The best loans for individuals with poor credit are secured loans and payday alternative loans. Credit unions and online lenders often provide these options with more favorable terms.

Navigating the financial landscape with poor credit can be daunting, yet options exist that cater to this demographic. Secured loans require collateral, offering lenders assurance and often resulting in lower interest rates for borrowers. Payday alternative loans, offered by credit unions, come with capped rates, preventing the debt spiral typical of traditional payday loans.

It’s crucial for individuals to review the terms carefully, considering the interest rates and fees, to ensure the loan is manageable within their budget. By making informed decisions, even those with less-than-ideal credit can find pathways to financial stability without exacerbating their situation.

Introduction To Poor Credit Challenges

Getting a loan feels tough with poor credit. Your credit score opens or closes doors to financial opportunities. A low score may seem like a roadblock. But, options exist for those with credit challenges.

The Impact Of A Low Credit Score

A low credit score affects more than just loan approval. It can lead to:

- Higher interest rates on loans and credit cards.

- Limited loan amount offers.

- Stricter loan terms.

- Increased insurance premiums.

- Difficulty securing housing.

Lenders view low scores as high risk. This means tougher borrowing terms for you.

Common Hurdles In Securing Loans

People with poor credit face several obstacles:

- Loan application rejections become common.

- Loan offers may have unfavorable terms.

- Securing a cosigner becomes necessary.

- Collateral might be required for approval.

Yet, specialized loans cater to poor credit individuals. Knowing your options is key.

