Understanding the intersection of cryptocurrency and taxes is crucial as digital assets gain popularity.

Overview: Reporting your cryptocurrency on tax returns is not as hard as it sounds. This article helps to simplify it.

Credit: founderscpa.com

Introduction to Crypto and Taxes

The Internal Revenue Service (IRS) treats cryptocurrency as property. All crypto transactions must be reported on your taxes.

What Crypto Transactions Are Taxable?

Several types of transactions can be taxed:

- Selling crypto for cash

- Using crypto to buy goods or services

- Exchanging one cryptocurrency for another

- Earning crypto as income

Credit: coinledger.io

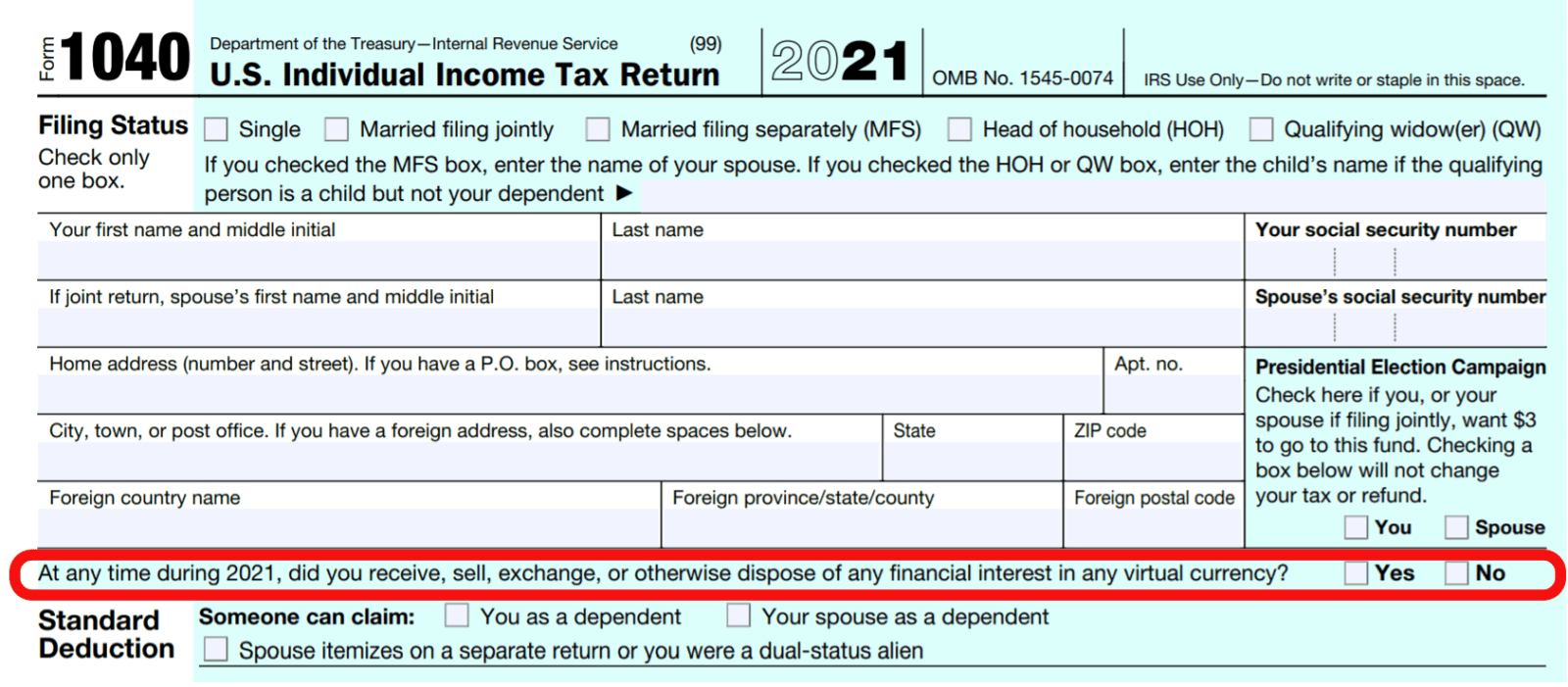

Which IRS Forms to Use?

You’ll likely need these forms:

