Health insurance often does not cover routine vision care. Separate vision insurance usually covers eye exams, glasses, and contact lenses.

Vision health is crucial for overall well-being. Many people assume their health insurance covers eye care, but that’s not always the case. Routine eye exams, glasses, and contact lenses usually fall under vision insurance, not standard health insurance. Understanding the difference can save you money and ensure you get the care you need.

Vision insurance typically includes coverage for annual eye exams and discounts on eyewear. Some plans also cover corrective surgeries like LASIK. Check your policy details to know what is included. Investing in vision insurance can be a smart move for maintaining good eye health.

Credit: averyhall.com

Introduction To Vision Coverage

Vision coverage is a type of insurance that helps cover the cost of eye care. Many people wonder if health insurance includes vision coverage. This blog will explain the basics of vision insurance and why it matters.

Basics Of Vision Insurance

Vision insurance is different from regular health insurance. It focuses on eye health and vision care. Typical vision insurance plans cover:

- Eye exams

- Prescription glasses

- Contact lenses

- Discounts on LASIK and other eye surgeries

Some plans may also offer discounts on eyewear and other vision-related products. Vision insurance can be added to your health insurance plan or purchased separately.

Why It Matters

Good vision is crucial for daily activities like reading, driving, and working. Regular eye exams can detect problems early. This can prevent serious issues later. Here are some reasons why vision coverage is important:

- Early Detection: Eye exams can catch diseases early.

- Cost Savings: Vision insurance lowers the cost of eye care.

- Overall Health: Eye exams can reveal other health issues.

Investing in vision coverage ensures you take care of your eyes. It saves money and helps maintain overall health.

Types Of Vision Services Covered

Understanding the types of vision services covered by health insurance is crucial. It helps you know what benefits you can access. This section breaks down routine eye exams, prescription glasses, and contacts.

Routine Eye Exams

Routine eye exams are essential for maintaining good eye health. Many health insurance plans offer coverage for these exams. They help detect vision problems early. An eye exam usually includes:

- Visual acuity test

- Refraction assessment

- Eye muscle test

- Glaucoma screening

These tests ensure your eyes stay healthy. Regular check-ups can prevent serious issues later.

Prescription Glasses And Contacts

Prescription glasses and contacts are often covered by health insurance. This coverage can vary. Some plans offer full coverage, while others cover only part of the cost. Important elements include:

| Service | Coverage |

|---|---|

| Prescription Glasses | Full or partial coverage |

| Contact Lenses | Full or partial coverage |

Having insurance can reduce the cost of these essentials. Check your plan for specific details.

