When it comes to managing your money or growing your investments, the choices you make can shape your financial future in big ways. You might have heard about Islamic finance and conventional finance, but do you really understand how they differ?

Choosing between these two isn’t just about numbers—it’s about values, risks, and how profits are earned. What if the way you handle your money could align more closely with your ethical beliefs and still help you succeed? You’ll discover the key differences between Islamic finance and conventional finance, how each system works, and why it matters to your wallet and your principles.

Ready to find out which approach fits you best? Keep reading to make smarter, more informed financial decisions.

Core Principles

The core principles of Islamic finance differ greatly from those of conventional finance. These principles shape how financial products and services are designed and offered. Islamic finance is rooted in Shariah law, which guides ethical and moral conduct. Conventional finance, on the other hand, focuses primarily on profit maximization and risk management.

Understanding these core principles helps to see why Islamic finance appeals to many seeking ethical and fair financial solutions. Each principle affects how money is earned, shared, and invested.

Interest Vs Profit Sharing

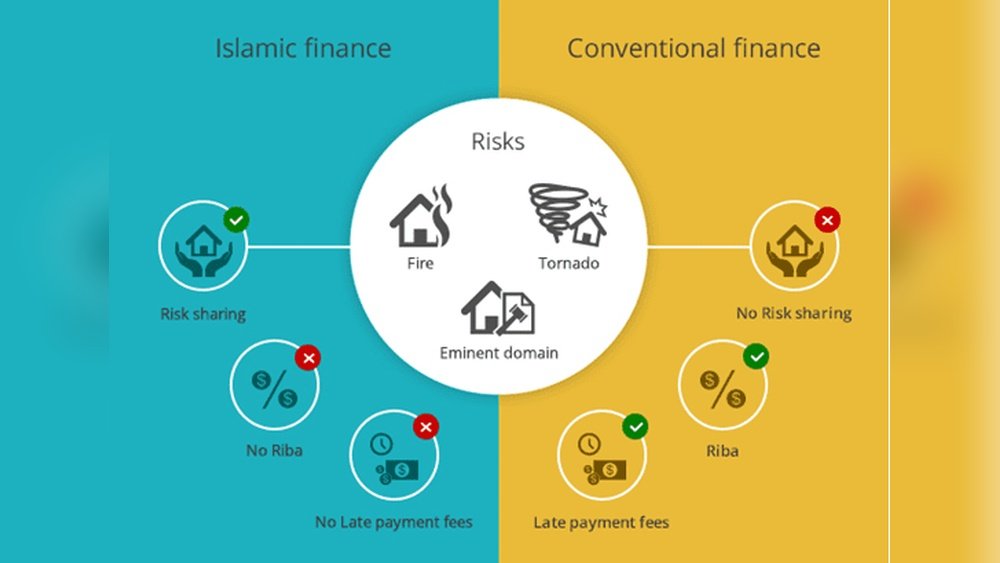

Conventional finance relies heavily on interest. Banks charge interest on loans and pay interest on deposits. Islamic finance forbids interest, known as “riba,” as it is seen as unfair gain. Instead, profit sharing is used. Investors and entrepreneurs share profits and losses together. This creates a partnership rather than a debtor-creditor relationship.

Risk Distribution

Risk in conventional finance is mostly on the borrower. The lender expects full repayment plus interest regardless of success. Islamic finance shares risk between parties. Both profit and loss are shared fairly. This encourages careful investment decisions and fairness in business dealings.

Ethical Restrictions

Islamic finance follows strict ethical rules. Investments in alcohol, gambling, and tobacco are forbidden. Conventional finance has no such restrictions. Islamic finance promotes social justice and avoids harm. This attracts investors who want their money to support positive causes and avoid unethical businesses.

Credit: www.researchgate.net

Financial Products

Financial products form the core of both Islamic and conventional finance systems. These products help individuals and businesses manage money and grow wealth. Each system offers unique structures shaped by its principles and rules. Understanding these differences helps in making informed financial choices.

Islamic finance follows Shariah law, which prohibits interest and emphasizes risk-sharing. Conventional finance focuses on interest-based earnings and fixed returns. These contrasting foundations create distinct financial products in both systems.

Loan Structures

Conventional loans charge interest over the loan period. Borrowers repay the principal plus interest. Islamic finance bans interest, called riba, as it is unfair profit. Instead, loans use profit-sharing or cost-plus models.

One common Islamic loan is Murabaha. The lender buys an item and sells it to the borrower at a higher price. The borrower pays in installments without interest. Another model is Mudarabah, where profits and losses are shared between lender and borrower.

