Are you curious about how Islamic finance is shaping the future of banking in Pakistan? If you want to understand a financial system that aligns with ethical values and religious principles, this is the place to start.

Islamic finance in Pakistan offers an alternative to conventional banking by focusing on profit-sharing and avoiding interest, which many find more fair and transparent. Whether you are a business owner, investor, or someone looking for ethical financial solutions, learning about Islamic finance can open new doors for your money.

Keep reading to discover how this growing sector works, why it matters to you, and how it could change the way you manage your finances.

Islamic Finance Principles

Islamic finance in Pakistan follows clear principles that guide all financial activities. These principles are based on Islamic law, called Shariah. They ensure finance is fair, ethical, and free from exploitation. Understanding these principles helps explain why Islamic finance works differently from conventional banking.

Prohibition Of Interest

Islamic finance strictly bans interest, known as riba. No one can charge or pay interest on loans. Instead, earnings come from real economic activity. This rule promotes fairness and prevents exploitation of borrowers.

Profit And Loss Sharing

In Islamic finance, profits and losses are shared between parties. Both investors and entrepreneurs share risks and rewards. This encourages cooperation and fairness in business. It also reduces the chance of one party bearing all the loss.

Asset-backed Transactions

All Islamic financial transactions must be backed by real assets. Money cannot be traded alone without an underlying asset. This rule ensures that deals are based on tangible value, not speculation or uncertainty.

Ethical Investment Guidelines

Investments in Islamic finance follow strict ethical rules. Businesses involved in gambling, alcohol, or harmful products are not allowed. This ensures money supports positive and socially responsible activities.

Credit: www.iflr.com

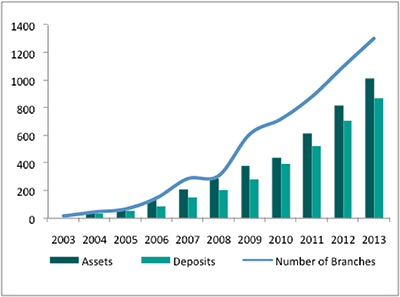

Growth Of Islamic Banking In Pakistan

Islamic banking in Pakistan has seen steady growth over the past decades. This growth reflects the increasing demand for financial services that comply with Islamic law. More people prefer banking options free from interest, aligning with their religious beliefs. The sector continues to expand, offering diverse products and services. It plays an important role in Pakistan’s financial landscape today.

Historical Development

The roots of Islamic banking in Pakistan date back to the 1970s. Early efforts focused on creating interest-free banking models. In the 1980s, the government introduced Islamic banking schemes. The 2000s brought formal licensing for Islamic banks. This era marked the start of rapid sector growth. Today, many banks offer Islamic banking windows or full-fledged services.

Government Support And Regulations

The Pakistani government supports Islamic banking through laws and policies. It encourages banks to develop Shariah-compliant products. Legal frameworks ensure transparency and protect consumers. Tax incentives motivate banks to invest in Islamic finance. Government initiatives aim to widen access and improve service quality.

Role Of State Bank Of Pakistan

The State Bank of Pakistan leads the regulation of Islamic banking. It issues guidelines to ensure Shariah compliance. The bank monitors financial stability and risk management. It promotes innovation while safeguarding customer interests. Training and awareness programs by the State Bank help build trust in Islamic finance.

Market Expansion And Customer Base

Islamic banking now serves millions of customers across Pakistan. Urban and rural populations show growing interest. Banks offer products for personal, business, and investment needs. The sector attracts young and middle-aged adults seeking ethical finance. Continuous product development meets diverse financial requirements.

Key Islamic Finance Products

Islamic finance in Pakistan offers several unique products that follow Shariah principles. These products avoid interest and focus on profit-sharing, trade, and partnership. Understanding these key products helps grasp how Islamic finance works in the country.

