Health insurance for remote workers provides essential coverage for medical expenses. It’s crucial for maintaining health and well-being.

Remote work has transformed the traditional office setting, leading to unique challenges in securing health insurance. Employers and remote workers need flexible health insurance plans that address specific needs. Remote workers often face difficulties in accessing employer-sponsored health plans due to their location.

Individual health insurance plans or joining a spouse’s plan may be viable options. Telehealth services have become vital, offering remote workers convenient access to healthcare. Investing in comprehensive health insurance ensures remote workers stay healthy and productive. Understanding the available options can help remote workers choose the best health coverage for their situation.

Introduction To Remote Work Health Insurance

Remote work is on the rise. Many people now work from home. Health insurance for remote workers is very important. This blog will explain why.

Rise Of Remote Work

Remote work has become very popular. Many companies now offer remote positions. This gives workers more flexibility. They can work from anywhere. This change has created new needs for health insurance.

Importance Of Health Insurance

Health insurance is essential for everyone. Remote workers need it too. It protects them from high medical costs. Here are some benefits of having health insurance:

- Access to healthcare: Remote workers can see doctors when needed.

- Financial security: Health insurance covers most medical expenses.

- Peace of mind: Workers feel safe knowing they are covered.

Health insurance helps remote workers stay healthy. They can work better when they are healthy. It also helps them save money. Without insurance, medical bills can be very high.

| Benefit | Description |

|---|---|

| Access to healthcare | See doctors and get treatments easily. |

| Financial security | Insurance covers most medical costs. |

| Peace of mind | Feel safe knowing you are covered. |

Health insurance is not just a safety net. It is a necessity for remote workers. Ensuring they have coverage is crucial. It helps them stay healthy and productive.

Credit: shaycpa.com

Types Of Health Insurance Plans

Remote workers need health insurance. It helps cover medical costs. There are different types of health insurance plans. Each type has its own benefits. Here, we explore two main types: Individual Plans and Group Plans.

Individual Plans

Individual plans are for single users. You buy these plans for yourself. They offer a lot of choices. You can choose the coverage you need.

Advantages:

- Flexible coverage options

- Personalized plans

- No need to rely on an employer

Disadvantages:

- Can be expensive

- Limited network of doctors

Group Plans

Group plans are for groups of people. Companies often offer these plans. They cover all employees in the group.

Advantages:

- Lower costs

- Wider network of doctors

- Employer often shares the cost

Disadvantages:

- Less flexibility

- Coverage ends if you leave the job

Here is a quick comparison:

| Individual Plans | Group Plans | |

|---|---|---|

| Cost | Higher | Lower |

| Flexibility | High | Low |

| Network | Limited | Wide |

Evaluating Coverage Needs

Health insurance for remote workers can be challenging. Evaluating coverage needs is crucial. Understanding your personal health and family coverage is essential.

Personal Health Needs

Remote workers must evaluate their personal health needs. Ask yourself these questions:

- Do you need regular doctor visits?

- Do you have any chronic conditions?

- Do you take prescription medications?

Consider coverage for mental health services. Remote work can be isolating and stressful. Ensure your plan covers therapy and counseling.

Check for wellness programs. Many insurers offer these programs. They promote healthy living and preventive care.

Family Coverage

If you have a family, their needs matter too. Family coverage ensures everyone is protected. Here are key factors to consider:

- Does your spouse have existing health conditions?

- Do your children need routine pediatric care?

- Are dental and vision services important?

Compare different family plans. Look at premiums, deductibles, and out-of-pocket costs. Ensure the plan fits your budget.

Evaluate network providers. Ensure your preferred doctors are in-network. This helps reduce costs significantly.

| Coverage Aspect | Questions to Ask | Importance |

|---|---|---|

| Personal Health | Do you need regular check-ups? | High |

| Mental Health | Does the plan cover therapy? | Medium |

| Family Coverage | Does your family need specific care? | High |

| Network Providers | Are preferred doctors in-network? | High |

Cost Considerations

Health insurance is vital for remote workers. Understanding cost considerations is crucial. This section delves into the financial aspects of health insurance.

