Are you looking for a financing option that aligns with your values and avoids interest? Ijara financing might be exactly what you need.

It’s a smart, Shariah-compliant way to lease an asset—like a home or a car—with the option to own it at the end. Instead of paying interest, you make rental payments, making this a fair and ethical alternative to traditional loans.

If you want to understand how Ijara works and how it can help you secure your dream asset without compromising your beliefs, keep reading. This guide will walk you through the key points and show why Ijara financing could be the perfect fit for your financial journey.

Ijara Basics

Ijara financing is a popular Islamic finance method. It offers a lease-to-own option without involving interest. This makes it suitable for those who seek Shariah-compliant financial solutions. Understanding its basics helps you see how it works and why it is preferred.

Ijara involves leasing an asset, such as a house or equipment, to a client. The client pays rent instead of interest. After the lease ends, the client can own the asset. This setup keeps the process clear and ethical.

Lease-to-own Structure

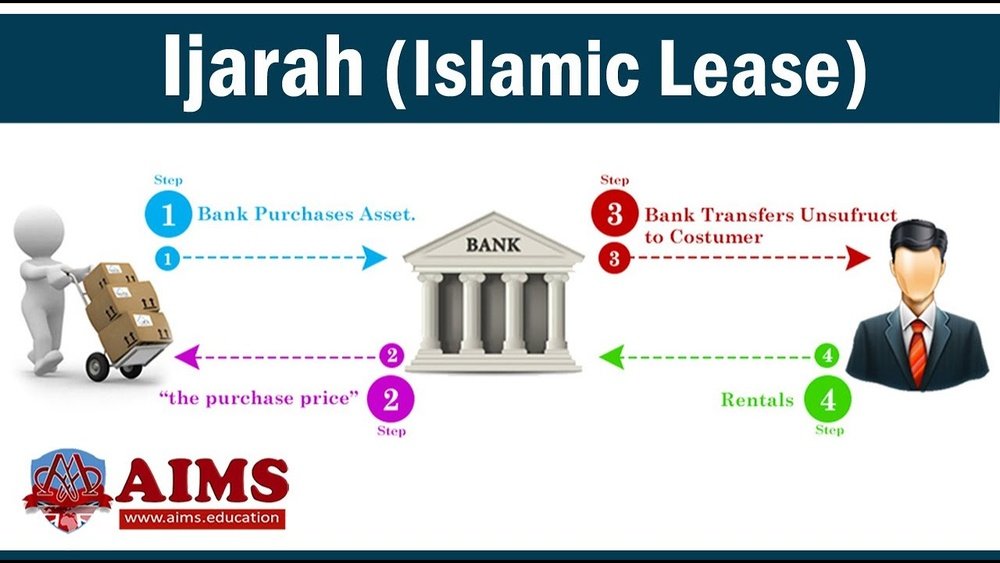

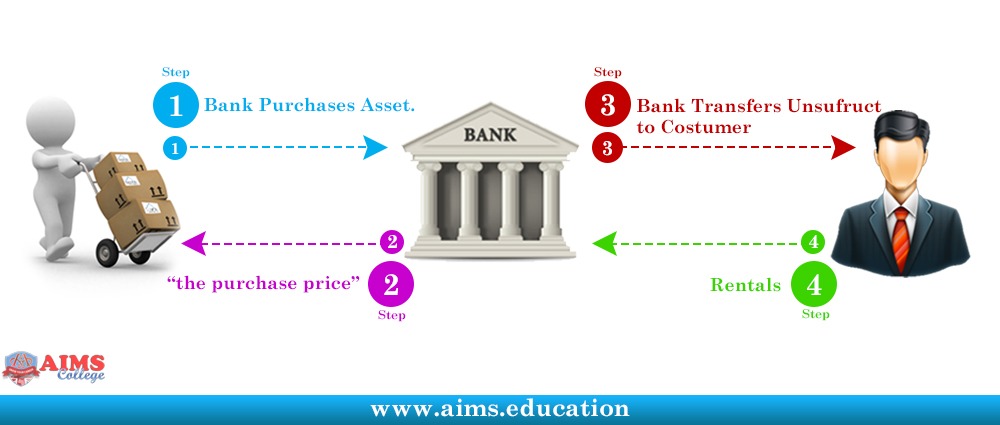

Ijara uses a lease-to-own model. The financial institution buys the asset first. Then, it leases the asset to the client for a fixed time. The client pays rent during this period. This rent replaces traditional loan interest. At the end, ownership transfers to the client. Usually, this happens by a separate sale agreement. The price is agreed upon at the start. This method provides clear rights and obligations for both sides.

Shariah Compliance

Ijara follows Islamic law, avoiding interest or “riba.” The financial institution remains the owner during the lease. This means the bank bears risks like maintenance and taxes. The client must take care of the asset and avoid damage. Payments are rent, not interest, making the deal lawful. This setup ensures fairness and ethical treatment for everyone involved.