Murabahah (cost-plus Financing)

Murabahah is a common Islamic finance product used for buying goods. The bank buys the item and sells it to the customer at a fixed profit. The customer pays in installments. This method avoids interest and is easy to understand.

Mudarabah (profit Sharing)

Mudarabah means profit sharing between two parties. One provides capital, and the other manages the project or business. Profits are shared as agreed, but losses are borne by the capital provider. It encourages partnership and risk sharing.

Musharakah (joint Venture)

Musharakah is a joint venture where all partners invest money. Profits are shared based on agreed ratios. Losses are shared according to the capital invested. This product supports business growth through cooperation.

Wadiah (safekeeping)

Wadiah is a safekeeping contract where the bank keeps money safe for the customer. The bank guarantees the return of the money on demand. It may give a gift as a token of appreciation. This product is safe and simple.

Tawarruq And Personal Financing

Tawarruq is used for personal financing needs like education and weddings. It involves buying and selling goods to generate cash without interest. This product provides a Shariah-compliant way to access funds quickly and easily.

Leading Islamic Financial Institutions

Islamic finance in Pakistan grows steadily, driven by strong demand for Shariah-compliant services. Leading institutions shape the market with diverse products and ethical finance models. These banks follow Islamic principles, avoiding interest and promoting profit-sharing instead. They offer a trusted alternative to conventional banks for millions of customers.

Meezan Bank

Meezan Bank leads Islamic banking in Pakistan with the largest market share. It offers a wide range of Shariah-compliant products for retail, corporate, and investment banking. The bank is known for strong governance and continuous innovation. Its commitment to Islamic values attracts many customers nationwide.

Faysal Islami

Faysal Islami provides Riba-free financing based on the Tawarruq principle. This bank focuses on affordable, hassle-free personal finance solutions. Customers use it for education, weddings, and medical needs. Faysal Islami blends modern banking with strict adherence to Islamic law.

Dubai Islamic Bank Pakistan

Dubai Islamic Bank Pakistan brings expertise from the UAE market. It offers a variety of Islamic finance products, including consumer and corporate banking. The bank emphasizes transparency and ethical financing. Its strong customer service enhances trust in Islamic banking.

Other Emerging Players

Several new Islamic banks enter Pakistan’s financial scene. These players expand product choices and competition. They focus on niche markets, digital services, and rural outreach. This growth supports overall development of Islamic finance in Pakistan.

Challenges Facing Islamic Finance

Islamic finance in Pakistan faces several challenges that slow its growth and wider adoption. These obstacles affect banks, customers, and regulators. Understanding these challenges helps to see why Islamic finance is still developing in the country.

Legal And Regulatory Framework

The legal framework for Islamic finance in Pakistan is still evolving. Laws often lack clarity on Shariah-compliant contracts. This causes uncertainty for banks and customers. Regulators try to balance Islamic principles with modern banking rules. More clear and supportive regulations are needed to boost confidence.

Public Awareness And Education

Many people in Pakistan know little about Islamic finance. Some confuse it with conventional banking. Awareness about its benefits and principles remains low. This limits demand for Islamic financial products. Better education programs can help people understand how Islamic finance works.

Competition With Conventional Banking

Conventional banks dominate Pakistan’s financial sector. They have established networks and more products. Islamic banks face tough competition to attract customers. They must improve services and marketing. Creating trust and showing value can help Islamic banks compete better.

Product Innovation And Standardization

Islamic finance products often lack variety and innovation. Many offerings are similar to conventional ones but with minor changes. Standardizing products and developing new solutions can meet diverse customer needs. Innovation will make Islamic finance more attractive and practical for users.

Opportunities For Growth

Islamic finance in Pakistan holds vast potential for growth. The sector continues to expand, driven by rising demand for Shariah-compliant financial services. Several key areas offer promising opportunities. These areas can help deepen Islamic finance’s impact on Pakistan’s economy and society.

Untapped Market Segments

Many population segments remain underserved by Islamic finance. Small businesses and rural communities are prime examples. These groups often lack access to Shariah-compliant loans and investment options. Expanding services to these segments can increase market reach. It also supports economic development and financial stability.

