The best student loan options typically include federal loans due to their fixed rates and flexible repayment plans. Private loans can serve as a supplement when additional funding is necessary.

Navigating the world of student loans can be daunting for both students and parents embarking on the college journey. With college costs on the rise, securing the right type of student loan is crucial for managing education expenses without falling into a financial pitfall.

Federal student loans, offered by the government, often come with lower interest rates and borrower protections, making them a preferable choice for many. For those who find federal loans insufficient, private student loans offered by banks, credit unions, and other financial institutions can fill the gap. It’s essential to compare rates, terms, and eligibility requirements to ensure you find the best fit for your educational needs. Remember, a well-informed decision now can lead to a more manageable financial future post-graduation.

Credit: tamingthehighcostofcollege.com

Introduction To Smart Funding For Education

Education is a powerful tool for success. Yet, funding it can be tough. Smart funding options help. They make education reachable for many students. Let’s explore the best student loan options available.

The Importance Of Investing In Education

Education opens doors to better careers and life chances. A degree can mean higher pay. It is a smart investment for a bright future. Students must know their funding options well.

Challenges Of Managing Student Loan Debt

Student loans can be heavy. They often bring stress. But, with smart planning, students can handle them better. Understanding loan terms is key. This can make repayment easier later on.

Credit: www.edvisors.com

Federal Student Loans: Start Here

Federal Student Loans: Start Here is the first step for many students entering college. These loans offer better terms than private loans. They are a smart choice for funding education.

Subsidized Vs. Unsubsidized Direct Loans

Federal Direct Loans come in two types: subsidized and unsubsidized. Subsidized loans are for students with financial need. The government pays the interest while you are in school. Unsubsidized loans are available to all students. You pay all the interest, but you can wait until after school.

- Subsidized Loans – Government pays interest during school.

- Unsubsidized Loans – You pay all interest. Payment can wait.

Perkins Loans: A Closer Look

Perkins Loans are for students with exceptional financial need. They have low interest rates. The school is your lender, not the government.

| Feature | Details |

|---|---|

| Borrower | Student with exceptional need |

| Interest Rate | Low |

| Lender | School |

These loans are rare and depend on your school. They help students who need it most.

Private Student Loans: What To Know

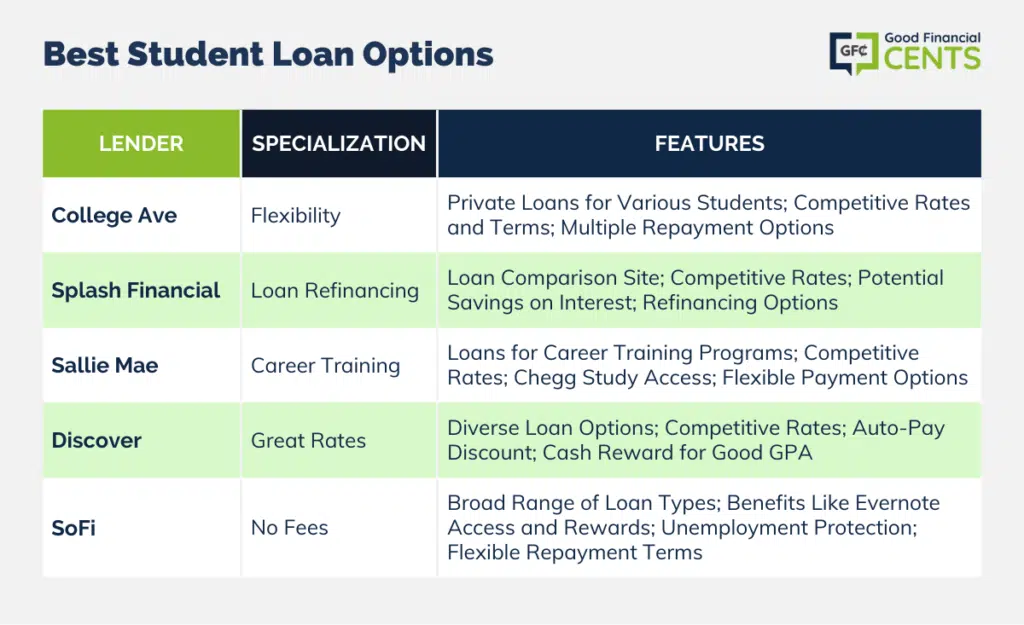

Private student loans can fill gaps in funding. They come from banks, credit unions, and lenders. Unlike federal loans, they’re not one-size-fits-all.

Comparing Interest Rates And Terms

Interest rates affect loan cost. They can be fixed or variable. Fixed rates stay the same. Variable rates change over time.

Loan terms outline repayment. Shorter terms mean higher payments but less interest overall. Longer terms lower monthly payments but increase total interest.

