Medicaid is the best health insurance for low-income families. It provides comprehensive coverage at little to no cost.

Low-income families often struggle to find affordable healthcare options. Medicaid offers an excellent solution, designed to assist those in financial need. This government-funded program covers a wide range of medical services, ensuring families receive necessary care without the burden of high costs.

Eligibility varies by state, but generally, it includes families with children, pregnant women, and individuals with disabilities. Accessing Medicaid can significantly reduce out-of-pocket expenses for medical treatments, prescriptions, and preventative care. Applying for Medicaid is straightforward, with resources available online and through local health departments. By choosing Medicaid, low-income families can secure their health and financial stability.

Introduction To Affordable Health Insurance

Affordable health insurance is crucial for low-income families. It ensures access to necessary medical care. Without insurance, many face high medical bills. This can lead to financial hardship. Understanding affordable options can help families stay healthy.

Importance Of Health Insurance

Health insurance provides financial protection. It covers medical costs and hospital stays. This helps families avoid debt. Insurance also offers preventive care. Regular check-ups catch health issues early. This leads to better health outcomes.

Insured families have peace of mind. They know medical help is available. This reduces stress and worry. Health insurance is essential for a secure life.

Challenges For Low-income Families

Low-income families face many challenges. Affording health insurance is one. Premiums and out-of-pocket costs can be high. This makes it hard to pay for coverage.

Many families lack information. They do not know about affordable options. This limits their choices. Finding the right plan can be confusing.

Transportation is another issue. Families may not have access to clinics. This makes getting care difficult. These challenges need solutions for better health.

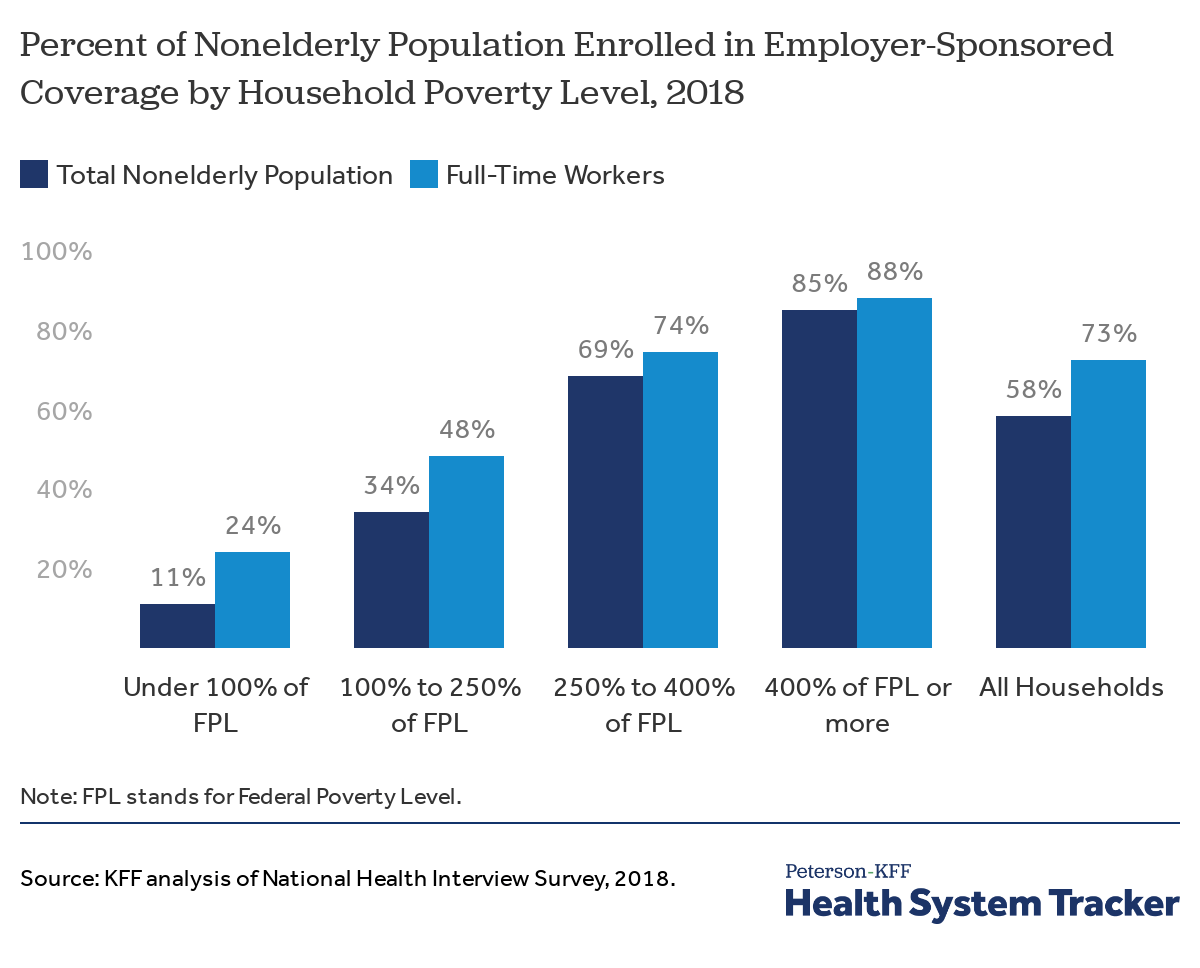

Credit: www.healthsystemtracker.org

Government-sponsored Programs

Government-sponsored programs provide vital health insurance for low-income families. These programs ensure affordable healthcare access. Below are two essential programs: Medicaid and the Children’s Health Insurance Program (CHIP).

