Are you looking to invest in a way that aligns with your faith and values? Islamic index funds could be the perfect solution for you.

These funds allow you to grow your wealth while following Shariah principles, avoiding industries like alcohol, gambling, and interest-based businesses. But how do you find the right fund, and what should you know before you invest? You’ll discover the key benefits, risks, and top options in Islamic index funds.

Keep reading to make confident investment choices that honor both your financial goals and your beliefs.

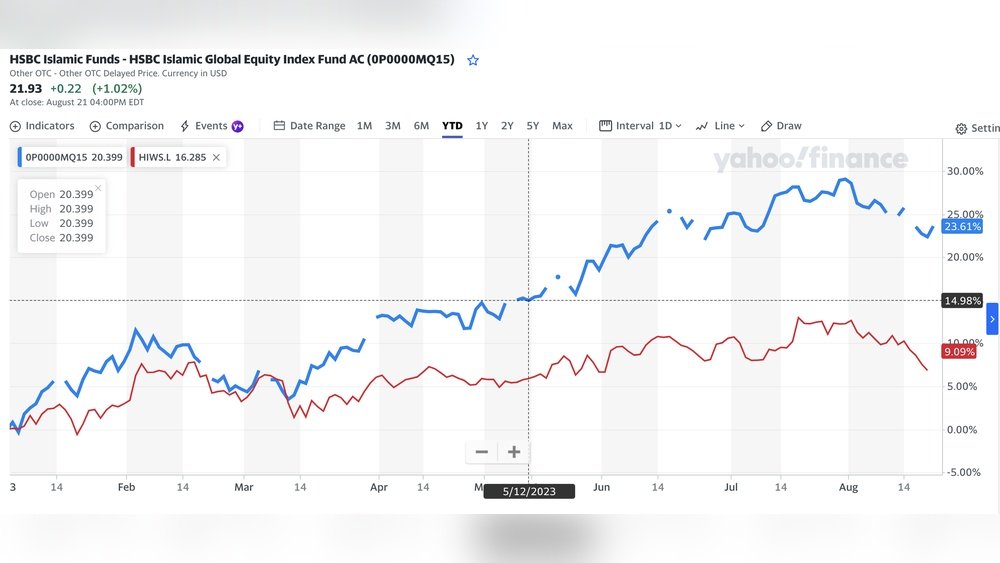

Credit: mena.assetmanagement.hsbc.com

Basics Of Islamic Index Funds

Islamic index funds offer a way to invest while following Islamic law. They combine traditional index investing with Shariah rules. These funds track a specific set of companies that meet Islamic finance principles. Investors gain exposure to a diverse portfolio without violating religious beliefs.

Understanding the basics helps investors choose the right fund. It also ensures investments align with personal values and financial goals.

Shariah Compliance Rules

Islamic index funds follow strict Shariah compliance rules. These rules forbid earning or paying interest (riba). Investments must avoid excessive uncertainty (gharar). Companies that pass Shariah screening are eligible for the fund. Scholars regularly review these funds for compliance.

Excluded Industries

Islamic index funds exclude certain industries. These include alcohol, gambling, pork products, and tobacco. Financial firms dealing with interest-based loans are also excluded. Avoiding these sectors keeps the investment halal. This helps maintain ethical and religious standards.

Key Islamic Finance Principles

Islamic finance principles guide investment decisions. Profit and loss sharing replaces fixed interest returns. Investments must avoid harm and promote social justice. Transparency and fairness are essential in all transactions. These principles create a responsible and ethical investment framework.

Popular Islamic Index Funds

Islamic index funds provide a way to invest while following Shariah principles. These funds screen out companies involved in prohibited activities such as alcohol, gambling, and interest-based finance. Investors gain access to global markets with ethical and compliant options. Here are some popular Islamic index funds that many investors trust.

Ishares Msci World Islamic Etf

The iShares MSCI World Islamic ETF tracks the MSCI World Islamic Index. It includes companies from developed markets that meet Shariah standards. This fund offers broad global exposure with a focus on ethical investments. It excludes firms involved in forbidden sectors like alcohol and gambling.

Hsbc Islamic Global Equity Fund

The HSBC Islamic Global Equity Fund invests in global stocks following Shariah rules. It avoids companies dealing with interest, alcohol, or pork products. The fund aims to deliver steady growth by selecting high-quality, compliant businesses worldwide. It suits investors seeking diversified Islamic equity exposure.

Wahed Ftse Usa Shariah Etf

The Wahed FTSE USA Shariah ETF tracks the FTSE USA Shariah Index. It focuses on American companies that follow Islamic finance principles. This ETF filters out businesses related to gambling, alcohol, and financial services involving interest. It allows investors to participate in the U.S. market responsibly.

Screening Criteria For Halal Investments

Choosing halal investments means following strict rules that respect Islamic law. Islamic index funds use clear screening criteria to ensure investments align with Shariah principles. These rules help investors avoid businesses and practices that Islam forbids. The screening process examines each company carefully before including it in the fund. This ensures the investment stays pure and ethical according to Islamic teachings.

