Are you a high-risk driver? Finding good car insurance can be hard. This article will help you. We will look at the best options for you. You can get good coverage even if you are high-risk.

Credit: www.creditkarma.com

What is a High-Risk Driver?

High-risk drivers are people who may have more accidents. Insurance companies think they are risky. Here are some reasons you might be high-risk:

- You had many accidents.

- You got many speeding tickets.

- You are a new driver.

- You have a bad credit score.

- You were caught driving drunk.

Why Do High-Risk Drivers Pay More?

Insurance companies want to make money. High-risk drivers have more accidents. This means insurance companies must pay more. So, they charge high-risk drivers more money.

Credit: www.valuepenguin.com

How to Find the Best Car Insurance?

Finding the best car insurance takes time. Here are steps to help you:

- Check your driving record.

- Improve your credit score.

- Compare different insurance companies.

- Look for discounts.

- Choose the right coverage.

Top Insurance Companies for High-Risk Drivers

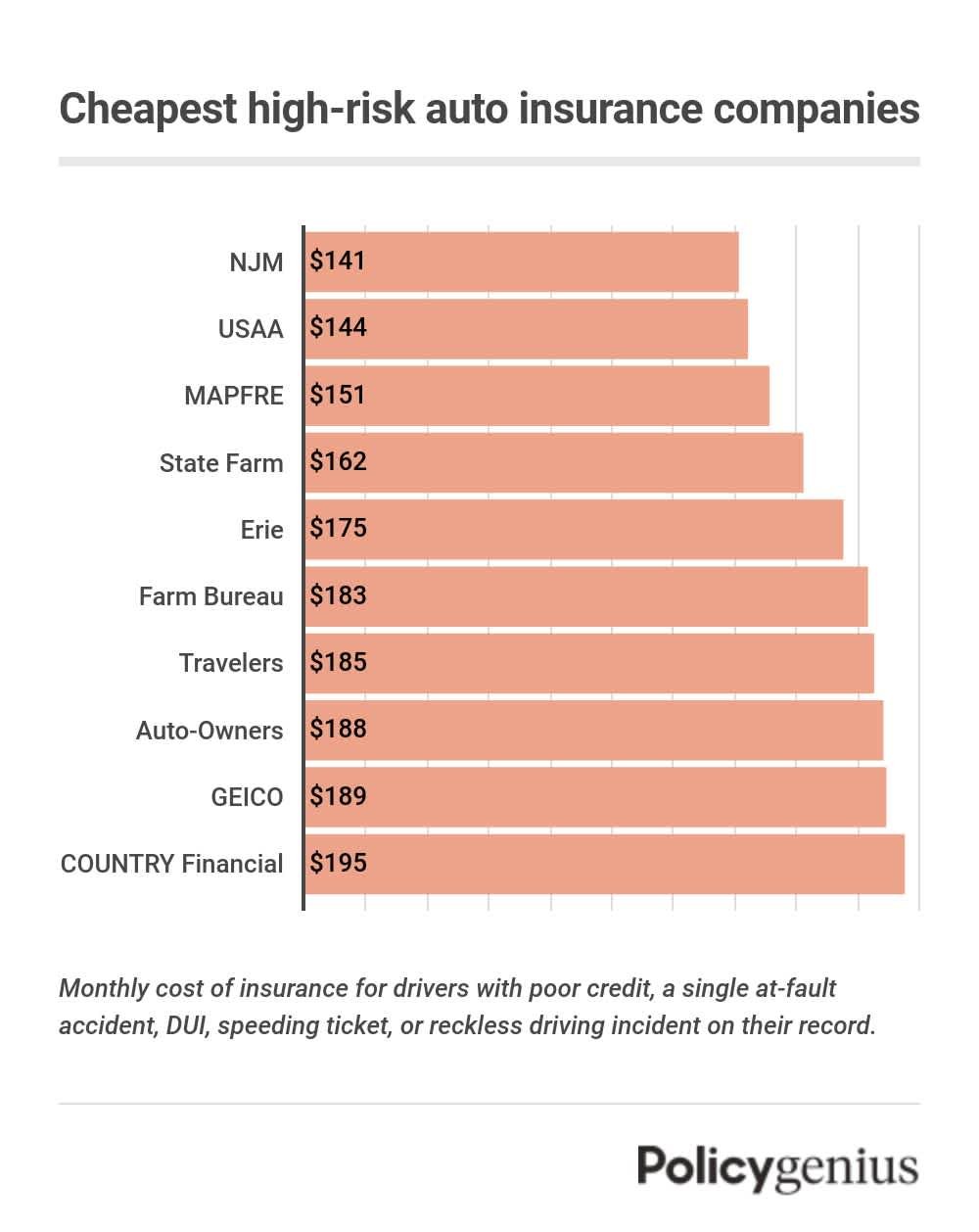

Some companies are better for high-risk drivers. Here are the best ones:

| Insurance Company | Why It’s Good for High-Risk Drivers |

|---|---|

| Geico | Offers many discounts, good customer service |

| Progressive | Specializes in high-risk drivers, many options |

| State Farm | Large network, good reputation |

| Nationwide | Flexible payment options, good for new drivers |

| The General | Focuses on high-risk drivers, easy online quotes |

How to Lower Your Insurance Costs?

You can lower your insurance costs even if you are high-risk. Here are some tips:

- Take a driving course. This shows you are trying to improve.

- Get a car with safety features. Insurance companies like safe cars.

- Ask about discounts. Many companies offer them.

- Pay your bills on time. This helps your credit score.

- Drive safely. Avoid speeding and accidents.

Discounts for High-Risk Drivers

Many insurance companies offer discounts. High-risk drivers can get these too. Here are some common discounts:

- Good driver discount. If you have no accidents for a while.

- Multi-car discount. If you insure more than one car.

- Bundling discount. If you get home and car insurance together.

- Low-mileage discount. If you do not drive a lot.

- Good student discount. For young drivers with good grades.

Importance of Good Coverage

Good coverage is important. It protects you and others. Here are types of coverage you should know:

- Liability Insurance: Covers damage you cause to others.

- Collision Insurance: Covers damage to your car in an accident.

- Comprehensive Insurance: Covers damage from things like theft or weather.

- Uninsured Motorist Insurance: Covers you if the other driver has no insurance.

- Personal Injury Protection: Covers medical bills for you and passengers.

Frequently Asked Questions

What Is High-risk Car Insurance?

High-risk car insurance is designed for drivers with poor driving records or higher risk profiles.

Who Needs High-risk Car Insurance?

Drivers with multiple traffic violations, accidents, or DUI convictions often need high-risk car insurance.

How Can High-risk Drivers Reduce Premiums?

High-risk drivers can reduce premiums by maintaining a clean driving record and taking defensive driving courses.

Which Companies Offer High-risk Car Insurance?

Companies like State Farm, GEICO, and Progressive offer high-risk car insurance policies.

Why Are High-risk Car Insurance Rates Higher?

High-risk insurance rates are higher because these drivers pose a greater risk to insurers.

Conclusion

Being a high-risk driver can be tough. But you can still get good car insurance. Follow the steps in this article. Compare different companies. Look for discounts. Choose the right coverage. Drive safely and improve your record. Soon, you will find the best car insurance for you.