Blue Cross Blue Shield and UnitedHealthcare offer the best health insurance options for people with chronic conditions. They provide comprehensive coverage tailored to individual needs.

Chronic conditions require consistent and specialized medical care. Finding the right health insurance can significantly ease the financial burden. Blue Cross Blue Shield and UnitedHealthcare stand out due to their extensive networks of healthcare providers and specialized plans. These insurers offer various programs designed to manage chronic illnesses effectively.

Their plans include benefits such as lower copayments for regular doctor visits, prescription drug coverage, and access to specialists. Choosing the right plan ensures that individuals receive the necessary care without overwhelming costs. Make sure to compare plans and read reviews to find the best fit for your health needs.

Credit: www.ncoa.org

Importance Of Health Insurance For Chronic Conditions

Chronic conditions require ongoing medical care. Managing these conditions can be costly. Health insurance is vital for those with chronic illnesses. It provides financial protection and access to specialized care. This helps improve the quality of life.

Financial Protection

Medical bills can be overwhelming. Chronic conditions often need regular treatments. These treatments can be expensive. Health insurance helps cover these costs. It reduces the financial burden on families. Without insurance, many cannot afford necessary care. This leads to worsened health outcomes.

Consider this example:

| Service | Cost Without Insurance | Cost With Insurance |

|---|---|---|

| Monthly Medication | $500 | $50 |

| Doctor Visits | $200 per visit | $20 per visit |

This table shows the stark difference. Insurance makes healthcare more affordable. It allows patients to follow their treatment plans.

Access To Specialized Care

Chronic conditions often need specialized care. This includes visits to specialists. Specialists have advanced knowledge in specific areas. Health insurance plans cover these specialist visits. This ensures patients get the best care possible. Specialized care improves treatment outcomes. It helps manage symptoms effectively.

Insurance also covers diagnostic tests. These tests are crucial for monitoring chronic conditions. They help doctors make informed decisions. Access to these tests can be costly without insurance.

Here is a list of some common specialized care needs:

- Regular blood tests

- Advanced imaging scans

- Visits to endocrinologists

- Physical therapy sessions

Health insurance ensures these needs are met. Patients can maintain their health better. They can lead more normal lives.

Credit: www.ncoa.org

Key Features To Look For

Choosing the best health insurance for people with chronic conditions can be challenging. It’s crucial to understand the key features that can make a big difference in your healthcare journey. Here are some essential aspects to consider:

Coverage Limits

One of the most important factors is the coverage limits. Ensure your insurance plan covers a wide range of treatments. Chronic conditions often need ongoing care. Look for plans that provide high annual and lifetime limits. This way, you won’t run out of coverage when you need it most.

| Plan Type | Annual Coverage Limit | Lifetime Coverage Limit |

|---|---|---|

| Basic Plan | $50,000 | $500,000 |

| Premium Plan | $100,000 | $1,000,000 |

Pre-existing Conditions

It is crucial to check how the insurance handles pre-existing conditions. Some plans may exclude them or charge higher premiums. Look for plans that offer coverage for pre-existing conditions from day one. This can save you a lot of trouble and expense.

- Check for waiting periods for pre-existing conditions.

- Ensure there are no extra charges for chronic conditions.

- Look for comprehensive coverage for all required treatments.

Understanding these key features can help you choose the best health insurance. This ensures you get the care you need without breaking the bank.

Top Health Insurance Providers

Finding the right health insurance for chronic conditions is crucial. The right provider can offer excellent coverage and support. Below are the top health insurance providers that cater to chronic conditions.

Provider A

Provider A offers comprehensive plans tailored for chronic conditions. Their plans cover a wide range of treatments and medications.

- Coverage: Full coverage for necessary treatments and medications.

- Network: Extensive network of hospitals and specialists.

- Customer Support: 24/7 customer support for any queries.

| Plan | Monthly Premium | Deductible | Coverage |

|---|---|---|---|

| Basic | $150 | $1,000 | 80% |

| Premium | $300 | $500 | 90% |

Provider B

Provider B is known for its specialized care for chronic conditions. Their plans offer high coverage and low out-of-pocket costs.

- Coverage: Comprehensive coverage for all chronic conditions.

- Network: Access to top specialists and hospitals.

- Customer Support: Dedicated support for chronic condition management.

| Plan | Monthly Premium | Deductible | Coverage |

|---|---|---|---|

| Standard | $200 | $750 | 85% |

| Advanced | $400 | $300 | 95% |

Comparing Plans And Benefits

Choosing the best health insurance for chronic conditions can be tough. It’s vital to compare plans and benefits carefully. This helps in finding the right coverage. Understanding premium costs and out-of-pocket expenses is essential.

Premium Costs

Premium costs vary between different health insurance plans. Monthly premiums can be higher for plans offering extensive coverage. It’s important to balance between coverage and premium costs. A plan with a lower premium might offer fewer benefits. Ensure the premium fits your budget while meeting your health needs.

| Plan Type | Monthly Premium | Coverage Level |

|---|---|---|

| Basic Plan | $200 | Low |

| Standard Plan | $350 | Medium |

| Premium Plan | $500 | High |

Out-of-pocket Expenses

Out-of-pocket expenses include deductibles, co-pays, and co-insurance. These can add up quickly, especially for chronic conditions. It’s crucial to understand these costs before choosing a plan. A plan with a higher premium might have lower out-of-pocket expenses. This can be beneficial for those needing frequent medical care.

- Deductibles: The amount paid before insurance starts covering costs.

- Co-pays: Fixed fees paid for specific services like doctor visits.

- Co-insurance: A percentage of costs paid after meeting the deductible.