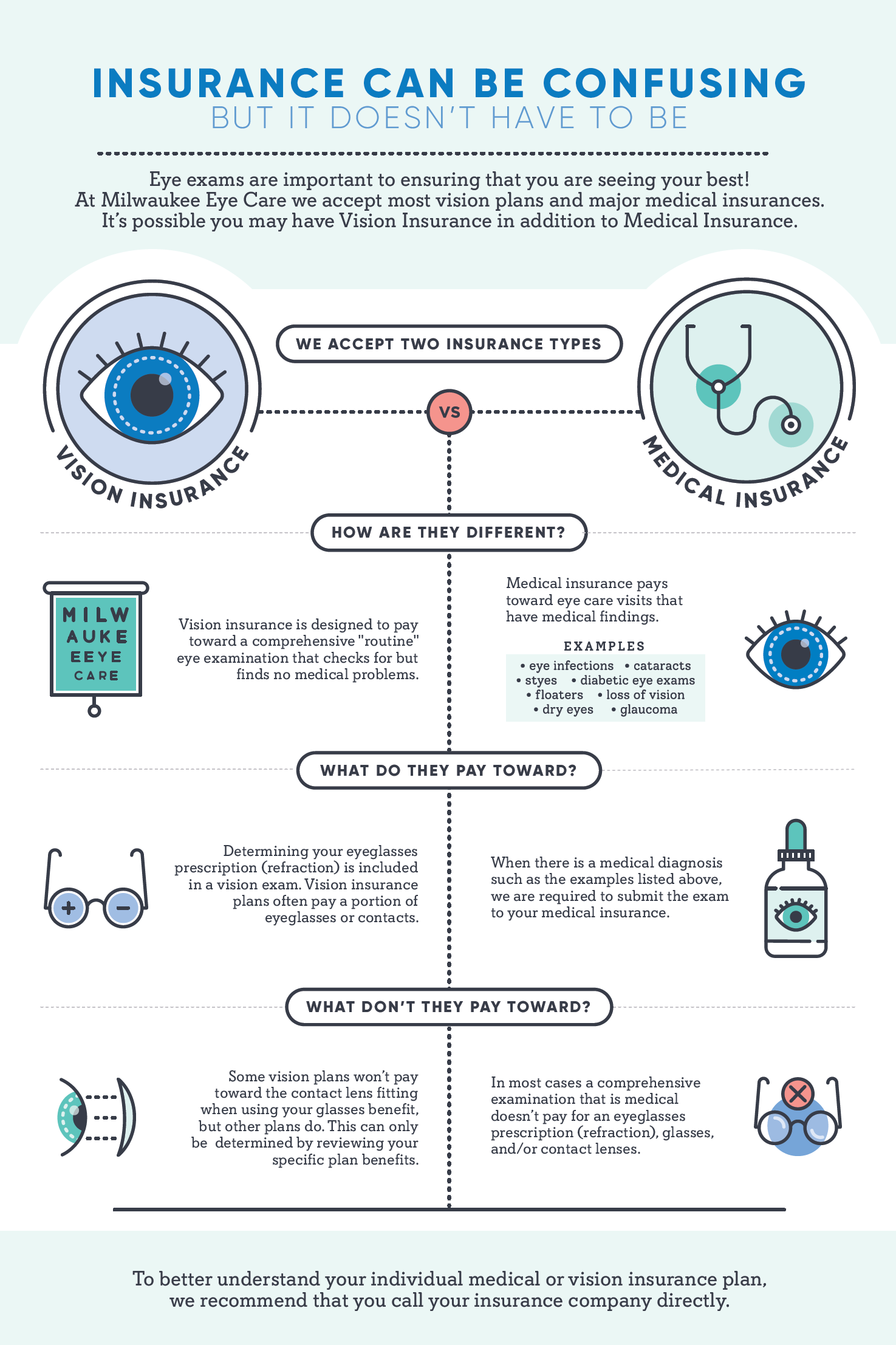

Health Insurance Vs. Vision Insurance

Understanding the differences between health insurance and vision insurance can be confusing. Both types of insurance provide valuable coverage, but they serve distinct purposes. This section will break down the key differences and guide you on when to use each type of insurance.

Key Differences

Health insurance typically covers medical and surgical expenses. It includes visits to the doctor, hospital stays, and emergency care. Vision insurance, on the other hand, focuses solely on eye care. This includes routine eye exams, prescription glasses, and contact lenses.

| Aspect | Health Insurance | Vision Insurance |

|---|---|---|

| Coverage | Medical and surgical expenses | Eye exams, glasses, contact lenses |

| Providers | Doctors, hospitals | Optometrists, ophthalmologists |

| Frequency | As needed for illnesses and injuries | Usually once a year for exams |

| Specialized Care | General health issues | Vision-specific needs |

When To Use Each

Use health insurance for general health needs. This includes doctor visits, surgeries, and emergency care. You should also use it for chronic conditions and medications.

Use vision insurance for eye-specific services. This includes annual eye exams, glasses, and contact lenses. It is also beneficial for managing vision-related conditions.

- Health Insurance:

- Doctor visits

- Hospital stays

- Surgeries

- Emergency care

- Vision Insurance:

- Eye exams

- Prescription glasses

- Contact lenses

- Vision therapy

Understanding these differences can help you make informed decisions. Choose the right insurance for your needs and maximize your benefits.

