Have you ever wondered how finance can work without charging interest or engaging in risky speculation? Islamic finance offers a fascinating alternative rooted in centuries-old principles that guide money management with fairness and ethical values.

Understanding the history of Islamic finance is more than just learning about banking—it’s about discovering a system designed to promote justice, shared prosperity, and social responsibility. By exploring its origins, evolution, and key milestones, you’ll gain insight into how this unique financial approach continues to shape economies worldwide.

Ready to uncover the story behind Islamic finance and see how it might change the way you think about money? Keep reading to find out.

Credit: www.slideteam.net

Origins Of Islamic Finance

The origins of Islamic finance trace back over 1,400 years to the early days of Islam. This financial system grew from the need to conduct trade and business according to Islamic teachings. Islamic finance is not just a modern invention; it reflects deep-rooted economic principles established by the Prophet Muhammad and his followers.

These principles guide Muslims on how to manage money, invest, and share wealth fairly. The system aims to avoid exploitation and promote social justice. Its foundation rests on religious texts and ethical guidelines that shape financial transactions today.

Early Islamic Economic Principles

Islamic economic principles began in the 7th century with the rise of Islam. The early Muslim community emphasized fairness, honesty, and responsibility in business. Trade was encouraged, but it had to be free from harm and deceit. Wealth was seen as a trust from God, meant to be used wisely and shared with others.

Muslims were taught to avoid excessive risk and uncertainty in deals. Profit was allowed, but it must come from real economic activity. These principles set the stage for a financial system based on partnership and mutual benefit.

Prohibition Of Usury In Islam

One of the most important rules in Islamic finance is the prohibition of usury, known as riba. This means charging or paying interest on loans is forbidden. Islam views interest as unfair because it exploits the borrower and creates inequality.

The ban on usury aims to protect people from debt traps and promote ethical lending. Instead of interest, Islamic finance encourages profit-sharing and risk-sharing arrangements. This principle helps build a financial system focused on justice and cooperation.

Role Of The Quran And Hadith

The Quran and Hadith provide the core guidance for Islamic finance. The Quran, the holy book of Islam, contains verses that explain economic justice and fairness. It stresses honesty in trade and forbids unjust gain.

The Hadith, sayings and actions of the Prophet Muhammad, offer practical examples of how to conduct financial transactions. Together, these sources form the legal and moral framework for Islamic finance. Scholars use them to develop rules that comply with Shariah law.

Credit: skrishnamachari.wordpress.com

Medieval Islamic Finance Practices

Medieval Islamic finance practices laid the foundation for modern Islamic banking. These practices emerged during the Islamic Golden Age, a period of great intellectual and economic growth. Islamic scholars and merchants developed unique financial ideas based on religious principles. They aimed to create a fair and ethical economic system. The methods they used helped expand trade and business across continents. Understanding these practices reveals the roots of contemporary Islamic finance.

Trade And Commerce In The Islamic Golden Age

Trade flourished under Islamic rule from the 8th to 14th centuries. Cities like Baghdad, Cairo, and Damascus became major trading hubs. Merchants followed Islamic laws that banned interest (riba) and promoted profit-sharing. They used partnerships and trusts to manage business risks. Trade routes linked the Middle East with Asia, Africa, and Europe. This network boosted the exchange of goods, ideas, and financial knowledge.

Early Financial Contracts And Instruments

Islamic finance introduced innovative contracts to support commerce. The mudarabah contract allowed one party to provide capital while the other managed the business. Profits were shared, and losses borne by the investor. The musharakah contract involved joint ventures with shared risks and profits. Islamic scholars also developed sukuk, early forms of bonds based on asset ownership. These tools followed Sharia rules and avoided interest, supporting ethical finance.

Influence On Global Trade Networks

Medieval Islamic finance influenced global trade by promoting trust and cooperation. Islamic merchants used letters of credit similar to modern banking. These financial instruments helped reduce risks in long-distance trade. The ethical framework attracted diverse traders and investors. Islamic finance practices spread along trade routes to Europe, Africa, and Asia. This legacy shaped the development of financial systems beyond the Islamic world.

Decline And Revival

The foundations of contemporary Islamic finance rest on principles shaped centuries ago. These principles guide financial activities while aligning with Islamic law, or Shariah. The system promotes fairness, transparency, and ethical investing. It offers an alternative to conventional finance by emphasizing moral and social values. Understanding these foundations helps grasp how Islamic finance operates today.

Core Principles And Shariah Compliance

Islamic finance is rooted in Shariah, the Islamic legal framework. All transactions must comply with Shariah rules. These rules forbid activities harmful to society or unethical. Honesty and justice are essential in every financial deal. Contracts must be clear and free from deceit. Shariah boards oversee and approve financial products. Compliance ensures that investments respect Islamic teachings.

Profit-sharing And Risk Sharing Models

Profit-sharing is a key feature of Islamic finance. Investors and entrepreneurs share profits and losses. This model reduces the risk of unfair gain or loss. Partnerships like Mudarabah and Musharakah reflect this approach. They encourage cooperation and mutual benefit. Risk sharing motivates all parties to work diligently. This system fosters trust and long-term relationships.

