Are you looking to buy a home but want to make sure your mortgage fits with your faith? A Shariah compliant mortgage could be the solution you need.

Unlike traditional loans, this type of mortgage avoids interest, which is prohibited under Islamic law. But how does it work? And is it right for your financial goals? You’ll discover what makes a mortgage Shariah compliant, how it differs from conventional loans, and what to watch out for when choosing one.

Keep reading to find out how you can own your dream home while staying true to your values.

Basics Of Shariah Mortgages

Shariah compliant mortgages provide an ethical way to finance a home. They follow Islamic laws and principles strictly. This type of mortgage avoids interest and any unfair gain. Understanding the basics helps you see how these mortgages differ from conventional ones.

People seek Shariah mortgages to align their finances with their faith. These mortgages use unique contracts that comply with Islamic rules. They offer a practical solution for Muslims wanting to own a home without breaking religious laws.

Core Principles Of Islamic Finance

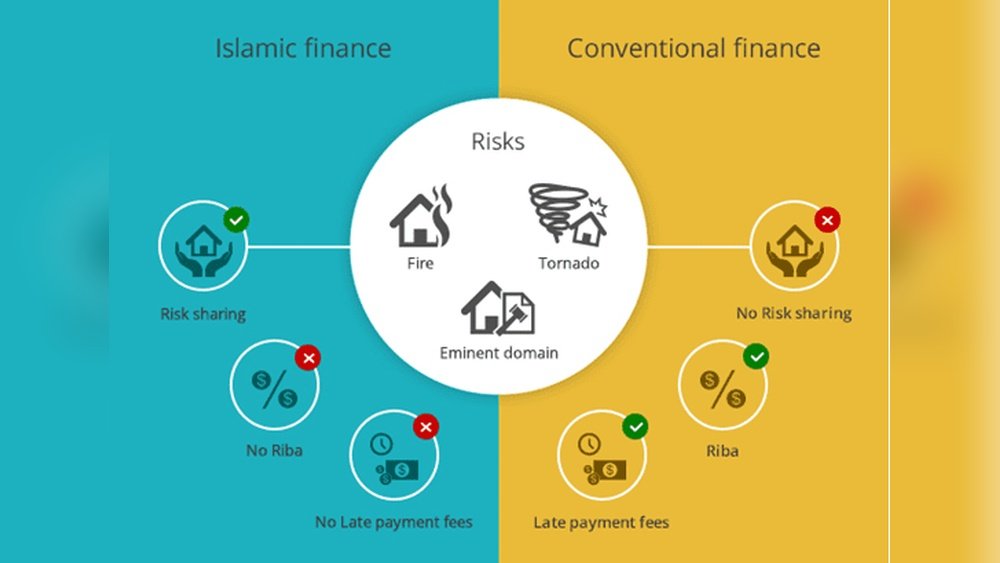

Islamic finance is based on fairness and justice. It promotes risk-sharing between lender and borrower. Transactions must be transparent and free from uncertainty. It forbids activities involving gambling or unethical businesses. Profit and loss are shared instead of charging fixed interest.

Difference From Conventional Loans

Conventional loans charge interest on the borrowed amount. Shariah mortgages avoid interest completely. Instead, they use contracts like Murabaha or Ijara. These contracts involve buying and leasing property rather than lending money. The bank owns the property until the mortgage is fully paid.

Prohibition Of Interest Explained

Charging interest, or riba, is strictly forbidden in Islam. It is seen as earning money from money without effort. Islamic law requires trade and investment to involve real assets. This rule protects people from exploitation and unfair debt. Shariah mortgages follow this rule carefully to remain halal.

Credit: www.r3mortgages.com

Types Of Shariah Compliant Mortgages

Shariah compliant mortgages offer home financing without interest, following Islamic law. These mortgages use different structures to avoid riba (interest) and ensure fairness. Understanding the types helps buyers choose the right option for their needs. Three common types include Murabaha, Ijara, and Diminishing Musharaka. Each has unique features but shares the goal of ethical home ownership.

Murabaha Structure

Murabaha is a cost-plus financing method. The bank buys the property and sells it to the buyer at a higher price. This price includes a fixed profit margin agreed upon in advance. The buyer pays in installments over time. There is no interest charged, only a clear profit margin. This method is simple and widely used in Islamic finance.

