Having a teen driver in the family can be both exciting and stressful. Teens are eager to get behind the wheel and explore their independence. As a parent, you want to ensure they are safe and responsible. One crucial aspect of this is having the right car insurance. This guide will help you understand car insurance for parents with teens, explore the best policies, and share tips to save money.

Credit: lapointeins.com

Why Car Insurance for Teens is Important

Teen drivers are more prone to accidents due to their inexperience. Car insurance provides financial protection in case of an accident. It covers the cost of damages and medical expenses. Without insurance, parents could face significant financial burdens.

Types Of Car Insurance Coverage

There are several types of car insurance coverage to consider:

- Liability Coverage: Covers damages to others if your teen is at fault.

- Collision Coverage: Covers damages to your teen’s car in an accident.

- Comprehensive Coverage: Covers non-collision-related damages, like theft or weather damage.

- Personal Injury Protection: Covers medical expenses for your teen and passengers.

- Uninsured/Underinsured Motorist Coverage: Covers damages if the other driver is at fault and lacks sufficient insurance.

How to Choose the Right Car Insurance for Your Teen

Choosing the right car insurance can be challenging. Here are some tips to help you:

Compare Different Insurance Providers

Different providers offer various rates and coverage options. It’s essential to compare them to find the best deal.

Consider Adding Your Teen To Your Policy

Adding your teen to your existing policy can be more affordable than getting a separate one. It also simplifies managing the insurance.

Look For Discounts

Many insurance companies offer discounts for teens. Here are some common ones:

- Good Student Discount: Teens with good grades can get lower rates.

- Driver’s Education Discount: Completing a driver’s education course can reduce premiums.

- Safe Driver Discount: Maintaining a clean driving record can lead to discounts.

- Multiple Policy Discount: Bundling car insurance with other policies, like home insurance, can save money.

Tips to Save Money on Car Insurance for Teens

Car insurance for teens can be expensive. Here are some tips to help you save money:

Choose A Safe Car

Cars with high safety ratings can lower insurance costs. Look for cars with features like airbags, anti-lock brakes, and electronic stability control.

Encourage Safe Driving

Teens with a clean driving record can get lower rates. Encourage your teen to drive safely and avoid distractions.

Raise The Deductible

Raising the deductible can lower the premium. However, make sure you can afford the deductible in case of an accident.

Install Telematics Devices

Some insurance companies offer discounts for using telematics devices. These devices monitor driving habits and can reward safe driving.

The Role of Parents in Teen Driving Safety

Parents play a crucial role in ensuring their teen’s safety. Here are some ways to help:

Set Rules And Expectations

Set clear rules for your teen’s driving. Discuss the importance of seat belts, speed limits, and avoiding distractions.

Lead By Example

Teens learn by watching their parents. Model safe driving behaviors, like obeying traffic laws and avoiding phone use while driving.

Provide Supervised Practice

Spend time practicing driving with your teen. Supervised practice helps build confidence and experience.

Discuss The Consequences Of Unsafe Driving

Talk to your teen about the potential consequences of unsafe driving. This includes accidents, injuries, and legal issues.