Compare lenders for the best deal. Use online tools to see different rates and terms. Choose what fits your budget.

The Role Of Credit Scores In Private Funding

Credit scores matter for private loans. They show how risky you are as a borrower.

A high score can mean lower rates. It can also help you qualify without a co-signer. A lower score may require a co-signer. It can also lead to higher rates.

Build your credit before applying. Check your credit report for errors. Pay bills on time. Lower your debt.

Remember to shop around. Ask questions. Understand your options before choosing a loan.

Credit: m.youtube.com

State-sponsored Loan Programs

When it comes to funding higher education, students often think of federal loans first. Yet, State-Sponsored Loan Programs are a treasure trove of financial aid. These loans can offer competitive rates and flexible terms. Each state tailors its programs to suit residents’ needs. They may provide a lifeline for those who fall through the federal aid cracks.

Benefits Of State-specific Options

- Lower interest rates: Often beat private loans.

- Flexible repayment: Plans match borrowers’ financial status.

- Forgiveness opportunities: Some jobs or locations qualify.

- Additional benefits: Grace periods and subsidies available.

Finding Programs In Your State

- Visit your state’s education website: Start with official sources.

- Check with local financial aid offices: They offer current program details.

- Use scholarship search tools: Filter for state-sponsored options.

Scholarships And Grants: Free Money

Navigating the world of student loans can be tricky. Scholarships and Grants offer a beacon of hope. They are free money for students. You don’t need to pay them back. This section explores how to find and apply for these opportunities.

Searching For Scholarships

Finding scholarships requires effort and strategy. Here are steps to help you start:

- Use scholarship search engines to find matches.

- Check with your school for exclusive offers.

- Look for community organizations that offer scholarships.

- Don’t ignore small awards. They add up!

Remember, deadlines are crucial. Mark them on your calendar.

Applying For Grants

Grants are another form of free money. They often focus on need rather than merit. Here’s how to apply:

- Start with the FAFSA. It opens doors to federal grants.

- Explore state grant programs. Each state has unique options.

- Check with your college for institution-specific grants.

- Research specialty grants. These are for specific studies or backgrounds.

Grants can significantly reduce college costs. Start your search early.

Work-study Programs: Earn And Learn

Many students face the challenge of financing their education. Work-study programs provide a solution. These programs allow students to work part-time while studying. This helps cover tuition and other expenses. The balance between work and education can set students up for success.

Understanding Work-study Eligibility

Not all students qualify for work-study programs. Eligibility depends on financial need and your school’s funding. To determine eligibility, students must complete the FAFSA form. This form assesses financial need. Students receive notifications of eligibility in their financial aid packages.

Finding Work-study Positions

Finding a work-study job requires action. First, check with your school’s financial aid office. They can provide a list of available positions. Jobs may be on-campus or with approved off-campus employers. Positions often relate to your field of study. This offers valuable experience. Use your school’s job portal or job fairs to find these opportunities.

- Check financial aid office: They provide job lists.

- Use job portals: Schools often have online resources.

- Attend job fairs: Meet potential employers in person.

Loan Forgiveness Programs

Struggling with student loans? Loan Forgiveness Programs might be your lifeline. They can wipe out your debt. Yet, not all qualify. Understand your options below.

Public Service Loan Forgiveness

Public Service Loan Forgiveness (PSLF) helps many. Work in public service? You could benefit. Ten years of payments might lead to total debt forgiveness. Here’s what you need:

- Employment by government or non-profit

- 120 qualifying payments

- Direct Loans or consolidated into Direct Loans

Follow these steps for PSLF:

- Confirm your employment qualifies

- Make 120 payments

- Submit your PSLF application

Teacher Loan Forgiveness

Teacher Loan Forgiveness recognizes educators. Teach for five years? You might see up to $17,500 vanish. Key points to note:

| Requirement | Details |

|---|---|

| Work full-time | At a low-income school or educational service agency |

| Qualifying loans | Direct or FFEL Program Loans |

| Subject area | Math, science, or special education teachers benefit most |

Complete these for Teacher Forgiveness:

