To compare health insurance policies, assess coverage options, premiums, deductibles, and network providers. Evaluate customer reviews and claim processes.

Choosing the right health insurance policy is crucial for financial and medical security. With numerous options available, it can be overwhelming to decide. Start by identifying your healthcare needs and budget. Compare the coverage options each plan offers, including hospital stays, outpatient services, and medications.

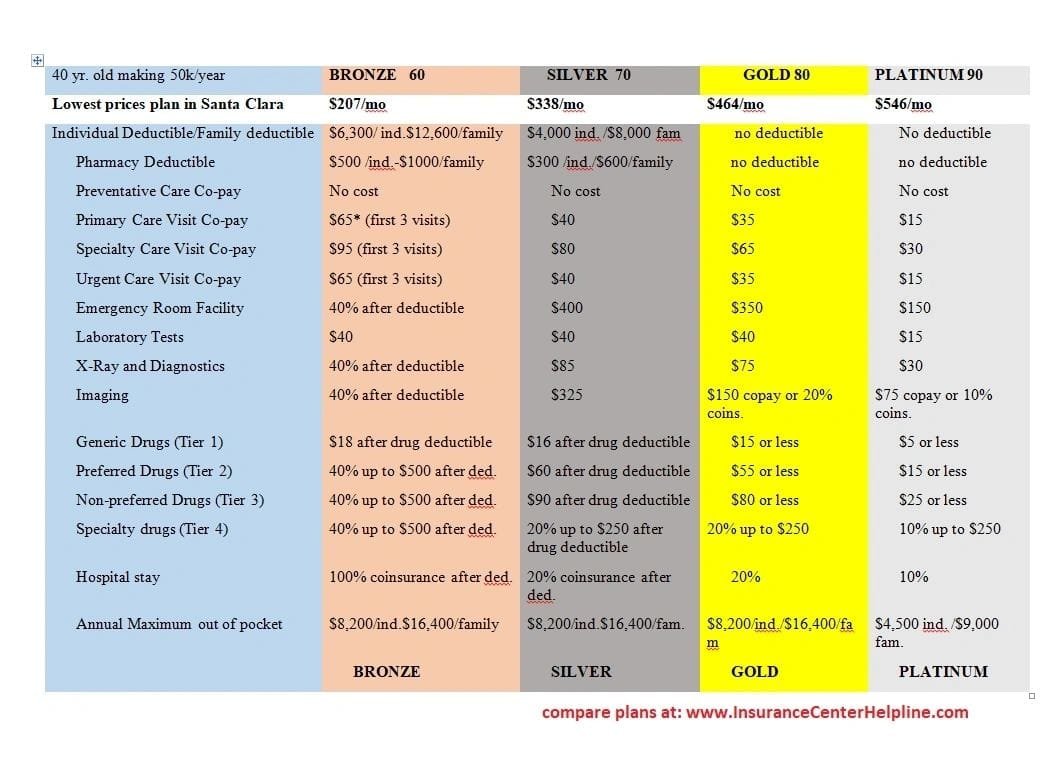

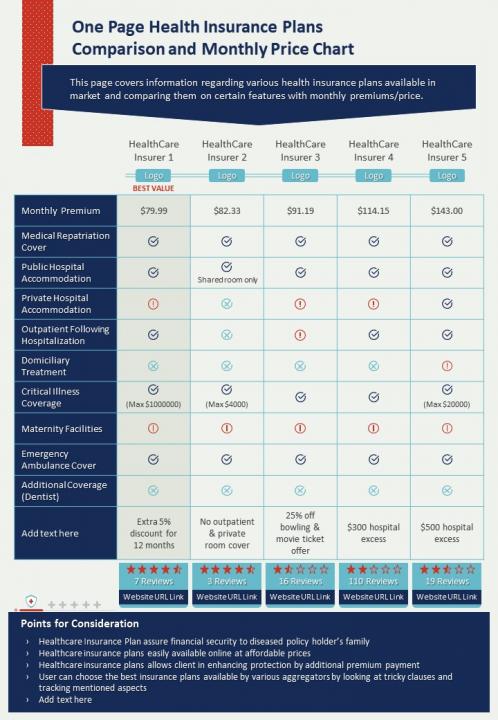

Check the premiums and deductibles to understand the cost implications. Ensure that your preferred doctors and hospitals are within the insurance network. Research customer reviews to gauge satisfaction and service quality. A comprehensive comparison will help you select the best health insurance policy for your needs.

Assess Your Needs

When comparing health insurance policies, the first step is to assess your needs. This helps in finding the most suitable plan for you and your family. Different factors like family size and health conditions play a crucial role.

Family Size

Your family size can greatly impact your health insurance needs. A policy that works for a single person may not be enough for a family of four. Consider the number of people you need to cover. Look at each person’s specific health needs. Here’s a quick breakdown:

- Single: Individual plans with lower premiums.

- Couple: Plans that cover both adults.

- Family: Plans that cover adults and kids.