Avoiding Interest-based Earnings

Islamic law forbids earning or paying interest, known as riba. Companies that rely on interest income cannot be part of halal funds. Funds screen out banks or financial firms that generate most of their revenue from interest. This keeps investments free from forbidden earnings. Instead, halal funds focus on companies with income from trade or services.

Excluding Gambling And Alcohol

Halal investments exclude companies involved in gambling or alcohol production. These industries are considered harmful and unethical in Islam. Screening removes stocks linked to casinos, betting, liquor, and related businesses. This step protects investors from supporting activities that violate Islamic values. It also helps maintain the moral integrity of the fund.

Ethical Business Practices

Islamic funds favor companies with honest and fair business behavior. They avoid firms involved in unethical practices like fraud or exploitation. The screening process looks for transparency, good governance, and respect for workers. Investing in companies with strong ethics supports social justice and community welfare. This aligns financial growth with Islamic principles of fairness and responsibility.

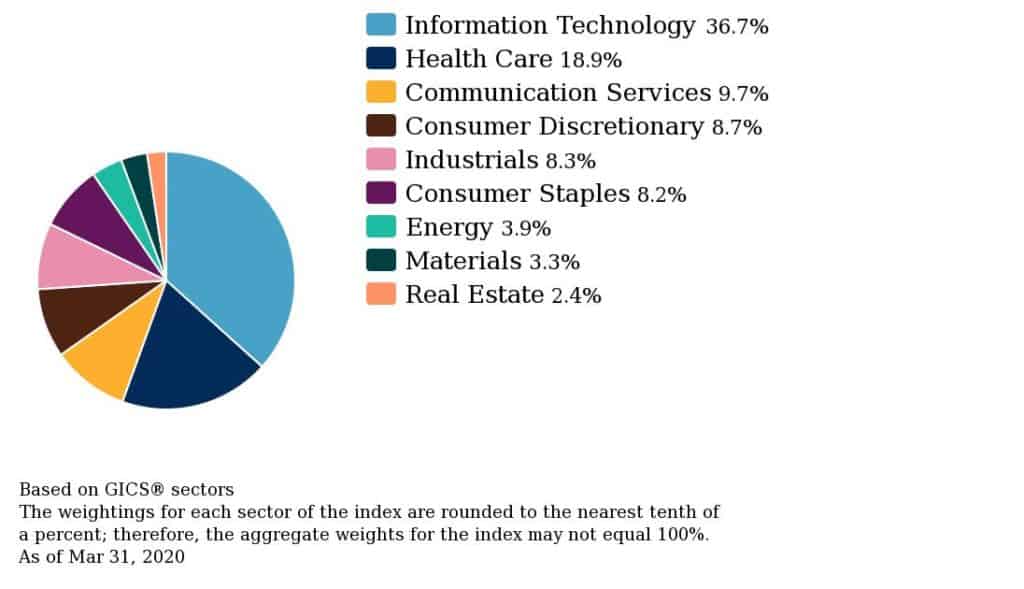

Credit: investingmuslim.com

Investment Strategies For Success

Investing in Islamic index funds requires clear strategies to achieve success. These strategies help grow wealth while following Shariah rules. Smart planning can protect your investments and ensure steady progress.

Careful choices and disciplined methods lead to better outcomes. Focus on growth, spread risks, and respect Islamic principles. This approach builds a strong foundation for your financial journey.

Long-term Growth Focus

Islamic index funds are best suited for long-term investment. Patience allows your money to grow steadily over years. Avoid quick trades that may break Shariah rules or increase risk. Regularly review your portfolio to stay aligned with your goals.

Diversification Techniques

Diversify your investments across many sectors and companies. This reduces risk and improves stability. Choose funds that include various industries allowed by Islamic law. Diversification helps balance market ups and downs effectively.

Balancing Risk And Compliance

Managing risk while following Shariah is crucial. Avoid investments in prohibited industries like alcohol or gambling. Use screening tools to ensure fund compliance. Balance your portfolio between safe and growth assets to protect capital.

Benefits Of Islamic Index Investing

Islamic index investing offers a unique way to grow wealth while following Shariah principles. It combines ethical values with financial goals. Investors can enjoy benefits that go beyond traditional investing. These benefits include aligning investments with faith, seeking steady returns, and managing risk effectively.

Ethical Alignment

Islamic index funds avoid industries prohibited by Shariah law. These include alcohol, gambling, and interest-based businesses. This ensures your money supports ethical and socially responsible companies. Investing aligns with your moral and religious beliefs. It provides peace of mind knowing your investments follow Islamic rules.

Steady Returns

Islamic index funds focus on companies with strong financial health. This often leads to more stable and consistent returns over time. The funds invest in diverse sectors that comply with Shariah guidelines. This balance helps reduce the impact of market swings. Investors can expect steady growth without excessive risk.

Reduced Volatility

By excluding highly leveraged companies, Islamic index funds often show lower volatility. These funds avoid businesses with high debt, which can be risky. The focus on quality companies helps protect investments during market downturns. Reduced volatility means less stress and smoother investment experience.