Compare the total potential out-of-pocket expenses across different plans. This helps in finding the most cost-effective option.

Tips For Choosing The Right Plan

Selecting the best health insurance for chronic conditions is crucial. The right plan ensures proper care and reduces out-of-pocket expenses. Here are some essential tips to help you choose wisely.

Consulting With Experts

Speak to a healthcare advisor or insurance specialist. They understand the complexities of chronic conditions. Their guidance helps you find plans that cover your specific needs.

- Ask detailed questions about coverage.

- Discuss your medical history.

- Seek advice on potential future treatments.

Experts can simplify the process. Their insights make a big difference.

Reading The Fine Print

Always read the fine print in any insurance policy. Pay close attention to coverage details. Look for:

- Exclusions: What treatments are not covered?

- Limits: Are there caps on certain services?

- Pre-authorization: Is approval needed before certain treatments?

Understanding these elements helps avoid unexpected costs. It ensures you get the necessary care without surprises.

| Coverage Aspect | What to Check |

|---|---|

| Exclusions | Identify non-covered treatments |

| Limits | Check service caps |

| Pre-authorization | Note required approvals |

Credit: youthwellness.ucsf.edu

Case Studies And Testimonials

When selecting health insurance for chronic conditions, real-life stories help. These case studies and testimonials show the impact of good coverage. People share their journeys, highlighting effective plans.

Real-life Experiences

John, a 45-year-old teacher, has lived with diabetes for 15 years. He needed a plan covering insulin and frequent doctor visits. John chose a policy with low co-pays and full coverage for diabetes care. He now manages his condition better and enjoys life.

Mary, a young mother, suffers from severe asthma. She needed a plan that covered inhalers and emergency visits. Mary found a plan with comprehensive asthma care. Now, she breathes easier and spends more time with her kids.

Success Stories

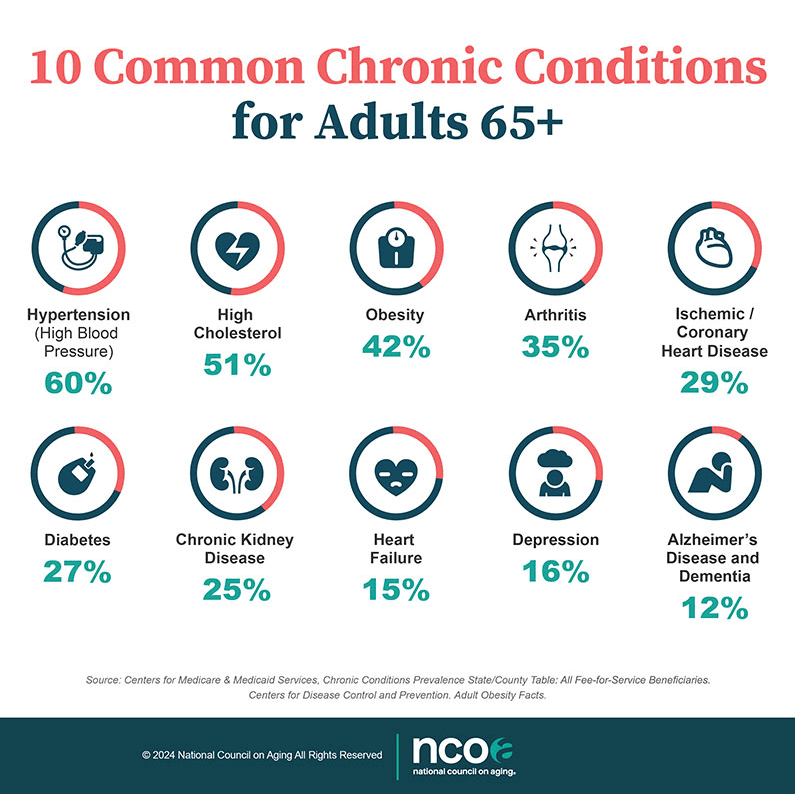

Paul, a retired engineer, struggled with hypertension for years. His previous insurance did not cover regular check-ups. Paul switched to a plan with full coverage for hypertension. His health improved, and he felt more secure.

Linda, a 60-year-old artist, has arthritis. Her condition required expensive medications and therapy. Linda chose a plan with no out-of-pocket costs for her treatments. She now creates art without pain and lives a fuller life.

| Case | Condition | Key Benefits |

|---|---|---|

| John | Diabetes | Low co-pays, full diabetes care |

| Mary | Asthma | Comprehensive asthma care |

| Paul | Hypertension | Full coverage for check-ups |

| Linda | Arthritis | No out-of-pocket costs for treatments |

These stories highlight the best health insurance for chronic conditions. Real-life experiences show the value of good coverage. Success stories inspire others to find the right plan.

Frequently Asked Questions

What Is The Best Health Insurance For Chronic Conditions?

Look for plans with low deductibles and comprehensive coverage for medications and treatments.

Can Chronic Conditions Affect Health Insurance Premiums?

Yes, chronic conditions often result in higher premiums due to increased healthcare needs.

Which Health Insurance Covers Pre-existing Conditions?

Most ACA-compliant plans cover pre-existing conditions without extra charges or waiting periods.

Are There Specific Plans For Chronic Illnesses?

Yes, some insurers offer specialized plans tailored for chronic conditions, focusing on necessary treatments and medications.

How To Choose Health Insurance For Chronic Conditions?

Compare coverage options, check for specialist availability, and review medication coverage to find the best plan.

Conclusion

Choosing the best health insurance for chronic conditions is crucial. It ensures access to necessary treatments and medications. Research and compare plans carefully. Always consider your specific health needs and financial situation. The right insurance can significantly improve your quality of life.

Make an informed decision for a healthier future.