Ban On Interest And Speculation

Charging interest, known as Riba, is strictly forbidden. Islamic finance prohibits earning money from money alone. Instead, profit must come from real economic activity. Speculation, or Gharar, is also banned due to its uncertainty. Contracts must avoid excessive risk or ambiguity. This rule protects parties from unfair loss or exploitation. It promotes stability and ethical investment.

Foundations Of Contemporary Islamic Finance

Islamic banking institutions have grown steadily since their inception. They provide financial services that follow Islamic law, called Shariah. This growth reflects a global demand for ethical banking options. Islamic banks avoid interest and focus on profit-sharing and asset-backed financing. Their rise shows the appeal of faith-based finance worldwide.

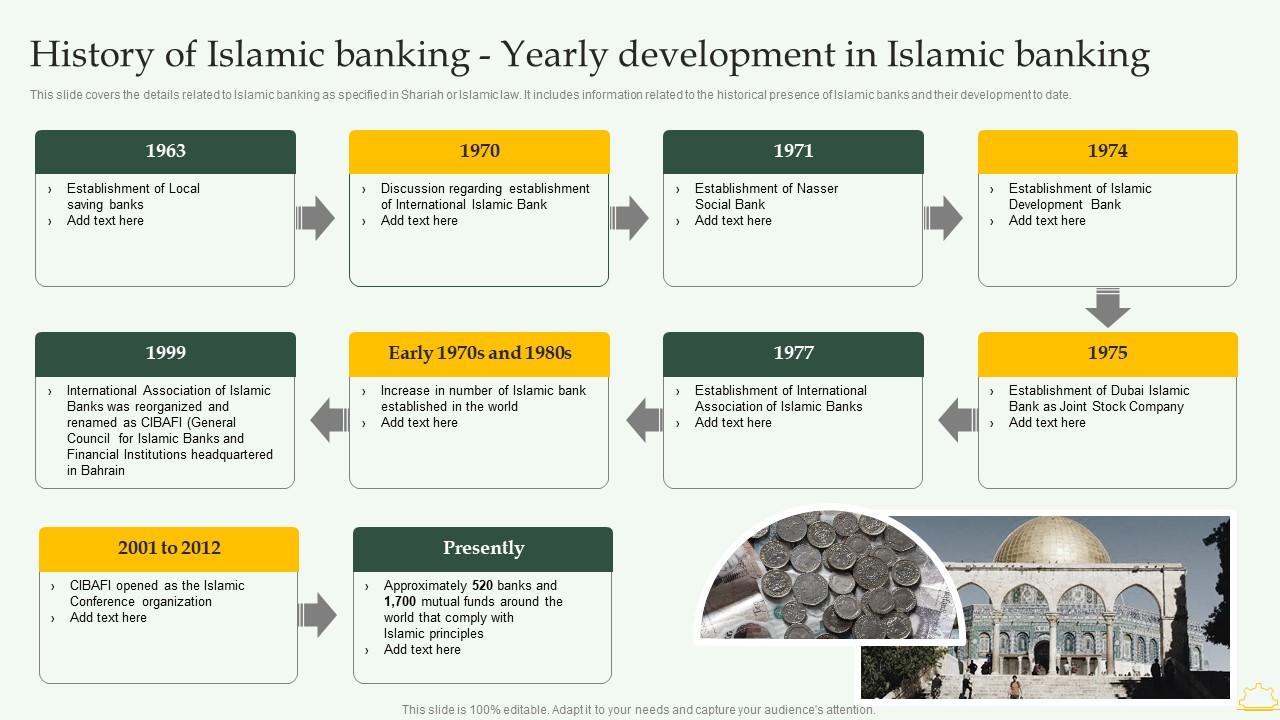

First Islamic Banks And Their Impact

The first Islamic bank started in the 1970s. Dubai Islamic Bank was the pioneer, founded in 1975. It offered banking without charging interest, which was new then. This bank showed that Shariah-compliant finance could work in modern markets. It encouraged more banks to adopt Islamic principles. Customers welcomed an alternative to conventional banks. The success of these early banks boosted confidence in Islamic finance.

Expansion In The Middle East And Southeast Asia

Islamic banking quickly expanded in the Middle East. Countries like Saudi Arabia and Kuwait launched their own Islamic banks. Southeast Asia, especially Malaysia and Indonesia, also saw rapid growth. Malaysia became a global leader by creating strong regulations. These countries built Islamic finance centers to attract global investors. Expansion helped spread Islamic banking products and services. It also promoted economic growth in these regions.

Islamic Finance In Western Countries

Islamic banking reached Western countries in the 1990s. Banks in the UK, the US, and Europe began offering Shariah-compliant services. These banks serve Muslim communities and ethical investors. Western countries adapted Islamic finance to fit their laws. This helped increase awareness and acceptance of Islamic banking. Now, Islamic finance is part of the global financial system. It offers an inclusive option for diverse customers.

Growth Of Islamic Banking Institutions

Islamic financial products follow strict rules based on Islamic law, or Shariah. These products avoid interest and invest in ethical ways. They promote fairness, transparency, and shared risk. Many Muslims use these products to align their finances with their beliefs. Islamic finance has unique contracts and tools that differ from conventional finance.