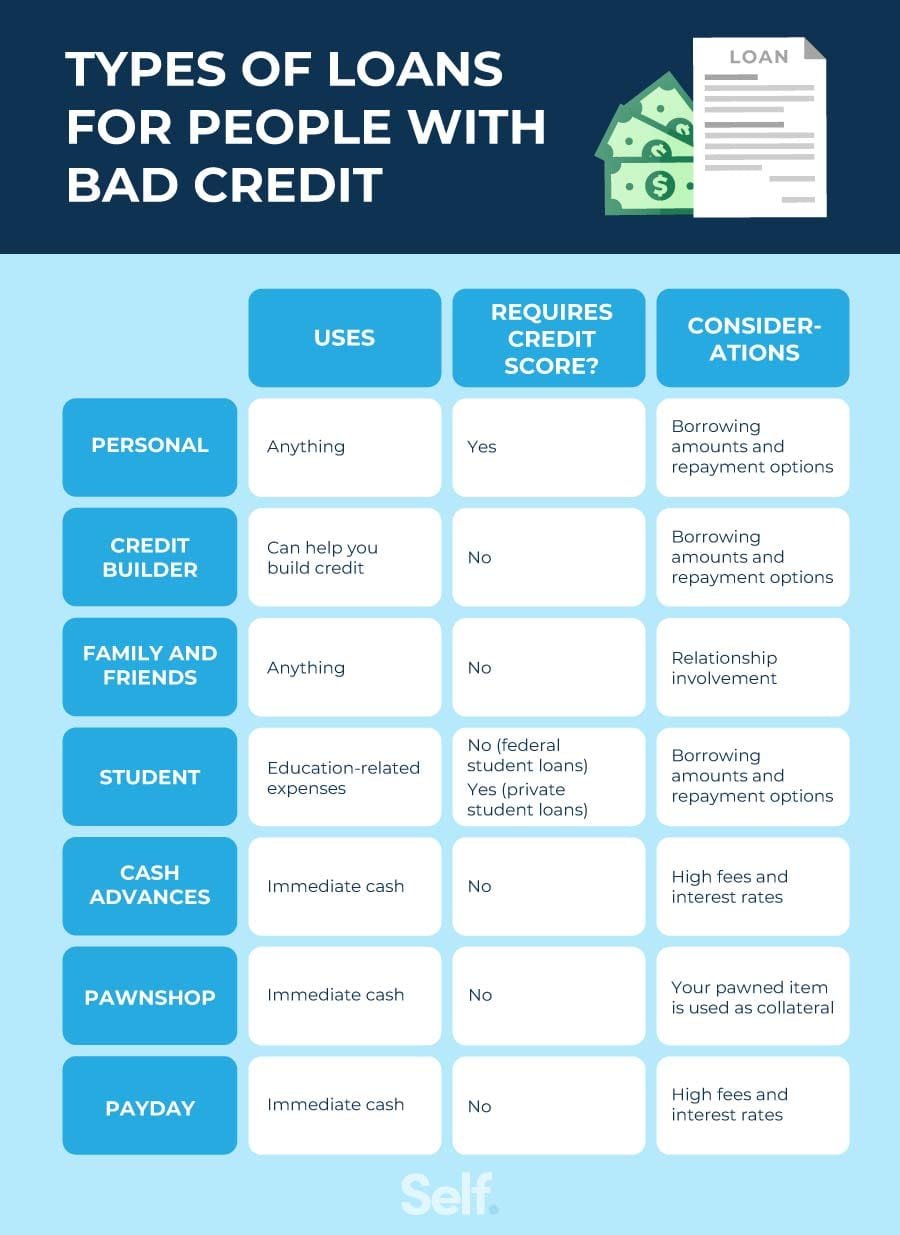

Types Of Loans Available For Poor Credit

Finding the right loan with poor credit can be tough. Yet, options exist for those in need. This section dives into the various loans available for individuals with less-than-perfect credit scores.

Secured Vs. Unsecured Loans

Two main loan types exist: secured and unsecured. Let’s explore.

- Secured Loans require an asset as collateral. This could be a car or a house. If you fail to repay, the lender can take this asset.

- Unsecured Loans do not need collateral. These are riskier for lenders. Hence, they may have higher interest rates.

Payday Loans: A Risky Option

Payday loans are short-term, high-cost loans. They are designed to cover immediate expenses. However, they come with high risks.

- They often have very high interest rates.

- Repayment is typically due by your next paycheck.

- Failing to repay can lead to debt cycles.

Criteria For Selecting A Loan With Poor Credit

Getting the right loan with poor credit is tricky. You must check several factors. This ensures a loan that fits your situation. Let’s explore the criteria that matter most.

Interest Rates Consideration

Interest rates greatly affect loan affordability. With a low credit score, rates are often high. Yet, some lenders offer competitive rates even for poor credit. Look for the lowest interest rates to save money over time.

- Compare multiple lenders.

- Check for fixed or variable rates.

- Understand the total cost of borrowing.

Terms And Conditions Analysis

Loan terms and conditions define your repayment obligations. It’s important to read them carefully. Shorter loan terms can mean higher payments but less interest over time. Longer terms can lower payments but increase total interest.

| Term Length | Monthly Payment | Total Interest |

|---|---|---|

| Short-term | Higher | Lower |

| Long-term | Lower | Higher |

- Check for prepayment penalties.

- Understand late payment fees.

- Know the loan’s flexibility for financial changes.