Medicaid

Medicaid offers free or low-cost health coverage. It helps millions of Americans, including low-income families. Each state runs its own Medicaid program. They follow federal guidelines. Medicaid covers various services:

- Doctor visits

- Hospital stays

- Long-term care

- Preventive services

Eligibility depends on income, family size, and other factors. Medicaid is a lifeline for many families. It ensures they get the medical care they need.

Children’s Health Insurance Program (chip)

The Children’s Health Insurance Program (CHIP) provides low-cost health coverage for children. It covers families that earn too much for Medicaid but can’t afford private insurance. Like Medicaid, CHIP is state-run and follows federal guidelines.

CHIP covers a broad range of services:

- Routine check-ups

- Immunizations

- Doctor visits

- Prescriptions

- Dental and vision care

- Inpatient and outpatient hospital care

- Laboratory and X-ray services

- Emergency services

Applying for CHIP is straightforward. Families can apply through their state Medicaid agency. This program is crucial for children’s health. It ensures they grow up healthy and strong.

Subsidized Health Plans

Subsidized health plans help low-income families access affordable healthcare. These plans lower the cost of insurance premiums and out-of-pocket expenses.

Affordable Care Act (aca) Marketplace

The ACA Marketplace offers health insurance options for low-income families. The government created this marketplace to provide affordable health insurance. Families can compare different plans and choose the best one for their needs.

Here are some key benefits of the ACA Marketplace:

- Lower premiums: Plans are more affordable for low-income families.

- Essential health benefits: All plans cover essential health services.

- No pre-existing conditions: Coverage is available regardless of health history.

Subsidy Qualifications

To qualify for subsidies, families must meet certain income requirements. The subsidies can help reduce the cost of health insurance. Below is a table showing the income levels that qualify for subsidies:

| Household Size | Income Range (Annual) |

|---|---|

| 1 | $12,880 – $51,520 |

| 2 | $17,420 – $69,680 |

| 3 | $21,960 – $87,840 |

| 4 | $26,500 – $106,000 |

Families within these income ranges can receive subsidies. These subsidies make health insurance more affordable.

Here is a summary of the qualifications:

- Check your household size.

- Compare your income with the given range.

- Apply through the ACA Marketplace.

By meeting these qualifications, low-income families can enjoy affordable health insurance.

Non-profit Health Insurance

Finding affordable health insurance can be tough for low-income families. Non-profit health insurance offers a great solution. These organizations provide quality care at lower costs. They focus on helping communities rather than making profits. Let’s explore some options available.

Community Health Centers

Community Health Centers (CHCs) serve low-income families with affordable care. They offer medical, dental, and mental health services. Families can get treatment regardless of their ability to pay. CHCs often have sliding fee scales based on income. This means you only pay what you can afford.

| Service | Description |

|---|---|

| Medical Services | Includes check-ups, vaccinations, and chronic disease management. |

| Dental Services | Offers cleanings, fillings, and emergency dental care. |

| Mental Health Services | Provides counseling and therapy sessions. |

Charitable Health Programs

Charitable Health Programs help families get the care they need. These programs are funded by donations and grants. They offer free or low-cost healthcare services. Many hospitals have programs for uninsured patients. These programs may cover hospital stays, surgeries, and medication costs.

- Free Clinics: Provide basic health services at no cost.

- Prescription Assistance: Help with the cost of medications.

- Specialty Care: Access to specialists for serious conditions.

Non-profit health insurance options are a lifeline for low-income families. They provide essential care without breaking the bank. Explore these options to find the best fit for your family.

Short-term Health Insurance

Short-term health insurance provides temporary coverage for low-income families. These plans cover gaps in health insurance and are ideal for those between jobs or waiting for other coverage to begin. While not a long-term solution, short-term health insurance can offer some peace of mind.

Pros And Cons

Short-term health insurance has its pros and cons. It is important to weigh these before choosing a plan.

| Pros | Cons |

|---|---|

|

|

Eligibility Criteria

Not everyone qualifies for short-term health insurance. Knowing the eligibility criteria is crucial.

- Residency: You must be a legal resident or citizen.

- Age: Most plans cover individuals under 65 years of age.

- Health status: You must generally be in good health.

Short-term health insurance can be a valuable option for low-income families. It is essential to understand both the benefits and limitations. Carefully review the eligibility criteria to ensure it meets your needs.