Risks And Challenges

Investing in Islamic index funds offers a way to follow Shariah principles. Yet, these funds come with unique risks and challenges. Understanding these risks helps investors make better decisions. Awareness of limitations and market factors is essential for managing expectations.

Limited Investment Universe

Islamic index funds only include companies that meet Shariah rules. This limits the number of eligible stocks. Many industries are excluded, such as banking with interest, alcohol, and gambling. The smaller pool reduces diversification options. Investors face fewer choices compared to conventional funds.

Performance Constraints

Islamic rules restrict investments in certain profitable sectors. This can impact fund returns. The exclusion of interest-based businesses may lower income sources. Sometimes, these constraints lead to underperformance versus wider markets. Fund managers must balance Shariah compliance with growth potential.

Market And Regulatory Risks

Islamic index funds are subject to general market risks like any other fund. Price volatility and economic downturns affect returns. Regulatory changes in different countries can also impact these funds. Shariah boards may update guidelines, causing shifts in fund composition. Investors should monitor these factors closely.

Tools And Resources

Investing in Islamic index funds requires proper tools and resources. These help ensure compliance with Shariah principles. They also simplify the investment process for both beginners and seasoned investors. Using reliable tools can boost confidence and improve decision-making.

Shariah Screening Services

Shariah screening services examine companies for Islamic compliance. They filter out firms involved in prohibited activities like alcohol, gambling, and interest-based finance. These services use strict criteria to select only halal stocks. Investors rely on them to avoid unintentional violations. Examples include MSCI Islamic Index and Dow Jones Islamic Market Index.

Financial Advisors Specializing In Islamic Finance

Financial advisors with expertise in Islamic finance guide investors properly. They understand Shariah law and Islamic financial products. These advisors help create portfolios matching personal values and goals. They explain complex rules in simple terms. Their advice reduces risks and aligns investments with faith.

Online Platforms And Apps

Many online platforms and apps offer Islamic index funds and related tools. They provide easy access to halal investment options. Users can track performance, read analysis, and manage portfolios in one place. Some apps offer educational content about Islamic finance. These digital tools make halal investing accessible and convenient.

Future Trends In Islamic Investing

Islamic investing is evolving quickly as more people seek ethical and faith-based options. The demand for Shariah-compliant financial products grows across the globe. Islamic index funds are at the center of this change, offering investors new opportunities.

Future trends show a mix of innovation and expansion. These trends aim to serve both Muslim and non-Muslim investors who value ethical investing. The landscape will continue to shift with technology and global market changes.

Growth Of Halal Etfs

Halal ETFs are becoming popular among investors. They provide easy access to Shariah-compliant assets with low fees. These funds track indexes that exclude forbidden industries, such as gambling and alcohol.

More companies are creating new Halal ETFs. These funds cover various sectors and regions, helping investors diversify. The growth helps Islamic investing reach a wider audience.

Technological Advances

Technology plays a key role in Islamic investing’s future. Robo-advisors and AI help tailor Shariah-compliant portfolios. They also improve transparency and ease of access for investors.

Blockchain may enhance trust by ensuring compliance and tracking investments. Digital platforms make it simple to invest in Islamic index funds worldwide. These tools reduce costs and speed up decision-making.

Global Market Expansion

Islamic index funds are expanding beyond traditional markets. Emerging economies in Asia, Africa, and the Middle East show strong interest. This expansion opens new opportunities for growth and diversity.

International cooperation and regulatory support boost cross-border investing. Global investors now find more Shariah-compliant options. This trend promotes ethical finance on a worldwide scale.

Credit: equal-finance.com

Frequently Asked Questions

Is There An Islamic Index Fund?

Yes, Islamic index funds exist. They invest only in Shariah-compliant companies, excluding industries like alcohol, gambling, and interest-based finance. Examples include iShares MSCI World Islamic UCITS ETF and HSBC Islamic Global Equity Index Fund. These funds follow Islamic finance principles while providing diversified market exposure.

Is The S&p 500 Index Fund Halal?

The standard S&P 500 index fund is not fully halal. It includes companies involved in interest and prohibited industries. For halal investing, choose Shariah-compliant or Islamic index funds specifically screened to exclude non-compliant businesses.

What Is The Islamic Version Of The S&p 500?

The Islamic version of the S&P 500 is the MSCI World Islamic Index. It tracks Shariah-compliant companies worldwide.

Do Muslims Get 0% Interest?

Muslims avoid earning or paying interest (riba) as it is prohibited in Islam. They use profit-sharing or fee-based alternatives instead.

Conclusion

Islamic index funds offer a way to invest following Shariah principles. They avoid companies involved in interest, gambling, or alcohol. These funds provide ethical options for Muslim investors. They also appeal to those seeking socially responsible investments. Understanding their rules helps make informed choices.

Research each fund’s holdings before investing. Islamic index funds balance faith and financial growth. Consider them to align investments with your values.