Are you curious about how you can grow your money or support others without dealing with interest, which Islamic finance strictly prohibits? The Peer to Peer Lending Islamic Model offers a fresh way to connect lenders and borrowers directly, all while following the clear rules of Shariah law.

Imagine earning profits through partnerships instead of interest, making your investments both ethical and rewarding. You’ll discover how this innovative model works, why it’s gaining popularity, and how it can fit your financial goals. Keep reading to unlock the secrets of halal, profit-sharing lending that respects your values and empowers your financial future.

Credit: feb.uinjkt.ac.id

Islamic Finance Principles

Islamic finance follows unique principles that guide all financial activities. These principles ensure fairness, transparency, and ethical behavior. They shape the Peer to Peer Lending Islamic Model to align with Sharia law. Understanding these rules helps explain how Islamic finance differs from conventional finance.

Prohibition Of Interest

Islamic finance strictly forbids charging or paying interest. This rule is called “Riba.” Any guaranteed interest on loans is considered unjust. Instead, profit comes from shared risk and real economic activity. Lending must avoid fixed interest rates to comply with Islamic law.

Profit And Loss Sharing

In Islamic finance, both parties share profits and losses. This principle creates fairness in transactions. It encourages cooperation between lenders and borrowers. Profit depends on the success of the project or business. Losses are also shared to avoid unjust burden on one side.

Ethical Investment Guidelines

Investments must follow ethical and moral standards. Money cannot fund businesses involved in alcohol, gambling, or harmful activities. Social responsibility is key in selecting investments. This ensures that financial growth supports positive social impact and aligns with Islamic values.

Peer-to-peer Lending Basics

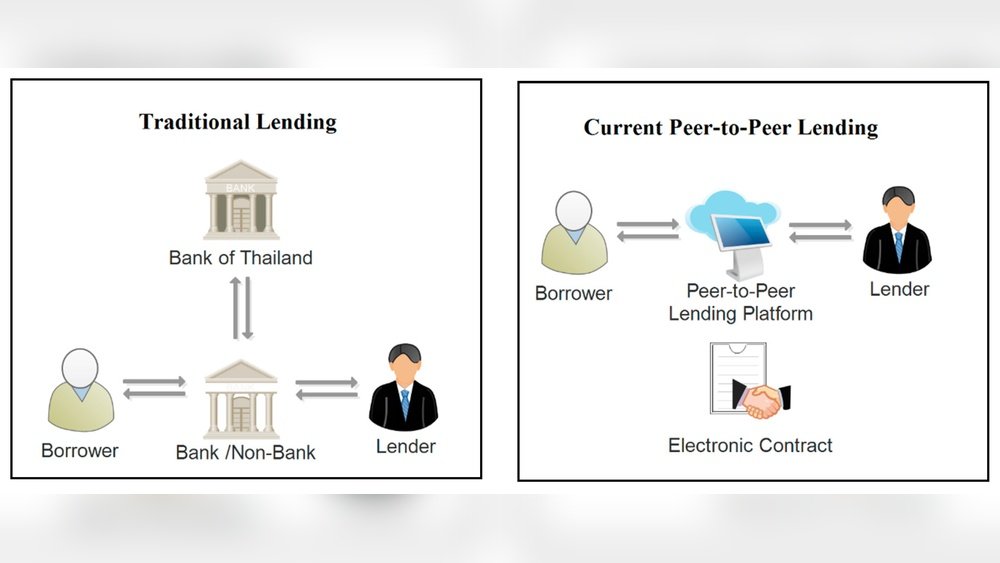

Peer-to-peer (P2P) lending has changed how people borrow and lend money. It lets individuals connect directly, cutting out banks or other middlemen. This model offers faster access to funds and better rates. Islamic P2P lending adapts this system to follow Islamic finance rules. These rules forbid interest and promote fairness and profit-sharing.

How P2p Lending Works

In P2P lending, borrowers post loan requests on an online platform. Lenders review these requests and choose where to invest their money. The platform manages payments and transfers between both parties. Borrowers repay over time, and lenders earn returns from fees or profit-sharing. This process is transparent and fast.

Traditional Vs Islamic Models

Traditional P2P lending charges interest on loans. Lenders earn fixed or variable interest payments. Islamic P2P lending forbids interest, as per Sharia law. Instead, it uses profit-loss sharing or trade-based contracts. This ensures investments are ethical and risk is shared fairly. The Islamic model promotes justice and avoids exploitation.

Key Stakeholders In P2p Lending

There are three main groups in P2P lending. Borrowers seek funds for personal or business needs. Lenders provide capital to earn returns. The platform connects both sides and handles operations. In Islamic P2P lending, a Sharia board oversees compliance. This ensures all deals follow Islamic principles.

