Delta Dental is often considered the best health insurance for dental coverage due to its comprehensive plans and extensive network. Cigna and Aetna also offer competitive dental insurance options.

Choosing the right dental insurance is crucial for maintaining oral health. Delta Dental stands out with its broad range of plans and a vast network of dentists. Their coverage includes preventive, basic, and major dental services, making it suitable for various needs.

Cigna and Aetna provide strong alternatives, each with unique benefits and flexible plans. These companies offer comprehensive dental care that can help reduce out-of-pocket expenses. Evaluate your specific dental needs and budget to select the best plan for you. Proper dental coverage ensures long-term oral health and financial peace of mind.

Introduction To Dental Coverage

Understanding dental coverage is crucial for maintaining oral health. Dental insurance helps cover the cost of dental care. This includes routine check-ups, treatments, and emergencies.

Importance Of Dental Health

Dental health affects overall well-being. Healthy teeth and gums prevent infections. Regular dental visits catch issues early.

- Prevents cavities and tooth decay

- Stops gum disease

- Improves smile and confidence

Ignoring dental health can lead to serious problems. These include pain, infections, and even heart disease. Taking care of your teeth is essential for a healthy life.

Role Of Insurance

Insurance plays a key role in dental health. It helps manage the costs of treatments. Many people avoid dentists due to high costs.

| Type of Coverage | Benefits |

|---|---|

| Preventive Care | Includes check-ups and cleanings |

| Basic Procedures | Includes fillings and extractions |

| Major Procedures | Includes crowns and dentures |

With insurance, you can access regular dental care. This leads to better oral health and fewer emergency visits. Choosing the right dental insurance is important. It ensures you get the best care possible.

Credit: www.policyadvisor.com

Key Features To Look For

Choosing the best health insurance for dental coverage can be overwhelming. Knowing what features to look for is crucial. This section outlines the key features to consider. Understanding these aspects will help you make an informed decision.

Coverage Limits

One of the most important features is the coverage limits. Ensure the plan covers a wide range of dental services. Here are some points to consider:

- Annual maximum limit

- Coverage for preventive services

- Inclusion of major procedures like root canals

- Orthodontic coverage, especially for children

Check if the plan offers a high enough annual maximum limit. This ensures you won’t run out of coverage. Preventive services should include cleanings and exams. Major procedures should also be covered adequately.

Network Of Dentists

The network of dentists is another critical factor. You need access to a wide network. This ensures you have many choices for dental care.

Here are some aspects to check:

- Number of in-network dentists

- Proximity to your home or office

- Specialists included in the network

A larger network means more options. Proximity is important for convenience. Ensure specialists like orthodontists and periodontists are included. This will give you comprehensive care options.

Top Dental Insurance Providers

Choosing the right dental insurance can be tricky. There are many options available. To help you out, we have listed top dental insurance providers. Each offers unique benefits. Read on to know more.

Provider A

Provider A is known for its comprehensive dental plans. They cover a wide range of dental services.

- Preventive Care

- Basic Procedures

- Major Procedures

Provider A has a large network of dentists. You can easily find a dentist near you. Their customer service is also top-notch.

| Plan | Monthly Premium | Annual Maximum |

|---|---|---|

| Basic Plan | $25 | $1,000 |

| Premium Plan | $40 | $1,500 |

| Family Plan | $60 | $2,000 |

Provider B

Provider B offers affordable dental insurance plans. They focus on preventive care.

- Regular Check-ups

- Teeth Cleaning

- X-rays

Provider B has flexible payment options. They also have a rewards program. You can earn points for healthy habits.

| Plan | Monthly Premium | Annual Maximum |

|---|---|---|

| Standard Plan | $20 | $800 |

| Advanced Plan | $35 | $1,200 |

| Family Plan | $50 | $1,800 |

Credit: www.starbucksbenefits.com

Comparing Plans And Costs

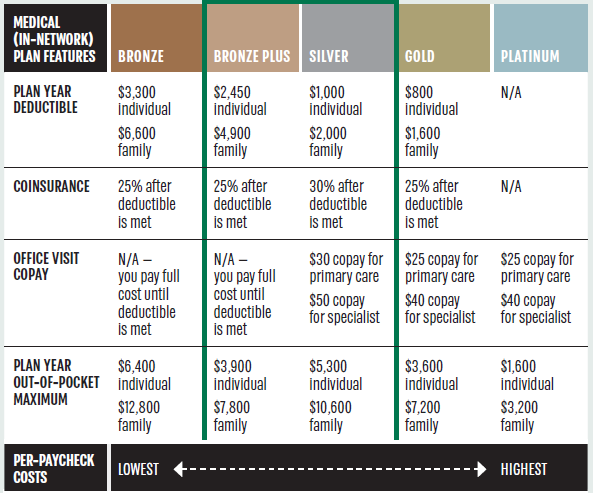

Finding the best health insurance for dental coverage can be tough. It’s important to compare plans and costs. This helps you choose the best option for your needs.

