Car insurance is important. It protects you and your car. But it can be expensive. Here are ways to reduce car insurance costs.

1. Shop Around for the Best Rates

Insurance rates vary. Different companies offer different rates. Compare rates from several companies. Use online tools to compare quotes. This helps you find the best deal.

Credit: elephant.in

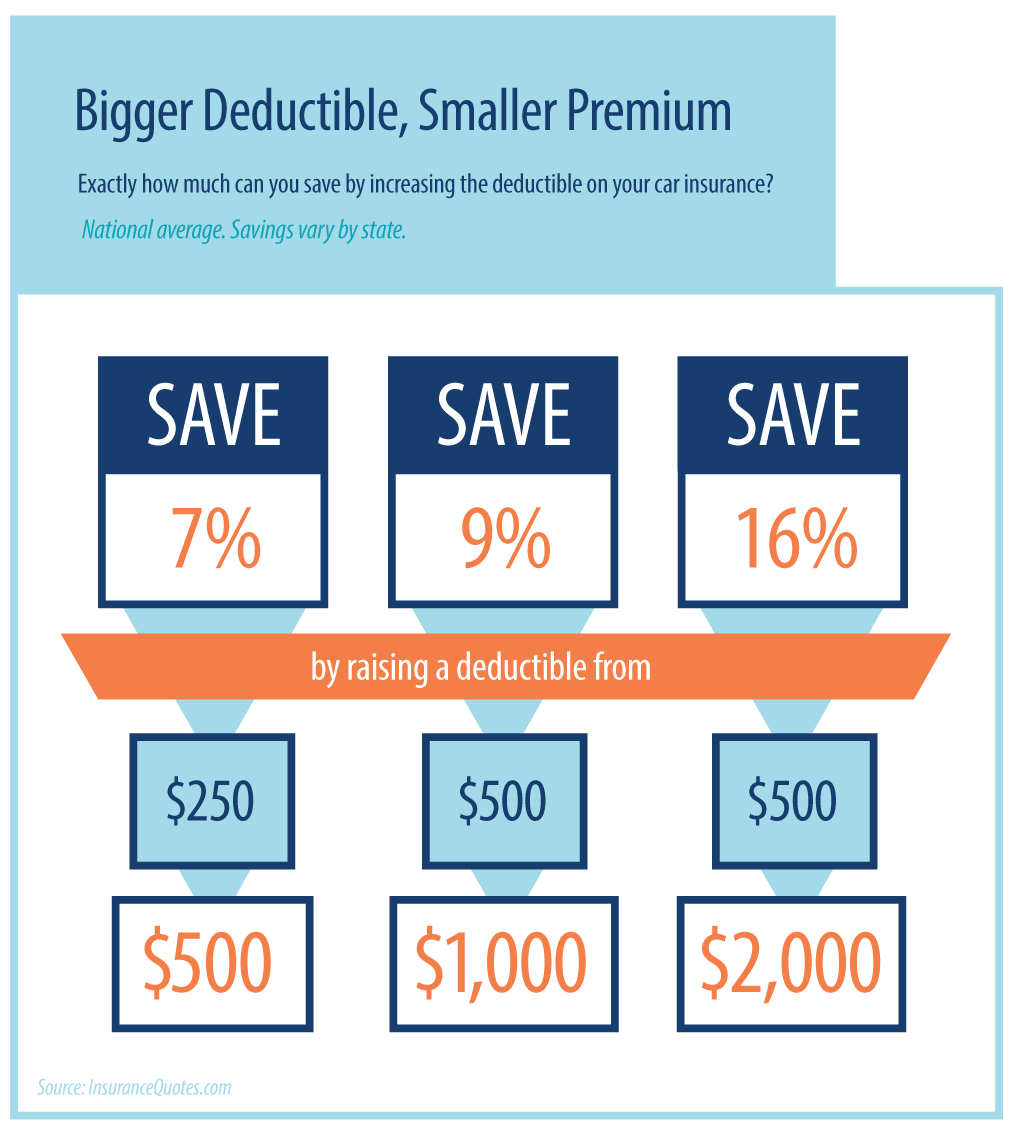

2. Choose a Higher Deductible

A deductible is what you pay before insurance helps. Higher deductibles mean lower premiums. Be sure you can afford the deductible in case of a claim.