Investment Models

Conventional investments often involve stocks, bonds, and mutual funds. Returns come from dividends, interest, or capital gains. Islamic investments avoid businesses that deal with alcohol, gambling, or pork.

Islamic finance uses profit-sharing models like Mudarabah and Musharakah. Investors and entrepreneurs share profits and losses. These models promote fairness and reduce unjust risk transfer. Transparency and ethical investing are key in Islamic investments.

Mortgage Differences

Conventional mortgages charge interest on borrowed money. Borrowers repay the loan with interest over time. Islamic mortgages avoid interest and use alternative contracts.

One Islamic mortgage is Ijara, or leasing. The bank buys the property and leases it to the buyer. The buyer pays rent and eventually owns the home. Another is Diminishing Musharakah, where ownership gradually transfers from bank to buyer.

Islamic mortgages focus on shared ownership and risk. This approach aligns with Islamic ethics and avoids riba.

Customer Relations

Customer relations form the heart of finance. The way banks and financial institutions treat their clients shapes trust and long-term loyalty. Islamic finance and conventional finance differ deeply in this regard. These differences influence how customers feel about their financial choices and partnerships. Understanding these distinctions helps customers make better decisions aligned with their values and needs.

Partnership Approach

Islamic finance treats the customer as a partner. Both parties share profits and losses. This shared risk builds a strong bond. Customers feel more involved and respected. Conventional finance views customers mainly as debtors. The bank lends money and expects fixed interest. The relationship is more transactional and less cooperative.

Creditor-debtor Dynamics

In Islamic finance, the creditor and debtor roles blend into partnership roles. The bank invests alongside the customer. Both benefit from the success or face losses together. This approach reduces unfair burden on the customer. Conventional finance keeps creditor and debtor roles separate. The borrower must repay principal plus interest. The risk is mostly on the borrower’s side.

Transparency And Disclosure

Islamic finance emphasizes clear disclosure of all terms. Customers know how their money is used. Investments must meet ethical and religious standards. This transparency helps customers avoid forbidden activities. Conventional finance also discloses terms but often lacks ethical filters. Customers may not always know where their money goes. Transparency in Islamic finance builds greater trust and confidence.

Credit: www.youtube.com

Regulatory Framework

The regulatory framework distinguishes Islamic finance from conventional finance. It shapes how financial products are created, approved, and supervised. The rules ensure compliance with either Shariah principles or secular financial laws. These regulations help maintain trust, protect consumers, and promote market stability.

Shariah Compliance

Shariah compliance is the core of Islamic finance regulation. Financial products must avoid interest (riba), excessive uncertainty (gharar), and unethical investments. Each product undergoes review by a Shariah board made up of Islamic scholars. This board ensures contracts follow Islamic law and ethical standards. Compliance certification builds confidence among Muslim investors and clients.

Conventional Financial Laws

Conventional finance operates under national and international financial laws. These laws focus on risk management, transparency, and consumer protection. Interest-based lending and trading are standard practices. Regulators monitor banks and financial institutions to prevent fraud and ensure solvency. The legal framework allows broad financial innovation but does not restrict based on religious principles.

Role Of Islamic Development Bank

The Islamic Development Bank (IsDB) supports the growth of Islamic finance worldwide. It provides guidance on best practices and helps harmonize Shariah standards. The IsDB funds projects that meet Islamic ethical criteria and promote social welfare. It also assists member countries in developing regulatory frameworks compatible with Islamic finance. The bank plays a key role in building trust and expanding the Islamic financial market.

Market Impact

The market impact of Islamic finance compared to conventional finance is significant and growing. Islamic finance follows Shariah principles, avoiding interest and promoting ethical investments. This approach influences global financial markets by attracting a diverse group of investors. The distinct features of Islamic finance create new opportunities and challenges for the financial industry.

Growth Of Islamic Finance

Islamic finance has expanded rapidly in recent years. Many countries have adopted Islamic banking systems. This growth is driven by demand for ethical and interest-free financial products. Islamic finance now covers banking, insurance, and investment sectors. Its steady rise challenges the dominance of conventional finance in many regions.

Global Reach

Islamic finance is no longer limited to Muslim-majority countries. It has spread to Europe, North America, and Asia. Financial institutions worldwide offer Shariah-compliant products. This global reach helps diversify financial markets and attract new clients. Cross-border investments and partnerships increase due to Islamic finance principles.

