Car accidents are scary. They are even scarier when the other driver has no insurance. This is where uninsured motorist insurance comes in.

Uninsured motorist insurance protects you. It helps when you are hit by someone without insurance.

Why is Uninsured Motorist Insurance Important?

Many people drive without insurance. This can be very risky for you.

If they hit you, they might not pay for the damages. Uninsured motorist insurance will cover these costs.

Types Of Uninsured Motorist Insurance

There are two main types of uninsured motorist insurance:

- Uninsured Motorist Bodily Injury (UMBI)

- Uninsured Motorist Property Damage (UMPD)

Uninsured Motorist Bodily Injury (UMBI)

UMBI covers your medical bills. It also covers lost wages if you can’t work.

UMBI also covers pain and suffering. This is the money you get for being hurt.

Uninsured Motorist Property Damage (UMPD)

UMPD covers repairs to your car. It also covers other property damaged in the accident.

This can include things like fences or mailboxes.

What Does Uninsured Motorist Insurance Cover?

Now, let’s look at what uninsured motorist insurance covers in detail.

| Coverage | Details |

|---|---|

| Medical Bills | UMBI pays for hospital visits and doctor bills. |

| Lost Wages | UMBI helps if you can’t work due to injuries. |

| Pain and Suffering | UMBI compensates for physical and emotional pain. |

| Car Repairs | UMPD pays to fix your car after an accident. |

| Property Damage | UMPD covers damage to other property like fences. |

Who Needs Uninsured Motorist Insurance?

Almost everyone should have uninsured motorist insurance. Here’s why:

- Some drivers don’t have insurance.

- Some drivers have very little insurance.

- Accidents can happen at any time.

Uninsured motorist insurance gives you peace of mind. You know you are protected.

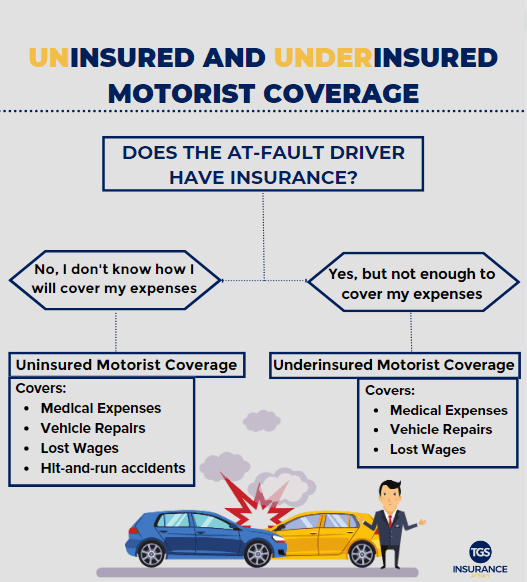

Credit: tgsinsurance.com

Is Uninsured Motorist Insurance Expensive?

Uninsured motorist insurance is not very expensive. It costs less than you might think.

The peace of mind it provides is worth the cost.

Credit: www.progressive.com

How to Get Uninsured Motorist Insurance?

Getting uninsured motorist insurance is easy. Follow these steps:

- Contact your insurance company.

- Ask about adding uninsured motorist coverage.

- Choose the coverage limits that work for you.

Your insurance agent can help you. They will explain all the options.

Frequently Asked Questions

What Is Uninsured Motorist Insurance?

Uninsured motorist insurance covers injuries and damages when the at-fault driver lacks insurance.

Does Uninsured Motorist Insurance Cover Hit-and-run?

Yes, it typically covers damages and injuries from hit-and-run accidents.

Is Uninsured Motorist Insurance Mandatory?

It depends on your state. Some states require it, while others do not.

What Does Uninsured Motorist Insurance Not Cover?

It doesn’t cover property damage if only bodily injury coverage is chosen.

How Much Uninsured Motorist Coverage Do I Need?

Consider matching your liability limits to ensure adequate protection.

Conclusion

Uninsured motorist insurance is very important. It protects you when others don’t have insurance.

It covers your medical bills and car repairs. It also compensates for pain and suffering.

Getting uninsured motorist insurance is easy and affordable. Don’t wait. Protect yourself today.

Contact your insurance company now. Ask about uninsured motorist insurance. Stay safe on the road!