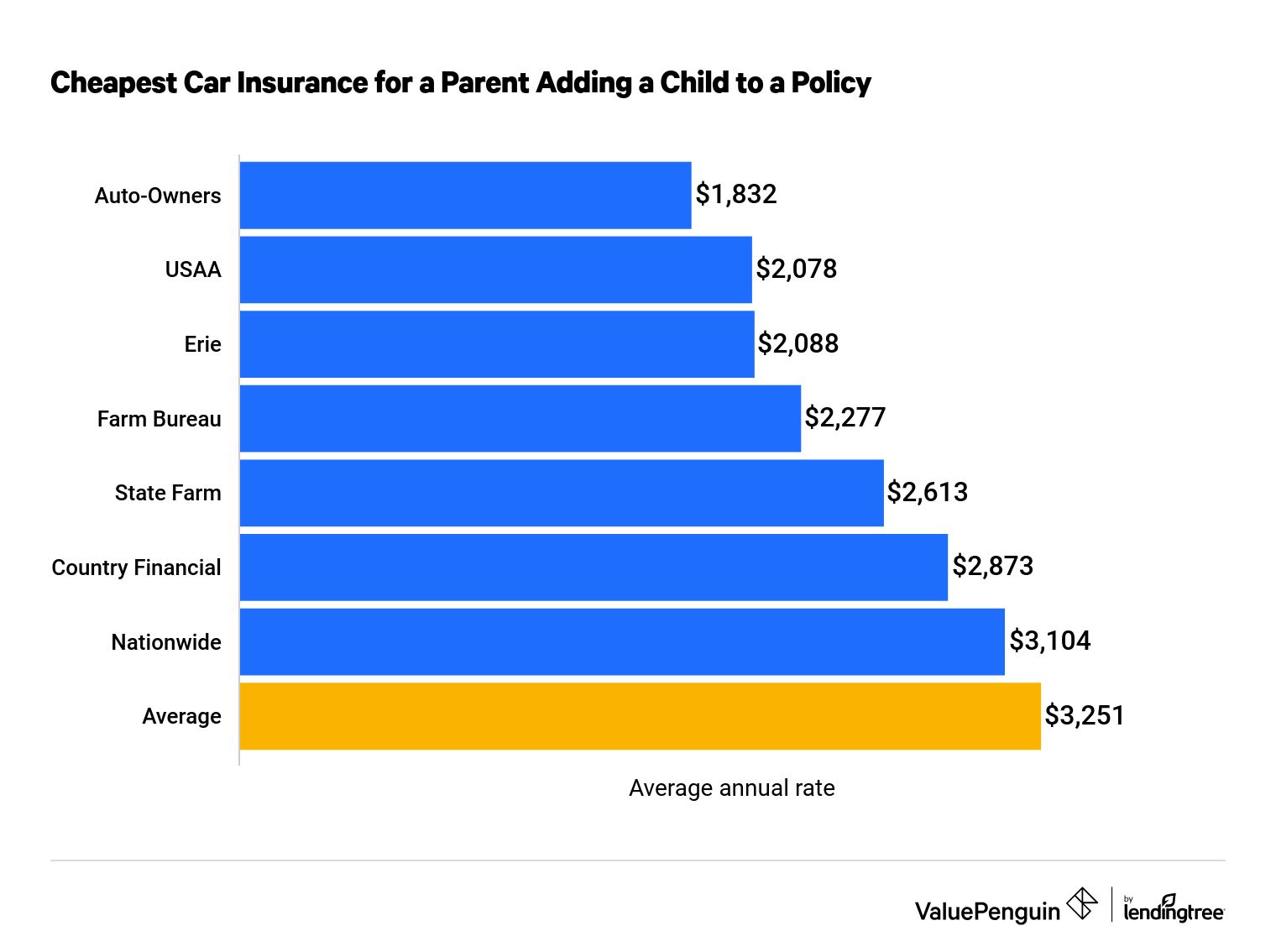

Credit: www.valuepenguin.com

Understanding the Cost of Car Insurance for Teens

Car insurance for teens is generally more expensive. This is due to their lack of experience and higher risk of accidents.

| Factor | Impact on Cost |

|---|---|

| Age and Gender | Young male drivers often have higher premiums. |

| Driving Record | Accidents and violations increase premiums. |

| Type of Car | Expensive or high-performance cars cost more to insure. |

| Location | Urban areas with high traffic have higher premiums. |

| Coverage Amount | Higher coverage limits lead to higher premiums. |

Final Thoughts

Car insurance for parents with teens is essential for financial protection. It’s crucial to choose the right coverage and find ways to save money. Encouraging safe driving habits and setting clear rules can help keep your teen safe. By following these tips, you can ensure your teen is well-protected on the road.

Frequently Asked Questions

How Can Teens Get Cheaper Car Insurance?

Teens can get cheaper car insurance by maintaining good grades, taking driver’s education courses, and driving safe vehicles.

Are There Discounts For Teen Drivers?

Yes, many insurance companies offer discounts for good students, safe driving courses, and multi-policy bundling.

What Coverage Is Best For Teen Drivers?

Full coverage is often recommended. It includes liability, collision, and comprehensive coverage for better protection.

Can Parents Add Teens To Their Policy?

Yes, adding teens to a parent’s policy is usually more affordable than a separate policy for the teen.

Is Tracking Teen Drivers Beneficial?

Yes, using telematics can promote safe driving habits and potentially lower insurance premiums through usage-based insurance programs.