Are you curious about how banking can work without charging interest? The Islamic banking system offers a unique approach to finance, based entirely on principles that promote fairness, shared risk, and ethical investments.

Unlike conventional banks, Islamic banks don’t just lend money with interest—they partner with you, sharing profits and losses while ensuring every transaction aligns with moral values. If you want to understand how your money can grow through a system that avoids unfair practices and supports real economic activities, this overview will guide you step-by-step through the core ideas and practical workings of Islamic banking.

Keep reading to discover how this alternative financial system could change the way you think about money.

Credit: www.youtube.com

Principles Of Islamic Banking

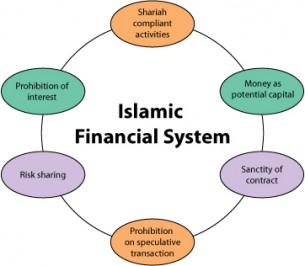

Islamic banking follows clear rules from Sharia law. These rules guide how banks handle money and investments. The principles focus on fairness, risk sharing, and ethical behavior. They avoid harmful practices like charging interest or investing in forbidden industries.

Understanding these principles helps explain how Islamic banks operate differently from conventional banks. They offer financial services that comply with religious and moral standards.

Prohibition Of Interest (riba)

Islamic banking strictly forbids earning or paying interest. This is called Riba. Money should not generate money by itself. Instead, banks share actual profits from business activities. This rule protects customers from unfair debt burdens and exploitation.

Profit And Loss Sharing

Banks and customers share risks and rewards together. Both parties invest in projects or businesses. If the project profits, both gain. If it loses, both share the loss. This approach creates fairness and encourages responsible investment.

Asset-backed Financing

All transactions must link to real, tangible assets. This rule prevents speculation and gambling with money. Financing is based on ownership or use of actual goods, like homes or equipment. This ties banking to the real economy and adds stability.

Ethical Investment Restrictions

Islamic banks avoid investments in harmful industries. Forbidden sectors include alcohol, tobacco, gambling, and weapons. Investments must promote social good and avoid causing harm. This ensures money supports positive and ethical activities.

Credit: www.responsible-investor.com

Core Islamic Banking Products

Core Islamic banking products form the foundation of this financial system. They follow strict rules based on Sharia law. These products avoid interest and focus on fairness and shared risk. Customers engage in partnerships and asset-backed deals. This ensures ethical and transparent banking services.

Profit-sharing Savings Accounts

Profit-sharing savings accounts do not pay fixed interest. Instead, the bank invests the deposited money in Sharia-compliant projects. Customers receive a share of the profits based on the bank’s earnings. This model encourages transparency and shared risk between the bank and customers.

Home And Car Financing Models

Islamic home and car financing uses co-ownership models. The bank and customer jointly buy the asset. The customer pays rent on the bank’s share and gradually buys it. This method avoids interest and shares the asset’s ownership and risk.

Mudarabah Partnerships

Mudarabah is a profit-sharing partnership. One party provides the capital, and the other manages the business. Profits are shared according to a pre-agreed ratio. Losses are borne by the capital provider. This encourages responsible management and investment.

Murabaha Sales

Murabaha is a cost-plus financing method. The bank buys an asset and sells it to the customer at a fixed profit margin. The customer pays in installments. This process is transparent and avoids hidden interest. It suits purchases like equipment or goods.

How Islamic Banking Operates

Islamic banking operates under a unique framework guided by Sharia law. It avoids interest (riba) and focuses on ethical, transparent, and asset-backed financing. The bank and customers share risks and rewards. This system promotes fairness and social justice in finance.

Risk And Reward Sharing

Islamic banks do not charge interest. Instead, they share profits and losses with customers. This partnership approach means both parties face financial risks together. For example, in a mudarabah contract, the bank provides capital while the customer manages the business. Profits are shared as agreed, but losses are borne by the bank unless caused by negligence.

Sharia Compliance And Monitoring

Every Islamic bank follows strict Sharia rules. A Sharia board supervises and approves all financial products and contracts. They ensure no interest or forbidden activities, like gambling or alcohol, are involved. Regular audits and reviews help maintain compliance. This monitoring builds trust with customers seeking ethical finance.

Customer-bank Relationship

The relationship between the bank and customer is based on transparency and trust. The bank acts as a partner, not just a lender. Customers share ownership in assets like homes or cars through joint financing. Payments may include rent or profit shares instead of interest. This collaboration creates a balanced and fair financial experience.

Credit: www.youtube.com

Frequently Asked Questions

How Does The Islamic Banking System Work?

Islamic banking follows Sharia law, banning interest (riba). It uses profit-loss sharing, asset-backed financing, and risk-sharing. Banks and customers jointly invest or co-own assets. Customers earn profits from investments instead of interest. Financing involves leasing or partnerships, ensuring ethical, tangible asset-based transactions.

What Is The Islamic Style Of Banking?

Islamic banking follows Sharia law, forbidding interest (riba). It uses profit-loss sharing, asset-backed financing, and risk-sharing models. Banks and customers jointly invest, share risks, and avoid forbidden industries like alcohol and gambling. Transactions focus on ethical, tangible assets without speculative practices.

What Are The Main Principles Of Islamic Banking?

Islamic banking follows Sharia law, prohibiting interest (riba). It emphasizes profit-loss sharing, asset-backed financing, risk-sharing, and ethical investments only.

Do Muslims Get 0% Interest?

Muslims avoid interest (riba) as it is forbidden in Islam. Islamic finance uses profit-sharing, leasing, and asset-backed models instead.

Conclusion

Islamic banking offers a unique way to manage money based on fairness. It avoids interest and shares profits and risks equally. All transactions link directly to real assets, promoting transparency and trust. This system supports ethical investments and avoids harmful industries.

Many people find Islamic banking aligns with their values and financial goals. Understanding its principles helps customers make informed choices. The system continues to grow worldwide, adapting to modern needs. Learning about Islamic banking can open new financial possibilities for many.