The best health insurance for mental health coverage often includes plans from providers like Aetna, Blue Cross Blue Shield, and Cigna. These insurers offer comprehensive mental health benefits, including therapy and medication.

Mental health is a crucial aspect of overall well-being. Quality health insurance plans that cover mental health services can make a significant difference. Aetna, Blue Cross Blue Shield, and Cigna are known for their robust mental health coverage. They provide access to therapy, psychiatric services, and necessary medications.

Choosing the right plan requires understanding your specific needs and the extent of coverage each insurer offers. Comprehensive mental health benefits can lead to better outcomes and improved quality of life. Always compare plans to find the best fit for your needs.

Credit: journeypure.com

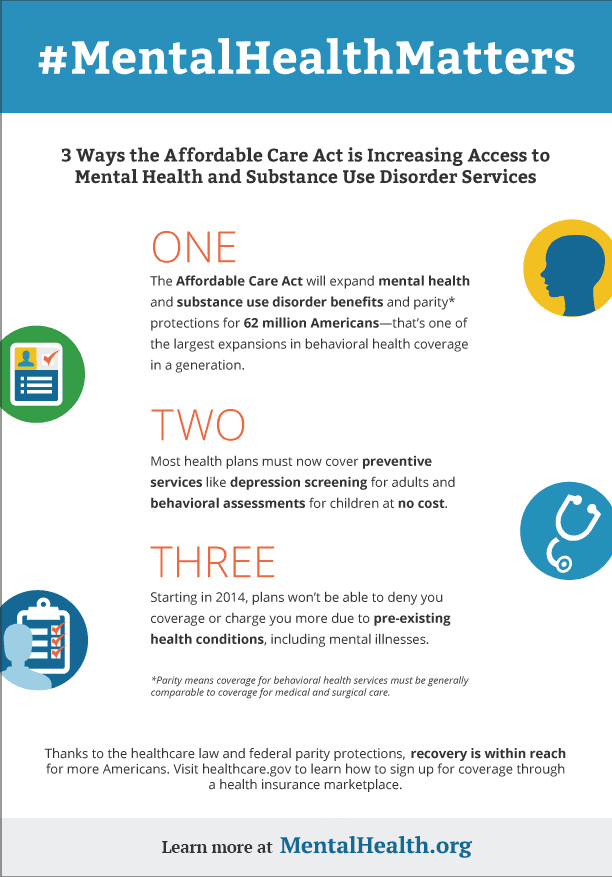

Introduction To Mental Health Insurance

Understanding mental health insurance is essential. It helps cover costs for mental health care. This type of insurance ensures you get the care you need. Mental health issues are as important as physical health problems. They require professional attention and support.

Importance Of Mental Health Coverage

Mental health coverage plays a vital role in overall well-being. It provides access to therapists and counselors. This support can make a big difference in your life. With proper coverage, you can manage conditions like depression and anxiety better. Access to mental health services reduces the stigma around seeking help.

- Access to Therapists: Connect with trained professionals.

- Medication Coverage: Helps pay for necessary prescriptions.

- Emergency Care: Access to urgent mental health services.

Current Trends In Mental Health Insurance

There are several trends in mental health insurance today. These trends aim to improve access and coverage. One major trend is the inclusion of telehealth services. This allows you to consult with professionals online. Another trend is the increasing coverage for therapy sessions.

- Telehealth Services: Online consultations with mental health experts.

- Expanded Therapy Coverage: More sessions covered by insurance.

- Preventive Care: Focus on early intervention and support.

Health insurance companies are recognizing the need for mental health coverage. They are expanding their plans to include more services. This change is beneficial for everyone seeking mental health care.

Criteria For Choosing A Plan

Choosing the best health insurance for mental health coverage can be daunting. Multiple factors impact your decision. This section explores key criteria to consider.

Coverage Options

First, examine the coverage options. Look for plans that include a wide range of mental health services. These services should cover:

- Therapy sessions

- Psychiatric consultations

- Medication management

- Inpatient and outpatient care

Check if the plan covers both short-term and long-term treatments. This ensures comprehensive care for all mental health needs.

Network Of Providers

Next, assess the network of providers. A good plan should have a broad network of mental health professionals. This includes:

- Therapists

- Psychiatrists

- Counselors

Having a wide network ensures you can access specialized care. Verify if your preferred providers are in-network. This reduces out-of-pocket expenses.

Cost And Affordability

Finally, consider the cost and affordability of the plan. Evaluate the following:

| Cost Factor | Details |

|---|---|

| Premiums | Monthly or annual payment for the insurance plan. |

| Deductibles | Amount you pay before insurance kicks in. |

| Co-payments | Fixed fees per visit or service. |

| Out-of-pocket limits | Maximum amount you pay in a year. |

Ensure the plan fits your budget. Compare different plans to find the best value for your money.

Top Plan 1: Plan Name

Choosing the best health insurance for mental health coverage is crucial. Top Plan 1 offers comprehensive mental health benefits. This plan stands out for its wide range of services and support.