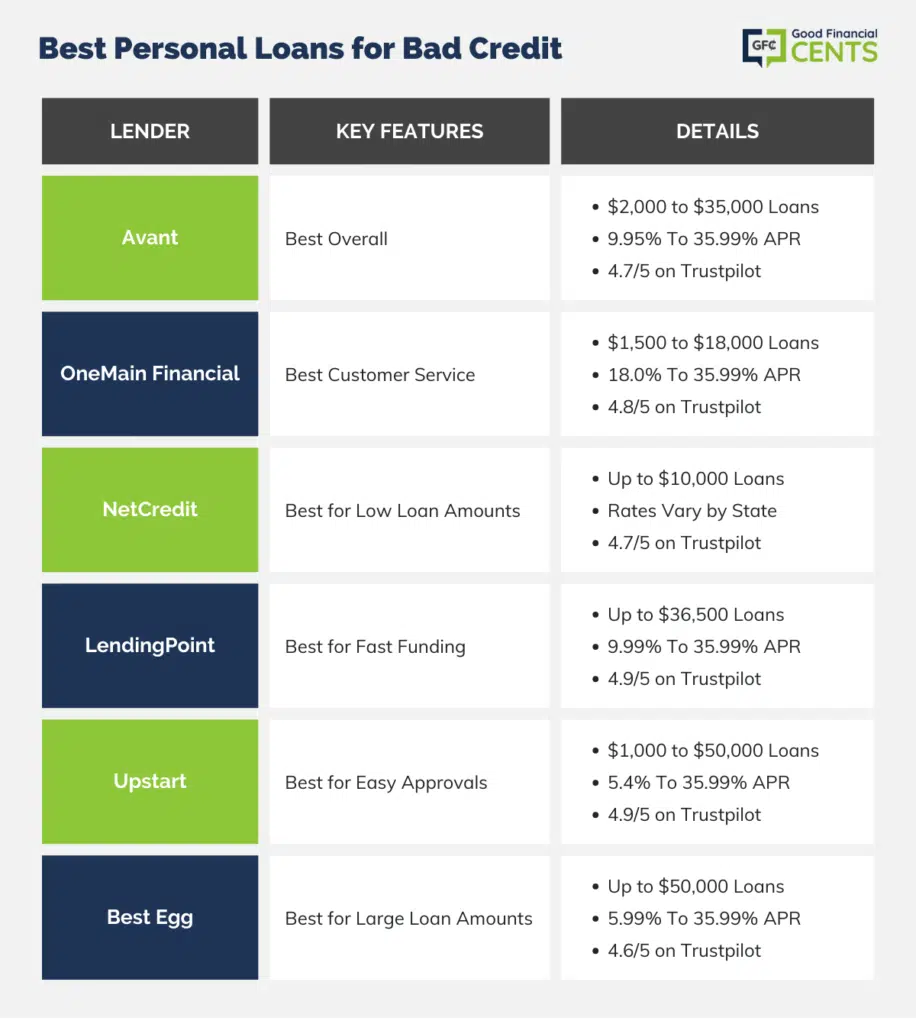

Top Loan Providers For Poor Credit Individuals

Finding a loan with poor credit feels daunting. Yet, options exist. This section explores lenders offering loans to those with less-than-perfect credit scores. We focus on online lenders and credit unions. Both extend credit to individuals with poor credit. Their terms and services differ, providing options tailored to various needs.

Online Lenders: Accessibility And Convenience

Online lenders make borrowing simple. They offer quick applications and fast decisions. Many online platforms specialize in poor credit loans. Here are features they provide:

- Easy online applications

- Fast funding times

- Flexible credit requirements

- Various loan types

These lenders use different criteria than traditional banks. They consider income and expenses. They look at employment history too. This approach helps those with poor credit.

Some top online lenders include:

| Lender Name | Loan Types | Minimum Credit Score |

|---|---|---|

| Upstart | Personal Loans | 580 |

| LendingPoint | Personal Loans | 585 |

| Avant | Personal Loans | 600 |

Credit Unions: Member-centric Lending

Credit unions serve members first. They are non-profit and member-owned. This means they can offer loans with better terms. Their services are more personal. They often consider your story beyond the credit score.

Benefits from credit unions include:

- Lower interest rates

- Personalized service

- Financial education resources

Members must meet certain criteria to join. These could be related to your job, location, or other affiliations.

Some well-known credit unions:

- Navy Federal Credit Union: Military and their families

- Alliant Credit Union: Easy membership requirements

- PenFed Credit Union: Open membership

Remember, credit unions often have physical branches. They provide in-person support.

Whether choosing online lenders or credit unions, research is key. Check terms, fees, and eligibility. Choose the best fit for your financial situation.

Peer-to-peer Lending Platforms

Many people have poor credit. This makes getting a loan hard. Peer-to-Peer Lending Platforms offer a solution. They connect people who need money with those willing to lend.

How P2p Lending Works

In P2P lending, you ask for a loan on a website. People, not banks, lend you money. You pay them back with interest. It’s like having many friends help you out.

- Sign up on a P2P platform.

- Share why you need the loan.

- People decide to lend you money.

- You get the loan and pay it back over time.

Pros And Cons For Borrowers With Poor Credit

P2P lending can be great for people with not-so-good credit. But, there are good and bad points.

| Pros | Cons |

|---|---|

|

|

:max_bytes(150000):strip_icc()/best-personal-loans-for-bad-credit-4774349-0e6f7835612c4290ac5f86989c6a3151.png)

Credit: www.investopedia.com

Strategies To Improve Loan Approval Odds

Securing a loan with poor credit is tough. Yet, certain strategies can boost approval chances. This section will delve into effective ways to strengthen loan applications for those with less-than-ideal credit scores. By focusing on these methods, individuals may increase their likelihood of getting the green light from lenders.