Credit: www.milwaukeeeyecare.com

Common Limitations And Exclusions

When exploring health insurance for vision, there are common limitations and exclusions. These can impact the coverage you receive. Understanding these limitations helps in making informed decisions.

Pre-existing Conditions

Many health insurance plans have specific rules for pre-existing conditions. A pre-existing condition is any vision problem you had before getting the insurance.

Insurance companies often exclude coverage for these conditions. This means they won’t pay for treatments related to your pre-existing vision issues.

Some plans might cover pre-existing conditions but with a waiting period. During this time, you must pay for your treatments yourself.

Surgical Procedures

Health insurance plans usually have limitations on surgical procedures for vision. Not all plans cover surgeries like LASIK or cataract removal.

Sometimes, insurance only covers surgeries deemed medically necessary. Cosmetic or elective surgeries are often excluded.

It’s essential to read your policy to understand what surgical procedures are covered. This helps avoid unexpected expenses.

How To Maximize Your Vision Benefits

Health insurance often covers vision care, but you can still get more from your plan. By making smart choices, you can save money and get the best care. This section will guide you through maximizing your vision benefits.

Choosing The Right Plan

Not all plans are the same. Some offer more vision benefits than others. Compare different plans to see which one fits your needs best.

- Look for plans with lower co-pays for eye exams.

- Check if they cover glasses or contact lenses.

- See if they offer discounts on LASIK surgery.

Read the fine print to understand what is covered. Some plans may have annual limits on vision care.

Utilizing Discounts And Networks

Many health insurance plans work with specific networks of doctors and stores. Using these networks can save you money.

| Benefit | In-Network | Out-of-Network |

|---|---|---|

| Eye Exams | Lower Co-pay | Higher Co-pay |

| Glasses | Discounted Prices | Full Price |

| Contact Lenses | Rebates Available | No Rebates |

Ask your insurance provider for a list of in-network doctors. Look for discounts at partner stores.

Some plans offer extra discounts for using specific brands. Check online for special deals through your insurance.

Credit: www.downtowneyes.com

Steps To File A Vision Insurance Claim

Filing a vision insurance claim may seem daunting. Follow these steps to make it easier. This guide helps you understand the process and avoid common mistakes.

Required Documentation

Gathering the right documents is crucial. Here’s what you need:

- Claim Form: This is provided by your insurance company.

- Receipt: Include the original receipt of your eye exam or glasses purchase.

- Doctor’s Report: A detailed report from your eye doctor.

- Prescription: Ensure you have the latest prescription details.

- Insurance Card: A copy of your vision insurance card.

Double-check all documents before submission. Incomplete forms cause delays.

Common Pitfalls To Avoid

Avoiding common mistakes saves time and hassle. Here are a few tips:

- Incorrect Information: Ensure all personal and policy details are accurate.

- Late Submission: Submit your claim within the allowed time frame.

- Missing Documents: Ensure all required documents are attached.

- Unclear Receipts: Clear and readable receipts are essential.

- Policy Exclusions: Know what your policy covers and excludes.

Following these steps ensures a smooth claim process. Stay organized and double-check everything.

Frequently Asked Questions

Does Health Insurance Cover Vision Care?

Some health insurance plans include vision care, but many require separate vision insurance.

What Vision Services Are Covered By Insurance?

Coverage can include eye exams, glasses, and contact lenses, depending on the plan.

Is Eye Surgery Covered By Health Insurance?

Basic health insurance may cover medically necessary eye surgeries but not elective procedures like LASIK.

Do I Need Separate Vision Insurance?

Separate vision insurance is often needed for routine eye care and corrective lenses.

Are Children’s Vision Needs Covered?

Many health plans include vision care for children, often covering eye exams and corrective lenses.

Conclusion

Understanding your health insurance coverage for vision care is essential. Many plans offer some level of vision benefits. Always review your policy details and consult your provider. This ensures you maximize your benefits and maintain optimal eye health. Stay informed and proactive about your vision care needs.