Challenges And Opportunities

Islamic finance faces regulatory and standardization challenges. Different countries have varying interpretations of Shariah law. This affects product development and market acceptance. Despite challenges, opportunities exist in emerging markets and digital finance. Innovation in Islamic fintech promises to enhance accessibility and efficiency. The future holds potential for balanced coexistence with conventional finance.

Ethical Considerations

Ethical considerations form the core difference between Islamic finance and conventional finance. Islamic finance is guided by moral principles derived from Shariah law. These principles ensure fairness, transparency, and social welfare in financial dealings. Conventional finance mainly focuses on profit maximization, sometimes overlooking ethical concerns. Understanding these ethical distinctions helps in choosing the right financial system for individual values.

Prohibited Sectors

Islamic finance forbids investment in sectors that harm society or violate Islamic teachings. These include alcohol, gambling, pork products, and weapons manufacturing. Conventional finance places no restrictions on industry type. This ethical screening helps Muslims avoid supporting harmful businesses. It promotes a socially responsible investment portfolio aligned with faith.

Social Responsibility

Islamic finance emphasizes social justice and community well-being. It encourages profit sharing and risk sharing among participants. Financial transactions must benefit all parties fairly. Conventional finance often prioritizes individual gains over social welfare. Islamic finance also supports charitable giving through mandatory almsgiving called Zakat. This system integrates ethics with economic activity for positive societal impact.

Wealth Accumulation Limits

Islamic finance discourages excessive wealth accumulation and exploitation. It promotes moderate profit through fair trade and ethical investment. Charging or paying interest (Riba) is strictly prohibited to avoid unfair gain. Conventional finance allows interest-based lending, which can increase wealth inequality. Islamic principles aim to balance wealth distribution and reduce social disparities through ethical limits.

Technological Influence

Technology shapes both Islamic finance and conventional finance. It changes how people access services and manage money. Both systems adopt digital tools but follow different rules. This section explores digital banking trends, cryptocurrency views, and the future of finance in these systems.

Digital Banking Trends

Digital banking grows fast worldwide. Islamic banks create apps and websites that follow Shariah rules. They avoid interest and risky investments. Conventional banks focus on speed, convenience, and variety of services.

Islamic digital banks use smart contracts to ensure fair deals. They also offer transparent investment options. Conventional banks often use AI for credit scoring and fraud detection. Both improve customer experience but with distinct goals.

Cryptocurrency Perspectives

Cryptocurrency remains controversial in Islamic finance. Scholars debate if it fits Shariah law. Some accept it as a currency, others see it as speculation. Conventional finance embraces crypto as an investment and payment method.

Islamic finance stresses real value and asset backing. Many Islamic experts want clear guidelines on crypto use. Conventional finance companies invest heavily in blockchain and crypto technology. The gap between views affects adoption rates.

Future Of Finance

The future blends technology with finance rules. Islamic finance aims to maintain ethical values using new tech. Conventional finance pushes innovation for profit and efficiency. Both explore blockchain for transparency and security.

Artificial intelligence will personalize banking services for all users. Islamic finance may use AI to ensure compliance with religious laws. Conventional finance will use AI to reduce costs and risks. The future holds opportunities for both systems to grow.

Credit: www.slideteam.net

Frequently Asked Questions

Is Islamic Finance Better?

Islamic finance avoids interest, promotes ethical investments, and shares risk between parties. It suits those valuing transparency and ethical principles. Its profit-sharing model differs from conventional interest-based finance, offering an alternative aligned with Islamic law. Whether it is better depends on personal values and financial goals.

Do Muslims Get 0% Interest?

Muslims do not receive or pay interest (riba) as Islam prohibits it. Islamic finance uses profit-sharing, leasing, and trade-based models instead.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total capital. It ensures financial stability and Shariah compliance.

What Are The Disadvantages Of Islamic Mortgage?

Islamic mortgages require lender ownership of the property, limiting borrower control. They often involve higher costs and complex contracts. Limited availability and stricter eligibility can restrict access. Profit rates may exceed conventional interest. These factors may reduce flexibility and increase expenses compared to conventional mortgages.

Conclusion

Islamic finance and conventional finance serve different needs. Islamic finance avoids interest and promotes ethical investing. Conventional finance relies on interest and often accepts higher risks. Both systems offer unique benefits and challenges. Choosing the right one depends on your values and financial goals.

Understanding these differences helps make smarter money decisions. Each approach shapes how money grows and circulates in society. Think about what aligns best with your beliefs and plans.