Freelancers need health insurance to protect themselves from unexpected medical costs. Options include private plans, ACA marketplace, and membership organizations.

Freelancers often lack the employer-provided health benefits that full-time employees receive. This makes securing health insurance crucial for their financial stability and well-being. Various options are available, such as private health insurance plans, the Affordable Care Act (ACA) marketplace, and health plans offered by membership organizations like the Freelancers Union.

Each option has its pros and cons, requiring careful evaluation based on individual needs and budget. Freelancers must consider factors like premiums, coverage, and network restrictions to choose the best plan. Proper health insurance ensures they can focus on their work without worrying about medical expenses.

Importance Of Health Insurance

Health insurance is crucial for everyone, but especially for freelancers. Without a traditional employer, freelancers must manage their own health coverage. This responsibility can be daunting but necessary for financial and health security.

Why Freelancers Need Coverage

Freelancers lack the safety net of employer-provided health benefits. This means they must find their own insurance plans. Without coverage, medical costs can be overwhelming. Routine check-ups and emergencies both require financial planning.

Being uninsured can lead to significant health risks. Freelancers often skip doctor visits due to costs. This can worsen untreated conditions and lead to severe health issues.

Freelancing offers flexibility but also uncertainty. Health insurance provides a layer of security against unexpected illnesses or injuries. This ensures freelancers can focus on their work without stress.

Financial Protection

Health insurance offers a buffer against high medical expenses. A single hospital visit can cost thousands of dollars. Insurance helps cover these costs, preventing financial ruin.

Consider the following table illustrating potential costs with and without insurance:

| Medical Service | Cost Without Insurance | Cost With Insurance |

|---|---|---|

| Emergency Room Visit | $1,200 | $200 |

| Annual Check-Up | $150 | $20 |

| Prescription Medication | $100 | $10 |

Freelancers often deal with irregular income. Health insurance helps manage unpredictable medical costs. This financial protection is essential for maintaining stability.

Health insurance also offers access to preventive care. Regular check-ups and screenings can detect issues early. This reduces long-term medical expenses and improves health outcomes.

Key Benefits of Health Insurance:

- Reduced Out-of-Pocket Costs

- Access to Preventive Care

- Financial Stability

- Peace of Mind

Investing in health insurance is a wise decision for freelancers. It protects both their health and finances, ensuring a more secure future.

Credit: accordingtotrish.com

Types Of Health Insurance Plans

Freelancers need health insurance too. But finding the right plan can be tricky. Understanding the types of health insurance plans helps you choose better.

Individual Plans

Individual health insurance plans cover just you. They are ideal if you work alone. You can find plans that fit your budget and needs. Here are some key features:

- Premiums: Monthly payments to keep your coverage active.

- Deductibles: Amount you pay before insurance kicks in.

- Co-payments: Small fee for doctor visits or prescriptions.

- Out-of-pocket maximum: The most you’ll pay in a year.

Individual plans can be found through marketplaces or private insurers. Make sure to compare options.

Family Plans

Family health insurance plans cover you and your family. These plans are great if you have dependents. They offer similar features to individual plans, but with added benefits:

- Premiums: Typically higher than individual plans, but cover more people.

- Deductibles: Can be individual or family-wide.

- Co-payments: Fees for doctor visits or prescriptions for any family member.

- Out-of-pocket maximum: Protects your family from high medical costs.

Family plans offer peace of mind. Your loved ones are protected too. Explore options in marketplaces or through private insurers.

Evaluating Coverage Options

Health insurance is vital for freelancers. Finding the right coverage can be hard. Evaluate your options for the best fit.

In-network Vs. Out-of-network

Doctors and hospitals in-network cost less. Out-of-network services are pricier. Always check your provider list.

| In-Network | Out-of-Network |

|---|---|

| Lower costs | Higher costs |

| More predictable expenses | Unpredictable charges |

| Covered by most plans | Limited coverage |

Prescription Coverage

Prescriptions can be expensive. Check if your plan covers your medications. Look for plans with generic drug options.

- Generic drugs: Lower cost, same effectiveness.

- Brand-name drugs: More expensive, higher out-of-pocket costs.

Consider plans with a mail-order pharmacy option. This can save time and money.

Credit: drnoorhealth.com

Cost Considerations

Freelancers often face unique challenges in securing health insurance. Understanding cost considerations helps you make an informed decision. This guide breaks down key elements to consider.

Premiums And Deductibles

Premiums are the monthly fees you pay for your insurance plan. They vary based on coverage levels and provider. Higher premiums usually mean lower out-of-pocket costs later.

Deductibles are amounts you pay before your insurance starts covering costs. Plans with lower premiums often have higher deductibles. Balancing premiums and deductibles is crucial for managing health expenses.

| Plan Type | Monthly Premium | Deductible |

|---|---|---|

| Basic Plan | $200 | $2,000 |

| Standard Plan | $400 | $1,000 |

| Premium Plan | $600 | $500 |

Out-of-pocket Maximums

The Out-of-Pocket Maximum is the most you will pay in a year. After reaching this limit, your insurance covers 100% of costs. This includes deductibles, copayments, and coinsurance.

A lower out-of-pocket maximum can save you from unexpected costs. Compare plans to find the best balance for your financial situation.

- High-deductible plans often have higher out-of-pocket maximums.

- Low-deductible plans might have lower out-of-pocket maximums.

Choosing a plan with the right balance helps you manage your health expenses effectively.

