Are you unsure whether your investments follow Islamic principles? Knowing if an investment is halal is crucial for staying true to your faith while growing your wealth.

But how can you confidently check if a stock or asset meets halal standards? This guide will walk you through simple steps to evaluate your investments, so you can make decisions that align with your values. Keep reading to discover practical tools and tips that make halal investing clear and straightforward for you.

Halal Investment Basics

Understanding the basics of halal investment helps Muslims invest according to Islamic principles. It ensures money grows without violating religious rules. This guide covers the fundamental concepts and common business activities to avoid.

Knowing these basics makes it easier to choose halal investments. It also helps protect your savings from non-permissible sources.

Key Principles Of Halal Investing

Halal investing follows rules based on Islamic law, or Shariah. It avoids interest (riba), which is forbidden in Islam. Investments must not involve excessive uncertainty or gambling (gharar and maysir). The business activities should be ethical and lawful. Profit and loss sharing is encouraged instead of fixed interest returns. Transparency and fairness guide all transactions. These principles ensure investments are pure and acceptable.

Common Non-halal Business Activities

Some industries and activities are not allowed in halal investing. These include alcohol production and sales. Gambling and casino businesses are forbidden. Pork products and related companies are also prohibited. Financial services that rely on interest, like conventional banks, are not halal. Entertainment that promotes immorality is avoided. Avoiding these sectors keeps investments compliant with Islamic values.

Credit: www.wahed.com

Screening Stocks For Halal Compliance

Screening stocks for halal compliance is essential for ethical investing. It helps ensure that investments align with Islamic principles. This process involves analyzing a company’s business activities and financial health. It filters out companies involved in forbidden industries or practices.

Careful screening protects your money from non-compliant investments. It also supports businesses that follow ethical and moral guidelines. The screening process can be simplified by focusing on key areas like revenue sources, financial ratios, and using specialized tools.

Primary Revenue Sources To Avoid

Start by checking what the company earns most of its money from. Avoid companies involved in alcohol, gambling, pork products, and tobacco. Also exclude firms dealing with conventional banking and insurance. These activities are not allowed in Islamic finance. Focus on companies with clean and halal main business activities.

Financial Ratios In Screening

Financial ratios help assess if a company’s finances comply with Shariah rules. Look at debt levels; high debt often means the company uses interest-based loans, which are not halal. Check if the company’s cash and interest income are minimal. Ratios like debt to equity and interest income to total revenue should be low. These numbers help weed out companies with non-compliant financial practices.

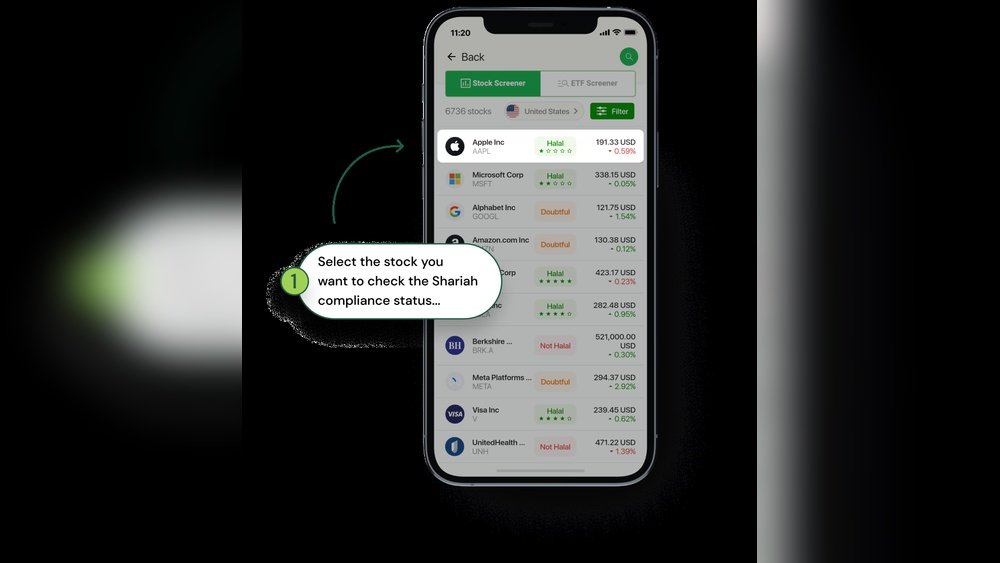

Using Halal Stock Screeners

Halal stock screeners are online tools designed to help investors find Shariah-compliant stocks quickly. They use databases and set filters based on Islamic rules. These screeners check business activities and financial ratios automatically. Many screeners follow standards like AAOIFI or S&P Shariah indices. Using these tools saves time and reduces errors in manual screening.

Tools And Resources

Finding out if an investment is halal needs the right tools and resources. These help you avoid companies that don’t follow Islamic rules. They make checking easier and faster. You get clear info on stocks and funds that meet halal standards. Tools also guide you on the financial practices allowed in Islam.

Using reliable resources saves time and reduces mistakes. You can make smart choices with confidence. Many tools are free and easy to use. They suit beginners and experienced investors alike.

Popular Halal Investing Apps

Several apps help Muslims invest in halal stocks. These apps screen companies based on Shariah rules. They check business activities and financial ratios. Apps like Islamicly and Musaffa offer simple interfaces. You can track your portfolio and get alerts about changes. Some apps also provide educational content for better understanding. Using these apps keeps your investments compliant and transparent.

