In Germany, crypto tax is a hot topic for investors and tax experts alike. We break it down into easy parts for you.

Introduction to Crypto Tax in Germany

Germany is a country that sees the future in crypto. But, they also ensure taxes are paid. Let’s dive into how much that might be.

Credit: koinly.io

What is Cryptocurrency?

Cryptocurrency is digital money. It is not held or managed by banks. This makes it very different.

The Basics of Crypto Taxation in Germany

Germany follows clear rules on crypto taxation. It is based on how long you hold your crypto.

If you hold your crypto for more than a year, it’s tax-free

Note: Tax laws can change. Always check for new updates.

Tax Rate For Crypto Held Less Than A Year

| Income Range | Tax Rate |

|---|---|

| Up to €600 | 0% (Tax-Free) |

| Above €600 | Varies |

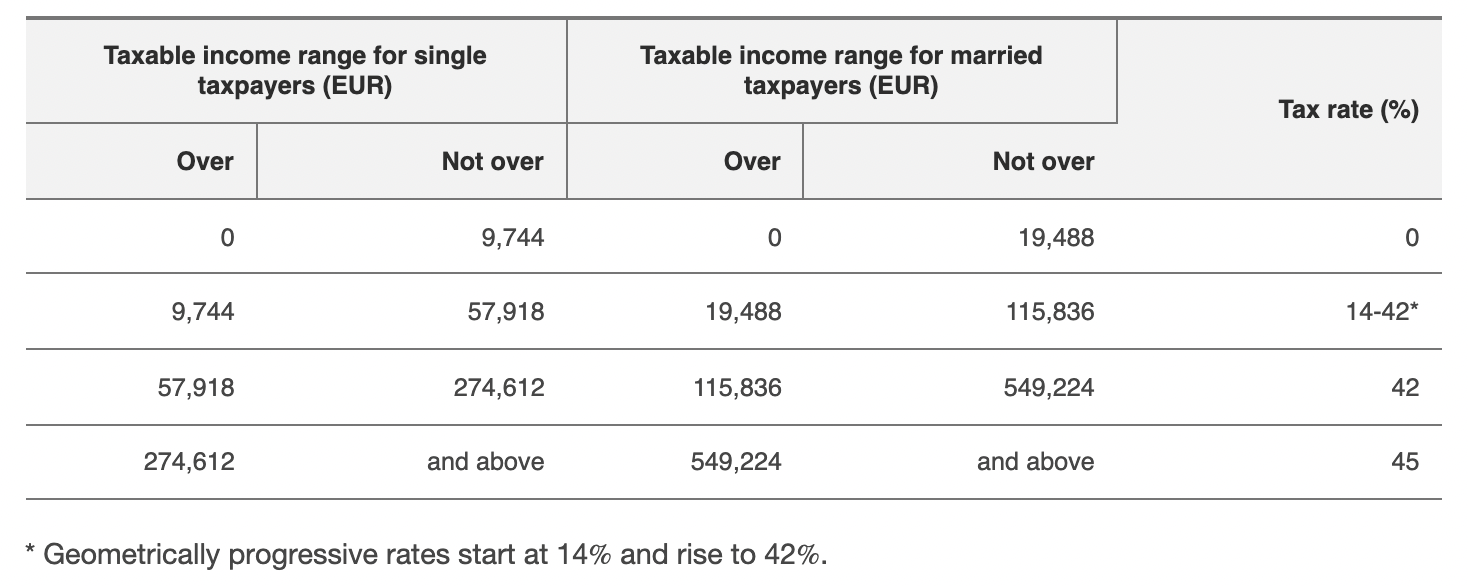

Varies based on total income. Could be up to 45%.

Example of How Crypto Tax Works

Let’s understand with an easy example:

- You buy €500 worth of Bitcoin.

- It grows to €1100 in 8 months.

- You sell and make €600 profit.

In this case, you pay tax on the €600 because it is above the tax-free limit and held for less than a year.

Rules for Specific Crypto Activities

- Mining: Taxed as income.

- Staking: Rules are complex. May be taxed like mining.

- Airdrops: Often taxed as income when sold.

Special Tax-Free Savings Accounts

Germany offers special accounts for saving. These can hold crypto and be tax-free.

Always talk to a tax expert if you use these accounts.

Credit: cointaxlist.com

Keeping Good Records is Key

You must keep records of all your crypto transactions. German tax officers may ask for these any time.

How to Report Your Crypto Taxes

You report your crypto taxes on your annual tax return. A tax expert can help make this easy.

Frequently Asked Questions For How Much Is Crypto Tax In Germany?

What Percentage Is Crypto Tax In Germany?

Germany taxes cryptocurrency at the same rate as capital gains, which can range from 0% to 45%, depending on the individual’s tax bracket and holding period.

Is Crypto Taxed If Held Long-term In Germany?

Long-term holding of cryptocurrencies for over one year in Germany can qualify for a tax exemption, effectively reducing the tax rate to 0%.

Can Crypto Losses Offset Tax In Germany?

Yes, in Germany, you can offset your crypto losses against gains, potentially lowering your overall taxable income from cryptocurrencies.

Are Crypto-to-crypto Trades Taxable In Germany?

In Germany, crypto-to-crypto trades are considered taxable events and are subject to capital gains tax, similar to crypto-to-fiat transactions.

Conclusion

Understanding crypto tax in Germany is important. If you hold your crypto for more than a year, it’s tax-free, simple!

For shorter holds, it gets tricky. The tax rate depends on your total income. Keeping records and talking to a tax expert is smart.

Get Professional Help

Always ask for help from a tax professional. They keep up with all the tricky parts of tax laws.