Credit: www.kff.org

Tips For Choosing The Right Plan

Finding the best health insurance for low-income families can be challenging. You need to consider various factors to ensure you make the best choice. Here are some tips to help you select the right plan for your family.

Comparing Coverage Options

Coverage options are crucial. Each plan offers different benefits. Compare them to see what fits your needs.

- Doctor Visits: Check if your preferred doctors are in-network.

- Prescriptions: Ensure your medications are covered.

- Specialist Care: Look for plans that cover necessary specialists.

- Emergency Services: Emergency room visits should be included.

Use a table to compare these options side by side.

| Plan Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Doctor Visits | Included | Included | Not Included |

| Prescriptions | Included | Not Included | Included |

| Specialist Care | Not Included | Included | Included |

| Emergency Services | Included | Included | Not Included |

Balancing Costs And Benefits

Balancing costs and benefits is important. You want affordable premiums, but you also need good coverage.

- Monthly Premiums: Choose a plan with a premium you can afford.

- Deductibles: Lower deductibles mean higher premiums. Find a balance.

- Co-pays and Co-insurance: These are out-of-pocket costs. Make sure they are manageable.

- Out-of-Pocket Maximum: This is the most you will pay in a year. A lower maximum is better.

Use the following tips to decide:

- Calculate your annual healthcare costs.

- Choose a plan that fits your budget.

- Ensure the plan covers essential services.

By following these tips, you can find a plan that offers the best value.

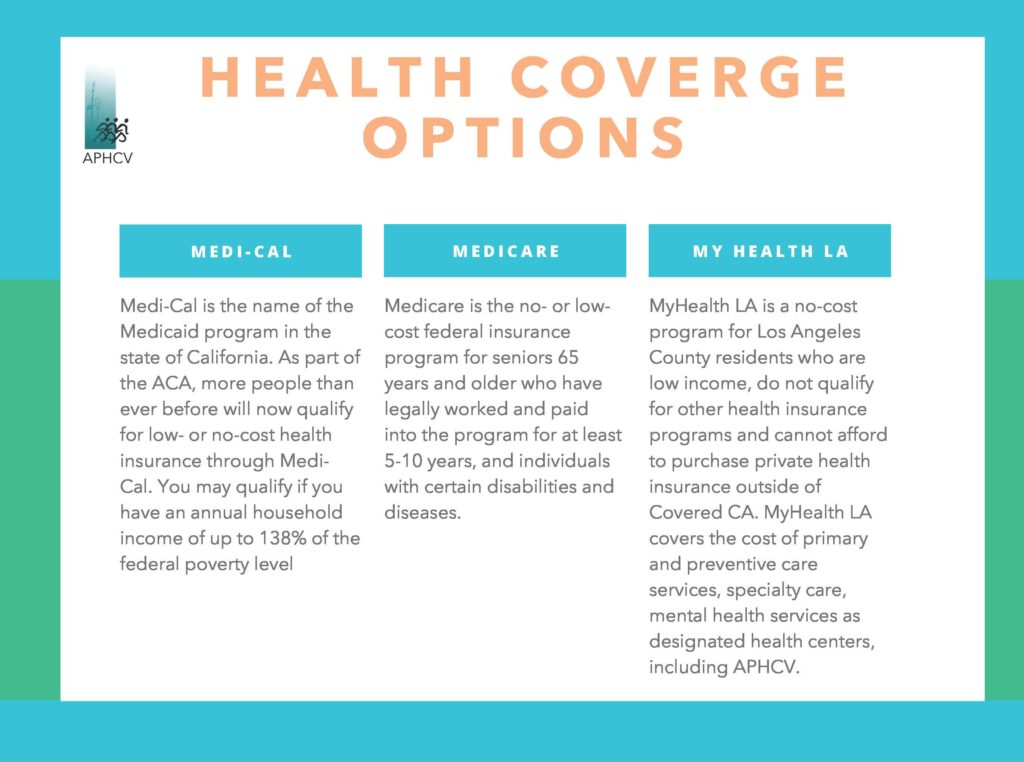

Credit: www.aphcv.org

Frequently Asked Questions

What Are The Best Health Insurance Options For Low-income Families?

Medicaid and CHIP are excellent options for low-income families, offering comprehensive coverage and low costs.

How Can Low-income Families Qualify For Health Insurance?

Eligibility depends on income, family size, and state-specific guidelines. Check local requirements for Medicaid or CHIP programs.

Are There Any Free Health Insurance Programs?

Yes, Medicaid and CHIP provide free or low-cost health insurance for eligible low-income families and children.

Can Low-income Families Get Subsidies For Health Insurance?

Yes, the Affordable Care Act offers subsidies to help low-income families afford health insurance through the marketplace.

What Benefits Do Low-income Health Insurance Plans Offer?

These plans typically cover essential health benefits like doctor visits, hospital stays, prescriptions, and preventive care.

Conclusion

Finding the best health insurance for low-income families is essential. Affordable plans can ensure better health and peace of mind. Make sure to compare options and benefits carefully. Choose a plan that fits your family’s needs and budget. Prioritize health coverage to safeguard your family’s future.