Are you curious about how Islamic finance offers alternatives to traditional loans? If so, understanding Murabaha could be the key.

Murabaha is a simple yet powerful concept where you buy an asset through a bank that purchases it first and then sells it to you at a clear, agreed-upon profit. This method avoids charging interest, making it compliant with Islamic law.

Imagine having full transparency on the cost and profit margin, while paying in easy installments over time. You’ll discover exactly what Murabaha is, how it works, and why it’s gaining popularity as an ethical and practical financing solution. Keep reading to unlock the secrets of this unique financial tool and see how it might fit your needs perfectly.

Murabaha Basics

Understanding the basics of Murabaha helps grasp its role in Islamic finance. This concept offers a unique way to buy and sell goods with clear terms. Murabaha avoids interest, following Islamic law. It is a simple and fair method for many people and businesses. Below are the main points to know about Murabaha.

Definition And Meaning

Murabaha is a contract where a seller discloses the cost of goods. The seller adds a known profit margin to the price. The buyer agrees to pay this total amount. This sale can be paid immediately or in installments. It is a common practice in Islamic banking for financing purchases.

Key Features

The price includes the cost plus a clear profit margin. Both buyer and seller agree on the price before the sale. Payment terms can be flexible but must be clear. The goods must be owned by the seller before selling. This method avoids hidden charges or interest fees.

Sharia Compliance

Murabaha follows Islamic law by avoiding interest, called riba. The transaction is based on trade, not loans. The profit margin is agreed upfront, ensuring transparency. The goods must exist and be delivered to the buyer. This structure promotes fairness and ethical business practices.

How Murabaha Works

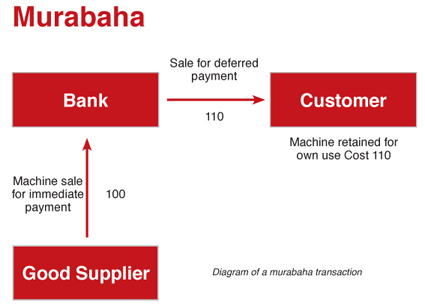

Murabaha is a popular Islamic finance method based on a clear sale contract. It involves a cost-plus-profit sale where the buyer and seller agree on the price upfront. There are two main types of Murabaha. Each type suits different business needs and customer demands. Understanding these types helps in choosing the right Murabaha structure.

Stock Murabaha

Stock Murabaha is when the bank buys goods first. The bank holds the goods in its inventory. It then sells these goods to customers with a profit margin. This type does not require a prior order from the customer. It is useful for businesses needing quick access to products. The bank takes the risk of holding the stock until it sells.

Order-based Murabaha

Order-Based Murabaha happens when the customer places an order first. The bank purchases the goods from a third party based on the customer’s request. The bank then sells the goods to the customer with a known profit margin. This method reduces the bank’s risk of holding inventory. It suits customers who want specific items without delay.

Types Of Murabaha

Understanding the legal and regulatory aspects of Murabaha is essential for its proper use. These aspects ensure that Murabaha transactions follow Islamic principles and local laws. They also protect both banks and consumers. This section covers the key legal points related to Murabaha.

Compliance With Islamic Law

Murabaha must strictly follow Islamic law, also known as Sharia. This means no interest (riba) is charged. The seller must disclose the original cost and the profit margin clearly. All terms must be transparent and agreed upon by both parties. Islamic scholars often review Murabaha contracts to ensure they meet these rules.

Banking Regulations

Islamic banks offering Murabaha must comply with local banking regulations. These rules govern how banks operate and protect the financial system. Banks need proper licenses and must follow reporting standards. Regulators check that Murabaha products do not violate conventional banking laws while respecting Islamic finance principles.

Consumer Protection

Consumer protection laws apply to Murabaha contracts to ensure fairness. These laws require clear contracts, truthful advertising, and fair treatment of customers. Borrowers should understand their payment obligations fully. Regulators may intervene if any party acts unfairly or deceives the other. This helps build trust in Islamic finance.

Credit: www.financialislam.com

Applications Of Murabaha

Murabaha financing offers a clear alternative to conventional loans. Yet, it comes with certain challenges and limitations that affect both providers and customers. Understanding these issues helps to make informed decisions about using Murabaha products.

Market Availability

Murabaha products are not equally available everywhere. Many regions have limited Islamic finance providers. This shortage restricts customer access to Murabaha financing. Smaller markets may struggle to support diverse Murabaha offerings. This limits choices and competition, affecting pricing and service quality.

Documentation And Transparency

Murabaha contracts require detailed documentation. Both parties must clearly state costs and profit margins. This process can be complex and time-consuming. Lack of transparency may lead to misunderstandings or disputes. Clear communication and proper paperwork are essential for trust. Some customers find the documentation overwhelming or confusing.

Cost Implications

Murabaha often costs more than conventional loans. The profit margin is fixed upfront and may be higher than interest rates. Additional fees for administration and documentation add to the cost. These expenses can make Murabaha less attractive for some borrowers. Careful comparison with other financing options is necessary.

Benefits Of Murabaha

The future of Murabaha holds significant promise as Islamic finance grows worldwide. This financing method continues to adapt and evolve with changing market demands and technological progress. Its appeal lies in its compliance with Sharia law, making it a preferred choice for ethical finance.

Murabaha’s role in global finance is expanding beyond traditional markets. Innovations and new trends shape its applications, offering more accessibility and efficiency. Understanding these changes helps predict how Murabaha will serve future financial needs.

Trends In Islamic Finance

Islamic finance is seeing steady growth globally. More banks and financial institutions offer Sharia-compliant products. Murabaha remains a top choice for many investors and businesses. The focus is on transparency, fairness, and risk-sharing. These principles align well with current market demands.

Technological Innovations

Technology is transforming Murabaha contracts. Digital platforms simplify documentation and approval processes. Blockchain technology ensures transparency and security in transactions. Artificial intelligence helps assess credit risk more accurately. These tools reduce costs and speed up financing.

Global Adoption

Murabaha is gaining popularity outside Muslim-majority countries. Non-Muslim investors show interest in ethical financing options. Countries in Asia, Europe, and America explore Islamic finance. Regulatory frameworks adapt to support Sharia-compliant products. This global reach opens new opportunities for Murabaha.

Credit: blogs.helsinki.fi

Credit: www.wallstreetmojo.com

Frequently Asked Questions

What Is Meant By Murabaha?

Murabaha is an Islamic finance method where a seller discloses the cost and adds a fixed profit margin. The buyer pays this agreed total, often in installments. It complies with Sharia by avoiding interest and is commonly used for asset financing like real estate or vehicles.

What Is An Example Of A Murabaha Loan?

A Murabaha loan example: a bank buys a car for a customer, then sells it to them at cost plus a fixed profit. The customer repays in installments, with transparent pricing and no interest charged.

Is Murabaha Halal Or Haram?

Murabaha is halal in Islamic finance as it follows Sharia rules, avoids interest (riba), and uses transparent cost-plus-profit sales.

What Are The Two Types Of Murabaha?

The two types of Murabaha are: 1) Bank buys goods without prior customer promise. 2) Bank buys goods ordered by the customer and sells them to the same customer.

Conclusion

Murabaha offers a clear, ethical way to finance purchases. It avoids interest by using a cost-plus profit model. Buyers and sellers agree on the price upfront. This method fits well with Islamic financial rules. Many people use Murabaha for home, car, or business needs.

It creates transparency and trust between parties. Understanding Murabaha helps make better financial choices. It shows how finance can align with faith and fairness.