Role Of Financial Institution

The financial institution plays a central role. It purchases the asset and leases it to the client. It holds ownership until the lease ends. The institution manages risks related to ownership. It also handles taxes and insurance. The client benefits by using the asset without upfront full payment. The institution earns rental income instead of interest. This role supports ethical financing aligned with Islamic principles.

Credit: www.researchgate.net

How Ijara Works

Understanding the key features of Ijara financing helps clarify why it suits many clients. This financing method follows Islamic law and avoids interest, making it ethical and fair. Below are the main features that make Ijara financing unique and practical.

Avoiding Riba

Ijara financing strictly avoids riba, or interest. Instead of charging interest, the client pays rent for using the asset. This rent is agreed upon in advance and stays fixed during the lease. This approach meets the requirements of Sharia law and protects clients from interest-based transactions.

Asset Ownership During Lease

The financial institution owns the asset throughout the lease period. The client only uses the asset and pays rent. Ownership transfers to the client at the end of the lease, usually by a separate sale agreement. This ensures the asset remains with the lessor until the contract ends.

Risk And Responsibility Allocation

The lessor bears risks related to asset ownership, such as maintenance, taxes, and insurance. The lessee must take care of the asset and avoid damage from misuse or negligence. This clear division of duties protects both parties and keeps the contract fair.

Contract Flexibility

Ijara contracts can be tailored to fit different needs. The lease term, rental amount, and purchase price at the end can be adjusted. This flexibility allows clients to find terms that suit their financial situation while following Islamic principles.

Key Features

Ijara financing offers a unique alternative to conventional leasing. Both allow the use of an asset without immediate ownership. Yet, they differ in structure and principles. Understanding these differences helps choose the right option for your needs.

Interest-free Financing

Ijara financing avoids interest, known as riba in Islamic law. Instead of charging interest, the client pays rent for using the asset. This rent covers the cost of ownership and profit for the financier. Conventional leasing includes interest as part of the payments. The interest reflects the cost of borrowing money over time.

Ownership Differences

In Ijara, the financier owns the asset during the lease term. The client only gets ownership after completing all payments. This transfer often happens through a separate sale agreement. Conventional leasing usually does not transfer ownership automatically. The lessee might have options to buy, but ownership stays with the lessor unless a purchase is made.

Payment Structures

Ijara payments are fixed rents based on the asset’s use and value. These payments remain stable throughout the lease period. Conventional leases can have variable payments influenced by interest rates. Ijara payments cover maintenance and insurance costs paid by the financier. In conventional leases, the lessee often handles these costs directly.

Ijara Vs Conventional Leasing

Ijara and Murabaha are two common Islamic financing methods. Both avoid interest (riba) but work differently in practice. Understanding their differences helps homebuyers choose the right option for their needs. This section compares Ijara and Murabaha on key points like ownership, payment structure, and suitability.

Immediate Ownership Vs Lease

Murabaha grants immediate ownership of the asset to the buyer. The bank buys the property and sells it to the buyer at a marked-up price. The buyer pays in installments, but owns the home from day one.

Ijara works like a lease-to-own agreement. The bank keeps ownership during the lease. The client pays rent and only gains ownership after the lease ends and final payment is made.

Payment And Registration Differences

Murabaha payments cover the purchase price plus profit, split over fixed installments. The buyer registers the property in their name at the start.

Ijara payments are rental fees paid periodically. Ownership transfer and registration happen later, after all rental payments and the final purchase are complete.

Suitability For Homebuyers

Murabaha suits buyers who want immediate ownership and clear payment plans. It is simpler for those wanting full control from the start.

Ijara fits buyers preferring lower upfront costs and flexible lease terms. It suits those who accept gradual ownership and want to avoid immediate registration costs.

Ijara Compared To Murabaha

Ijara financing has many practical uses in daily life and business. It offers a Shariah-compliant way to access assets without paying interest. Many sectors benefit from Ijara’s lease-to-own structure. This makes financing easier and ethical for people who follow Islamic principles.

Ijara is popular in real estate, vehicle leasing, and industrial equipment leasing. Each use allows the client to use an asset while making rental payments. At the end of the lease, ownership usually transfers to the client. This method suits those who want to avoid interest and still acquire valuable assets.

Real Estate Financing

Ijara helps people buy homes without traditional loans. The bank buys the property and leases it to the client. The client pays rent instead of interest. After the lease ends, the client can buy the home at a pre-agreed price. This method meets Islamic rules and helps families own houses ethically.

Vehicle Leasing

Many use Ijara to lease cars and other vehicles. The financial institution purchases the vehicle and leases it out. The lessee pays rent for using the vehicle. Ownership moves to the lessee once the lease ends and payment completes. This option suits people needing a car but avoiding interest-based loans.

Industrial Equipment Leasing

Businesses lease machinery and equipment through Ijara financing. The bank buys the equipment and leases it to the company. Rental payments replace interest charges, making it Shariah-compliant. At lease end, the company can buy the equipment. This helps businesses expand without interest-based debt.