Health Conditions

Your current health conditions are vital in choosing the right policy. If you have a chronic illness, you need more coverage. Look for policies that cover your specific needs. Here’s a simple table to help:

| Health Condition | Recommended Coverage |

|---|---|

| Chronic Illness | Comprehensive plans with low out-of-pocket costs |

| Frequent Doctor Visits | Plans with low co-pays |

| Rarely Sick | High-deductible plans with lower premiums |

By understanding your family size and health conditions, you can make a better choice. Choose a policy that fits your unique needs and provides adequate coverage.

Credit: www.slideteam.net

Understand Policy Types

Choosing the right health insurance policy can be daunting. Understanding policy types is crucial. Different policies offer varied benefits and limitations. Knowing these differences helps make an informed decision.

Hmo Vs Ppo

Health Maintenance Organizations (HMO) and Preferred Provider Organizations (PPO) have distinct features:

| Feature | HMO | PPO |

|---|---|---|

| Network Flexibility | Limited to network | More network options |

| Primary Care Physician (PCP) | Required | Not required |

| Specialist Visits | Referral needed | No referral needed |

| Cost | Lower premiums | Higher premiums |

Epo Vs Pos

Exclusive Provider Organizations (EPO) and Point of Service (POS) plans offer different advantages:

- Network Flexibility: EPOs require staying within the network. POS plans offer flexibility.

- Primary Care Physician (PCP): EPOs do not require a PCP. POS plans need a PCP.

- Specialist Visits: EPOs do not need referrals. POS plans usually need referrals.

- Cost: EPOs generally have lower premiums. POS plans might have varied costs.

Understanding these policy types helps in choosing the best health insurance. Make sure to weigh the options carefully.

Examine Coverage Options

Understanding coverage options is crucial when comparing health insurance policies. Coverage determines what medical expenses your policy will pay. It includes various services and treatments. Let’s explore some key aspects.

Inpatient Care

Inpatient care involves treatments that require a hospital stay. These include surgeries, emergency care, and advanced diagnostics. Check if the policy covers room charges, doctor fees, and medications. Ensure the policy includes coverage for intensive care units (ICUs).

| Service | Covered | Not Covered |

|---|---|---|

| Surgeries | Yes | No |

| Emergency Care | Yes | No |

| Room Charges | Yes | No |

Outpatient Services

Outpatient services cover treatments that do not require a hospital stay. These include doctor visits, lab tests, and minor procedures. Ensure your policy covers regular check-ups and specialist consultations.

- Doctor Visits: Check if consultations are covered.

- Lab Tests: Ensure necessary tests are included.

- Minor Procedures: Verify if small surgeries are covered.