- Form 1040 for your tax return

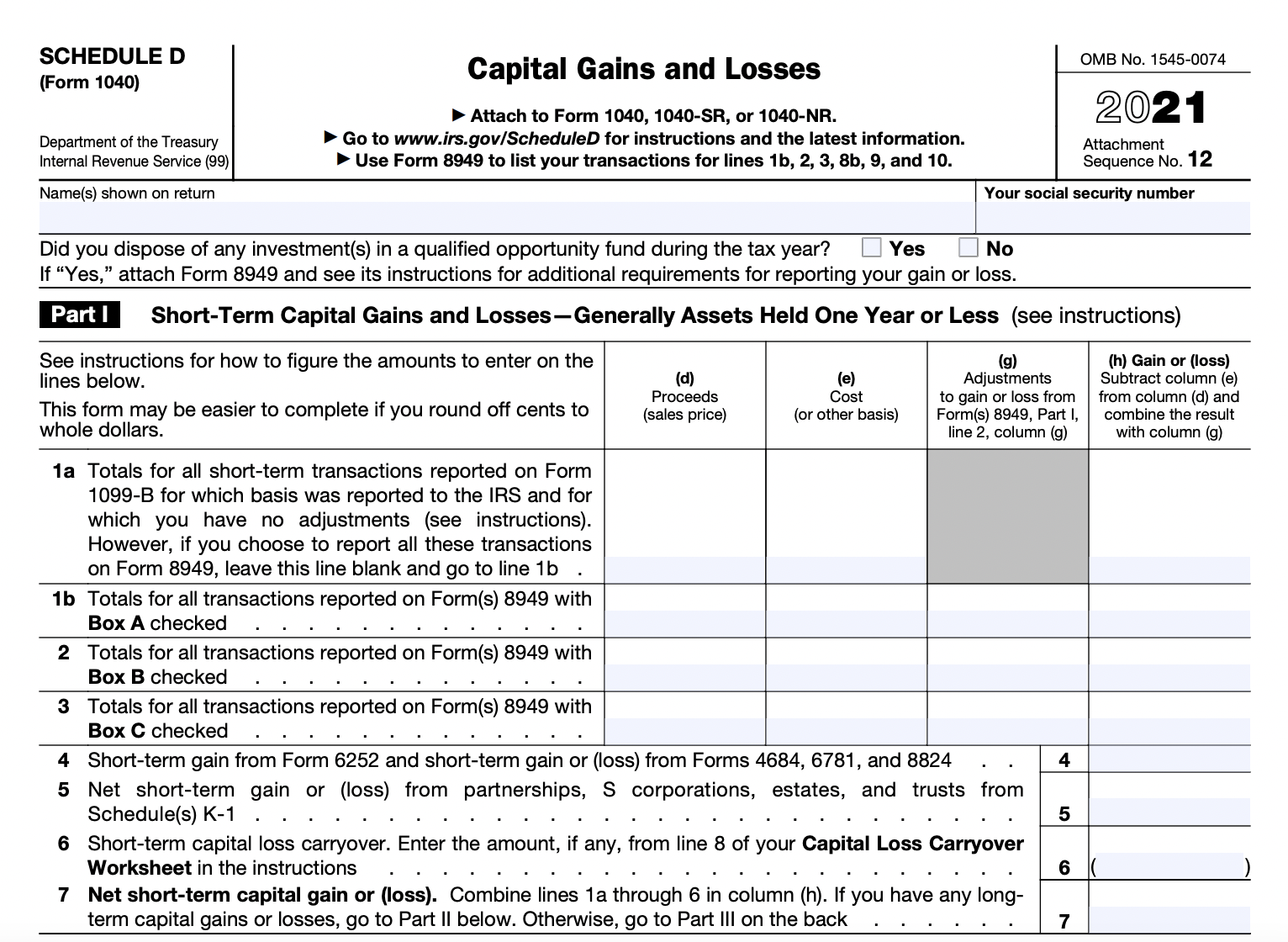

- Schedule D for capital gains and losses

- Form 8949 to list all transactions

Where to Report on Tax Return?

Here’s where your crypto should go:

| Type of Transaction | Where to Report |

|---|---|

| Capital Gains | Schedule D, Form 8949 |

| Income | Form 1040, Schedule 1 |

| Gifts | Form 709 (if above annual exclusion) |

How to Keep Track of Crypto for Taxes

Good record keeping is vital:

- Record the date of each transaction

- Note the value of crypto in USD at the time

- Keep track of any gains or losses

- Save all crypto exchange statements

Common Crypto Tax Mistakes to Avoid

Here are some mistakes not to make:

- Not reporting crypto at all

- Misreporting your transactions

- Not keeping thorough records

- Failing to report gifts or transfers

How Capital Gains Tax Works with Crypto

Capital gains tax depends on how long you owned the crypto before selling.

Short-term gains (held for less than a year) are taxed as regular income.

Long-term gains (held for more than a year) have lower tax rates.

What If You Have Crypto Losses?

Losses could lower your taxable income.

You can use your losses to offset other capital gains.

You can deduct up to $3,000 from your income if your losses exceed your gains.

Frequently Asked Questions For Where Does Crypto Go On Tax Return?

Where To Report Cryptocurrency On Taxes?

Cryptocurrency transactions are reported on IRS Form 8949 and summarized on Schedule D for tax returns, reflecting capital gains and losses.

Is Crypto Taxed As Income Or Asset?

Crypto is taxed both as income when earned and as a capital asset when sold, depending on how you’ve received or used your cryptocurrency.

How To Calculate Crypto Gains For Taxes?

Calculate crypto gains by subtracting the purchase price plus fees (cost basis) from the selling price, which represents your capital gain or loss.

Can I Deduct Crypto Trading Losses?

Yes, you can deduct crypto trading losses on your tax return, subject to capital loss limitations and rules applicable to property transactions.

Conclusion

Cryptocurrency and taxes can get complex.

Always report your crypto transactions on your tax return.

Seeking help from a tax professional is often a wise choice.