Employer-sponsored health insurance is a health coverage plan provided by an employer to employees. It often includes benefits for medical, dental, and vision care.

Employer-sponsored health insurance offers a significant benefit to employees. Companies usually pay a portion of the premium, making it more affordable. This type of insurance often includes comprehensive coverage, ensuring employees receive necessary medical care. Employees can also extend coverage to their dependents, enhancing family health security.

Employers benefit too, as offering health insurance can attract and retain top talent. Overall, employer-sponsored health insurance is a key component of employee benefits, contributing to the overall well-being and job satisfaction of the workforce. It also plays a crucial role in reducing out-of-pocket healthcare expenses for employees.

Credit: www.kff.org

Introduction To Employer-sponsored Health Insurance

Employer-Sponsored Health Insurance is a popular benefit in the workforce. It helps employees get medical care. Employers offer this to attract and keep good workers.

Definition

Employer-Sponsored Health Insurance is health coverage provided by an employer. Employers often share the cost with employees. This means the company pays part of the premium. Employees pay the rest.

Importance

Employer-Sponsored Health Insurance is very important for employees. It helps them stay healthy. It also saves them money on medical bills.

- Financial Security: Employees have fewer out-of-pocket costs.

- Access to Care: They can visit doctors and hospitals.

- Peace of Mind: They feel secure knowing they are covered.

Employers also benefit from offering health insurance. It makes employees happy and loyal. It also attracts talented workers.

| Benefits for Employees | Benefits for Employers |

|---|---|

| Lower medical costs | Higher employee retention |

| Access to better care | Attracts top talent |

| Healthier lifestyle | Boosts morale |

Employer-Sponsored Health Insurance is a key part of a good job. It helps both employees and employers. It makes the workplace better for everyone.

Types Of Employer-sponsored Health Plans

Employer-sponsored health insurance is a valuable benefit. It helps employees access quality healthcare. There are different types of plans available. Here are the most common types.

Hmo Plans

HMO stands for Health Maintenance Organization. These plans require employees to choose a primary care physician (PCP). The PCP coordinates all healthcare services. Referrals are needed to see specialists. HMO plans often have lower premiums. They also have lower out-of-pocket costs. The network of doctors is limited to specific providers.

Ppo Plans

PPO stands for Preferred Provider Organization. These plans offer more flexibility. Employees do not need a PCP. They can see specialists without a referral. PPO plans have a larger network of providers. This means more choices for doctors and hospitals. They usually have higher premiums. Out-of-pocket costs can also be higher.

| Feature | HMO Plans | PPO Plans |

|---|---|---|

| Primary Care Physician | Required | Not Required |

| Specialist Visits | Referral Needed | No Referral Needed |

| Network Size | Limited | Larger |

| Premium Costs | Lower | Higher |

| Out-of-Pocket Costs | Lower | Higher |

How Employer-sponsored Health Insurance Works

Employer-sponsored health insurance is a common benefit. It helps workers get healthcare. Understanding how it works is important. This section explains the basics.

Premiums

The premium is the cost of the insurance plan. Employers and employees share this cost. Employers pay a large part of the premium. Employees pay the rest through payroll deductions.

| Party | Percentage Paid |

|---|---|

| Employer | 70-80% |

| Employee | 20-30% |

Coverage Options

Employer-sponsored plans offer various coverage options. These may include:

- Medical insurance

- Dental insurance

- Vision insurance

- Prescription drug coverage

Employees can choose plans that suit their needs. Some plans cover more services but cost more. Others cover fewer services but are cheaper.

Credit: axenehp.com

Benefits For Employees

Employer-sponsored health insurance offers many benefits for employees. It provides cost savings and easier access to medical care. Employees appreciate this valuable perk.

Cost Savings

Employer-sponsored plans often cost less than individual plans. Employers usually cover a significant portion of the premium. This reduces the financial burden on employees.

In a typical employer-sponsored plan, the company pays part of the premium. The employee pays the rest, often through payroll deductions. This can lead to substantial savings compared to individual health insurance costs.

Additionally, employers often negotiate better rates with insurance companies. This means employees can get more coverage for less money.

Access To Care

With employer-sponsored health insurance, employees have access to a wide network of doctors and hospitals. This makes it easier to find and receive medical care when needed.

Many plans also include preventive care services at no extra cost. These services can include annual check-ups, vaccinations, and screenings. Regular preventive care helps catch health issues early, leading to better outcomes.

Additionally, employer-sponsored plans often come with added benefits. These may include prescription drug coverage, mental health services, and wellness programs. This comprehensive coverage ensures employees can address various health needs.

Employer Responsibilities

Employer-sponsored health insurance is a significant benefit. It helps attract and retain employees. Employers have key responsibilities in this area. These responsibilities ensure the smooth operation of health insurance plans.

Plan Selection

Choosing the right health insurance plan is crucial. Employers must assess employee needs. They should consider factors like coverage options, cost, and network of providers.

- Evaluate multiple insurance providers

- Compare premiums and coverage

- Ensure the plan meets employee needs

This process often includes consultations with insurance brokers. They can provide valuable insights into various plans. Employers should also consider employee feedback during this selection process.

Compliance With Laws

Employers must comply with federal and state laws. These laws govern employer-sponsored health insurance. Key regulations include:

- Affordable Care Act (ACA): Requires employers to offer minimum essential coverage.

- COBRA: Allows employees to continue coverage after leaving the job.