Credit: www.healthreformbeyondthebasics.org

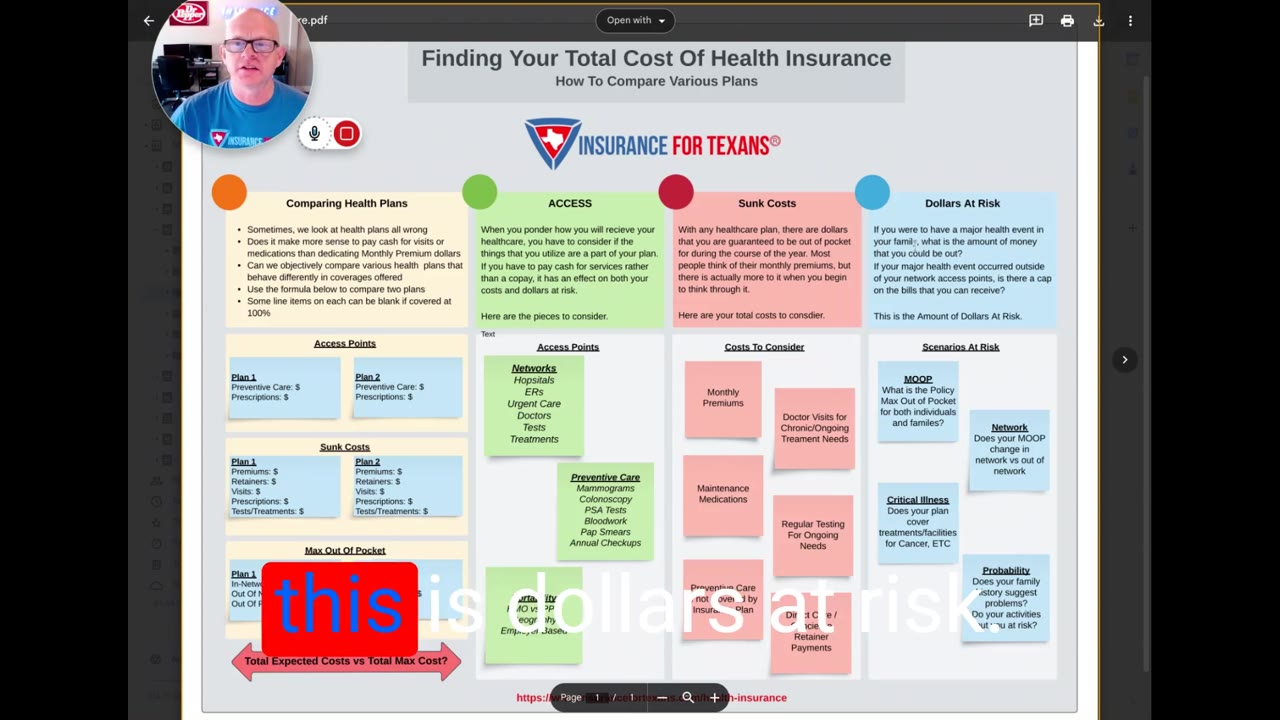

Evaluate Costs

Evaluating the costs of health insurance policies is crucial. You must understand how much you will pay and what you will get. This section will help you compare costs effectively.

Premiums

Premiums are the monthly fees you pay for your health insurance. These payments keep your coverage active. It’s important to find a premium that fits your budget.

Here is a table to help you compare premiums:

| Plan | Monthly Premium |

|---|---|

| Plan A | $200 |

| Plan B | $250 |

| Plan C | $300 |

Deductibles

Deductibles are the amounts you must pay before your insurance starts to cover costs. Higher deductibles usually mean lower premiums. But you will pay more out-of-pocket.

Consider these points when evaluating deductibles:

- How much can you afford upfront?

- Do you expect high medical expenses?

- Will you need frequent doctor visits?

Lower deductibles can be better if you have many medical needs. Higher deductibles might suit those with fewer health issues.

Here is a table to compare deductibles:

| Plan | Annual Deductible |

|---|---|

| Plan A | $1,000 |

| Plan B | $1,500 |

| Plan C | $2,000 |

Check Provider Networks

Comparing health insurance policies can be a daunting task. One crucial aspect to consider is the provider network. Understanding this can save you both time and money.

In-network Providers

Insurance companies have a list of doctors and hospitals they work with. These are called in-network providers. Using in-network providers will usually cost you less. Your insurance company has agreements with these providers. This means you pay lower rates for medical services.

To find in-network providers:

- Check the insurer’s website.

- Call customer service.

- Ask your current doctor if they are in-network.

Always confirm with your insurance company before making an appointment.

Out-of-network Fees

Sometimes you may need to see a doctor who is not in your network. These are called out-of-network providers. Seeing these providers can be costly. You might have to pay higher fees or the full cost of the visit.

Out-of-network fees can include:

- Higher co-pays.

- Higher deductibles.

- Additional charges not covered by insurance.

To avoid unexpected costs:

- Always check if a provider is in-network.

- Understand your insurance policy’s out-of-network coverage.

- Ask for cost estimates before receiving care.

Knowing about these fees helps you budget better for healthcare expenses.

Read The Fine Print

When choosing a health insurance policy, it’s crucial to read the fine print. This ensures you understand what the policy covers and what it doesn’t. Ignoring the fine print can lead to unexpected costs and frustration.

Exclusions

Exclusions are services or treatments not covered by the insurance policy. Always review the list of exclusions before making a decision. Common exclusions can include:

- Cosmetic surgeries

- Dental treatments

- Alternative therapies

Understanding these exclusions helps avoid unpleasant surprises later. It’s better to know upfront what you are not covered for.

Pre-existing Conditions

Pre-existing conditions are medical issues you have before buying the policy. Insurance companies often have specific rules for these conditions. Some policies may not cover pre-existing conditions immediately. Others might have a waiting period.

Here’s a quick comparison of pre-existing condition policies:

| Insurance Company | Waiting Period | Coverage Details |

|---|---|---|

| Company A | 12 months | Covers after waiting period |

| Company B | 24 months | Limited coverage initially |

| Company C | 6 months | Full coverage after period |

Always check how each policy handles pre-existing conditions. This ensures you get the best coverage for your needs.

Credit: www.insurancefortexans.com

Frequently Asked Questions

What Factors To Consider For Health Insurance?

Look at coverage, premiums, deductibles, network hospitals, and customer reviews to compare health insurance policies effectively.

How To Compare Health Insurance Costs?

Compare premiums, deductibles, co-pays, and out-of-pocket maximums to understand the true cost of each policy.

Can I Compare Health Insurance Online?

Yes, many websites offer tools to compare health insurance policies based on your needs and preferences.

What Is A Deductible In Health Insurance?

A deductible is the amount you pay out-of-pocket before your insurance begins to cover expenses.

How To Check Network Hospitals?

Visit the insurance provider’s website or contact their customer service to get a list of network hospitals.

Conclusion

Choosing the right health insurance policy requires careful comparison. Consider coverage, premiums, and out-of-pocket costs. Evaluate network doctors and hospitals. Read customer reviews for insights. Make an informed decision to protect your health and finances. With these tips, you can confidently select the best policy for your needs.