Supplemental Coverage

Freelancers often face unique challenges in securing comprehensive health insurance. One critical aspect is supplemental coverage. Supplemental coverage fills gaps in primary health insurance. It ensures freelancers have complete protection for various health needs.

Dental And Vision

Standard health insurance rarely covers dental and vision needs. Yet, these are essential for overall health. Dental insurance helps cover routine check-ups, cleanings, and procedures like fillings and crowns.

Here are some common services covered by dental insurance:

- Routine cleanings

- Fillings and crowns

- Root canals

- Orthodontics

Vision insurance is equally important. It covers eye exams, glasses, and contact lenses. Some plans also offer discounts on LASIK surgery.

Consider the following vision benefits:

- Annual eye exams

- Prescription glasses

- Contact lenses

- Discounts on corrective surgeries

Critical Illness Insurance

Freelancers need to prepare for unexpected health crises. Critical illness insurance provides a lump-sum payment if diagnosed with a serious illness. This includes illnesses like cancer, heart attack, and stroke.

Key benefits of critical illness insurance:

- Financial support during recovery

- Coverage for non-medical expenses

- Peace of mind in tough times

This coverage helps cover costs not included in primary health insurance. It can cover expenses like mortgage payments and childcare. Freelancers can focus on recovery without financial stress.

Tips For Choosing A Plan

Choosing a health insurance plan can be challenging for freelancers. With many options available, it’s crucial to make an informed decision. Here are some tips to help you pick the right plan.

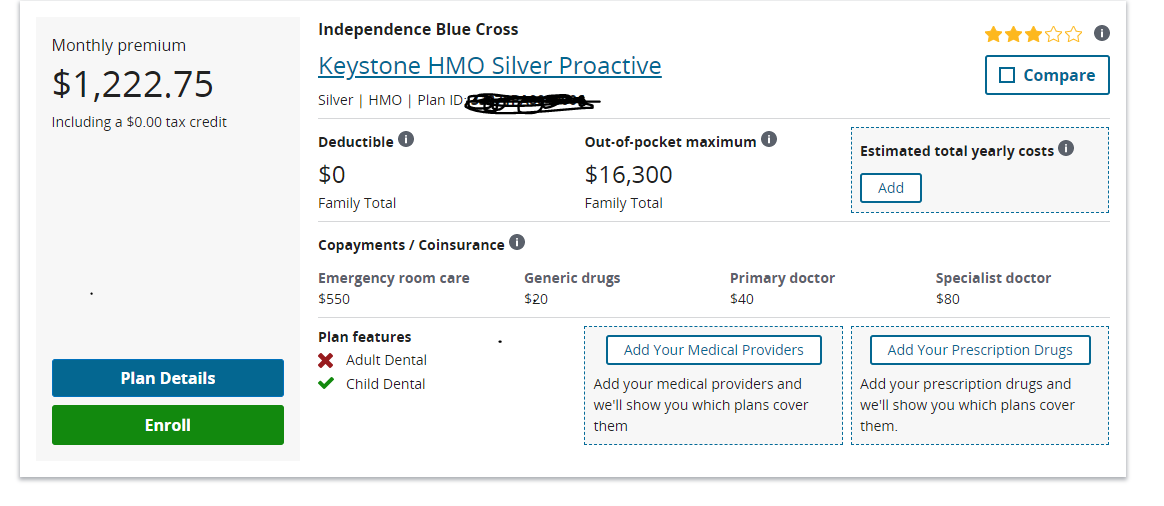

Comparing Quotes

Start by gathering multiple quotes from different insurance providers. Use online tools and resources to compare prices easily. Ensure you look at the coverage details for each plan. Don’t focus only on the monthly premium. Consider other costs like deductibles, co-pays, and out-of-pocket maximums.

| Provider | Monthly Premium | Deductible | Co-pay | Out-of-pocket Maximum |

|---|---|---|---|---|

| Provider A | $300 | $1,000 | $20 | $6,000 |

| Provider B | $250 | $1,500 | $25 | $7,000 |

| Provider C | $275 | $1,200 | $15 | $5,500 |

Reading The Fine Print

Always read the fine print before signing up for any plan. Look for hidden fees and exclusions. Check if your preferred doctors are in the network. Ensure the plan covers essential services like prescriptions, hospital visits, and preventive care.

- Check for hidden fees.

- Ensure your doctors are in-network.

- Verify coverage for prescriptions.

- Look for hospital visit coverage.

- Check preventive care services.

Credit: ilovecreatives.com

Frequently Asked Questions

What Is Health Insurance For Freelancers?

Health insurance for freelancers covers medical expenses for self-employed individuals who do not have employer-sponsored insurance.

How Can Freelancers Get Health Insurance?

Freelancers can get health insurance through government marketplaces, private insurers, or professional associations offering group plans.

Are There Affordable Health Insurance Options For Freelancers?

Yes, freelancers can find affordable options through subsidies on government marketplaces or by choosing high-deductible plans with lower premiums.

What Should Freelancers Consider When Choosing Health Insurance?

Freelancers should consider coverage options, costs, network of providers, and whether the plan meets their specific health needs.

Can Freelancers Deduct Health Insurance Premiums On Taxes?

Yes, freelancers can often deduct health insurance premiums as a business expense, reducing their taxable income.

Conclusion

Securing health insurance as a freelancer is crucial. It offers peace of mind and protection against unexpected medical expenses. Research your options thoroughly and choose a plan that fits your needs. Remember, investing in health insurance is investing in your future.

Stay covered, stay healthy, and enjoy the freedom of freelancing.