Are you an occasional driver? Do you drive only on weekends or holidays? Then you need the best car insurance for occasional drivers. This can save you money and give you the protection you need.

Occasional drivers do not need regular car insurance. Regular insurance can be expensive. Instead, look for car insurance that fits your needs.

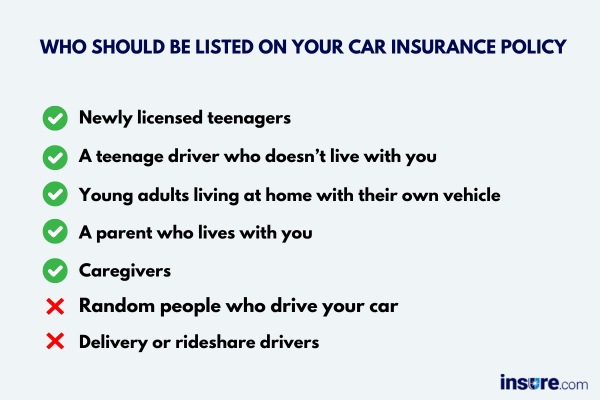

Credit: www.insure.com

Why Do Occasional Drivers Need Special Insurance?

Occasional drivers are on the road less often. This means they have a lower risk of accidents. Regular insurance does not consider this. Special insurance for occasional drivers can be cheaper and more suitable.

Types of Car Insurance for Occasional Drivers

There are different types of car insurance for occasional drivers. Each type has its own benefits. Here are the main types:

- Pay-As-You-Go Insurance: This type of insurance charges you based on the miles you drive. If you drive less, you pay less. It is great for occasional drivers.

- Temporary Car Insurance: This is short-term insurance. You can get it for a few days or weeks. It is perfect for road trips or when you need a car for a short period.

- Usage-Based Insurance: This type uses a device to track your driving. The safer you drive, the less you pay. It rewards safe and occasional drivers.

Credit: www.autoinsurance.org

Top Car Insurance Companies for Occasional Drivers

Here are some of the best car insurance companies for occasional drivers:

| Insurance Company | Type of Insurance | Benefits |

|---|---|---|

| Metromile | Pay-As-You-Go | Low rates for low mileage, easy tracking, good customer service. |

| Root Insurance | Usage-Based | Rewards safe driving, easy app, good discounts. |

| Progressive | Temporary | Flexible terms, easy online process, reliable coverage. |

| GEICO | Temporary | Affordable rates, easy to get, good customer support. |

How to Choose the Best Insurance

Choosing the best car insurance for occasional drivers can be easy. Follow these steps:

- Understand Your Needs: How often do you drive? What kind of coverage do you need?

- Compare Options: Look at different insurance types and companies. Compare their prices and benefits. <liRead Reviews: Check customer reviews online. This can help you choose a reliable insurance company.

- Check Discounts: Some companies offer discounts for safe driving or low mileage. Ask about these discounts.

- Get Quotes: Get quotes from multiple companies. Compare them to find the best deal.

Tips for Saving Money on Car Insurance

Here are some tips to help you save money on car insurance:

- Drive Less: The less you drive, the less you pay. Consider carpooling or using public transport.

- Bundle Policies: Some companies offer discounts if you bundle your car insurance with other policies.

- Maintain a Good Driving Record: Safe drivers get better rates. Avoid accidents and traffic violations.

- Choose a Higher Deductible: A higher deductible can lower your premium. Be sure you can afford the deductible if you need to make a claim.

- Ask About Discounts: Always ask about available discounts. You might qualify for more savings than you think.

Frequently Asked Questions

What Is The Best Car Insurance For Occasional Drivers?

The best car insurance for occasional drivers offers flexible coverage and low premiums based on usage.

How Can Occasional Drivers Save On Insurance?

Occasional drivers can save by choosing pay-per-mile insurance, usage-based policies, or opting for discounts.

Are There Discounts For Low-mileage Drivers?

Yes, many insurers offer discounts for drivers who log fewer miles annually.

Which Insurance Companies Offer Usage-based Policies?

Companies like Progressive, Allstate, and Nationwide offer usage-based car insurance policies.

How Does Pay-per-mile Insurance Work?

Pay-per-mile insurance charges a base rate plus a per-mile fee, making it ideal for occasional drivers.

Conclusion

Finding the best car insurance for occasional drivers does not have to be hard. Understand your needs and compare your options. Look for companies that offer special insurance for occasional drivers. Use our tips to save money. With the right insurance, you can drive safely and affordably. Happy driving!