Premiums Vs. Benefits

Premiums are the monthly fees you pay for insurance. Benefits are what the insurance covers. It’s important to balance both. A lower premium might mean fewer benefits. A higher premium could offer more coverage.

| Plan Type | Monthly Premium | Dental Benefits |

|---|---|---|

| Basic | $20 | Cleanings, Exams |

| Standard | $50 | Cleanings, Exams, Fillings |

| Premium | $100 | All basic and major dental work |

Compare the monthly premium with the dental benefits provided. This helps you make an informed choice.

Out-of-pocket Expenses

Out-of-pocket expenses are costs you pay yourself. These include deductibles, co-pays, and co-insurance.

- Deductible: The amount you pay before insurance starts covering costs.

- Co-pay: A small fee you pay for each dental visit.

- Co-insurance: A percentage of the cost you share with the insurance company.

Check each plan’s out-of-pocket costs. This will help you avoid surprises. Higher premiums usually mean lower out-of-pocket costs. But, this isn’t always the case.

It’s vital to understand the balance between premiums and out-of-pocket expenses. This ensures you get the best value for your money.

How To Choose The Right Plan

Choosing the right health insurance plan for dental coverage is crucial. It ensures you get the best care for your teeth. This section helps you pick the best plan.

Assessing Your Needs

First, understand your dental needs. Do you need routine cleanings or braces? Make a list of your dental requirements.

- Routine check-ups

- Fillings

- Braces

- Root canals

- Extractions

Next, think about your budget. How much can you spend on dental care? Check if you need coverage for the whole family.

Reading The Fine Print

Always read the fine print of the insurance plan. Look for details about coverage limits and exclusions. Make sure you know what is covered and what is not.

| Feature | Details to Check |

|---|---|

| Annual Maximum | Maximum amount the plan pays in a year. |

| Waiting Period | Time before coverage starts for certain services. |

| Network Dentists | List of dentists you can visit under the plan. |

| Co-payments | Amount you pay for each visit or service. |

Some plans may have a waiting period. This means you must wait before getting certain services covered. Check the list of network dentists. Ensure your preferred dentist is included.

Understand co-payments. This is the amount you pay for each service. Knowing these details helps you avoid surprises.

Credit: www.marketwatch.com

Tips For Maximizing Your Coverage

Maximizing your dental coverage can save you money and ensure your oral health. Here are some essential tips to make the most of your dental insurance plan.

Regular Check-ups

Scheduling regular check-ups helps catch dental issues early. This can prevent more costly treatments later. Most plans cover bi-annual cleanings and exams. Ensure you use this benefit.

- Visit your dentist every six months.

- Check if your plan covers additional visits if needed.

Preventive Care

Engaging in preventive care can significantly reduce dental problems. Many insurance plans cover preventive treatments fully. These treatments include cleanings, X-rays, and fluoride treatments.

- Brush and floss daily.

- Use fluoride toothpaste.

- Limit sugary foods and drinks.

| Preventive Treatment | Coverage Details |

|---|---|

| Cleanings | Usually covered twice a year |

| X-rays | Often covered annually |

| Fluoride Treatments | Typically covered for children |

Always verify what your insurance covers. This ensures you don’t miss out on benefits. Staying informed helps you maximize your coverage and maintain a healthy smile.

Frequently Asked Questions

What Does Dental Coverage Include?

Dental coverage typically includes exams, cleanings, X-rays, fillings, and sometimes orthodontics and oral surgeries.

Is Dental Insurance Worth It?

Yes, it helps cover costly dental procedures and regular check-ups, promoting overall oral health.

How To Choose Dental Insurance?

Compare plans based on coverage, network of dentists, premiums, deductibles, and customer reviews.

Does Health Insurance Cover Dental?

Some health insurance plans offer limited dental coverage, but separate dental insurance is often more comprehensive.

Can I Use Dental Insurance Immediately?

Most plans have a waiting period before certain services are covered, usually ranging from a few months to a year.

Conclusion

Finding the best health insurance for dental coverage can greatly improve your oral health. Evaluate your needs and budget carefully. Compare different plans and read reviews. Choosing the right insurance ensures peace of mind and better dental care. Make an informed decision for a healthier smile.