Online Halal Stock Lists

Many websites publish updated lists of halal stocks. These lists show companies that follow Islamic guidelines. They exclude businesses involved in alcohol, gambling, or interest-based finance. Lists from trusted sources use strict screening methods. You can download or view them anytime for research. These lists are a good starting point before investing. They help avoid companies that break halal rules.

Community And Scholar Guidance

Islamic scholars and community groups offer valuable advice on halal investing. They explain complex rules in simple words. You can join forums or attend webinars for support. Scholars review new investment options and issue fatwas. Their guidance ensures your money stays within halal boundaries. Listening to experts prevents confusion and mistakes. Engaging with the community builds trust and confidence in your choices.

Credit: blog.tabadulat.com

Steps To Verify Halal Status

Verifying if an investment is halal requires careful steps. Each step helps ensure the investment follows Islamic principles. These steps reduce risks and keep your money clean.

Start with understanding the company’s core activities. Then, analyze financial details. Finally, seek expert advice to confirm compliance.

Researching Company Activities

Begin by studying what the company does. Avoid companies involved in alcohol, gambling, or pork products. Check if the company earns from interest or forbidden businesses. Focus on companies with clear, halal operations.

Checking Financial Statements

Review the company’s financial reports carefully. Look for interest income and high debt levels. Ensure that non-halal income is minimal or absent. Compare financial ratios with Islamic finance standards. This step helps identify hidden non-compliant elements.

Consulting Shariah Advisors

Find a qualified Shariah advisor or scholar. They have deep knowledge of Islamic finance rules. Advisors can confirm if an investment meets halal criteria. Their guidance adds confidence to your decision. Trust their opinion to avoid mistakes.

Ethical Investing Strategies

Ethical investing strategies help ensure your investments follow halal principles. These strategies focus on choosing investments that align with Islamic values. They avoid prohibited activities and promote responsible financial growth. Ethical investing also reduces risks by promoting transparency and fairness in business.

Diversifying Within Halal Options

Diversifying spreads your money across different halal investments. It lowers risk by avoiding too much focus on one sector. Choose stocks, real estate, and businesses that comply with Shariah law. This approach balances growth and safety. It helps protect your portfolio from sudden losses.

Avoiding Speculative Practices

Speculative practices involve high risks and uncertain outcomes. Islamic finance forbids gambling or excessive uncertainty in investing. Avoid day trading and quick flips. Focus on investments with clear, stable value. This keeps your portfolio halal and reduces stress.

Long-term Ethical Growth

Ethical investing aims for steady growth over time. Choose companies with good social and environmental records. Look for businesses that treat workers fairly and avoid harmful products. Long-term growth builds wealth without compromising your values. Patience and discipline are key to success.

Common Challenges

Checking if an investment is halal involves facing several common challenges. These challenges can make the process confusing and time-consuming. Understanding these difficulties helps investors make better choices aligned with Islamic principles.

Ambiguous Business Models

Some companies have unclear business activities. They may earn money from both halal and haram sources. This mix creates confusion about the investment’s purity. Investors must dig deeper to know the real nature of the business. Public reports might not always show the full picture. This ambiguity requires careful analysis and expert advice.

Varying Interpretations Of Shariah

Islamic scholars sometimes disagree on what is halal. Different schools of thought apply different rules. What one scholar permits, another may forbid. This causes uncertainty for investors who follow Islamic law. It is important to consult trusted scholars or advisors. Understanding the reasoning behind each view helps in making informed decisions.

Keeping Up With Market Changes

Markets change constantly and so do companies’ activities. A business that was halal yesterday might not be halal today. New products or partnerships can affect compliance. Investors need to review their investments regularly. Staying updated prevents unknowingly holding haram assets. This ongoing effort is key to maintaining a halal portfolio.

Credit: academy.musaffa.com

Frequently Asked Questions

What Makes An Investment Halal?

An investment is halal if it complies with Islamic principles. It must avoid interest (riba), gambling (maysir), and investing in prohibited industries like alcohol or pork. The company’s business model should align with Shariah law for the investment to be considered halal.

How To Check If A Stock Is Halal?

To check if a stock is halal, review the company’s business activities and financial ratios. Use Shariah-compliant stock screeners or consult Islamic finance scholars. Ensure the company avoids interest income and prohibited sectors to confirm its halal status.

Which Financial Ratios Determine Halal Investments?

Common financial ratios include debt-to-equity, interest income, and liquidity ratios. A halal investment typically has low debt and minimal interest income. These ratios help screen companies to ensure they follow Islamic finance principles and avoid haram financial practices.

Are There Free Tools For Halal Stock Screening?

Yes, there are free halal stock screeners online. They evaluate companies based on Shariah compliance and filter out prohibited sectors. Examples include Islamicly, Musaffa, and other dedicated halal investment platforms to help investors find halal stocks easily.

Conclusion

Checking if an investment is halal helps you follow Islamic principles. Start by examining the company’s core business activities. Avoid companies involved in alcohol, gambling, or interest-based finance. Use trusted halal stock screeners and seek advice from knowledgeable scholars. Regularly review your investments to stay compliant.

Keeping your investments halal supports both your faith and financial goals. Simple steps make a big difference in ethical investing. Stay informed and choose wisely for peace of mind.