Premiums And Deductibles

Monthly premiums are the regular payments for health insurance. These payments can vary widely. Higher premiums often mean better coverage. Lower premiums might save money upfront.

Deductibles are the amounts paid before insurance kicks in. Higher deductibles mean lower premiums. Lower deductibles offer more immediate coverage. Balance both to suit your financial situation.

| Premium | Deductible | Coverage |

|---|---|---|

| High | Low | Comprehensive |

| Low | High | Basic |

Out-of-pocket Costs

Out-of-pocket costs include co-payments and co-insurance. Co-payments are fixed fees for services. Co-insurance is a percentage of the service cost.

There are also out-of-pocket maximums. These caps limit your annual expenses. Once reached, insurance covers all further costs.

- Co-payments: Fixed fees per service.

- Co-insurance: Percentage of the service cost.

- Out-of-pocket Maximums: Annual expense cap.

Understanding these costs helps manage your budget. Choose plans that fit your financial needs.

Finding The Right Provider

Choosing the best health insurance as a remote worker is crucial. It ensures you get the right coverage without breaking the bank. This section will guide you in finding the right provider.

Research And Reviews

Start by researching various health insurance providers. Look for reviews from other remote workers. This helps you understand the provider’s reliability and service quality.

- Check online forums and social media groups.

- Read customer reviews on trusted websites.

- Ask for recommendations from fellow remote workers.

Trustworthy reviews often highlight important aspects. These include claim processing speed, customer service, and network coverage. Pay attention to both positive and negative reviews.

Comparing Policies

After researching, compare the policies offered by different providers. Use a table to make this process simpler:

| Provider | Monthly Premium | Deductible | Coverage |

|---|---|---|---|

| Provider A | $200 | $1,000 | Basic |

| Provider B | $250 | $500 | Comprehensive |

| Provider C | $180 | $1,500 | Basic |

Focus on key factors like:

- Cost of monthly premiums

- Amount of deductible

- Extent of coverage

Choose a policy that balances cost and coverage. Ensure it meets your healthcare needs.

Credit: www.justworks.com

Additional Coverage Options

Exploring Additional Coverage Options can greatly benefit remote workers. These options provide more comprehensive health support tailored to unique needs. Below, we delve into two critical coverage options: Telehealth Services and Wellness Programs.

Telehealth Services

Telehealth services offer remote workers easy access to healthcare. This can be a game-changer for those living in remote areas or with busy schedules.

- Virtual doctor visits

- 24/7 access to medical advice

- Prescription refills online

These services save time and offer convenience. No need to travel for minor health issues.

Telehealth can include mental health support. Many plans offer online therapy sessions. This is crucial for maintaining mental well-being.

Wellness Programs

Wellness programs encourage healthy lifestyles among remote workers. They offer various resources and tools to stay fit and healthy.

| Feature | Benefits |

|---|---|

| Gym Memberships | Access to fitness facilities |

| Nutrition Counseling | Personalized diet plans |

| Stress Management | Workshops and resources |

Participating in wellness programs can lead to lower health risks. They often reduce stress and improve overall health.

Wellness programs can also include incentives. Completing health challenges might earn rewards. This motivates remote workers to stay healthy.

Credit: www.footholdamerica.com

Frequently Asked Questions

What Is Health Insurance For Remote Workers?

Health insurance for remote workers is coverage designed to meet the needs of employees working from home or various locations.

Why Do Remote Workers Need Health Insurance?

Remote workers need health insurance for medical coverage and financial protection against unexpected health issues and emergencies.

Can Remote Workers Get Employer-provided Health Insurance?