- Verify your school’s eligibility

- Teach full-time for five complete and consecutive academic years

- Apply for the Teacher Loan Forgiveness

Refinancing Student Loans

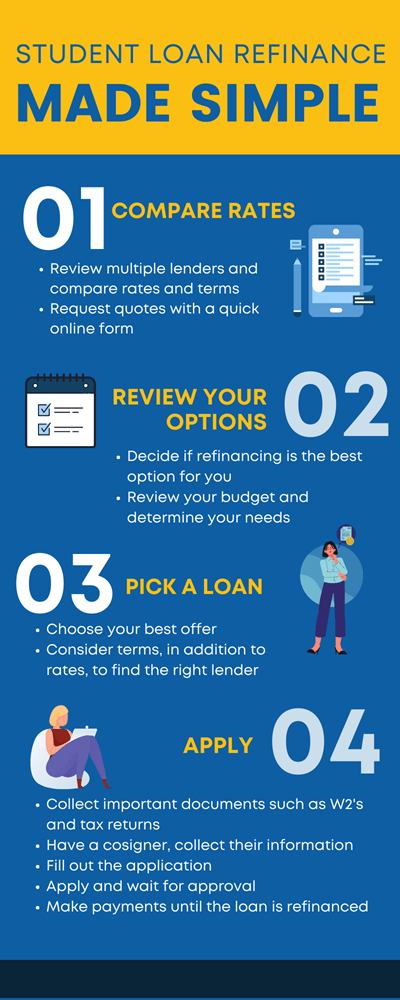

Exploring the world of student loan refinancing can open doors to lower interest rates and better terms. It’s a strategy that can lead to significant savings over time. However, knowing the right time to refinance and understanding the benefits and drawbacks are crucial.

When To Consider Refinancing

Several key moments signal the right time for refinancing student loans:

- Credit Score Improvement: A higher score can secure lower rates.

- Stable Income: Consistent earnings make you a safer bet for lenders.

- Interest Rate Drop: Refinancing can lock in a lower rate, saving money.

- Single Monthly Payment: Combine multiple loans for one easy payment.

Pros And Cons Of Refinancing

| Pros | Cons |

|---|---|

| Lower Interest Rates: Potentially save thousands over the loan’s life. | Federal Benefits Loss: Say goodbye to income-driven repayment plans. |

| Term Flexibility: Choose a term that fits your financial goals. | Variable Rates Risk: Rates may increase over time. |

| Simplified Finances: One lender and one monthly bill. | Qualification Hurdles: Good credit and stable income are a must. |

| Cosigner Release: Free a cosigner from your original loan. | Lost Benefits: No more federal forbearance or forgiveness. |

Budgeting And Repayment Strategies

Smart budgeting and repayment are crucial for student loans. They can turn daunting debt into manageable installments. A good plan saves money and stress. Let’s explore how to do this effectively.

Creating A Repayment Plan

Start with understanding your loan terms. Know your interest rates and due dates. This knowledge is key to crafting a solid plan. Your aim should be to pay more than the minimum. This reduces total interest over time.

Consider different repayment strategies. The ‘snowball’ method focuses on the smallest debt first. The ‘avalanche’ method targets high-interest loans first. Pick the one that suits your financial situation.

Always check for loan forgiveness programs. Some professions offer these benefits. They can significantly cut down what you owe.

Tools And Resources For Budgeting

Effective budgeting tools can simplify your financial life. They keep track of expenses and help you stay on target. Use apps like Mint or YNAB (You Need A Budget). They offer visual insights into your spending habits.

Create a monthly budget plan. Allocate funds for essential expenses first. Then set aside a portion for loan repayment. Make sure to review and adjust your budget regularly.

Free online calculators estimate monthly payments. They show how extra payments shorten loan terms. Use these tools to stay informed and motivated.

Remember, budgeting and repayment require discipline. Stick to your plan. It leads to a debt-free future.

Conclusion: Making Informed Decisions

Choosing the best student loan is crucial for your future.

This section helps you make smart choices.

Staying Informed About Loan Changes

The world of student loans often changes.

New laws can affect your payments.

Sign up for updates from your loan provider.

This way, you won’t miss out on important news.

Planning For The Future

Think about your job after college.

Some jobs help you pay loans faster.

Save money when you can. It helps later.

- Use a budget to track spending.

- Consider jobs with loan forgiveness.

- Save a part of your paycheck.

Choosing wisely now means less stress later.

Frequently Asked Questions

What Are The Top Student Loan Options?

Federal student loans typically offer the best terms, including low-interest rates and flexible repayment plans. Private loans are also available but may have higher rates.

How Do I Qualify For Student Loans?

To qualify for federal student loans, complete the FAFSA form. Eligibility depends on financial need, academic enrollment status, and being a U. S. citizen or eligible non-citizen.

Are There Student Loans Without Cosigners?

Yes, federal student loans do not require a cosigner. Private loans usually need one, but some lenders may offer loans without a cosigner to qualified borrowers with good credit.

Can Student Loans Cover Full Tuition?

Federal student loans have limits but can cover a significant portion of tuition. Private loans can fill the gap or cover full tuition, depending on the lender’s terms and borrower’s eligibility.

Conclusion

Exploring the best student loan options is essential for managing education costs smartly. Our guide aims to simplify your search, offering insights into the most favorable loans available. Remember, selecting the right loan can significantly impact your financial future. Start your journey with informed decisions, ensuring a smoother path towards achieving your academic goals.