Building A Stronger Application

A solid application is key. Here are steps to make yours stand out:

- Check credit reports for errors. Dispute them promptly.

- Gather proof of steady income. Show you can pay back.

- Limit new credit requests. They can lower your score.

- Offer collateral if possible. It secures the loan.

- Write a personal statement explaining your credit situation.

Finding A Co-signer

A co-signer may greatly help. They promise to pay if you cannot. Here’s what to know:

| Co-signer Criteria | Benefits |

|---|---|

| Good credit score | Increases approval odds |

| Stable income | Assures lenders of payment ability |

| Understanding of risks | Maintains relationship health |

Choose someone you trust. Discuss all risks involved. Make sure they are ready to commit. This can be a big step towards loan approval.

Loan Use And Management Tips

Finding the right loan demands smart strategies, especially with poor credit. It’s not just about getting funds. It’s about using them wisely. Here are some tips for managing loans effectively.

Responsible Borrowing Practices

- Check credit reports for errors that hurt scores.

- Compare lenders to find the best rates and terms.

- Borrow only what’s needed to avoid extra debt.

- Plan a clear repayment strategy before accepting a loan.

- On-time payments improve credit and avoid penalties.

Avoiding The Debt Trap

- Avoid loans with high fees and interest rates.

- Do not use loans for unnecessary expenses.

- Create a budget to manage loan repayments.

- Consider extra income options to pay off loans faster.

- Reach out for financial advice if struggling with repayment.

Credit: www.goodfinancialcents.com

Alternatives To Traditional Loans

Many people face challenges getting loans with poor credit. Traditional banks often say no. But, there are other ways to get money.

Credit Builder Loans

Credit builder loans can help. They are small and easy to manage. You borrow a small amount. You pay it back over time. Your credit score gets better with each payment. These loans are like stepping stones. They build your credit step by step.

Community Programs And Grants

Look for local help too. Community programs offer loans and grants. They do not always need a good credit score. They help people in tough spots. Some programs are for emergencies. Others are for education or housing. Check with community centers or online databases for such programs in your area.

Remember, these options can open doors. They offer a chance to rebuild credit. They provide funds when needed most. Always read terms carefully. Make sure you can meet the payment schedule.

Conclusion: Navigating Loan Choices With Poor Credit

Finding the right loan with poor credit can be tough.

Yet, options exist for those willing to look.

Understanding these choices is key to better financial health.

Long-term Financial Health Strategies

Improving credit scores is crucial for better loan terms.

Focus on paying debts on time and keeping credit utilization low.

Consider secured credit cards to rebuild credit responsibly.

Check credit reports regularly for errors and dispute them promptly.

The Role Of Financial Education

Knowledge empowers borrowers with poor credit.

Learn about budgeting, saving, and responsible spending.

Free online courses and workshops can help understand finances better.

Seek advice from non-profit credit counselors for personalized guidance.

Credit: www.linkedin.com

Frequently Asked Questions

Can I Get A Loan With A 500 Credit Score?

Yes, it’s possible to get a loan with a 500 credit score, but options are limited. Look for lenders offering bad credit loans or consider secured loans. Expect higher interest rates and fees compared to standard loans.

What Are The Best Loans For Bad Credit?

The best loans for individuals with bad credit often include secured loans, payday alternative loans from credit unions, and online lenders specializing in subprime borrowers. Always compare terms and check for reasonable fees and manageable repayment plans.

How Can I Improve My Chances Of Loan Approval?

To improve your chances of loan approval, consider adding a co-signer with good credit, offer collateral for a secured loan, or work on increasing your credit score. Show stable income and reduce your debt-to-income ratio to appeal to lenders.

Are Payday Loans A Good Option For Poor Credit?

Payday loans can provide quick cash, but they’re not a good option for poor credit due to extremely high-interest rates and fees. They can lead to a cycle of debt. Look for alternatives like credit builder loans or personal installment loans.

Conclusion

Navigating the loan landscape with a less-than-perfect credit score can be daunting. Yet, hope is not lost. The options we’ve explored provide viable paths to financial assistance, even for those with poor credit. By carefully considering each, you can find a solution that suits your needs.

Remember, responsible borrowing is key to improving your financial health and credit score.