3. Bundle Your Insurance Policies

Many companies offer discounts if you bundle. Bundle your home and car insurance. This can save you money. Check with your provider for bundle options.

4. Maintain a Good Credit Score

Insurance companies check your credit score. A good credit score can lower your rates. Pay bills on time. Keep credit card balances low. This improves your credit score.

5. Drive Safely

Safe driving records lower insurance costs. Avoid accidents and traffic tickets. Insurance companies reward safe drivers with lower rates.

6. Take a Defensive Driving Course

Defensive driving courses teach safe driving skills. Many insurance companies offer discounts for completing these courses. Check with your provider to see if they offer this discount.

7. Ask About Discounts

Insurance companies offer many discounts. Ask about discounts for students, seniors, or good drivers. Every little bit helps to reduce costs.

8. Limit Your Mileage

Some companies offer discounts for low mileage. If you drive less, you may pay less. Check if your company offers a low-mileage discount.

9. Install Safety Features

Cars with safety features cost less to insure. Features like airbags, anti-lock brakes, and alarms can lower rates. Check with your insurance company for a list of approved features.

10. Review Your Coverage Annually

Review your insurance policy every year. Make sure you have the right coverage. Adjust your policy as needed to save money.

Credit: www.moneymanagement.org

11. Use Public Transportation

Using public transportation reduces your driving. Less driving can lower your insurance rates. If you can, use buses, trains, or carpools.

12. Pay Your Premiums Annually

Paying your premiums annually can save you money. Monthly payments often have extra fees. Paying once a year avoids these fees.

13. Avoid Unnecessary Coverage

Only pay for coverage you need. If your car is old, you may not need full coverage. Consider dropping collision or comprehensive coverage.

14. Keep Your Car in Good Condition

Maintaining your car can lower your insurance costs. Fix any issues promptly. Well-maintained cars are less likely to be in accidents.

15. Choose a Car with Low Insurance Costs

Some cars cost less to insure. Before buying a car, check its insurance costs. Smaller, safer cars often have lower rates.

16. Be a Loyal Customer

Some insurance companies offer loyalty discounts. Staying with the same company for several years can save you money. Ask your provider if they offer this discount.

17. Use Telematics

Telematics devices monitor your driving. Safe drivers can earn discounts. Check if your insurance company offers telematics programs.

18. Reduce Coverage on Older Cars

Older cars may not need full coverage. Consider dropping collision or comprehensive coverage. This can lower your insurance costs.

19. Park in a Safe Location

Parking in a safe location can reduce your rates. Garages or well-lit areas lower the risk of theft or damage.

20. Join an Affinity Group

Some groups offer insurance discounts. These groups include alumni associations or professional organizations. Check if you qualify for any group discounts.

Frequently Asked Questions

How Can I Lower My Car Insurance?

Shop around for quotes, increase deductibles, and maintain a clean driving record to lower car insurance costs.

What Discounts Are Available For Car Insurance?

Look for discounts like safe driver, multi-policy, and good student to save on car insurance premiums.

Does Increasing Deductibles Reduce Insurance Costs?

Yes, increasing deductibles can significantly lower your monthly car insurance premiums by reducing the insurer’s risk.

Can Bundling Policies Save Money?

Bundling car insurance with home or other policies often leads to substantial savings on premiums.

Do Driving Habits Affect Insurance Rates?

Yes, safe driving habits and fewer claims can lead to lower car insurance rates over time.

Conclusion

Reducing car insurance costs is possible. Use these tips to save money. Shop around, drive safely, and ask for discounts. Every little bit helps to lower your car insurance costs.