Ijara Lease-to-own Model

Ijara works like a lease-to-own agreement. The bank buys the property and leases it to the buyer. The buyer pays rent each month, which includes the bank’s profit. Over time, the buyer gradually buys the bank’s share of the property. At the end of the contract, the buyer fully owns the home. This model is flexible and fair for both parties.

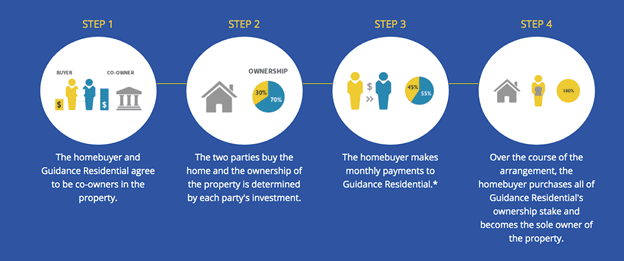

Diminishing Musharaka Partnership

Diminishing Musharaka is a partnership between the buyer and the bank. Both share ownership of the property. The buyer gradually buys the bank’s share through monthly payments. These payments include rent for the bank’s share and a purchase portion. Over time, the buyer’s ownership increases while the bank’s decreases. This continues until the buyer owns the home entirely.

Application Process In Austin, Texas

The application process for a Shariah Compliant Mortgage in Austin, Texas, focuses on meeting specific Islamic finance principles. This process ensures the home financing is free from interest, aligning with Shariah law.

Applicants should understand the local requirements and prepare necessary documents. This helps speed up approval and makes the process smoother.

Eligibility Requirements

Applicants must be residents of Austin or nearby areas. They should have a steady income to support monthly payments without interest. A good credit score increases chances of approval. The property must meet Shariah compliance standards and serve as the primary residence. Applicants should show commitment to ethical financing principles.

Documentation Needed

Proof of identity, such as a driver’s license or passport, is essential. Income verification includes recent pay stubs and tax returns. Bank statements help show financial stability. Property details and purchase agreements must be provided. A letter explaining adherence to Islamic finance rules may be required by some lenders.

Finding Local Providers

Austin has several lenders offering Shariah Compliant Mortgages. Research providers who specialize in Islamic finance. Contact local Islamic centers for recommendations. Check if lenders are familiar with Shariah law and local real estate market. Compare terms and fees carefully before choosing a provider.

Credit: www.guidanceresidential.com

Benefits Of Ethical Home Financing

Ethical home financing offers more than just a way to buy a house. It provides a financial path that respects personal beliefs and promotes fairness. Many people seek options that fit their values and help build a better community. Shariah compliant mortgages deliver these benefits while avoiding common financial pitfalls. Understanding these advantages helps homeowners choose wisely and live peacefully with their financial decisions.

Aligning Finance With Faith

Shariah compliant mortgages follow Islamic principles closely. They avoid interest, which is forbidden in Islam. This alignment helps believers keep their faith intact while owning a home. Choosing this path means staying true to religious values. It offers peace of mind knowing finance respects personal beliefs.

Avoiding Riba And Gharar

Riba means earning interest, which Shariah law prohibits. Gharar refers to uncertainty or risk in contracts. Ethical home financing removes these elements to protect buyers. This creates a fair and clear agreement for both parties. It reduces stress and builds trust between lender and homeowner.

Supporting Community Development

Shariah compliant mortgages encourage social responsibility. They promote investment in local projects and businesses. This helps create strong, supportive neighborhoods. Ethical financing also fosters cooperation and shared success. It benefits not just individuals but the whole community.

Cost Considerations

Cost considerations play a key role in choosing a Shariah compliant mortgage. Understanding all related expenses helps you make smart financial decisions. These mortgages differ from traditional loans in many ways, including their cost structure.

Comparing Fees With Traditional Mortgages

Shariah compliant mortgages often have different fees than conventional loans. You may see higher upfront charges due to unique contract terms. The absence of interest means lenders charge fees differently. Some fees may be fixed rather than variable. It is important to review all fees before committing.

Long-term Financial Impact

These mortgages can affect your finances over time in unique ways. Profit rates replace interest, which can fluctuate based on market conditions. This can change your monthly payments compared to fixed-rate loans. Early repayment penalties may also differ. Careful planning helps avoid surprises in total costs.

Administrative And Processing Charges

Administrative fees on Shariah compliant mortgages may be higher. Lenders invest more time ensuring contracts meet Islamic law. Processing fees cover legal reviews and compliance checks. You should ask for a clear breakdown of these charges. Knowing all costs upfront prevents unexpected expenses later.