Digital Transformation And Fintech

Technology is reshaping financial services worldwide. Islamic finance in Pakistan benefits from digital tools and fintech solutions. Mobile banking and online platforms simplify access to Islamic products. Fintech innovation lowers costs and improves service delivery. This digital shift can attract younger, tech-savvy customers.

Cross-border Investments

Islamic finance in Pakistan can tap into regional and global markets. Cross-border investments bring new capital and expertise. Partnerships with Gulf countries and Southeast Asia offer growth prospects. These collaborations can support infrastructure and trade financing. They also enhance Pakistan’s role in the global Islamic finance ecosystem.

Enhancing Financial Inclusion

Islamic finance promotes ethical and inclusive banking. It provides alternatives for those avoiding conventional interest-based services. Expanding Islamic finance can increase financial access for low-income groups. Inclusion boosts economic participation and reduces poverty. It strengthens social welfare by offering fair financial solutions.

Impact On Pakistan’s Economy

Islamic finance plays a key role in shaping Pakistan’s economy. It offers an alternative to conventional banking that aligns with ethical and religious values. This financial system supports economic growth by encouraging fair practices and social responsibility. The impact is visible across multiple sectors, helping build a stable and inclusive economy.

Promoting Ethical Finance

Islamic finance promotes fairness and transparency in all transactions. It prohibits interest, which prevents exploitation and unfair gains. This system encourages risk-sharing and profit-sharing, creating trust between lenders and borrowers. Ethical finance helps reduce economic inequality and fosters social justice. Pakistan benefits from these principles by building a more responsible financial market.

Encouraging Investment And Entrepreneurship

Islamic finance motivates people to invest in real economic activities. It supports projects that have tangible benefits and avoid speculation. Entrepreneurs find easier access to funding through Shariah-compliant products. This boosts business creation and job opportunities. Pakistan’s economy grows stronger as new ventures receive the support they need.

Supporting Sme Development

Small and medium enterprises (SMEs) are vital for Pakistan’s economy. Islamic finance offers tailored solutions for SMEs, ensuring they get adequate funding. These businesses face fewer financial barriers and can expand more quickly. By supporting SMEs, Islamic finance helps increase employment and economic diversity. The overall economic structure becomes more resilient and balanced.

Contribution To Sustainable Development

Islamic finance encourages investments in projects that are socially and environmentally responsible. It focuses on long-term benefits rather than short-term gains. Sustainable development helps protect resources for future generations. Pakistan’s economy benefits from projects that improve community welfare and environmental health. This approach aligns financial growth with the country’s social goals.

Credit: www.iflr.com

Credit: www.dawn.com

Frequently Asked Questions

Do Muslims Get 0% Interest?

Muslims avoid paying or earning interest (riba) as it is prohibited in Islam. Instead, they use profit-sharing and asset-based financing methods. Islamic finance offers Shariah-compliant alternatives with moderate, ethical returns without involving interest.

Which Bank Is Riba Free In Pakistan?

Meezan Bank is the leading Riba-free, fully Shariah-compliant bank in Pakistan. It strictly follows Islamic banking principles.

Is Meezan Bank 100% Islamic?

Meezan Bank operates fully under Islamic Shariah principles, offering 100% Shariah-compliant banking products and services.

What Is The 30% Rule In Islamic Finance?

The 30% rule in Islamic finance limits debt to 30% of a company’s total capital. It ensures financial stability and Shariah compliance.

Conclusion

Islamic finance in Pakistan offers ethical and interest-free banking options. It supports economic growth while respecting religious values. More people trust Islamic banks for their fairness and transparency. The sector continues to expand with new products and services. This growth helps Pakistan’s financial system become more inclusive and stable.

Understanding Islamic finance can guide better financial choices for everyone. The future looks promising as Islamic banking meets modern needs.