-plus sale) and Ijarah (leasing). Conventional banking often involves lending money without direct asset backing. Asset-backed financing protects both the bank and the customer from speculation and uncertainty.

Profit Sharing Vs Interest

Islamic banks and customers share profits and losses based on agreed ratios. This system is called Mudarabah or Musharakah. It aligns the interests of both parties and encourages cooperation. Conventional banks pay fixed interest to depositors and charge interest to borrowers. This creates a fixed income for the bank regardless of project success. Profit sharing promotes risk-sharing and ethical investment in Islamic banking.

Credit: www.slideteam.net

Frequently Asked Questions

What Are The Services Of Islamic Banking?

Islamic banking services include deposit accounts, trade finance, fixed asset and working capital financing. They use profit-sharing, leasing, and asset-backed contracts. Products include Mudarabah, Musharakah, Murabaha, Ijarah, Istisna’a, Salam, and Tawarruq, all compliant with Shariah principles.

What Are Banking Services And Products?

Banking services include loans, deposits, payment processing, and overdrafts. Products cover savings accounts, credit cards, and mortgages. Islamic banking offers profit-sharing, asset-backed financing, and trade finance. These services help manage money, finance projects, and support personal and business needs securely and efficiently.

What Are The Options For Islamic Banking?

Islamic banking options include profit-sharing (Mudarabah, Musharakah) and asset-backed financing (Murabaha, Ijarah). Other contracts are Istisna’a, Salam, and Tawarruq.

How Many Types Of Islamic Banking Are There?

Islamic banking has three main types: Profit and Loss Sharing (Mudarabah, Musharakah), Asset-backed financing (Murabaha, Ijarah), and other contracts (Istisna’a, Salam, Tawarruq). These methods comply with Sharia law, avoiding interest and promoting ethical finance.

Conclusion

Islamic banking offers many products that follow Shariah rules. These services help customers with savings, financing, and trade needs. Profit and loss sharing models promote fairness and partnership. Asset-backed financing provides clear and transparent transactions. Customers gain options like Murabaha, Ijarah, and Musharakah to suit their needs.

Understanding these products can help you make better financial choices. Islamic banking blends ethical values with modern banking practices. It supports both personal and business financial goals. Exploring these services can open new paths for your financial growth.