Islamic P2p Lending Model

The Islamic P2P lending model offers a unique way to lend and borrow money. It follows Islamic laws that forbid interest (riba). This model creates a fair and ethical lending environment. It connects lenders and borrowers directly using online platforms. Trust and fairness are key in this system. The model supports financial inclusion while respecting religious beliefs.

Sharia-compliant Structures

The Islamic P2P lending model uses contracts that follow Sharia law. These contracts avoid interest and uncertainty. Common structures include Mudarabah, where one party provides capital and the other manages the project. Another is Murabaha, a cost-plus financing method. All contracts must be approved by Sharia scholars. This ensures all deals are ethical and lawful under Islam.

Profit-loss Partnership Mechanisms

Profit and loss sharing is central to Islamic P2P lending. Lenders and borrowers share the business risks and rewards. If the project earns profit, it is divided based on pre-agreed ratios. If it incurs loss, both parties share it fairly. This partnership approach encourages responsible lending and borrowing. It promotes cooperation and trust between both sides.

Risk Sharing And Transparency

Transparency is essential in the Islamic P2P lending model. All terms and conditions are clear to both parties. Risk sharing reduces unfair burden on either side. Borrowers do not pay fixed interest but share actual business outcomes. Lenders get returns only if the project succeeds. This open communication builds confidence and ensures ethical financial dealings.

Technological Platforms

Technological platforms drive the growth of Islamic peer-to-peer lending. These platforms connect lenders and borrowers in a seamless, digital environment. They ensure compliance with Islamic finance principles. Technology also helps reduce costs and increase transparency. With user-friendly interfaces, these platforms make Islamic P2P lending accessible globally.

Online Marketplaces For Islamic P2p

Online marketplaces serve as hubs for Islamic P2P lending. They allow individuals to invest or borrow funds without banks. These marketplaces follow Shariah rules strictly. Each transaction avoids interest, focusing on profit-sharing or leasing contracts. The platforms provide detailed information to help users make informed decisions. They also offer risk management tools to protect lenders and borrowers.

Role Of Blockchain And Fintech

Blockchain enhances transparency and trust in Islamic P2P lending. It records all transactions securely and immutably. This technology reduces fraud and errors significantly. Fintech innovations simplify compliance with Islamic finance laws. Smart contracts automate agreements, ensuring terms are met exactly. Together, blockchain and fintech improve efficiency and lower costs for users.

Examples Of Leading Platforms

Several platforms lead the Islamic P2P lending market today. Beehive connects investors with small businesses in the Middle East. It uses profit-sharing models compliant with Shariah. LenderKit builds customizable Islamic P2P lending solutions for different markets. These platforms prioritize transparency, compliance, and user experience. They show how technology supports ethical and interest-free financing.

Benefits Of Islamic P2p Lending

Islamic peer-to-peer (P2P) lending offers unique benefits for both investors and borrowers. It aligns with Sharia principles, avoiding interest and promoting profit-sharing. This model fosters fairness and trust in financial transactions.

Many people gain access to funds they could not get from traditional banks. Investors find ethical ways to grow their money. Small businesses get new chances to expand without heavy debt.

Financial Inclusion

Islamic P2P lending opens doors for many excluded from banks. People with limited credit history can still receive financing. It supports those in rural or underserved areas. This helps reduce the gap between rich and poor. More individuals can participate in the economy fairly.

Ethical Investment Opportunities

Investors avoid interest-based returns, which Islam forbids. Instead, profits come from shared business success. This aligns with moral and religious values. Funds go only to halal (permissible) projects. It attracts people seeking responsible and honest investment options.

Alternative Financing For Smes

Small and medium enterprises (SMEs) often struggle with bank loans. Islamic P2P lending provides a new funding source. It uses profit-and-loss sharing rather than fixed interest. This reduces pressure on businesses during slow periods. SMEs gain more flexibility to grow and innovate.

Challenges And Solutions

Peer to peer lending under the Islamic model faces unique challenges. These must be addressed carefully to maintain trust and compliance. Solutions focus on balancing modern finance with Islamic law. This section explores key challenges and practical solutions.

Regulatory Compliance

Islamic P2P lending platforms must follow local financial laws. Many countries lack clear rules for Islamic fintech. This creates uncertainty for lenders and borrowers.

Platforms should work closely with regulators. They must ensure all operations meet legal standards. Transparent reporting and audits help build trust. Clear licensing safeguards users and supports growth.

Ensuring Shariah Governance

Following Shariah law is essential for Islamic lending. Interest (riba) is strictly prohibited. Profit-sharing and risk-sharing models replace interest-based loans.

Shariah boards guide product design and operations. They review contracts and transactions regularly. Continuous education for staff ensures compliance. Using certified scholars strengthens credibility.

Managing Credit Risk

Credit risk arises from borrower defaults. Islamic models avoid conventional collateral and interest penalties. This makes risk management challenging.

Platforms use thorough borrower screening and credit scoring. Profit-loss sharing aligns interests between lenders and borrowers. Diversifying loan portfolios reduces risk exposure. Technology tools improve risk prediction and monitoring.