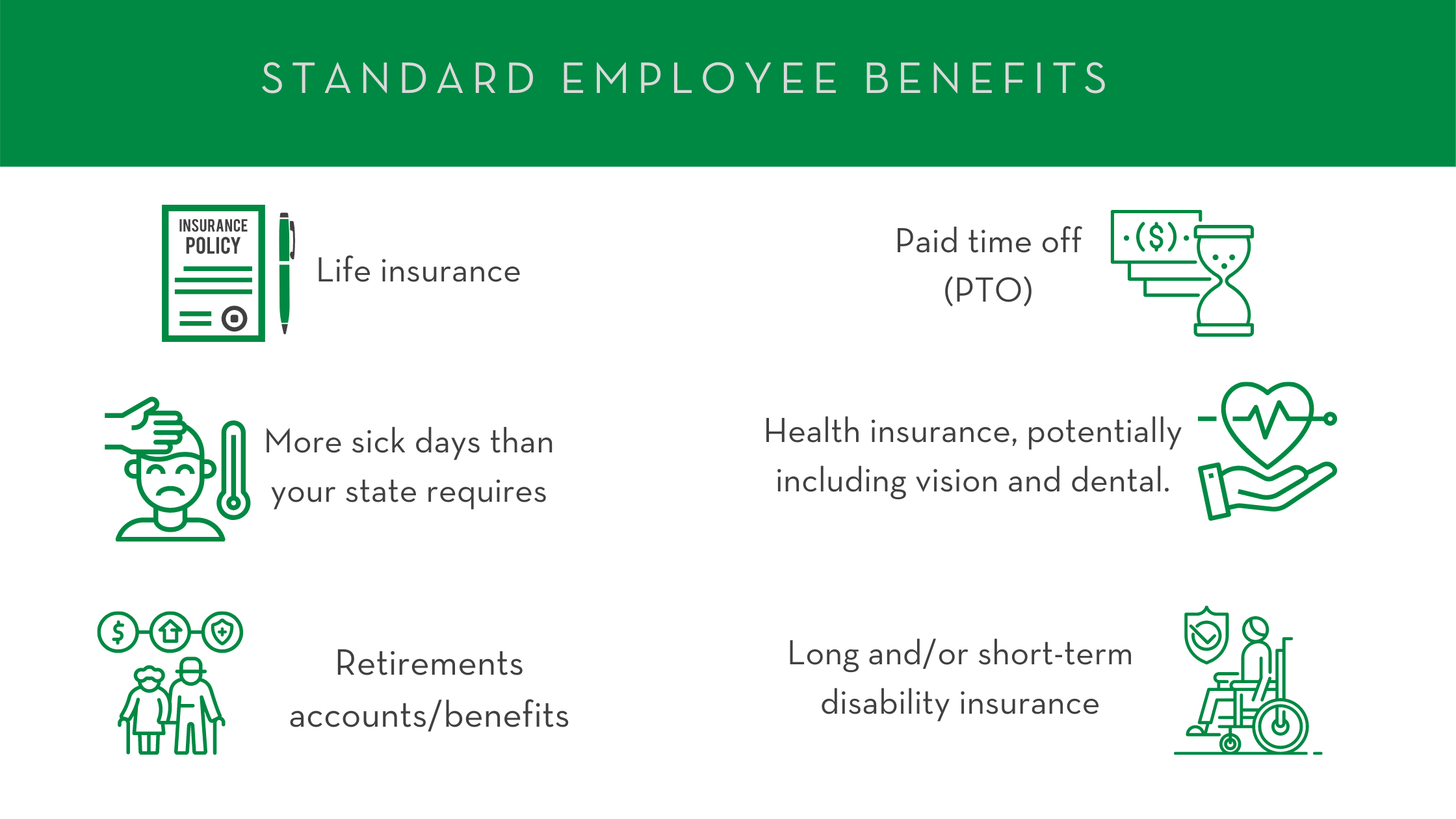

Yes, many employers offer health insurance to remote workers as part of their employee benefits package.

Is Health Insurance More Expensive For Remote Workers?

Health insurance costs for remote workers depend on the plan and location. Employer-provided plans may offer cost advantages.

How Do Remote Workers Choose The Best Health Insurance?

Remote workers should compare plans, consider coverage options, provider networks, and premiums to choose the best health insurance.

Conclusion

Choosing the right health insurance is crucial for remote workers. It ensures access to necessary medical care. Evaluate various plans and consider your unique needs. Don’t overlook the importance of comprehensive coverage. Make informed decisions to secure your health and peace of mind.

Prioritize your well-being in your remote work journey.