Applications Of Ijara

Ijara financing offers unique advantages for those seeking homeownership without compromising their values. It blends ethical principles with practical financial solutions. This method supports a fair and transparent path to owning a home.

Understanding the benefits of Ijara financing helps buyers make informed decisions. It suits individuals wanting to avoid interest-based loans. Here are the key benefits that make Ijara an appealing choice.

Ethical Homeownership

Ijara financing allows homebuyers to avoid paying interest, which is prohibited in Islam. The structure follows a lease-to-own model, promoting fairness and transparency. This ethical approach respects religious beliefs and ensures peace of mind. Homeowners gain property rights without compromising their values.

Financial Flexibility

Payments in Ijara are fixed rental amounts, not interest, easing budgeting. It often requires lower upfront costs compared to traditional loans. The lease term and payment schedule can be tailored to fit individual needs. This flexibility helps manage cash flow and plan for the future.

Shariah Compliance Assurance

Ijara financing strictly follows Islamic law, avoiding Riba (interest). Financial institutions offering Ijara are overseen by Shariah boards. These boards review contracts to ensure full compliance. Clients receive assurance that their financing respects religious rules and ethical standards.

Benefits Of Ijara Financing

Ijara financing in Austin, Texas offers a unique way to purchase assets without involving interest payments. It follows Islamic finance principles, making it attractive for individuals seeking Shariah-compliant options. Many residents of Austin find Ijara a practical solution for home and vehicle financing.

The city’s diverse financial market supports several providers that understand local needs. These institutions help clients through a straightforward process. Austin’s market options for Ijara financing continue to grow, reflecting increasing demand.

Local Providers

Austin hosts various banks and financial institutions offering Ijara financing. These local providers understand the community and cultural expectations. They offer tailored financing plans that meet Shariah compliance. Customers can expect personalized service and clear contract terms. Some providers also offer online support for easier access.

Application Process

The application process for Ijara financing in Austin is simple. Applicants must submit proof of income and identity. Financial providers evaluate eligibility based on income stability and credit history. The process usually involves signing a lease contract with clear payment terms. After approval, the asset is purchased by the provider and leased to the client.

Current Market Options

Current Ijara financing options in Austin vary by provider and asset type. Home financing is common, with terms ranging from 10 to 30 years. Vehicle leasing is also popular, with flexible payment schedules. Some providers include maintenance and insurance in the lease. Clients can choose plans that fit their budgets and needs.

Credit: www.temenos.com

Ijara Financing In Austin, Texas

Ijara financing offers a unique way to acquire assets without involving interest. Despite its benefits, many face challenges during the process. Understanding these common hurdles helps both clients and institutions navigate the system more smoothly.

Contract Complexity

Ijara contracts often include detailed terms and conditions. These documents can be long and filled with legal jargon. This complexity makes it hard for many clients to fully grasp their obligations. Mistakes or misunderstandings may lead to disputes later. Simplifying contract language can reduce confusion and improve trust.

Understanding Lease Terms

The lease terms in Ijara financing differ from traditional loans. Clients must understand how rental payments replace interest. They also need clarity on maintenance responsibilities and asset usage rules. Misunderstanding these terms causes frustration and delays. Clear explanations and examples help clients feel confident and informed.

Navigating Legal Frameworks

Ijara financing operates within both Shariah law and local legal systems. This dual framework can create challenges for compliance. Legal rules vary by region, affecting contract enforcement and dispute resolution. Clients and institutions must work closely with legal experts. This ensures all agreements meet religious and civil requirements.

Credit: aims.education

Frequently Asked Questions

What Is Ijara Financing?

Ijara financing is a Shariah-compliant lease-to-own agreement where a bank buys an asset and leases it to the client. The client pays rent instead of interest. After the lease term, ownership transfers to the client at a pre-agreed price. This avoids interest and ensures ethical financing.

What Is The Difference Between Murabaha And Ijara?

Murabaha is a cost-plus sale where the bank sells an asset with a fixed profit margin. Ijara is a lease-to-own contract where the bank leases an asset and transfers ownership after lease payments. Murabaha focuses on sale, while Ijara centers on leasing and eventual ownership transfer.

Is Ijara Rent To Own?

Ijara is a Shariah-compliant lease-to-own financing. You rent the asset and buy it later at a pre-agreed price.

What Is An Example Of Istisna Financing?

An example of istisna financing is a bank funding a factory’s construction. The bank pays in stages, and the client receives the completed factory later.

Conclusion

Ijara financing offers a clear way to own assets without paying interest. It follows Islamic rules by leasing first, then transferring ownership. Clients pay rent instead of interest, making it fair and simple. This method suits many needs, from homes to vehicles.

Understanding Ijara helps you choose ethical and lawful financing. It keeps costs transparent and responsibilities clear. Many find it a good option for Shariah-compliant purchases. Consider Ijara as a practical choice for your financing needs.