Market Trends And Growth

The market for Peer to Peer (P2P) lending under the Islamic model shows steady growth worldwide. This growth reflects rising demand for financial services that follow Sharia principles. More platforms are emerging, connecting investors and borrowers without interest. The model supports ethical and transparent financing, attracting users looking for faith-based options. Understanding regional adoption, investor behavior, and future trends helps grasp the market’s development.

Regional Adoption Patterns

Islamic P2P lending grows faster in Muslim-majority countries. Southeast Asia, the Middle East, and North Africa lead adoption. These regions have strong demand for Sharia-compliant finance. Regulatory support also plays a key role in growth. Some countries offer clear rules to protect users and ensure compliance. Others are in early stages but show potential for expansion. Urban areas see higher platform usage due to better internet access.

Investor Behavior Insights

Investors prefer risk-sharing models aligned with Islamic law. Profit and loss sharing attracts cautious yet interested lenders. Many seek ethical investment that avoids interest and gambling. Trust in platform transparency is crucial for investor confidence. Younger investors show growing interest in digital Islamic finance. Repeat investment rates are higher among users satisfied with returns. Education on Islamic finance principles influences investor decisions.

Future Outlook For Islamic P2p Lending

The future looks promising for Islamic P2P lending markets. Technology improvements will increase platform efficiency and security. Wider acceptance may occur as awareness grows in non-Muslim regions. Partnerships with traditional banks could boost credibility and reach. Regulators will likely introduce clearer guidelines to protect all parties. Innovation in product offerings may attract diverse investor groups. Overall, growth will continue as faith-based finance gains momentum.

Credit: www.researchgate.net

Case Studies

Examining real-world examples helps understand the Peer to Peer Lending Islamic Model better. Case studies reveal how this model operates across different regions and cultures. They highlight successes, challenges, and innovative approaches. These insights guide future projects and improve compliance with Islamic finance principles.

Successful Platforms In Mena

The Middle East and North Africa (MENA) region hosts several thriving Islamic P2P lending platforms. Beehive, based in the UAE, is one of the pioneers. It connects small businesses with investors following Sharia rules. These platforms avoid interest and use profit-sharing agreements. Their success shows strong demand for ethical financing alternatives in MENA.

Another example is LenderKit, which offers tailored solutions for Islamic P2P lending. It emphasizes transparency and risk-sharing to align with Islamic law. These platforms promote financial inclusion by supporting entrepreneurs who lack access to traditional loans. They demonstrate how technology can meet religious and economic needs.

Innovations In Austin, Texas

Austin is emerging as a hub for Islamic finance innovation, including P2P lending. Local startups experiment with combining blockchain technology and Sharia-compliant contracts. This approach ensures transparency and trust between lenders and borrowers. They design smart contracts that share profits instead of charging interest.

These innovations attract both Muslim and non-Muslim investors who seek ethical investment opportunities. Austin’s model focuses on community engagement and education about Islamic finance. It proves that Islamic P2P lending can adapt to Western markets with proper technology and awareness.

Lessons From Global Markets

Global markets teach valuable lessons for Islamic P2P lending. In Malaysia and Indonesia, regulatory frameworks support Sharia-compliant fintech growth. Strict guidelines ensure consumer protection and financial stability. These examples highlight the importance of legal clarity in fostering trust and growth.

In the UK, platforms blend conventional and Islamic finance principles to widen their appeal. They introduce hybrid models that respect Sharia while attracting diverse investors. Such flexibility helps expand market reach without compromising core values. Overall, global case studies emphasize adaptation, regulation, and education as keys to success.

Credit: www.jimf-bi.org

Frequently Asked Questions

Is Peer-to-peer Lending Halal?

Peer-to-peer lending can be halal if it follows Islamic finance principles, avoiding interest and sharing profit and loss.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total capital. This ensures financial stability and Sharia compliance.

Do Muslims Get 0% Interest?

Muslims avoid paying or earning interest (riba) as it is prohibited in Islam. Instead, they engage in profit-sharing or trade-based financing. Islamic finance uses alternative models like profit-loss sharing to comply with Shariah law, ensuring returns without interest.

What Is The Halal Way To Lend Money?

The halal way to lend money avoids interest (riba). Lenders share profit and loss fairly, following Islamic finance principles.

Conclusion

The Peer to Peer Lending Islamic Model offers a clear alternative to traditional lending. It respects Islamic rules by avoiding interest and focusing on profit-sharing. This model connects lenders and borrowers directly through online platforms. It promotes fairness and transparency in financial dealings.

Many people seek ethical ways to manage money today. Islamic P2P lending meets this demand while supporting community growth. It encourages responsible borrowing and investing under Shariah law. This approach can help build trust and financial inclusion. Exploring this model can benefit those wanting faith-aligned financial solutions.