Murabaha And Ijara Contracts

Murabaha is a cost-plus-sale contract. The seller buys an item and sells it to the buyer at a marked-up price. The buyer pays this price over time. This method avoids interest and is popular for home and car financing.

Ijara means leasing. It allows a person to rent an asset from an owner. The lessee pays rent and uses the asset. At the lease end, the asset can be sold or transferred. Ijara is often used for equipment and property.

Sukuk (islamic Bonds)

Sukuk are financial certificates like bonds. They represent ownership in a tangible asset or business. Instead of interest, Sukuk holders earn profits from the asset. This method shares risk and reward among investors. Sukuk finance projects, infrastructure, and companies.

Takaful (islamic Insurance)

Takaful is a cooperative insurance system. Participants contribute money into a pool. The pool helps members in need, like in case of loss or damage. It avoids uncertainty and gambling, which are forbidden in Islam. Takaful promotes mutual support and shared responsibility.

Islamic Financial Products

The regulatory and legal framework forms the backbone of Islamic finance. It ensures all financial activities follow Islamic law, known as Shariah. This framework guides institutions to operate ethically and transparently. It supports the growth and trust in Islamic financial products worldwide.

Shariah Boards And Compliance Mechanisms

Shariah boards play a vital role in Islamic finance. They consist of scholars who understand Islamic law deeply. These boards review and approve financial products and contracts. Their job is to ensure no interest (riba) or forbidden activities occur.

Compliance mechanisms help maintain Shariah standards daily. Financial institutions use audits and reports to monitor their activities. This process builds confidence among investors and customers. It also protects the reputation of Islamic finance globally.

International Standards And Organizations

Several bodies set international standards for Islamic finance. The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) is one key example. It creates rules for accounting, auditing, and governance in Islamic finance.

The Islamic Financial Services Board (IFSB) promotes stability and soundness in the industry. These organizations help unify practices across different countries. They make Islamic finance more reliable and accessible worldwide.

Challenges In Harmonizing Global Regulations

Harmonizing regulations across countries remains a major challenge. Different nations apply Shariah interpretations differently. This diversity creates inconsistencies in financial products and services.

Legal systems and regulatory frameworks vary widely. Some countries have strong Islamic finance laws, while others are still developing them. These differences slow down the global integration of Islamic finance.

Efforts continue to create common standards. Collaboration between regulators and scholars is essential. A unified framework would support growth and cross-border investments.

Regulatory And Legal Framework

Islamic finance has significantly influenced global finance through its unique principles. Its growth introduced new ways of managing money that focus on fairness and ethics. The impact reaches beyond Muslim countries to many international markets. Islamic finance promotes risk-sharing and asset-backed financing. These features offer alternatives to conventional banking and investing methods. This section explores how Islamic finance shapes ethical finance, supports stability during crises, and drives future innovations.

Contribution To Ethical Finance

Islamic finance promotes ethical investment and social justice. It prohibits interest (riba), excessive uncertainty (gharar), and gambling (maysir). This encourages transparency and fairness in financial transactions. Many investors seek Islamic finance for its moral values. It supports projects that benefit society and avoid harm. Islamic finance emphasizes real economic activity and asset backing. This reduces speculation and promotes responsible lending. Its principles inspire growing interest in ethical finance worldwide.

Role During Financial Crises

Islamic finance showed resilience during global financial crises. Its risk-sharing model limits excessive debt and risky lending. During the 2008 crisis, Islamic banks faced fewer losses than conventional banks. The absence of interest-based lending reduced vulnerability to market shocks. Islamic finance encourages long-term partnerships between lenders and borrowers. This creates financial stability and reduces systemic risk. Many countries now consider Islamic finance as a tool for crisis management.

Future Trends And Innovations

Technology is driving new growth in Islamic finance. Digital banking, blockchain, and fintech improve access and transparency. Sukuk (Islamic bonds) and green finance gain popularity globally. Regulators work to standardize rules for wider adoption. Islamic finance adapts to modern needs while keeping core values. Its future includes more inclusive products for individuals and businesses. Innovation will help Islamic finance expand its role in global markets.

Credit: carreralearning.com

Frequently Asked Questions

Who Is The Father Of Islamic Finance?

Dr. Hussein Hamid Hassan is known as the father of contemporary Islamic finance. He pioneered modern Islamic banking principles.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total assets. This ensures financial stability and Shariah compliance.

What Is The Summary Of Islamic Finance?

Islamic finance follows Sharia law, promoting ethical money management without interest. It emphasizes profit-sharing, risk-sharing, and social justice in banking and investments.

Which Country Introduced Islamic Banking?

Islamic banking was first introduced in Egypt during the 1960s. It follows Sharia law principles, prohibiting interest.

Conclusion

Islamic finance has deep roots in history and faith. It guides money use with clear moral rules. This system avoids interest and promotes shared risk. It grew from early Islamic teachings to a global practice. Today, many seek ethical finance inspired by these principles.

Understanding its past helps appreciate its role today. The story of Islamic finance is one of faith and fairness.