Key Features

- Comprehensive Coverage: Includes therapy, counseling, and psychiatric care.

- Network of Providers: Access to a large network of mental health professionals.

- Low Copayments: Affordable copayments for mental health visits.

- 24/7 Helpline: Immediate support through a dedicated helpline.

- Telehealth Services: Access to virtual consultations and therapy sessions.

Pros And Cons

| Pros | Cons |

|---|---|

| Wide range of mental health services | Higher premiums compared to other plans |

| Extensive network of providers | Requires pre-authorization for certain services |

| 24/7 helpline for immediate support | Limited coverage for out-of-network providers |

| Low copayments | Telehealth services may have restrictions |

Customer Reviews

- John D.: “Top Plan 1 has been a lifesaver. The coverage is excellent.”

- Sarah P.: “I appreciate the 24/7 helpline. It provides peace of mind.”

- Michael R.: “The network of providers is extensive. I found the right therapist easily.”

- Emily S.: “The copayments are low. It makes therapy sessions affordable.”

Credit: manhattanmentalhealthcounseling.com

Top Plan 2: Plan Name

Choosing the right health insurance for mental health can be challenging. Top Plan 2: Plan Name stands out for its comprehensive coverage. This plan ensures you get the support you need.

Key Features

- Extensive network: Access to a wide range of mental health professionals.

- Affordable premiums: Budget-friendly options without sacrificing coverage.

- Low co-pays: Minimal out-of-pocket costs for therapy sessions.

- Telehealth services: Convenient online consultations available.

- 24/7 support: Round-the-clock assistance for emergencies.

Pros And Cons

| Pros | Cons |

|---|---|

|

|

Customer Reviews

Users praise the extensive network and low co-pays.

Many appreciate the convenience of telehealth services.

Some note the need for referrals as a drawback.

Overall, the customer satisfaction rate is high.

Top Plan 3: Plan Name

Plan Name offers excellent mental health coverage. This plan stands out for its wide range of services and affordable premiums. It is ideal for individuals seeking comprehensive mental health support.

Key Features

- Coverage: Includes therapy sessions, psychiatric consultations, and medication.

- Network: Access to a large network of mental health professionals.

- Telehealth: Offers telehealth services for mental health consultations.

- Support: 24/7 mental health helpline for immediate assistance.

- Pre-Existing Conditions: Covers pre-existing mental health conditions.

Pros And Cons

| Pros | Cons |

|---|---|

| Extensive mental health network | Higher premium for extensive coverage |

| 24/7 mental health helpline | Limited coverage for non-network providers |

| Telehealth options available | May require referrals for certain specialists |

Customer Reviews

- John D.: “This plan has been a lifesaver. The mental health helpline is excellent.”

- Sarah P.: “I love the telehealth options. It makes getting help easy.”

- Emily R.: “The network of professionals is vast. I always find the care I need.”

- Michael S.: “The premiums are a bit high, but the coverage is worth it.”

- Anna K.: “I appreciate the coverage for pre-existing conditions. It’s a huge relief.”

Final Thoughts

Choosing the best health insurance for mental health coverage is crucial. It affects not only your mental well-being but also your overall health. By making an informed decision, you can ensure peace of mind and financial stability.

Making An Informed Decision

Research is vital when picking the right plan. Compare different options and benefits. Look for policies with comprehensive mental health coverage.

- Check for therapy and counseling coverage.

- Ensure medication costs are included.

- Look at the network of mental health professionals.

Consider the costs involved. Look at premiums, deductibles, and co-pays. Balance your budget with your mental health needs.

Future Of Mental Health Coverage

The future of mental health coverage is evolving. New policies and regulations are improving access and affordability.

| Aspect | Future Trends |

|---|---|

| Telehealth Services | Increasing availability and acceptance. |

| Policy Changes | More inclusive mental health benefits. |

| Technology Integration | Use of apps and AI for mental health. |

Stay updated on these trends. They can help you get better coverage. Your mental health deserves the best care possible.

Credit: joinditto.in

Frequently Asked Questions

What Is Mental Health Insurance Coverage?

Mental health insurance covers therapy, counseling, and medication. It supports mental health treatments and services.

Does Health Insurance Cover Therapy?

Yes, most health insurance plans cover therapy. Check with your provider for specific coverage details.

How To Find The Best Mental Health Insurance?

Compare different plans, check coverage options, and read reviews. Consult an insurance expert if needed.

Is Mental Health Coverage Expensive?

Costs vary by plan and provider. Some plans offer affordable mental health coverage options.

Can I Switch To A Better Mental Health Plan?

Yes, you can switch during open enrollment or qualifying life events. Research plans before making changes.

Conclusion

Choosing the best health insurance for mental health coverage is essential. Prioritize plans that offer comprehensive mental health benefits. Consider factors like therapy sessions, medication coverage, and provider networks. Investing in the right plan can improve overall well-being. Make informed decisions for better mental health support and peace of mind.