Carpooling is a great way to save money and help the environment. But carpool drivers need to understand their insurance coverage. This article will help you learn about car insurance for carpool drivers.

Credit: www.stewartlawoffices.net

Why Car Insurance is Important

Car insurance is important because it protects you and others. It helps cover the cost of accidents, damages, and injuries. Without it, you might have to pay a lot of money out of pocket.

Types of Car Insurance Coverage

There are different types of car insurance coverage. Each type helps in different situations. Here are the main types:

- Liability Coverage: This covers damages and injuries to others if you are at fault.

- Collision Coverage: This covers damages to your car if you hit another car or object.

- Comprehensive Coverage: This covers damages to your car from things like theft, fire, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: This covers damages if the other driver has no or not enough insurance.

Car Insurance for Carpool Drivers

Carpool drivers need to make sure their insurance covers them while driving others. Here are some tips to ensure you are covered:

Check Your Policy

First, check your current policy. Look for any restrictions on carpooling. Some policies may not cover you if you drive for a carpool.

Talk To Your Insurance Agent

Talk to your insurance agent about your carpooling plans. They can help you understand your coverage. They can also suggest any changes you might need.

Consider Rideshare Insurance

If you carpool often, consider rideshare insurance. This type of insurance is designed for drivers who carry passengers. It can offer extra protection that regular car insurance might not.

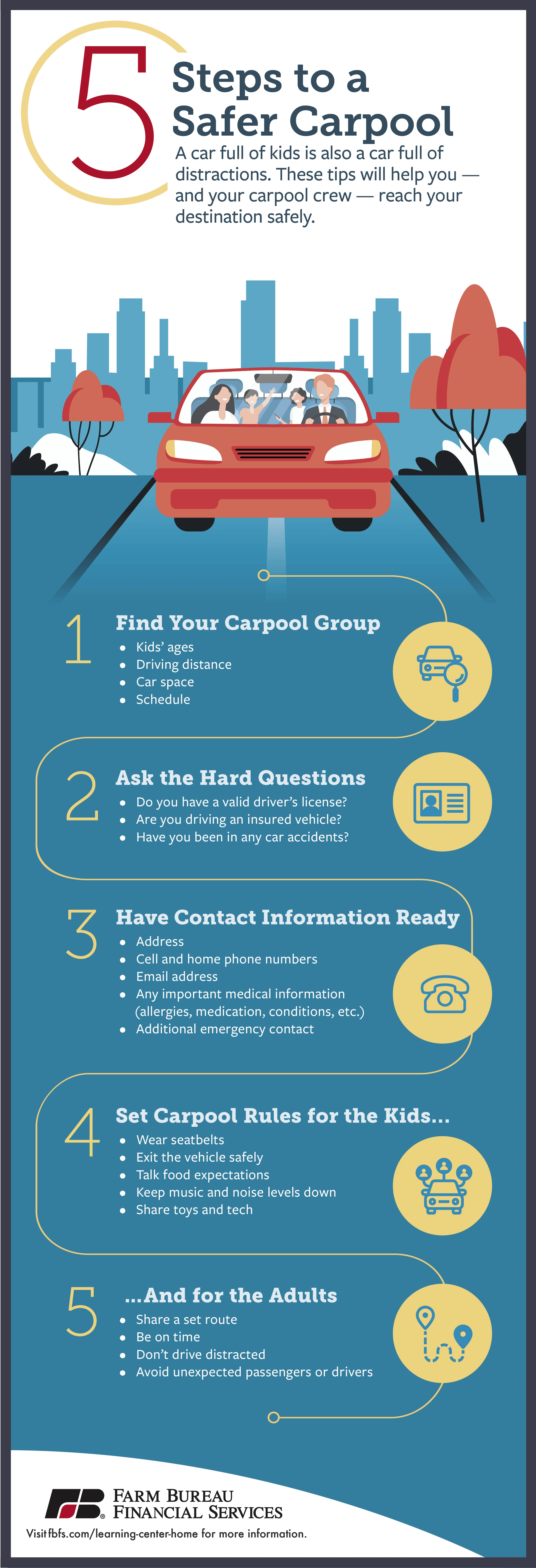

Credit: www.fbfs.com

What to Do in Case of an Accident

Accidents can happen even if you are careful. Knowing what to do can help you stay calm and handle the situation better. Here are some steps to follow:

Stay Safe

First, make sure everyone is safe. Move to a safe location if possible. Turn on your hazard lights to alert other drivers.

Call For Help

Call 911 if there are any injuries. Even if no one is hurt, it’s a good idea to call the police. They can help document the accident.

Exchange Information

Exchange information with the other driver. This includes names, contact information, insurance details, and license plate numbers.

Document The Accident

Take pictures of the scene, damages, and any injuries. Write down what happened while it’s still fresh in your mind.

Contact Your Insurance Company

Report the accident to your insurance company as soon as possible. Provide them with all the information you have gathered.

Ways to Save on Car Insurance

Car insurance can be expensive, but there are ways to save money. Here are some tips to help you lower your premiums:

Shop Around

Compare quotes from different insurance companies. This can help you find the best deal for your needs.

Bundle Your Policies

If you have other types of insurance, like home or renters, consider bundling them with your car insurance. Many companies offer discounts for bundling policies.

Maintain A Good Driving Record

A good driving record can help you get lower rates. Avoid accidents and traffic violations to keep your record clean.

Take A Defensive Driving Course

Some insurance companies offer discounts if you take a defensive driving course. This can also help you become a safer driver.

Increase Your Deductible

Raising your deductible can lower your premiums. Just make sure you can afford to pay the higher deductible if you need to make a claim.

Ask About Discounts

Many insurance companies offer various discounts. These can include good student discounts, low mileage discounts, and more. Ask your agent about any discounts you might qualify for.

Frequently Asked Questions

What Is Carpool Insurance Coverage?

Carpool insurance covers liability for passengers in your vehicle during carpooling.

Does Car Insurance Cover Carpooling?

Yes, standard car insurance typically covers carpooling, but check with your insurer for specific details.

Is Carpooling Considered Commercial Use?

No, carpooling is generally not considered commercial use, but it’s wise to confirm with your insurance provider.

Do I Need Extra Insurance For Carpooling?

Not usually, but verifying with your insurance company ensures you meet all coverage requirements.

Can Carpool Drivers Be Sued By Passengers?

Yes, passengers can sue for injuries, so having adequate liability coverage is crucial.

Conclusion

Carpooling is a great way to save money and help the environment. But it’s important to make sure you have the right insurance coverage. Check your policy, talk to your agent, and consider rideshare insurance if needed. And remember to follow the steps above to stay safe and save money on your car insurance. Happy carpooling!