- ERISA: Sets standards for health plans in private industry.

Maintaining compliance is crucial. Non-compliance can result in penalties. Employers should stay updated on changes in health insurance laws.

Credit: baudrytherapy.com

Choosing The Right Plan

Choosing the right employer-sponsored health insurance plan can be overwhelming. With many options available, it’s essential to select the plan that best fits your needs. This section will guide you through the process of assessing your needs and comparing options.

Assessing Needs

To choose the right health insurance plan, start by understanding your health needs. Consider these factors:

- Health conditions: Do you have any chronic illnesses?

- Doctor visits: How often do you visit the doctor?

- Prescription drugs: Do you take any medications regularly?

- Family health: Do your family members need regular check-ups?

Understanding these factors helps in determining the type of coverage you need.

Comparing Options

Once you know your needs, compare the available insurance options. Consider the following aspects:

| Aspect | Explanation |

|---|---|

| Premiums | Monthly cost of the insurance plan. |

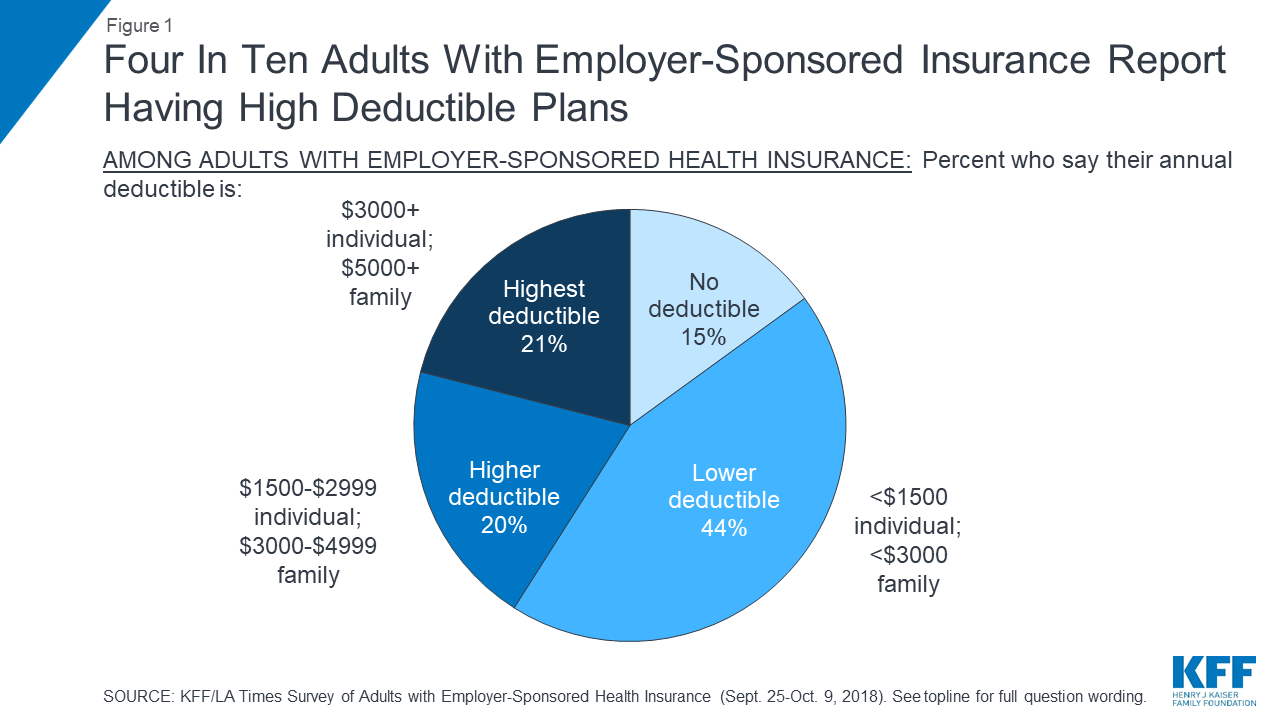

| Deductibles | Amount you pay before insurance starts covering costs. |

| Co-payments | Fixed fee for doctor visits and prescriptions. |

| Network | List of doctors and hospitals covered by the plan. |

| Coverage | What services and medications are covered. |

Make a list of your priorities. Use this list to compare different plans. Choose the one that offers the best value and fits your needs.

Frequently Asked Questions

What Is Employer-sponsored Health Insurance?

Employer-sponsored health insurance is a health plan provided by an employer to their employees as part of their benefits package.

How Does Employer-sponsored Health Insurance Work?

Employers select and offer health insurance plans. Employees enroll, often paying a portion of the premium, while employers cover the rest.

Who Qualifies For Employer-sponsored Health Insurance?

Full-time employees typically qualify. Some employers also offer plans to part-time workers, dependents, and spouses.

What Are The Benefits Of Employer-sponsored Health Insurance?

It often provides lower premiums, comprehensive coverage, and tax benefits. Employers may also offer additional wellness programs.

Can I Opt Out Of Employer-sponsored Health Insurance?

Yes, employees can opt out. They may choose individual plans or coverage through a spouse’s employer-sponsored plan.

Conclusion

Employer-sponsored health insurance offers valuable coverage for employees. It helps attract and retain top talent. Understanding its benefits and options is crucial. Choose a plan that meets your needs and budget. Employer-sponsored health insurance can provide peace of mind and financial security for you and your family.