Challenges In The U.s. Market

The U.S. market faces several challenges in adopting Shariah compliant mortgages. Islamic home financing must align with religious rules. This creates unique hurdles compared to traditional mortgages.

These challenges affect availability, legal approval, and customer understanding. Each issue limits access to Shariah compliant home loans for many Muslims. Overcoming these obstacles is key to growing this market in the U.S.

Limited Availability

Few lenders offer Shariah compliant mortgages in the U.S. Many banks avoid these products due to complexity. The small number of providers limits options for buyers. This scarcity can increase costs and reduce competition.

Regulatory Barriers

U.S. financial laws do not always support Islamic financing models. Shariah compliant mortgages must avoid interest, which conflicts with standard rules. Regulators need to adapt or provide clear guidance. Without this, lenders face risks and uncertainty.

Awareness And Education

Many potential borrowers do not know about Shariah compliant mortgages. Misunderstandings about Islamic finance create doubts. Education is needed for consumers and professionals alike. Clear information helps buyers make confident decisions.

Choosing The Right Shariah Mortgage

Choosing the right Shariah mortgage is important for a smooth home buying experience. It ensures your financing follows Islamic principles and meets your needs. Careful selection helps avoid future issues and keeps your finances clear and ethical.

Evaluating Terms And Conditions

Read all terms and conditions carefully. Check how profit rates are calculated and if there are any hidden fees. Understand payment schedules and penalties for late payments. Confirm the contract avoids interest, which is not allowed in Shariah law. Clear terms protect you from surprises later.

Consulting Islamic Finance Experts

Talk to experts in Islamic finance before deciding. They can explain complex rules and help you compare offers. Experts ensure your mortgage complies with Shariah principles. They also guide you through the paperwork and legal details. Their advice adds confidence to your choice.

Checking Shariah Board Certification

Verify the lender’s Shariah board certification. This board reviews and approves the mortgage product. It confirms the financing meets Islamic law requirements. Look for official certificates or statements on the lender’s website. Certification shows trust and authenticity in the mortgage offer.

Future Trends In Islamic Home Financing

The future of Islamic home financing shows promising growth and innovation. More people seek Shariah-compliant options that fit their values. The market adapts to meet this rising demand with new ideas. These trends signal wider acceptance and better access to Islamic mortgages.

Growing Demand In The U.s.

The U.S. Muslim population is increasing steadily. Many want home loans that follow Islamic law. This creates a strong demand for Shariah-compliant mortgages. Financial institutions respond by offering more products. Awareness and education about Islamic finance also improve. This trend helps more families achieve homeownership ethically.

Innovations In Product Offerings

New Islamic mortgage products are emerging with flexible terms. Lenders use modern technology to streamline the approval process. Hybrid models combine traditional finance with Islamic principles. These products reduce paperwork and speed up approvals. Some plans offer competitive pricing while staying Shariah-compliant. Innovations make Islamic home financing easier and more accessible.

Potential For Wider Acceptance

More banks and credit unions show interest in Islamic finance. Regulators work to create clearer guidelines for Shariah-compliant loans. Partnerships between Islamic and conventional lenders increase. This cooperation may reduce costs and expand options. Wider acceptance could bring Islamic mortgages to mainstream markets. It opens doors for diverse communities seeking ethical financing.

Credit: www.youtube.com

Frequently Asked Questions

What Is A Sharia-compliant Mortgage?

A Sharia-compliant mortgage avoids interest, following Islamic law. It uses profit-sharing or rent-to-own structures for home financing.

Is There An Islamic Mortgage In The Usa?

Yes, Islamic mortgages exist in the USA as Shariah-compliant home financing. They avoid interest and follow Islamic law.

Is It Possible To Get A Halal Mortgage?

Yes, halal mortgages, or Shariah-compliant home financing, exist. They avoid interest by using ethical, no-interest home purchase plans.

Are Sharia Mortgages Cheaper?

Sharia mortgages often cost more due to higher administration fees and unique compliance requirements. They avoid interest, following Islamic law.

Conclusion

Choosing a Shariah compliant mortgage helps you follow Islamic principles. It avoids interest, which is not allowed in Islam. These mortgages offer ethical and fair home financing options. You can own a home while respecting your faith. Understanding how these mortgages work is important.

They differ from traditional loans in key ways. Explore your options carefully and ask questions. This approach supports both your financial goals and religious values. Owning a home becomes possible without compromising beliefs. Shariah compliant mortgages provide a clear, honest path to homeownership.